Dealing with multiple debts can be overwhelming. For many people struggle to decide which strategy, the Debt Snowball or Debt Avalanche, is best for paying down their financial obligations.

This blog post dives into both these strategies in detail and provides a comprehensive comparison to help you determine which approach will work best for your particular situation.

Keep reading to discover how making a well-informed decision could save you money and stress!

Key takeaways

● Both Debt Snowball and Debt Avalanche are good ways to pay off debts.

● The Snowball method works best with small debts. It lets you see progress fast.

● The Avalanche method saves on interest but takes more self - discipline.

● Your choice depends a lot on your goals, habits, and types of debt you have.

Understanding Debt Snowball and Debt Avalanche

This section will explore the debt snowball and debt avalanche methods, highlighting their strategies for debt repayment, to provide readers with a comprehensive understanding of these two popular ways to manage and eliminate personal debts.

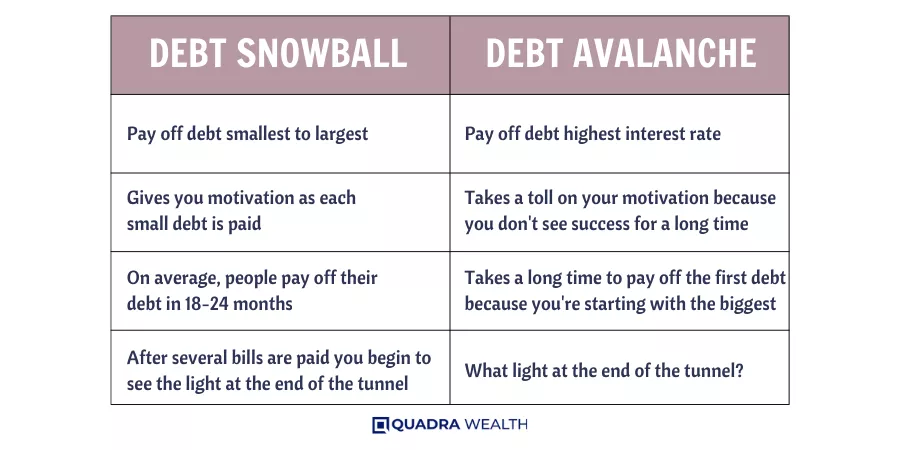

Definition of Debt Snowball Method

The debt snowball method helps you pay off your debts. First, you list all your debts from the smallest to the biggest. You put as much money as you can on your smallest debt while paying the minimum on others.

Once you pay off one debt, use that money to tackle the next small debt. This method helps people see progress fast and keeps them going strong in their journey to be free of debt.

Definition of Debt Avalanche Method

The Debt Avalanche Method is a plan to pay off debt. It starts with high-interest debt. This method uses extra funds, money not needed for other things, to pay this debt first. The Debt Avalanche Method helps people save on interest fees over time.

The goal of the Debt Avalanche Method is to cut down total interest paid. This is a good fit for people who like budgets. But it needs self-discipline and strong willpower to work well.

For many, these are habits they have worked hard to build in their lives. The plus side? They get rewarded by saving money and time with this method!

Comparison of Debt Snowball and Debt Avalanche

In this section, we will compare the Debt Snowball and Debt Avalanche methods by highlighting their key differences, revealing how each strategy functions in distinct financial scenarios and explaining their unique benefits and drawbacks to assist you in choosing the most effective debt-repayment plan.

Key Differences between the Two Methods

The debt snowball method focuses on small debts first. You pay off the smallest ones and then move to bigger ones. It gives you a feeling of winning early. The debt avalanche method works differently.

This plan has you pay off high-interest debts first, no matter their size. As a result, you end up paying less money in interest over time than with the snowball method.

