Are you confused about the effects of public debt on the economy? Did you know that high levels of such debt can negatively impact economic growth? This article will demystify the complexities related to public debt and its effects, providing easy-to-understand explanations.

Let’s dive in to comprehend this seemingly complex financial phenomenon better!

Key takeaways

●Public debt is the total amount of money that a government owes to external creditors and its own citizens.

●High levels of government debt can negatively impact economic growth by leading to higher taxes, inflation, and reduced private investment.

●Increased government borrowing can crowd out private investment and lead to higher interest costs.

●High public debt poses risks such as fiscal crisis, reduced access to credit, higher inflation rates, and limited flexibility in responding to economic crises.

Understanding Public Debt

Public debt is the total amount of money that a government owes to external creditors and its own citizens.

Definition Of Public Debt & The Effects of Public Debt On The Economy

Public debt is money owed by the government. The government borrows this money when it spends more than it gets from taxes. Money can be borrowed from people in the country or from other countries.

These loans must be paid back with interest, which is extra money charged for borrowing the funds. This debt influences how a nation’s capital markets grow and change over time.

Key Drivers of National Debt

Public debt can grow for many reasons. Here are the main ones:

- Government Spending: When a government spends more than it makes from taxes, it borrows to cover the gap.

- Social Security and Medicare: These programs help older people. But they cost a lot of money.

- Tax Cuts: Less tax means less money for the government. It may need to borrow more.

- Government Borrowing: When a government needs more money, it borrows from people or other countries.

- The Congressional Budget Office projects predict that rising interest rates and expanding federal budget deficits will cause the United States’ debt financing expenses to skyrocket by 2052.

Government Spending

Lots of dollars are spent by the government. It uses this money to fix roads and pay for schools. But, when it spends too much money, we call that public debt.

Public debt is often tied to economic growth in a negative way according to many studies. This means if there’s more government debt, there may be less growth or slowdown in the economy.

One reason could be higher taxes needed to cover the government debt which can affect how well businesses do their work and how people spend their money.

Too much government spending can also lead to inflation, where costs of things go up but wages don’t always match those increases.

Social Security and Medicare

Social Security and Medicare are big parts of our debt. These plans help old people and sick people. As more baby boomers retire, the cost goes up.

This makes the debt larger. But these plans also do good things.

They keep many old and sick people from being poor.

Tax Cuts

Tax cuts are used to help the economy. They put more money in people’s pockets, so they can spend it on goods and services.

This helps businesses grow and creates jobs. But tax cuts also mean less money for the government.

The government needs money for many things like roads, schools, and healthcare. When there is not enough money, the government has to borrow it.

This borrowing adds up over time and turns into public debt.

Also, some groups benefit from tax cuts more than others do.

Government Borrowing

The government often needs to borrow money. This can happen for many reasons.

One big reason is to pay for things the country needs, like roads and schools. But borrowing too much can lead to a high level of public debt.

This means the government owes a lot of money.

When there’s too much debt, it hurts economic growth. Studies show this in places like peer-reviewed journals.

They use systems such as panel data analysis and time series analysis to find out more about how debt affects growth.

The results from these studies teach us that it’s important for the government not to owe too much money.

The Economic Impact of Public Debt

Public debt has several economic impacts, including effects on economic growth, crowding out of private investment, and rising interest costs.

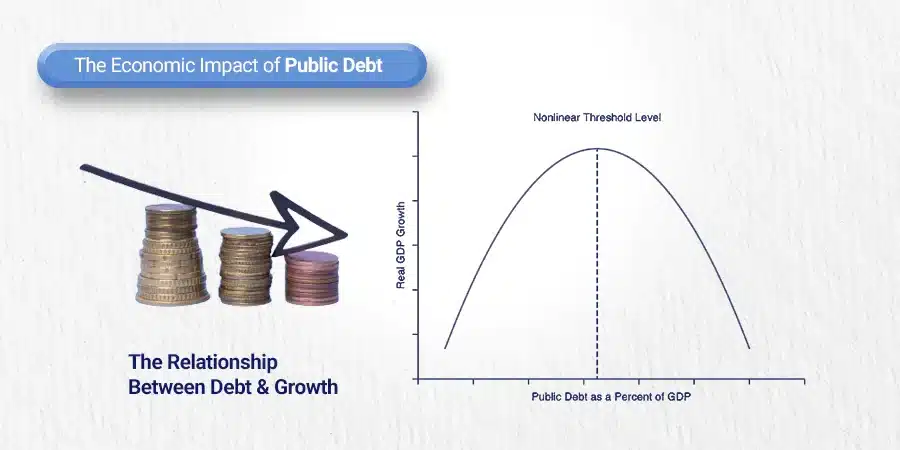

Effects on Economic Growth

Public debt impacts economic growth in big ways. A high level of public debt can slow down the speed at which an economy grows.

