Credit Linked Notes (CLNs) are financial instruments that offer investors exposure to credit risk.

They are structured products that combine elements of both bonds and derivatives.

In simple terms, CLNs are a form of debt instrument where the issuer’s creditworthiness is linked to the performance of an underlying asset, typically a reference entity or a basket of reference entities.

A CLN is essentially a bond with a credit derivative component.

It is designed to transfer credit risk from one party, known as the issuer, to another party, known as the investor.

The investor assumes the credit risk of the issuer in exchange for a higher potential return.

To understand how CLNs work, it is important to grasp the concepts of Credit Default Swaps (CDS) and Collateralized Debt Obligations (CDO).

A CDS is a financial contract that allows investors to protect themselves against the risk of default on a particular debt obligation.

A CDO, on the other hand, is a structured product that pools together various debt obligations, such as loans or bonds and creates tranches of different risk levels.

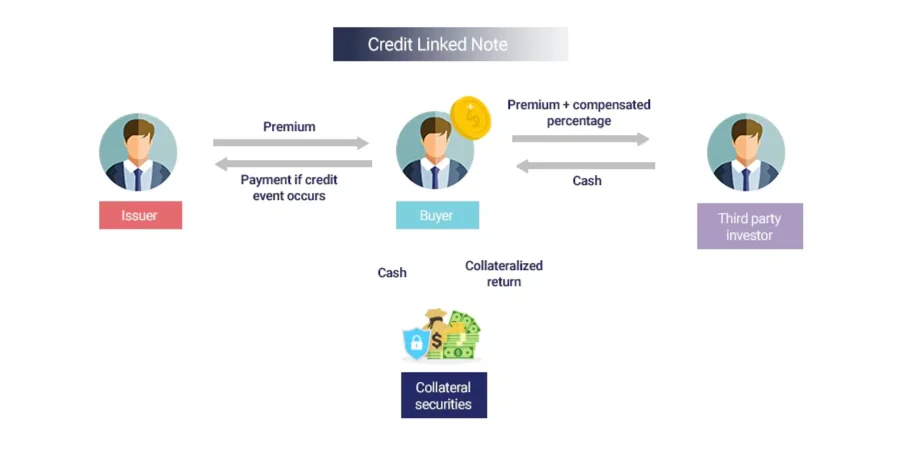

The structure of CLNs involves the issuance and investment process. The issuer creates the CLN, specifying the reference entity and the terms of the contract.

Investors then have the opportunity to purchase the CLNs, which offer potential returns based on the performance of the reference entity.

In terms of benefits, CLNs provide diversification of credit risk, as investors can gain exposure to a variety of reference entities.

They also offer the potential for higher returns compared to traditional bond investments.

CLNs provide customization and flexibility in terms of structuring and payout options. However, there are risks associated with CLNs.

The main risk is the credit risk of the issuer, as the investor is essentially relying on the issuer’s ability to principal repayment and make coupon payments.

Liquidity risk is another concern, as CLNs may have limited secondary market trading.

The complexity of CLNs and the lack of transparency can make them difficult to understand and evaluate.

Understanding Credit Linked Notes

Understanding Credit Linked Notes can be challenging. However, breaking it down into simple terms can help grasp the concept.

Credit Linked Notes are financial products that enable investors for accepting exposure to credit risk.

They are structured as bonds with embedded credit derivatives, providing investors with the opportunity to earn higher yields based on the creditworthiness of reference entities like corporations or sovereign governments.

To understand Credit Linked Notes, it’s important to know that financial institutions or investment banks typically issue them.

These institutions assume the credit risk of the reference entities and offer the notes to investors.

The residual value of the notes depends on the credit quality and performance of the reference entities.

Investors can use Credit Linked Notes to diversify portfolios, enhance returns, or hedge against credit risk.

By investing in these notes, investors can indirectly participate in the credit market and potentially earn higher yields.

Pro-tip: When considering investing in Credit Linked Notes, it’s crucial to carefully evaluate the creditworthiness of the reference entity.