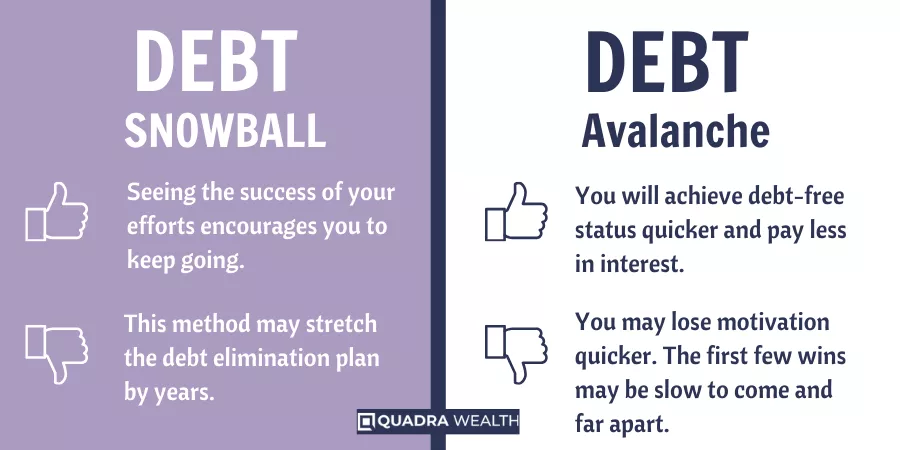

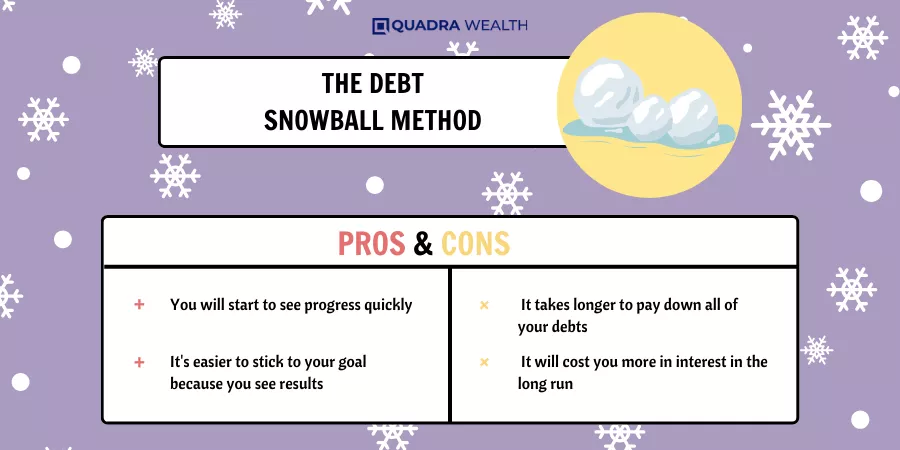

Pros and Cons of Debt Snowball

Discover the potential advantages and drawbacks of implementing the Debt Snowball method, as we delve into how it can impact your financial journey. Read on to understand if this debt management strategy aligns with your fiscal goals and circumstances.

Advantages of Debt Snowball Method

The Debt Snowball method has many good points. Here there are:

- It gives you quick wins. This method lets you clear small loans first. This can boost your spirits.

- It helps build better habits. By paying off debts, you learn to control money better.

- It offers a clear plan to follow. You start with the smallest loan and move up.

- It gives quicker results than other ways of paying off debt.

- The Debt Snowball method makes budget planning easier as smaller loans get paid off fast.

- It aids in improving your credit score by reducing the number of outstanding debts quickly.

Staying Invested and Diversifying Your SIP Investments

The debt snowball method has some downsides.

- You may pay more in interest. This method might result in higher interest payments over time.

- It may take more time. Paying off your debts could take longer with this method than others.

- It doesn’t focus on the costliest debts first. The highest interest rates are not the main focus, which can also lead to more interest paid.

- It requires patience and commitment. Seeing progress might take time, which can test your patience.

- Online tools needed to compare results. You often have to use online calculators to see how it’s doing against other methods like the avalanche method.

Pros and Cons of Debt Avalanche

Explore the benefits of the Debt Avalanche method, such as potentially faster debt repayment and less interest paid over time. Also uncover its drawbacks, like needing high self-discipline to stick to the plan.

Continue reading to determine if this strategy is a good fit for your financial situation.

Advantages of Debt Avalanche Method

The Debt Avalanche Method has several strong points.

- It saves money: This method helps to cut down your total interest cost. You pay less money over time.

- It’s quick: Debt Avalanche makes you free from debt faster. This is due to the focus on high-interest debt first.

- It boosts your credit score: Paying off high-interest loans can improve your credit score quickly.

- It’s good for large debts: If you have big loans, this method can help manage them better.

- It brings financial discipline: By focusing on the highest interest rate, it teaches effective money management.

Disadvantages of Debt Avalanche Method

The Debt Avalanche Method also has a few drawbacks. Here they are:

- It requires strong self – control because some debts take longer to pay off.