This is because more money goes to paying back the debt instead of using it for things that help grow the economy.

On the flip side, sometimes a bit of public debt can speed up growth. It’s like a sweet spot where just enough debt helps but too much hurts.

This is known as a nonlinear threshold in fancy terms and varies from place to place based on their unique situations. Also, not all studies agree on how much negative impact exists between high amounts of debt and slowed growth rates.

Some say it’s small while others think it’s bigger than we realize.

Crowding Out of Private Investment

Increased government borrowing can have a negative impact on investment.

When the government borrows more money, it reduces the availability of funds for private businesses and individuals to invest in things like new equipment, research and development, and expanding their operations.

This is known as crowding out. Crowding out occurs because when the government borrows more money, it increases demand for loans, which in turn leads to higher interest rates.

Higher interest rates make it more expensive for businesses to borrow money and invest in their growth. As a result, job creation and innovation in the private debt sector may be limited.

The extent of this crowding-out effect depends on factors such as the level of public debt and its sustainability over time.

Rising Interest Costs

High levels of public debt can lead to rising interest costs. When a country has a large amount of debt, it needs to borrow money to pay off its obligations. This borrowing comes with interest that needs to be paid back.

As the debt increases, so do the interest payments. These rising interest costs can have negative effects on the economy.

For example, they can lead to higher taxes and inflation, which in turn increase the overall cost of borrowing for businesses and consumers.

Studies have shown a negative relationship between debt and economic growth, suggesting that as debt levels rise, so do the corresponding interest costs.

The magnitude of this impact may vary depending on the level of debt reached by a country.

Risks Associated with High Public Debt

High public debt poses significant risks to the economy, including the risk of a financial crisis and other economic disruptions. Find out more about these risks and their potential consequences in this blog post.

Risk of a Fiscal Crisis

High levels of public debt pose a risk of a fiscal crisis for a country. When the federal government has accumulated too much debt, it may struggle to make payments on that debt, leading to a financial crisis.

This can happen when the government’s borrowing costs become unsustainable, and investors lose confidence in its ability to repay the debt.

A fiscal crisis can have serious consequences for an economy, including higher interest rates, reduced access to credit, and decreased investment.

It is important for countries to carefully manage their public debt levels to avoid this risk and maintain economic stability.

Risk of Other Economic Disruptions

High public debt levels can lead to various other economic disruptions. One risk is that it can lead to higher inflation rates, which reduces the purchasing power of individuals and erodes their savings.

Another risk is that it can result in higher interest rates, making it more expensive for businesses and individuals to borrow money. This can dampen investment and spending, further slowing down economic growth.

Additionally, excessive public debt may limit a government’s ability to respond effectively to future economic crises or emergencies, as they have less flexibility in terms of fiscal policy options.

The Relationship between Public Debt and National Economy

Public debt has a significant impact on the national economy, affecting GDP and tax revenues. Understanding this relationship is crucial for comprehensive economic analysis.

Read on to explore the intricate dynamics between public debt and the overall health of a country’s economy.

How Debt Impact GDP

High levels of public debt can have a negative impact on a country’s GDP or economic growth.

When the amount of debt increases beyond a certain threshold, it can lead to higher distortionary taxes and inflation, which in turn can hinder economic growth.

However, it is important to note that there is a non-linear relationship between debt and GDP. Initially, as the level of debt rises, it can have a positive impact on growth up until a certain point.

After surpassing this threshold, the negative consequences start to outweigh any potential benefits. The specific threshold varies across different studies but is generally found to be around 90-100 percent of GDP.

The Role of Tax Revenues and Benefit Payments

Tax revenues and benefit payments play a crucial role in managing public debt and the national economy.

Tax revenues are the funds that the government collects from individuals and businesses through income taxes, sales taxes, and other forms of taxation.

These revenues are used to finance government spending, including social programs like Social Security and Medicare.

Benefit payments, on the other hand, refer to the financial support provided by the government to citizens in the form of welfare benefits or entitlement programs.

These payments are often targeted towards specific groups such as low-income households or retirees.

The amount of tax revenue collected by the government affects its ability to service its debt obligations and meet other expenses.

Higher tax revenues can help reduce public debt by providing additional funds for debt repayment.

Conversely, lower tax revenues may lead to an increase in borrowing or a higher accumulation of debt.