Thorough research and analysis of the credit risk involved can help make informed investment decisions.

Understanding Credit Linked Notes allows investors to navigate the world of credit risk and potentially benefit from higher yields.

It is essential to stay informed and consult with financial professionals before investing in these complex financial instruments.

What are Credit Linked Notes?

Credit Linked Notes (CLNs) are investment products linked to the creditworthiness of a reference entity.

They function like bonds but carry a higher risk. By investing in CLNs, investors take on the risk of the reference entity defaulting on its debt obligations.

If this happens, investors may lose money. However, if the reference entity maintains a strong credit rating and fulfills its debt obligations, investors receive a return.

So, what are Credit Linked Notes? CLNs can be a good option for diversifying a portfolio and potentially earning higher returns.

However, it is important to thoroughly research the creditworthiness of the reference entity before investing.

It is also crucial to carefully consider the risks involved and assess whether the potential returns outweigh the potential losses.

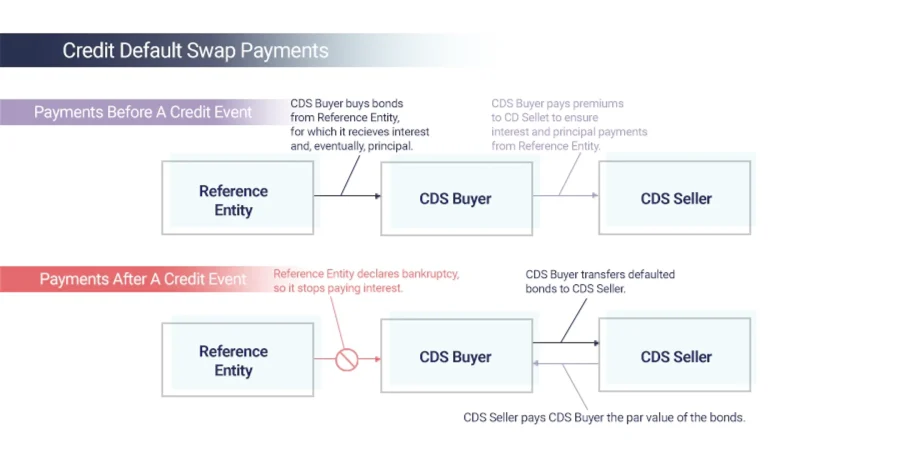

What is a Credit Default Swap ?

A Credit Default Swap (CDS) is a financial contract between a buyer and a seller. It acts as insurance against default on a loan or bond issued.

The buyer pays a premium to the seller in order to shift the credit risk.

If a default happens, the seller compensates the buyer by paying the face value of the bond or loan or the difference between the face value and the recovery value.

The pricing of CDS contracts is based on the creditworthiness of the reference entity.

If the reference entity has a high risk of default, the CDS cost is high. Conversely, if the reference entity has a low risk of default, the CDS cost is low.

Financial institutions like banks and hedge funds utilize CDS contracts to manage their credit risk exposure and provide opportunities for investors to speculate on the creditworthiness of companies or bonds.

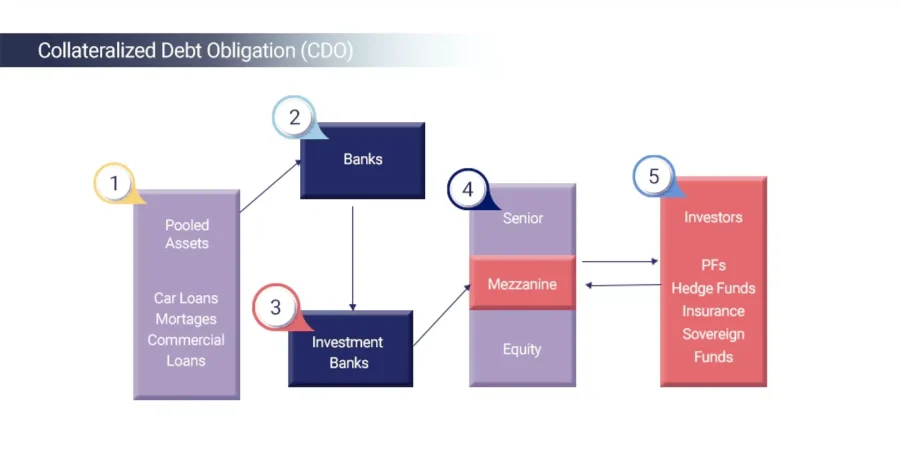

What is a Collateralized Debt Obligation ?

