Are you wondering if you can manage your own finances without the help of a financial advisor? This is an important question, as financial advisors play vital roles in wealth management and retirement planning.

Every decision about money matters, and this blog post will guide you on how to be your own financial advisor by navigating various aspects including creating budgets, understanding investments and more.

Let’s dive into this captivating journey towards becoming financially independent!

Key takeaways

● You can manage your own money without a financial advisor.

● To do this, first understand where you stand with your money today.

● Then make out a plan for where you want to be in the future.

● Remember, being your own financial advisor means checking on how well you are doing each year.

Understanding the Role of a Financial Advisor

Financial advisors are professionals who use their expertise to guide you in managing your finances, encompassing areas like investment management, budgeting guidance, retirement planning and tax preparation.

Their role includes diverse functions such as acting as brokers or portfolio managers, financial coaches or even financial therapists – all depending on your needs. They offer advisory based either on fee-only or fee-based model and vary greatly in the extent of service offered; from robo-advisors providing online financial planning services to traditional advisors rendering face-to-face advice.

What Financial Advisors Do

Financial advisors help people manage their money. They give advice on savings, investments, taxes and insurance decisions. Some may work with persons who need to plan for retirement or college funds.

Others help clients learn how to save and budget better. They look after their client’s assets using proper ways that fit the client’s needs, goals and comfort level with risk. So, financial advisors make sure clients get most out of their income and hard-earned cash in a safe way.

Can You Be Your Own Financial Advisor?

Unearth the possibility and process of becoming your own Financial Advisor as we delve into assessing personal financial needs, documenting current finances and framing a path for future financial endeavors.

Keep reading to quantify your fiscal powers!

Identifying Your Financial Needs

Identifying your financial needs takes a bit of work.

- Begin with an understanding of your net worth.

- Your net worth is the total all your assets minus your debts (liabilities).

- Connect it to income and expenses.

- Look at how much money you make monthly and compare it to how much you spend.

- Make use of budget apps such as Mint, You Need a Budget or Personal Capital.

- These tools are great for identifying where your money is going each month.

- Think about what you want in the future.

- Set aside funds for major goals like buying a new car or paying down debt.

- Consider unexpected situations.

- Medical emergencies or sudden job loss can require extra cash on hand.

- Take time pondering how much retirement savings you need.

- Use retirement calculators like NewRetirement to see if on track to retire comfortably.

Mapping Your Current Financial State

To be your own financial advisor, first, you need to know your current money situation. Here is how:

- Track Income: Write down all the money you get each month. This can be from your work, a part-time job, or payments like rent.

- List Expenses: Make a list of what you spend every month. This can be things like bills, food, and fun activities.

- Calculate Net Worth: Your net worth is what you have left after you subtract what you owe from what you own.

- Make A Budget: Use apps like Mint or Personal Capital to plan how much to spend each month.

- Understand Assets and Liabilities: Things that bring in money are assets. Things that cost money are liabilities.

- Figure Out Savings: See how much money is left over for savings after all expenses are paid.

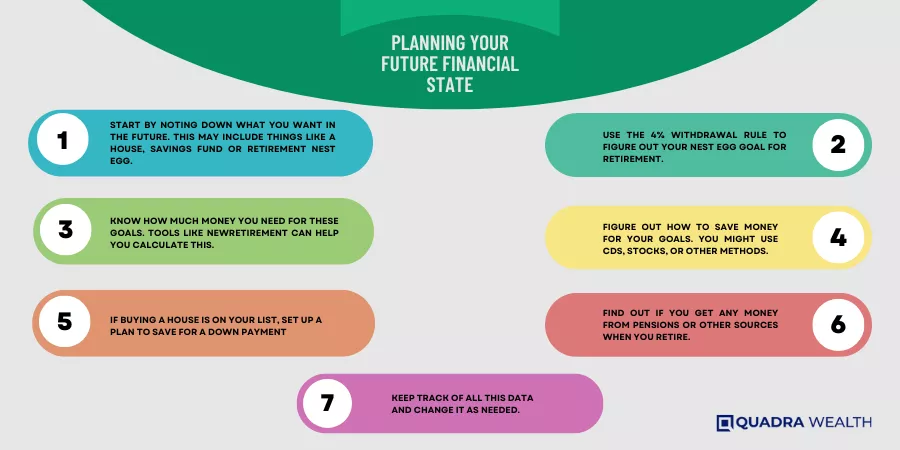

Planning Your Future Financial State

Grasp your future financial state with a clear plan.

- Start by noting down what you want in the future. This may include things like a house, savings fund or retirement nest egg.

- Know how much money you need for these goals. Tools like NewRetirement can help you calculate this.

- Use the 4% withdrawal rule to figure out your nest egg goal for retirement.

- Figure out how to save money for your goals. You might use CDs, stocks, or other methods.

- If buying a house is on your list, set up a plan to save for a down payment.

- Find out if you get any money from pensions or other sources when you retire.

- Keep track of all this data and change it as needed.

Considerations When Deciding to Be Your Own Financial Advisor

When deciding whether to become your own financial advisor, you should take into account a few things. First, understand the range of options for financial advisors such as broker-dealers and registered investment advisors.

Then, consider the different business models including fee-based models that can potentially introduce conflicts of interest due to third-party commissions. Evaluate how much you’re willing or able to spend on advisory fees if choosing professional help.

Remember that becoming your own financial advisor requires ample personal finance knowledge and ability to plan toward future financial states while managing current assets effectively.