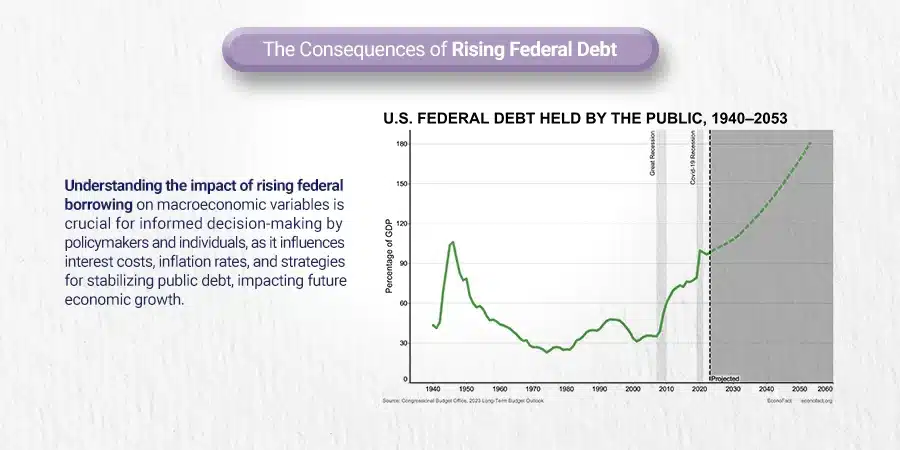

The Consequences of Rising Federal Debt

Rising federal borrowing can have significant consequences on various macroeconomic variables such as interest costs and inflation rates.

Understanding these consequences is crucial for policymakers and individuals alike to make informed decisions about managing public debt.

To delve further into the topic, continue reading to explore different strategies for stabilizing public debt and how it impacts future economic growth.

Impact on Macroeconomic Variables

Rising debt can significantly affect key macroeconomic variables, such as inflation, interest rates, and economic growth.

The increased borrowing can lead to higher interest rates, reducing private investment and hindering economic progress.

Additionally, heightened public debt can also exert upward pressure on inflation. It’s also worth noting that a high debt-to-GDP ratio may deter economic growth.

Macroeconomic Variable | Effect of Rising Federal Debt |

Inflation | Increased public debt can lead to higher inflation as more money chases fewer goods and services. |

Interest Rates | High public debt can lead to higher interest rates, reducing private investment and hence slowing economic growth. |

Economic Growth | A high debt-to-GDP ratio can lead to decreased economic growth, as the country must dedicate a higher portion of its resources to debt servicing, rather than investment or consumption. |

These effects underscore the need for prudent fiscal management and debt control to ensure sustainable economic growth.

Effects on Net Interest Costs

Rising federal borrowing often leads to an increase in net interest costs. This is primarily due to the amount of interest the government must pay on its debt.

Impact | Description |

Increased Interest Payment | As the level of public debt increases, the amount of interest paid by the government on this debt also rises. This means that more of the budget is spent on servicing the debt, leaving less for other governmental functions. |

Increased Burden on Taxpayers | With increasing interest costs, the financial burden on taxpayers also grows. This is because the government might have to raise taxes or cut back on public services to manage the debt. |

Reduced Investment in Public Services | Increased net interest costs can lead to reduced investment in public services. The government, striving to manage its debt, might decide to cut back on certain services, which can negatively impact the economy. |

Negative Impact on Economy | Rising net interest costs due to increased public debt can put a strain on the economy. Higher interest rates can discourage private investment, which is a key driver of economic growth. |

Risk of Fiscal Crisis | Rising debt increases the risk of a fiscal crisis. This risk heightens as more government funds are funneled toward servicing the debt, leaving little to address any potential economic downturns. |

Different Strategies for Stabilizing Public Debt

Increase income tax rates, and reduce benefit payments. Learn more about the strategies to stabilize public debt and their potential impact on the economy.

Increase in Income Tax Rates

One strategy for stabilizing public debt is to increase income tax rates. This means that people would have to pay more taxes on their earnings.

Older generations, who rely more on capital income, would be most affected by this change.

For younger people, higher taxes on labor income would have a bigger impact. It’s important to note that the effects of increased tax rates on consumption vary depending on age and income level.

People born between 1940 and 1979 may experience a slight increase in lifetime consumption with a 5-year delay in debt stabilization.

However, for those born after 1999, consumption falls across all income groups with a similar delay in stabilization.

Reductions in Benefit Payments

Reducing benefit payments can be an effective strategy for stabilizing public debt. By cutting back on government spending for programs like Social Security and Medicare, the amount of money owed by the government can be reduced.

This helps to decrease the debt-to-GDP ratio and prevent it from growing even larger.

However, it is important to consider the impact that these reductions may have on individuals who rely on these benefits.

It is crucial to find a balance between managing public debt and ensuring that citizens are not left without essential support systems.

Generational and Income-Level Impact of Public Debt

The impact of public debt on different generations and income levels can have long-lasting consequences for consumption and hours worked over a lifetime.

Understanding these effects is crucial in assessing the overall economic impact of high levels of public debt.

Read more to explore the generational and income-level implications of public debt.