A collateralized debt obligation (CDO) is a structured financial product that combines various types of debt, such as bonds and loans.

It repackages them into different tranches with varying levels of risk and return.

A CDO combines multiple debt securities and has different tranches with different risk and return levels.

The underlying debt can include assets like corporate bonds, residential mortgage-backed securities, and commercial mortgage-backed securities.

A special purpose vehicle (SPV) creates a CDO. It holds the debt and issues securities to investors.

Credit rating agencies rate the tranches, with higher-rated tranches being less risky and lower-rated tranches having higher risk but the potential for higher returns.

Cash flows from the underlying debt pay interest and principal payments to investors in each tranche.

The performance of a CDO depends on the credit quality of the underlying debt and the borrowers’ ability to make interest payments.

CDOs gained attention during the 2008 financial crisis, as many were backed by subprime mortgage loans that defaulted.

Investing in CDOs carries significant risk, including potential loss of principal if the underlying debt defaults or the CDO’s market value declines.

Thoroughly understanding the structure and risks of a CDO is crucial before considering investment.

How do Credit Linked Notes Work?

Curious about how credit linked notes actually work? Delve into the fascinating world of these financial instruments with us.

In this section, we’ll explore the intricacies of their structure, the process of issuance and investment, as well as the crucial aspects of coupon payments and maturity.

Join us as we unravel the mechanics behind credit linked notes and gain insight into this intriguing aspect of the financial realm.

The Structure of Credit Linked Notes

The structure of credit linked notes is crucial to understand when considering investment.

It involves components that work together to create this financial instrument. One way to comprehend the structure is through a table that highlights key elements:

Issuer – The entity that offers credit-linked notes to investors.

Underlying Assets –

Specific assets, such as loans or bonds, that the credit-linked notes are linked to.

Reference Entity – The entity whose creditworthiness determines the value of the credit-linked notes.

Notional Amount – The initial value of the credit-linked notes used as a reference point for determining payments.

Trigger Event – An event that can lead to a payout on the credit-linked notes, such as a default by the reference entity.

Payment Terms – Specifies when and how payments are made to investors, based on the occurrence of the trigger event.

Understanding the structure of credit linked notes is vital in assessing the risks and returns associated with these instruments.

It allows investors to evaluate the specifics and make informed decisions based on their financial goals and risk tolerance.

Fact: Credit linked notes offer investors the opportunity to gain exposure to credit risk without directly holding the underlying assets.

Issuance and Investment in Credit Linked Notes

Issuance and investment in credit linked notes play a crucial role in the financial market. Financial institutions utilize issuance to raise capital or transfer credit risk.

They achieve this by creating credit linked notes, which involve combining a bond or loan with a credit derivative such as a credit default swap or collateralized debt obligation.

Investors have the opportunity to participate in the credit linked notes market by purchasing these financial instruments from the issuing financial institution.

This allows them to gain exposure to credit risk without directly holding the underlying credit assets.

However, it is important to note that investing in credit linked notes carries various risks.

One of the key risks is credit risk, where the issuer or reference entity may face a default or experience a downgrade.

Additionally, liquidity risk is a concern as credit linked notes may have lower liquidity compared to traditional bonds or loans.

Moreover, the complexity and lack of transparency associated with credit linked notes can pose challenges for investors in fully comprehending and assessing the involved risks.

Credit linked notes gained popularity in the early 2000s, especially after the global financial crisis in 2008.

Nevertheless, their complexity and lack of transparency contributed to the financial market turmoil experienced during the crisis.