- There is less joy in the early stages, so it’s hard to stay pumped up.

- You’ll see slower progress if your biggest debt also has the highest rate.

- High overall interest can pile up compared to the debt snowball method.

- Big debts with high rates may take more time to clear fully.

- Sometimes, there is little difference in total money saved between this plan and the snowball way.

Case Scenarios: Debt Snowball vs Debt Avalanche

We delve into real-world examples considering both average and high-interest debts, demonstrating how each method, snowball and avalanche, could work in different scenarios. Intrigued on which strategy pays off debt quickest or saves you more on interest? Read further to find out!

Scenario with Average Debts

Let’s paint a picture. You have average debts, like many people do. This could be in the form of credit card debt, a car loan or student loans.

The snowball method would see you pay off your smallest debt first. It does not look at interest rates. Once the small debt is paid off, you move to the next smallest one and so on.

On the other hand, with the avalanche method, focus is on high-interest debts first, no matter their size. The goal here is to save money over time by dealing with big interest rates early on.

Both strategies work well for average debts but choosing between them depends on your financial goals and personal mindset.

Scenario with High Interest Debts

High interest debts can be a big problem. They grow faster than others. The debt avalanche method helps here. You pay off these debts first with this method. This way, you don’t lose a lot of money on interest.

You will need to stay strong and keep going though, as this needs discipline and focus.

Making the Right Choice: Snowball or Avalanche?

Pondering between the snowball or avalanche method? Explore essential factors to consider while picking a strategy, which could catalyze your journey towards debt freedom. Delve into this section to empower your financial decisions.

Factors to Consider when Choosing a Method

Making a choice between debt snowball and debt avalanche needs careful thought.

- Look at your debts. Do you have many small bills or a few big ones? The debt snowball method works well with small debts.

- Think about your interest rates. Pay the high – interest debts first with the debt avalanche way.

- Weigh up your personality style. If you need quick wins, the snowball approach may motivate you more.

- Review your monthly budget. Can you handle the minimum payments on all but one of your debts? Both methods require this.

- Consider how long – term savings matter to you. The avalanche strategy can save more in interest over time.

- Reflect on your financial goals and mindset. You must feel good about the plan you choose because motivation is key to success.

- Remember, there’s no perfect way to pay off debt! What matters is choosing the best method for where you are now.

Frequently Asked Questions

Dive into common inquiries about debt repayment strategies, answering queries such as the fastest method for paying off debt and considerations to make regarding credit card debt before applying for a mortgage.

What is the Fastest Repayment Strategy?

The fastest way to pay off debt changes from person to person. It rests on your goals, how you think and the money you owe. As well as the rates of interest on your debts. Some might find that Debt Snowball works best for them.

Others prefer using Debt Avalanche. Both are good ways but work best in different cases.

Should You Pay Off All Credit Card Debt Before Getting a Mortgage?

Paying off all credit card debt before getting a mortgage can be clever. It helps lower your debt-to-income ratio. This makes you more likely to get a better mortgage rate. But, there’s more to consider.

If you’re thinking about buying a home, look at your complete financial picture first. Do you have enough money saved up for a down payment? Can you cover closing costs and moving expenses? Plus, owning a home means other costs too like property taxes and repairs.

Clearing your credit card debt is smart but balance it with these other needs as well.

Conclusion

Choosing between debt snowball and debt avalanche is not a one-size-fits-all choice. Every person’s situation is unique. It depends on your debts, how you want to pay them off, and what fits your style best.

After all, the best plan is the one that works for you!

FAQs

The debt snowball plan is a debt repayment method, where you pay off loans starting with the smallest ones first to gain momentum.

In contrast, the debt avalanche strategy targets debts with high annual percentage rate (APR) first for faster relief and less paid in interest over time.

Your choice may depend on your personal finance situation. Some people prefer paying low-balance debts first for quick wins and more self-organization skills; While others select tackling higher-interest debts for its long-term financial health benefits.

Financial advisors can provide guidance based on an in-depth review of your financial circumstances including loan balances, monthly expenses, discretionary income and financial health goals.

You can pay for your Monthly SIP payment using multiple modes that include PDCs (Post-Dated Cheques), NACH (National Automated Clearing House), and bank mandates set up with entities such as the National Payment Corporation of India.

Both methods are used for different sorts of debts like mortgages, credit cards, and personal loans but always take into account your unique conditions before committing.