Introduction

Hedging is a predominantly effective technique for investors to leverage their investment options on equities, bonds, or structured notes.

Here, you buy bonds or security for a lesser amount of money. You then hedge them over changing interest rates or other volatilities in the market. You can introduce add-ons to your initial investment option. This way, you can get stable returns on your investment portfolio. Or even sell your portfolio over a lump sum.

On this parlance, let us unveil deeper insights on the blog titled ‘How Does Hedging Help You Maximize Returns On Your Notes’. Helping you get started further on this:

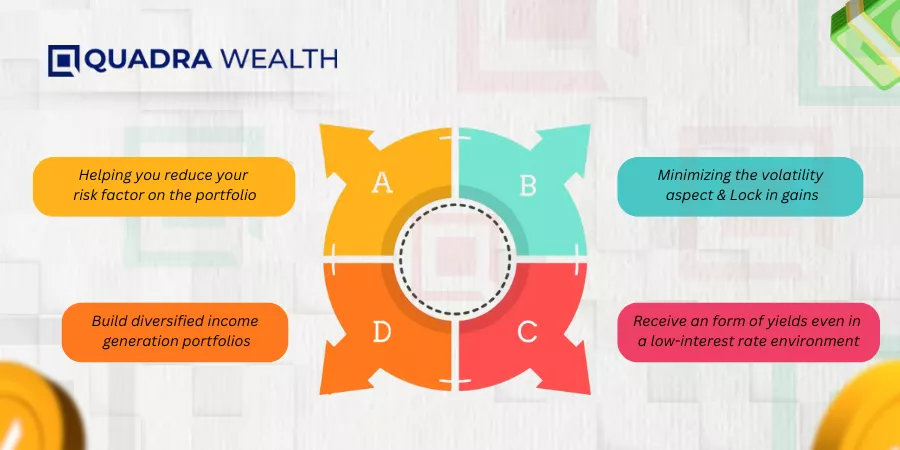

Helping you reduce your risk factor on the portfolio

Reducing the risk factor is the key aspect an investor would want on his investment portfolio. You do not want to lose your capital funds at any cost. It could be years of saving on your employment-based income that you can collate funds in favor of a financial firm or an investment conglomerate.

Whether you choose fixed-income bonds, high-paying equities, or structured notes, capital or principal protection is at the top-most priority list when deciding to invest.

As you already know, structured notes are hybrid securities comprising debt and equity. Hence, product-issuing firms incubate futures as derivative strategies to provide a layer of downside protection against the overall volatility of the market.

You can use hedging against a variety of derivatives like options, swaps, or futures. This way, you can protect your notes against unfavorable pricing movements, changing interest rates, or against other forms of credit risks, to name a few. By using the hedging technique effectively, you can avoid the negative consequences of adverse market scenarios that can negatively impact the returns of your investment portfolios on the whole.

Minimizing the volatility aspect

When you use hedging as an effective derivative strategy, you help smoothen out the volatility that might otherwise impact the value of your notes.

For instance, when you have notes comprising bonds, you can use interest-rate swaps. This way, you hedge these notes against changing interest rates.

Likewise, you can use hedging as a wiser investment technique to reduce swings in the value of your investment portfolio and gain consistent rewards over the portfolios that stand chosen.

Lock in gains

When you have witnessed an appreciation of your notes already, hedging provides downside protection against a fleet of risks that are involved in deriding the cap wallet for investors. While at the same time, hedging also helps you capitalize on receiving the upside returns for notes.

For instance, when you opt for ‘call’ or ‘put’ options on futures or derivatives that are tied to the performance of said stocks or equity indexes, you retain the potential returns on capital despite adverse market scenarios.

Here, you also get a certain degree of downside protection against capital erosion.

Build diversified income generation portfolios

When you hedge certain positions, you can get a better foothold over diversifying your existing investment portfolio. In other words, you can convert your existing investment portfolio into a profitable one or an income-generating one indeed.