As a result, regulators have implemented stricter regulations and increased transparency requirements for these instruments.

Consequently, investors are now more cautious and seek greater clarity and understanding of credit linked notes before making any investment decisions.

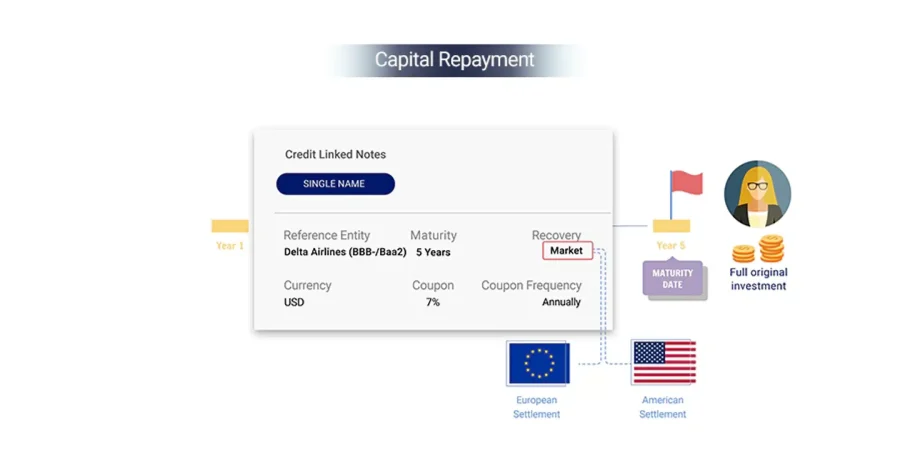

Coupon Payments and Maturity of Credit Linked Notes

The table below explains coupon payments and maturity in credit-linked notes:

Coupon payments are interest payments made by the issuer to the investor.

Maturity is the date when the note reaches its final payment and ceases to exist.

Coupon payments are determined by the note’s terms and are usually expressed as a percentage of the face value.

At maturity, the investor receives the final repayment, including the principal and accrued interest.

Coupon payments are made on a regular schedule, such as quarterly or annually.

The maturity date is predetermined and specified in the note’s documentation.

The coupon rate is determined when the note is issued and remains fixed until maturity.

Investors can hold the note until maturity or sell it in the secondary market.

Sarah invested in a credit-linked note (CLN) with a 5% coupon payment and a 5-year maturity.

She received a 5% coupon payment per year based on the note’s face value.

After 5 years, Sarah received the full repayment of the principal amount and accumulated coupon payments.

This investment provided her with steady income and a return of her initial investment at maturity.

Sarah was satisfied with the note’s performance and considered it suitable for her financial goals.

Benefits and Risks of Credit Linked Notes

Discover the advantages and potential pitfalls of credit linked notes as we dive into the benefits and risks associated with these financial instruments.

From diversification of credit risk to the possibility of higher returns, we’ll explore the upside of credit linked notes.

However, we must also address the potential dangers, such as credit risk, liquidity risk, and the complex nature of these instruments.

Brace yourself for an enlightening exploration of the pros and cons that come with investing in credit linked notes.

Benefits:

Credit Linked Notes offer several benefits:

- Diversification of credit risk: Investors can diversify their exposure to credit risk by investing in a portfolio of different underlying assets. This reduces the impact of individual defaults on the overall investment.

- Potential for higher returns: Credit Linked Notes offer higher returns compared to traditional fixed income investments. Investors are compensated for taking on the credit risk associated with the underlying assets.

- Customization and flexibility: Credit Linked Notes can be structured to meet specific investor needs and preferences. They offer flexibility in terms of maturity dates, coupon payments, and underlying asset types.

Investors should carefully consider these benefits before investing in Credit Linked Notes.

However, it is crucial to be aware of the risks associated with these investments, such as credit risk, liquidity risk, complexity, and lack of transparency.

Diversification of Credit Risk

Diversification of credit risk plays a pivotal role when it comes to investing in credit-linked notes.

It is crucial for investors to spread their investments across various credit risks in order to mitigate the potential impact of a default by a single issuer.

