Do you ever wonder just how much money you should be setting aside for your golden years? It’s a fact that stashing away 15% of your potential income annually, including employer contributions, can set you on the right retirement path.

This blog post will guide you through practical steps and strategies to meet your retirement savings goals with peace of mind. Are you ready to secure your financially comfortable retirement? Let’s dive in!

Key takeaways

● Start saving for retirement early to have more money later.

● Aim to save 15% of your yearly income for retirement.

● Use the 4 percent rule. Only spend 4% of your savings each year when retired.

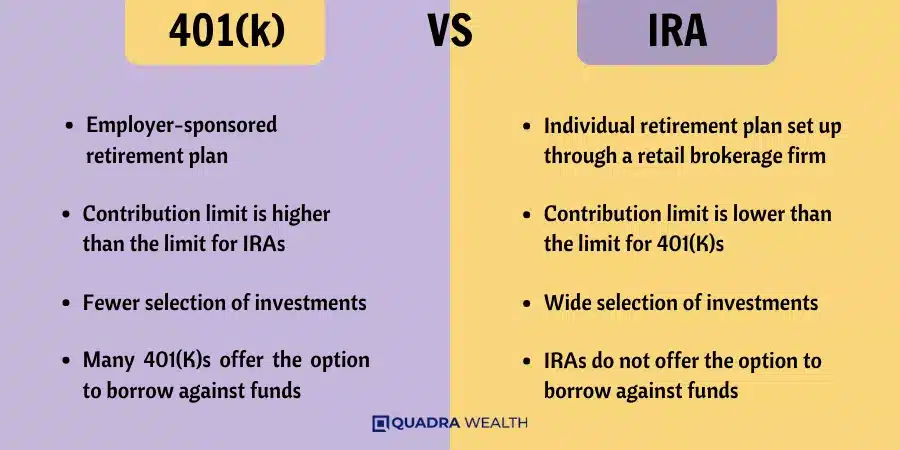

● Think about using a special account like an IRA or 401(k) to help with saving.

● Avoid common mistakes like not starting early and ignoring free money from your job's match plan.

● Use free online calculators to see how much money you need for retirement.

Why Save for Retirement?

Saving for retirement matters a lot. It makes sure you have money when you stop working. You can live on this retirement income in the future. You don’t want to worry about bills or food when old age comes.

Humans are living longer now than ever before. This means more years without work pay but with living costs like rent and food. But, if savings are there, this time can be fun and relaxing! So it’s good to start saving sooner rather than later to enjoy retirement life fully!

- Financial Security

- Compound Interes

- Lower Savings Rate

- Flexibility and Options

- Less Stress

- Employer Contributions

- Financial Insecurity

- Limited Growth Time

- Higher Savings Required

- Reduced Investment Options

- Stress and Anxiety

- Missed Employer Contributions

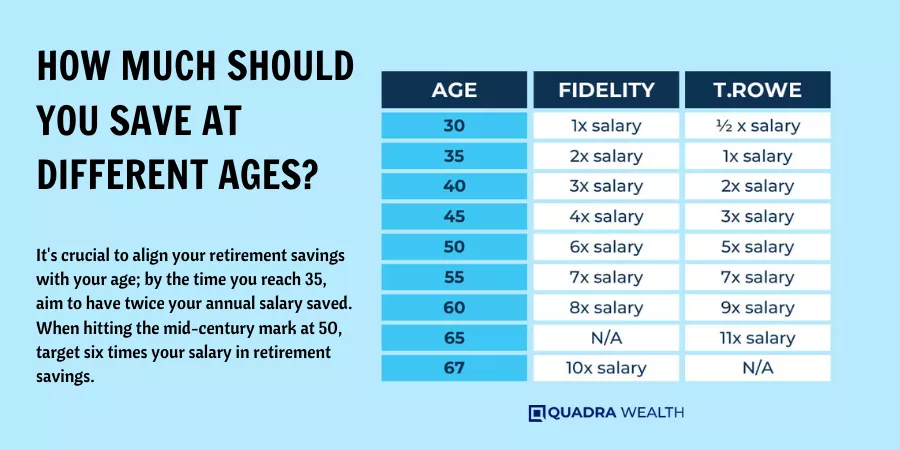

How Much Should You Save at Different Ages?