This way, your overall scope of capital depreciation or incurring declined returns on investment can eventually reduce for you as such.

For instance, when you hold Certificates of Deposits or CDs, you can reduce credit-oriented defaults by opting for credit default swaps on your investing instruments as such.

This way, you would be able to leverage your returns on investment in a more effective and efficient manner indeed. And, you can focus your time and efforts on diversifying your portfolios with fewer concerns about potential defaults and other pertinent market risks that can impact the value of your investment portfolios in the longer run.

Receive an enhanced form of yields even in a low-interest rate environment

Hedging is a very effective and cost-saving strategy that can help you get better returns even if market conditions are not that suitable for investors on the whole.

For instance, even if the interest rates keep changing on a constant basis, you can allow the product issuing firm to incubate a ‘curve-yielding’ as a hedging strategy on your structured notes.

This way, you earn turbo returns on your investment rate even with a low interest rate environment or with scenarios wherein the market volatility is at its adverse level.

Therefore, hedging helps investors maintain a robust investment portfolio even during adverse market scenarios as compared to investors who deal with traditional investing options like bonds or fixed-income securities.

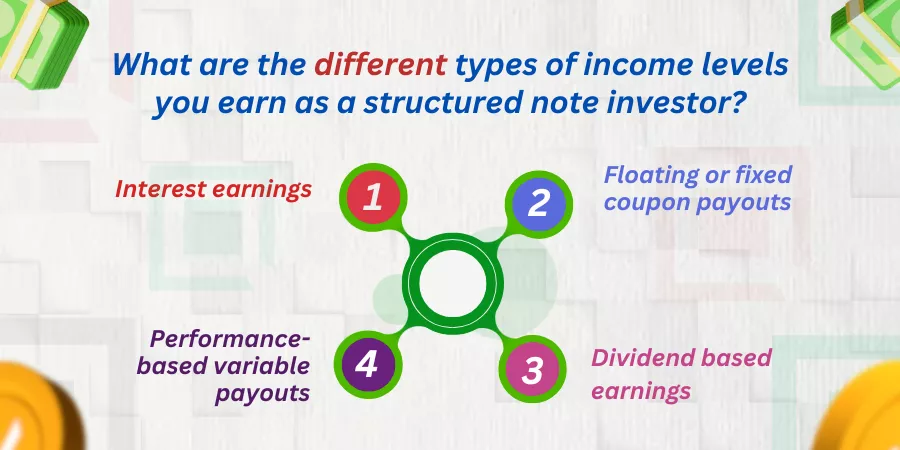

What are the different types of income levels you earn as a structured note investor?

These are the different types of incomes you earn as a structured note investor. Helping you through with a run-down into the same:

Interest earnings

When you have your structured note that comprises traditional investment options like corporate bonds, government-backed mortgages or capital-protected securities, you get interest payouts periodically. The interest amounts are tendered to your on a quarterly, half-yearly, or annual basis. However, all of this depends on the terms and conditions the note is backed with by product issuing firms.

Floating or fixed coupon payouts

ELNs or Auto Callable Notes primarily offer investors a mix of fixed as well as floating coupon payouts. The notes here are linked to equity-based derivatives like stocks, shares or a basket of commodities to name a few. Therefore, the returns you expect from your portfolio are primarily subject to the performance of the underliers your notes are predominantly linked with.

The better performance levels your underlying assets display, you can garner heightened or potential income returns on your investment portfolios.

On the contrary, if the underlying assets do not perform well, you get coupons in congruence with the modest rate of returns you were promised while the notes were designed and you get the principal amount at the time the notes are redeemed upon maturity.

Performance-based variable payouts

Auto Callable Notes or Non Protected ELNs have equity-based derivatives that underlie the note’s product structures. While the cap wallet may or may not get protected, the returns are linked to the performance of the underlying assets the notes are linked with.

Therefore, investors receive performance-based variable payouts in the form of coupons or capital-intensive payouts and the notes do not garner fixed rates of returns that you find with traditional bonds or fixed-income securities.