Effects on Consumption Over People's Lifetime

The impact of public debt on consumption can vary depending on a person’s lifetime. Generational and income-level factors play a role in determining how public debt affects consumption.

For individuals born between 1940 and 1979, delaying debt stabilization by five years would result in a slight increase in lifetime consumption, especially for those with lower incomes.

On the other hand, individuals born between 1980 and 1999 would see slightly higher consumption if there is a delay in debt stabilization, but this effect is more pronounced for lower-income groups.

However, for individuals born after 1999, a delay in debt stabilization would lead to decreased consumption across all income groups.

Impact on Hours Worked Over People's Lifetime

Public debt can have an impact on the number of hours people work throughout their lifetime. This impact is influenced by generational and income-level factors. In order to stabilize debt, tax rates may need to be increased.

However, this would affect different cohorts in different ways.

Older cohorts would primarily face changes in tax rates on capital income, while younger cohorts would experience higher taxes on labor income.

Research suggests that people born between 1940 and 1979 could see a slight increase in their lifetime consumption if debt stabilization is delayed by five years.

This increase would be slightly larger for individuals in the bottom third of the income distribution within those cohorts.

The Future of Public Debt and its Impact on the Economy

The future of public debt holds significant implications for the economy, with potential scenarios for economic growth and a critical need to find the tipping point.

Understanding these dynamics is crucial in managing national debt and addressing the annual deficit.

Discover more about this topic to gain insights into the future of public debt and its impact on the economy.

Potential Scenarios for Future Economic Growth

- The article explores potential scenarios for future economic growth associated with the future of public debt and its impact on the economy.

- Delaying debt stabilization could lead to increased consumption for older cohorts and decreased consumption for younger ones.

- Tax rates, particularly changes in tax rates on capital income for older cohorts, would play a significant role in the impact of debt on different age groups.

- A delay in debt stabilization would result in slightly higher consumption for certain income groups born between 1940 and 1999, while higher-income groups would consume slightly less.

- People born after 1999 would be most affected by a delay in debt stabilization, with consumption falling for all income groups.

Finding the Tipping Point

High levels of public debt can have a negative impact on economic growth. However, there is also evidence to suggest that the relationship between debt and growth is not linear.

Some studies have found that there is a threshold, or tipping point, where debt levels start to harm economic growth.

This means that up to a certain point, having some amount of debt may actually stimulate economic growth.

However, once the debt reaches this tipping point, it starts to have a detrimental effect on the economy.

The exact threshold varies in different studies, but many suggest it falls between 75 and 100 percent of GDP.

It’s important for policymakers to be aware of this tipping point and take steps to manage public debt responsibly to avoid crossing it and undermining economic growth in the long run.

Managing National Debt

Managing national debt requires careful consideration and strategic planning to ensure the long-term stability of the economy.

By addressing the annual deficit, implementing policies to stabilize public debt becomes a crucial step toward economic prosperity.

The Role of Public's Debt

Public debt plays a significant role in managing a country’s finances. When governments need to fund their spending, they often borrow money by issuing bonds and other forms of debt.

This allows them to finance various programs and services, such as infrastructure projects and social welfare programs.

Additionally, public debt can also be used during times of economic recession or crisis to stimulate the economy through increased government spending.

However, it is important for governments to manage their debt carefully, as high levels of public debt can have negative consequences on economic growth and financial stability.

Addressing the Annual Deficit

Addressing the annual deficit is crucial for managing national debt and maintaining a stable economy.

If we don’t take action to reduce the deficit, it can lead to increased borrowing and higher interest costs in the long run.

One approach to address this financial crisis is by increasing tax rates, which would have different effects on different age groups.

Older cohorts would be mainly affected by changes in tax rates on capital income, while younger people would face higher taxes on labor income.

By taking steps to address the annual deficit now, we can help ensure a more balanced and sustainable economic future for all generations.

Conclusion

In conclusion, high levels of public debt can have a negative impact on economic growth.

This is because it leads to higher distortionary taxes and inflation, which can hinder private investment and innovation.

Additionally, delaying the implementation of policies to stabilize debt can increase the risk of a fiscal crisis and burden future generations with larger tax rates or benefit cuts.

It is important for policymakers to address public debt in a timely manner to ensure sustainable economic growth for the country.

FAQs

Public debt can have various effects on the economy, such as higher interest rates, decreased investment, and reduced government spending on other important areas.

High levels of public debt can lead to increased taxes or reduced government services, which can impact individuals and businesses in terms of lower disposable income or fewer opportunities for growth.

In certain circumstances, borrowing money through public debt can be used to fund projects that promote economic growth, such as infrastructure development or education initiatives.

When a country has excessive public debt, there is a risk that it may resort to printing more money, leading to inflation which reduces purchasing power and negatively affects the overall economy.