It’s crucial to align your retirement savings with your age; by the time you reach 35, aim to have twice your annual salary saved. When hitting the mid-century mark at 50, target six times your salary in retirement savings.

As you approach retirement age at 60, strive to have eight times your annual income saved up.

Savings Goals by Age 35

Aiming to have one to one-and-a-half times your annual income saved for retirement by age 35 is a reasonable and attainable target for those who start saving at age 25. The table below outlines this strategy in detail.

Age | Savings Goal | Strategy |

25 | Start saving at a rate of 6% of income | Initiate retirement savings, benefitting from the power of compounding over time. |

30 | Should have half of the annual income saved | Continue saving, increasing the rate by one percentage point each year. |

35 | Aim to have one to one-and-a-half times annual income saved | Persist in saving at an increased rate to meet retirement goals. |

This savings trajectory relies on the power of compounding, which allows money saved early on to grow significantly over time.

Savings Goals by Age 50

Here is an important benchmark while planning for retirement: by the age of 50, you should aim to have three to six times your preretirement income saved for retirement. This benchmark is based on a trajectory of earnings and savings rates that begin at a 6% savings rate at age 25 and increase by one percentage point each year.

Age | Savings Goal | Income Level |

50 | Three to Six Times Preretirement Gross Income | Low to High |

These savings benchmark ranges widen as individuals get older due to factors such as varying household income levels and marital statuses. Notably, higher earners generally need more asset allocation in relation to their income due to receiving a smaller portion of their income from Social Security in retirement. Therefore, as a higher earner, you may need to aim towards the higher end of the savings goal range.

Savings Goals by Age 60

Making your way into your 60s, the focus on retirement savings amplifies. By this age, it’s recommended to have 5.5 to 11 times your pre-retirement salary. The following table provides a more detailed breakdown of these savings goals.

Income Level | Recommended Savings at Age 60 |

$75,000 | $412,500 – $825,000 |

$100,000 | $550,000 – $1,100,000 |

$150,000 | $825,000 – $1,650,000 |

$200,000 | $1,100,000 – $2,200,000 |

$300,000 | $1,650,000 – $3,300,000 |

Remember, these benchmarks account for projected spending needs, taxes, and social security benefits in your retirement years. Also, keep in mind that higher earners should aim for a higher savings target as they often receive a smaller portion of their income from Social Security. So, having a substantial retirement fund becomes even more crucial.

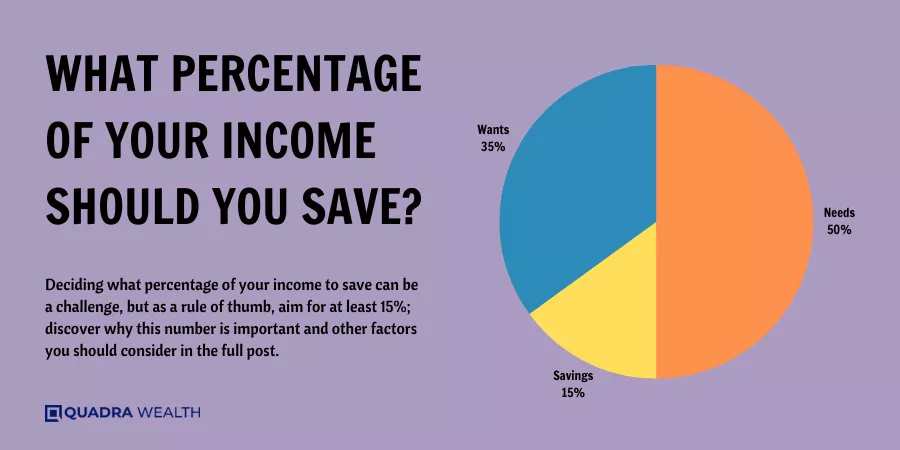

What Percentage of Your Income Should You Save?