Dividend based earnings

As most of the structured notes have a strong allocation to equity-based assets, if the performance of the underlying stocks or shares go higher up, then companies can distribute dividend-based earnings to their investors. However, this is based on the capped limits or ceiling limits as set up on the notes by-product issuing firms.

What factors would you consider while choosing structured notes?

Here is a list of factors or guidelines you consider while choosing structured notes as your investment option. Helping you through with a run-down of pointers connected with the same:

Looking at the credibility of the product issuing firm

To invest in a structured note of your choice, you must research a lot of the credibility of a product issuance firm you would want to zero in on. Investment grade banks, private management financial firms, or reputed wealth management firms offer structured notes to their high net-worth institutional as well as retail investors. You must therefore thoroughly look into the years of experience a financial firm has in dealing with investments and customers on the whole and then you can zero in on the same.

Looking for independent wealth management practitioners

Most of you are busy salaried individuals doing proper 9-5 jobs and you may return home exhausted. And, during the weekends, you may rather want to unwind with your family members or take them for weekend drives stepping from one investment office to another.

Therefore, you look for a more holistic and tailor-made solution that can possibly suit your lifestyle on the whole. Here, you can look for professional and competent fiduciary financial advisors or investment practitioners who connect with their clients on a one-on-one forum to discuss investment options with you.

You can connect via Google Meets, Zoom, or Skype- FaceTime to connect with independent practitioners. You can discuss your financial obligations with them and seek customized financial solutions that you are looking for.

Looking for online-based client testimonials

To make things easier, going in for online-based customer testimonials is way better over running helter-skelter to investment firms or banking firms. You must read online testimonials and you can do so by visiting the official web pages of financial firms you have zeroed in with.

You can do your online research during your free time and look at other client testimonials who have poured their experience snippets of working with the firm. This way, you get better cue cards on how the firm functions and what kind of clients have they worked with before.

By reading authentic client testimonials, you will surely be able to choose the right firm for curating your structured note portfolios and then there is absolutely no looking back!

Reading through the fine print

You can visit our online website which is https://quadrawealth.com/articles. Here, you can get a thorough know-how into how every type of structured note works for you as such.

We have curated simple blogs that describe the pros and cons of ELNs, Autocallable Notes, Credit linked notes, PPNs, and other diversified investment notes you can think of.

The website is a one-stop stop hub wherein you get the A to Zee info on how each structured note works, what the pros and cons are connected with the same and as a newbie how should you go about pursuing the whole thing.

By reading through the fine print, you make sure that you put your best foot forward in the world of finances or investments.

The Bottom Line

Hedging can be a very good technique for you to leverage turnbo returns on your whole. Changing interest rates, or other volatile factors of the market are taken care of here seamlessly.

You can also have a word with your product issuing firm to incubate user-friendly options on your notes so as to achieve your principal protection and garner better rates of returns on your investment portfolios.

What are your thoughts on this? Do let us know in the comments below!

Frequently Asked Questions or FAQs

Define Hedge Fund

Answer: A Hedge Fund is a type of investment fund that primarily uses hedging techniques to build returns on an investment portfolio. A hedge fund manager will allocate the trading instruments that use hedging as an investment boosting technique and therefore help investors secure better returns on their cap wallet even during adverse market scenarios.

How does hedging become an effective risk management strategy?

Answer: The financial markets depend on asset allocation of interest rate derivatives or currency fluctuations or get you better exposure to mutual funds. You can ask the product issuer to attach that type of hedge that helps mitigate your investment losses or risks effectively.

Does the trader hedge borrowings or loans for investment options?

Yes, the trader takes help from hedging companies to create turbo returns for investors. The veterans who use hedging as an investment strategy are appointed to help investment firms gauge potential returns for their customers. Therefore, third-party hedging companies can also be hired by investment firms to utilize hedging as an investment-earning strategy.