One way investors can achieve diversification is by investing in a portfolio of credit-linked notes that represent exposures to multiple underlying assets or reference entities, such as bonds, loans, or other debt instruments.

This approach helps reduce their exposure to the credit risk of any individual issuer.

Another strategy for diversification is investing in credit-linked notes that are tied to different sectors or industries.

This helps mitigate the risk of sector-related events impacting the portfolio.

Geographical diversification is also an effective approach, wherein investors can invest in credit-linked notes linked to issuers from various regions or countries.

This provides an added layer of protection against localized economic downturns or political events that may have a negative impact on a single region.

However, it is important to note that diversification alone cannot completely eliminate credit risk.

Factors such as market place conditions, macroeconomic factors, and correlation risk can still influence the performance of credit-linked note portfolios.

Therefore, investors must conduct thorough research and analysis to ensure appropriate diversification that aligns with their risk tolerance and investment objectives.

Potential for Higher Returns

The potential for higher returns is a key factor when investing in credit-linked notes.

Credit-linked notes offer higher returns compared to traditional fixed-income investments like corporate bonds.

Investors can earn higher yields based on the credit quality of the underlying assets.

The potential for higher returns is influenced by market conditions and the performance of the underlying assets.

In a favorable market, where the credit quality of the underlying assets improves, investors may experience higher returns.

However, it’s important to note that the potential for higher returns comes with increased risk.

Credit linked notes are exposed to credit risk and other risks associated with the underlying assets.

Investors should carefully assess their risk tolerance before investing.

Diversification can enhance the potential for higher returns.

Investors can spread their risk and potentially increase their chances of achieving higher returns by investing in a portfolio of credit-linked notes with a mix of underlying assets.

The potential for higher returns may vary depending on the investment horizon.

Short-term investments in credit linked notes may offer different return potentials compared to long-term investments.

Considering the potential for higher returns is important for investors seeking to maximize their investment gains.

However, investors should carefully evaluate the associated risks and consider other factors such as market conditions and investment horizon before making investment decisions.

Customization and Flexibility

Customization and flexibility are key features that make credit linked notes attractive to investors.

These notes offer the ability for investors to customize the investment structure and terms according to their specific needs.

They can choose the reference entity, the maturity date, and the coupon payment structure, aligning the investment with their risk appetite and goals.

Moreover, credit linked notes provide flexibility for investors to take either a long or short credit risk position based on their outlook of the credit market.

They can also select from a range of credit events that trigger a payout, including default, bankruptcy, or credit rating downgrades.

This level of flexibility allows investors to actively manage their credit exposure and potentially enhance their returns.

Through the offering of customization and flexibility, credit linked notes empower investors to design investments that align with their risk preferences and investment objectives.

This gives them greater control over their portfolios and the potential for higher returns.

However, it is important for investors to assess the risks associated with credit linked notes and seek advice from a financial advisor before making any investment decisions.

Risks:

- One of the main risks associated with credit-linked notes is credit risk. This refers to the possibility of the issuer defaulting on payment obligations, which can result in a loss of principal or interest for investors.

- Another risk is liquidity risk. Credit-linked notes may have limited liquidity in the secondary market, making it challenging to buy or sell them at favorable prices, especially during market stress.

- Credit-linked notes are complex financial instruments that may be difficult for investors to understand. This complexity is compounded by the lack of transparency regarding the underlying credit portfolio, making it challenging to assess the risks involved.

Investors should carefully evaluate their risk tolerance and seek professional advice before investing in credit-linked notes.

Diversifying their investment portfolio can help mitigate some of these risks.

Thorough research and understanding of the underlying assets and risks are crucial for any investment.

Credit Risk

Credit risk is a crucial consideration when investing in credit-linked notes.

It pertains to the possibility that the CLN issuer may fail to make timely payments.

This risk stems from the credit quality of the underlying entity, which could be a corporate, government, or financial institution.