Deciding what percentage of your income to save can be a challenge, but as a rule of thumb, aim for at least 15%; discover why this number is important and other factors you should consider in the full post.

The Importance of Saving at Least 15% of Your Income

Saving 15% of what you make each year is important. This amount gives the right start for most people towards a good retirement. Your savings rate at this level lets your money grow over time.

For example, if you begin to save by age 25 and increase it by one percent every year, it adds up fast.

You can get more money from Social Security when you retire if your earnings are lower while working. But if you earn more now, saving 15% or even more is key. Higher earners need to save more because they won’t get as much from Social Security in their retirement years.

No matter what, starting early with any saving plan leads to better results later on.

Strategies to Reach Your Retirement Savings Goals

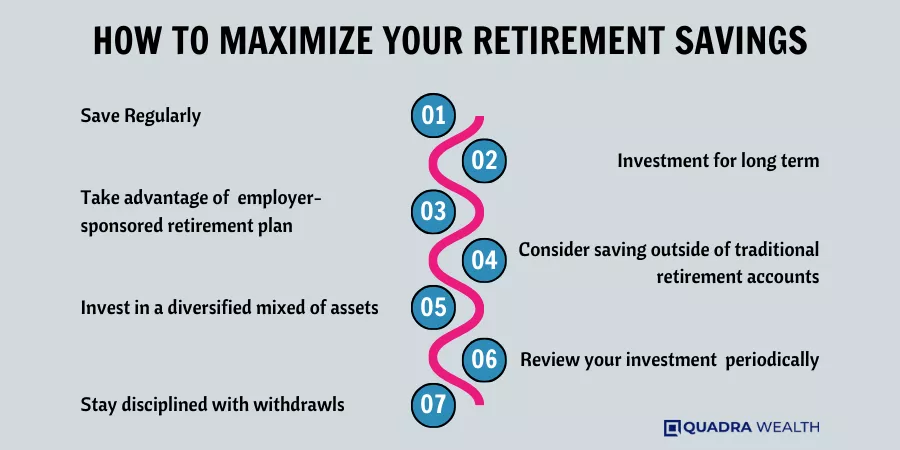

Whether you’re just starting out or nearing retirement, it’s vital to have a savings strategy in place. One effective strategy is to start saving early; the sooner you begin, the more time your money has to grow through compound interest.

Another approach is delaying retirement, which can provide extra years for your savings to accumulate and lessen the number of years those savings will need to last. Above all, make your retirement savings a priority – consider automatic contributions from your paycheck into your 401(k) or IRA as part of this commitment.

Start Saving Early

Start saving early is a smart move. The sooner you start, the more money you will have for retirement. It also gives your savings more time to grow. Let’s say you begin at age 25. By the time you hit 35, try to have saved up an amount equal to your yearly pay.

This might seem hard, but every bit helps! Plus, many jobs can help with this by putting part of your pay into a retirement plan for you. Put as much money as possible towards your future now, so you’re ready when it’s time to stop working.

Delay Retirement

Working more years can grow your retirement savings. You have more time to save money. You also give your savings more time to grow. Delaying retirement means you take money out later.

This can make your retirement accounts last longer. So, it is a good idea to delay retirement if you can.

Make Savings a Priority

Every dollar you save now can grow over time. Make sure to put money into your retirement account each month. You will thank yourself later.

It’s all about the habit of saving up. The more often you do it, the easier it becomes. So, get started right away!

The Importance of Returns on Retirement Savings

Building a substantial retirement fund involves not only saving but also earning returns on your investments. Dive into the 4 percent rule, discover ways to mitigate investment risks, and learn how you can secure better returns for a financially steady post-retirement life.

Read on!

Understand the 4 Percent Rule

The 4 percent rule is a tip for people saving for retirement. It says you should only use 4 percent of your savings each year after you stop working. This way, your money lasts longer.