Understanding the Types of Financial Advisors

Financial advisors come in a variety of types, each with their own specialization and methods of compensation. These include investment advisors, financial planners, and certified public accountants (CPAs). Working with a professional who is registered with the Securities and Exchange Commission ensures that they are bound by fiduciary duty to act in your best interest. Some advisors are also representatives of broker-dealers or insurance companies, earning commissions from third-party firms. Fee-only advisors, on the other hand, earn compensation solely from advisory fees charged to clients.

Type of Financial Advisor | Specialization | Method of Compensation |

Investment Advisors | Specializes in managing and investing client funds to meet specified investment goals. | Typically, they are paid a percentage of assets managed. |

Financial Planners | They assist in managing your finances comprehensively and plan for financial goals like retirement or education. | They can be either fee-based or commission-based. |

Certified Public Accountants (CPAs) | Specializes in tax planning and preparation. Some also offer financial planning services. | Fees are typically hourly, per form for tax preparation, or a flat fee for financial planning. |

Broker-Dealer Representatives | They recommend and sell securities, insurance, and other financial products. | They earn commissions from the financial products they sell. |

Insurance Company Representatives | They specialize in selling insurance products. | They earn commissions from the insurance policies they sell. |

Fee-Only Advisors | They provide financial advice and create a comprehensive financial plan. They do not sell financial products. | They are compensated solely from advisory fees charged to clients. |

Reviewing the Range of Options for Financial Advisors

You have many choices when picking a financial advisor.

- There are Investment Advisors. They handle your money and make a plan for you. They are with the Securities and Exchange Commission. This means they must do what’s best for you.

- Some advisors work for stock brokers or insurance companies. They might get extra money from these firms.

- Financial planners help you set goals and plan how to reach them.

- Certified Public Accountants (CPAs) know about tax laws and can help you pay less taxes.

- Fee – only advisors only take money from their clients, not from other companies.

- You can also use online tools like robo – advisors to help manage your money.

Analyzing How Much You Can Afford to Pay an Advisor

Money is key when picking an advisor. Look at how much money you have. Each advisor charges different fees. Some get paid a percent of the assets they manage, it’s often 1%. Others are fee-only advisors, they might charge per hour, session or plan made for you.

Ensure their price matches what you can pay without hurting your finances.

Steps to Becoming Your Own Financial Advisor

Begin by crafting a solid financial plan without a professional planner. Make use of online tools and platforms to help guide you. Don’t hesitate to seek an expert opinion if in doubt, it’s often beneficial to supplement your own knowledge with added validation from seasoned professionals.

Finally, once your plan is made, review it annually – assessing its success can give you confidence or insights into required changes; remember the importance of adaptability in finance.

Building a Financial Plan without a Professional Financial Planner

Building a financial plan without a professional can be a great choice for some. Here are the steps to do it:

- Get clear on your goals: Know what you want to reach and when.

- Look at where you stand today: Add up your income, expenses, assets, and debts.

- Plan where you want to be in the future: Think about how much money you may need later in life.

- Set aside emergency funds: A rule is to have three months’ worth of living costs saved.

- Save and invest smartly: Use retirement calculators to see if you’re saving enough.

- Keep checking your plan every year: This will ensure that it lines up with changes in your life or economic conditions.

Getting an Expert Opinion

Ask a pro for help. Sometimes, it’s smart to chat with a financial advisor. Even if you know a lot about money, an expert can still help. They see things in different ways and might suggest new ideas.

For instance, they could find errors in your plan or tell you how to pay less tax. Go online and look up an advisor near you today

Reviewing Your Plan Annually

One key step to being your own financial advisor is checking your plan each year.

- You will look at how you are doing.

- This helps you see if you are getting to your goals.

- You may need to change your plan if something in your life changes.

- It is crucial to see how much money you are making and spending.

- People often find it tough to say what will happen in the future.

- Breaking down plans into smaller parts, like five or ten years, can make them easier.

- A good plan makes you think about the future and make smart choices.

- You can avoid making choices based only on feelings with a solid plan.

When You Should Consider Hiring a Financial Advisor

Grasping when professional financial guidance becomes necessary, we navigate the intersections of complex decisions and self-management, preparing you to identify your distinct need for a Financial Advisor.

Stay tuned!

When to Work With a Financial Advisor

You should find a financial advisor if you have a big amount of money. They can help make sure your cash is safe. If you will retire soon, they can plan out your money for then too.

You may want to think about an advisor when big events happen like getting a lot of money all at once. Hiring an expert can be good if you feel unsure or don’t have time to watch your own funds.

When to Go It Alone

Choosing to manage your own money is a big decision. You might feel ready to do this if you know how the stock market works. The act of picking and buying stocks can be exciting for some people.

If you have a small amount of money, paying an advisor may not make sense for you. Also, having no big life events in sight might leave fewer financial choices to deal with on your own.

For example, someone who already owns a home and plans to stay there doesn’t need help deciding how much house they can afford.

Conclusion

You truly can be your own financial advisor. But, it takes time and lots of learning. Remember to always check your plan each year. Make sure you are meeting all your money goals.

FAQs

Yes, with good financial knowledge, anyone can manage money and become their own financial advisor.

You need a good grip on investment issues, tax strategy, liquid assets handling, estate planning decisions, account balance checks and risk tolerance awareness.

By understanding your asset value and getting an expert opinion if needed one could effectively map the present state while considering market performance for future states.

Understanding your Insurance needs is very vital; adjusting protection depending upon life situation changes helps in making solid strategies for medical emergencies or major events like large inheritance.

Independent publishers like NerdWallet provide comparison services that aids financially curious individuals though gaining CPA or CFP Designation would add more value.

No! There may be certain costs involved such as hourly rate or retainer but offerings vary even to include lower-cost types based on account minimums & annualized return over typical subscription fees.