There are several factors to carefully evaluate when assessing credit risk:

1. Credit rating: It is important to assess the creditworthiness of the entity by considering ratings provided by reputable agencies like Standard & Poor’s, Moody’s, or Fitch.

2. Default probability: Factors such as financial stability, industry conditions, and economic outlook should be taken into account when determining the likelihood of the entity defaulting.

3. Recovery rate: It is crucial to measure the principal amount that investors can potentially recover if a default occurs. A higher recovery interest rate can help mitigate the impact of credit risk.

4. Diversification: Spreading investments across different entities is a strategy employed to minimize credit risk.

Despite the potential risks involved, credit-linked notes offer advantages such as diversification, the potential for higher returns, and the ability to customize investments.

However, it is essential for investors to assess their risk appetite and conduct thorough research on the creditworthiness of entities before making investment decisions.

Understanding and effectively managing credit risk is vital for making informed investment choices when it comes to credit-linked notes.

By diligently evaluating credit quality and diversifying investments, investors can navigate potential risks and make sound investment decisions.

Liquidity Risk

Liquidity risk is an essential aspect to consider when investing in credit linked notes.

It pertains to the challenge of selling or buying a security at a reasonable price within a reasonable timeframe.

In the credit-linked notes market, liquidity risk can occur for various reasons.

Firstly, these securities do not experience as much trading activity as traditional fixed-income instruments.

Consequently, there might be a scarcity of buyers or sellers, making it more difficult to find a counterparty for your transaction.

Credit linked notes are intricate financial instruments that necessitate expertise to comprehend and analyze.

This complexity can limit the number of market participants who are willing and capable of trading these securities.

During times of market stress or uncertainty, liquidity risk can exacerbate.

In such situations, investors tend to be more cautious and demand higher premiums for illiquid assets.

This results in wider bid-ask spreads and reduced market liquidity. When considering credit linked notes, investors should evaluate their own liquidity needs and risk tolerance.

Individuals with shorter investment horizons or an urgency for quick access to funds should be especially mindful of liquidity risk.

A fact worth mentioning is that liquidity risk is frequently assessed through bid-ask spreads, trading volume, and market size for a given security.

Complexity and Lack of Transparency

Investing in credit-linked notes can be complex and raise concerns about transparency.

These financial instruments are intricate, posing a challenge for investors to fully comprehend.

One major drawback is the lack of transparency associated with these notes.

Investors often struggle to obtain comprehensive and up-to-date information regarding the underlying assets and overall performance, making it difficult to assess the true risks and potential returns.

It is crucial for investors to exercise caution and diligently review all available information, including the structure and credit risk.

Seeking professional advice and conducting thorough research can help mitigate the risks involved.

When considering investments like credit linked notes, it is essential to have a complete understanding of the structure, risks, and potential returns.

Therefore, it is advisable to seek guidance from financial experts before making any investment decisions.

Some Facts About How Credit Linked Notes Work: Explained in Simple Terms:

- ✅ A credit-linked note (CLN) allows a company to transfer the credit risk of a fixed income instrument to a group of investors. (Source: Management Study Guide)

- ✅ CLNs are considered safer than credit default swaps and are allowed by most organizations. (Source: Management Study Guide)

- ✅ In a CLN, the company buys bonds from another company and promises to make periodic payments for principal and interest. (Source: Management Study Guide)

- ✅ The investor pools their bonds and creates an underlying portfolio, which is then used to issue securities backed by the bonds. (Source: Management Study Guide)

- ✅ In a CLN, the credit risk is transferred from the company to the investors, providing the company with protection in case of default. (Source: Management Study Guide)