If we put it in simple math, the 4 percent rule can help figure out how much to save. Want to know how much? Just take the yearly income you want and multiply by 25. Now you know what total amount to aim for! But be mindful that this is not set in stone; life can change and so will your needs.

Mitigate Risk and Get a Better Return

You can lessen your risk and boost your return in a few ways. First, make sure to mix it up with stocks, bonds, and cash. This is called a diversified mix of investments. If one area does poorly, the others may do well.

Next, consider using special funds for help. Target date funds or managed accounts do this for you automatically based on when you plan to retire. Also, think about investing more in bonds as you get older to keep things safe while growing money.

How to Maximize Your Retirement Savings

Explore the benefits of individual retirement accounts (IRAs) and 401(k)s, learn to avoid common investment pitfalls, and discover strategies to increase your returns. Don’t miss out on techniques that could boost your retirement savings – read on for more!

Consider an IRA or 401(k)

Saving for your retirement age? You might want to think about an IRA or 401(k). These are special accounts that help you save money. They come with tax benefits too! A 401(k) is often given by your job.

Some jobs even put money in it for you! An IRA(individual retirement account) is an account you set up yourself. Both make your money grow faster over time. This makes it easier for you to have enough money when you stop working one day.

Avoid Common Retirement Investing Mistakes

There are some common mistakes people make when saving for retirement. Avoid these to keep your savings safe.

- Not starting early: It’s vital to start saving as soon as you can. The sooner you start, the more money you will have when you retire.

- Ignoring your employer’s match: If your job offers a 401(k) match, take full advantage of it. This is free money that can grow over time.

- Making risky investments: Make wise choices with your money. Too much risk can lead to big losses.

- Drawing out money early: Taking money out of your retirement account before time can cause penalties and taxes.

- Not saving enough: Aim to save at least 15% of your income each year for retirement.

- Forgetting about inflation: Prices will rise over time. Remember this when deciding how much to save.

- Relying only on Social Security benefits: It may not be enough to cover all your needs in retirement.

What is a realistic retirement income?

As mentioned above, the amount of money you’ll need to retire depends on your individual circumstances. What works for some people might not be enough for others.

During retirement, your earnings will likely come from a combination of Social Security payments and withdrawals made from employer-sponsored retirement plans and IRA accounts. The more you’re able to contribute to those accounts during your working years, the more you’ll have to rely on them during retirement. The amount you’ll need will vary, but experts generally recommend being able to replace about 80 percent of your salary during retirement.

Using Retirement Calculators to Plan Ahead

Retirement calculators are handy tools. They help you see how much money you need for retirement. You input your age, income, and savings into the calculator. It tells you if you save enough or need to save more.

There are many types of retirement calculators online. Some may ask how long you plan to work or when you plan to retire. Others may want to know about your spending plans in retirement years.

Using a retirement calculator helps make sure your money can last as long as it needs to.

Conclusion

Saving for retirement is a key part of your life. It’s vital to start early and save often. Estimating your retirement income needs is not an exact science. You have options, such as taking advantage of catch-up contributions and reviewing your asset allocation and risk tolerance. No matter your life stage or how much you’ve saved, a careful review of your expected needs and sources of income can help you prepare for the years ahead. Take steps today to ensure a comfortable future. So, aim high, save more, and enjoy your golden years!

FAQs

There are many ways to save for retirement. Some people use traditional or Roth 401(k)s and IRAs, while others might have employer-sponsored savings plans like a 403(b) plan.

Using tools like the Retirement Income Calculator can help estimate your retirement expenses based on your current income, age, and lifestyle.

Many financial advisors suggest saving at least 15% of your annual income for retirement. Your workplace might match part of these contributions as well.

Market movements can change the value of long-term investments in your portfolio. This could impact your ability to afford post-retirement needs based on pre-retirement annual income.

Retirement accounts like Traditional or the Roth IRA offer different tax breaks that lower taxable incomes now or during withdrawal, helping you grow funds more efficiently.

Yes! Healthcare is often one of the biggest costs in old age so it’s important to include estimated healthcare fees in any calculations about future requirements.