In Conclusion

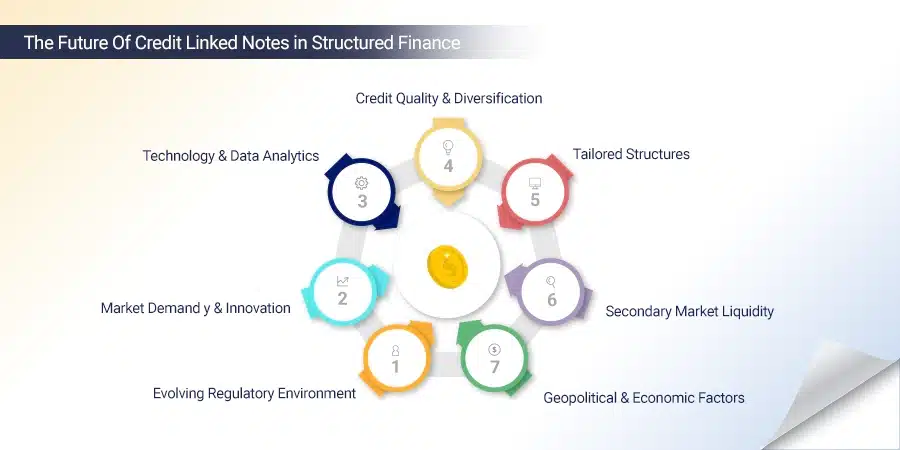

Credit Linked Notes (CLNs) are financial instruments that offer investors exposure to credit risk by linking the issuer’s creditworthiness to the performance of an underlying asset.

They combine elements of bonds and derivatives, providing potential for higher returns compared to traditional bonds.

CLNs offer diversification and customization benefits, but their complexity and lack of transparency pose risks.

Investors must carefully assess credit risk, liquidity risk, and market conditions before investing in CLNs.

Seeking professional advice and conducting thorough research is crucial to make informed investment decisions that align with individual financial goals and risk tolerance.

Frequently Asked Questions

A credit-linked note work as a structured finance product that allows a company to transfer the specific credit risk of a fixed-income instrument to a group of investors. The company buys bonds from another company and creates an underlying portfolio of these bonds. The company then issues securities backed by these bonds and sells them to investors. The investors pay upfront and in return, they receive periodic payments for principal and interest. In the so-called credit event of default, the investors are protected because the company took the money upfront. Credit-linked notes ensure that credit events at the original seller do not impact the company, as the credit risk has been transferred.

A credit-linked note offers several benefits. They allow companies to transfer credit risk to investors, reducing their own exposure. They are considered safer than credit default swaps and are allowed by most organizations. Credit-linked notes also provide a higher yield for credit investors who are willing to accept exposure to specified credit risks. They are structured with a security and an embedded credit default swap, eliminating the need for a third-party insurance provider. Additionally, credit linked notes can be backed by highly rated collateral such as U.S. Treasury securities, making them a conservative product for investors.

To create a credit linked note, a loan is issued to a customer. The loan can be held by an institution or sold to another institution. If sold, the loan is divided into parts and bundled together based on risk or rating. These bundled parts are used to create securities that investors can purchase. The securities are issued by a special purpose vehicle or trust, which collateralizes them with AAA-rated securities. Investors buy these securities and earn a fixed or floating coupon during the life of the note.

A credit default swap is an important component of credit-linked notes. The special purpose vehicle or trust enters into a default swap with a dealer. If the referenced entity defaults, the dealer will pay the trust an amount equal to the recovery rate minus par. The dealer charges an annual fee for this arrangement, which is passed on to the investors as a higher yield on their note. This allows the risk of default to be sold to other parties, similar to insurance.

Credit-linked notes are typically marketed to institutional investors, but there have been cases where they have been sold to retail investors. However, difficulties can arise for retail investors due to a lack of data and risk identification. After the financial crisis, retail investors claimed that banks and brokers mis-sold credit-linked notes as low-risk products. It is important for retail investors to carefully evaluate the risks associated with a credit-linked note and ensure that they align with their investment goals and risk tolerance.

While credit-linked notes transfer credit risk to investors, other risks such as market risks still remain with the company. The amount of loss experienced in the event of default depends on the number of loans or parts of the loan in the security, how many end up in default, and how many investors are participating. Credit-linked notes also expose investors to interest rate fluctuations, as the coupon or price of the note is linked to the performance of a reference asset. It is important for investors to carefully assess these risks and consider their risk tolerance before investing in credit-linked notes.