Mastering the art of retirement planning is pivotal for securing a financially stable future.

This post will give an in-depth look into making the ideal retirement plan, helping you attain financial stability.

We’ll begin by discussing when to start planning and how much money you’ll need for a comfortable life after full retirement age.

We then explore various types of retirement accounts available in the UAE, including traditional IRAs and their tax advantages.

We look at various methods for investing, such as putting funds into inexpensive mutual and diversifying your portfolio.

You’ll also learn about micro-financial habits that can bolster your savings and understand Roth functionality’s guidance towards achieving this end.

The importance of lifestyle changes like maintaining physical activity levels and proper nutrition will be highlighted too.

The post wraps up with insights from leading financial minds on income strategies, communication’s role in finance management during retired life, early retirements through frugal living & aggressive saving tactics, along taxation considerations within overall strategy – all essential elements for creating the retirement planning blueprint.

Understanding the Basics of Retirement Planning

To maximize one’s chances of a comfortable retirement, beginning the planning process early is essential.

To retire comfortably, you need to replace 70% – 90% of your pre-retirement income through savings and Social Security benefits.

Determining the Right Time to Start Retirement Planning Strategies

Start planning for retirement as soon as you start earning. The power of compound interest can make your money grow over time.

- Financial security

- Goal setting

- Time for adjustments

- Lower financial stress

- Insufficient savings

- Missed growth opportunities

- Limited options

- Increased financial uncertainty

Calculating Necessary Funds for a Comfortable Retired Life

Calculate how much you’ll need for retirement by considering your desired lifestyle, expected medical expenses, inflation rate, and future financial emergencies.

Use online calculators like this one from Bankrate to estimate these costs accurately. It’s not just about putting away funds, but also making smart investments.

Understand various investment options available in UAE and globally, including mutual funds, stocks, and bonds, and choose those that align with your personal risk tolerance and financial goals.

Remember, social security benefits may not be enough to cover all post-retirement expenses.

A diversified portfolio is essential to safeguard against unforeseen circumstances and ensure a steady retirement income stream during your golden years.

Financial experts suggest aiming to replace approximately 70%-90% of your annual pre-retirement income through a combination of savings, investments, and social security benefits.

Seek professional advice to tailor a plan that suits your unique needs and aspirations.

- Accurate financial planning

- Realistic expectations

- Early adjustments

- Peace of mind

- Inadequate savings

- Unexpected financial challenges

- Dependency on others

- Limited choices and compromises

Exploring Retirement Savings Accounts in UAE

Retirement planning in the UAE may be distinct from other regions. Workplace retirement plans like pensions or provident funds are not common here. But don’t worry, you still have options to save for your golden years.

Benefits of Individual Retirement Account (IRA)

An Individual Retirement Account (IRA) is an excellent option to consider. IRAs provide numerous retirement benefits including tax advantages and flexibility with investment choices.

- Tax Advantages: Contributions made into an IRA may be tax-deductible depending on your income level and whether or not you have access to a workplace retirement plan.

- Investment Choices: An IRA allows you to invest in various types of assets including mutual funds, stocks, bonds, ETFs, and more which provides ample opportunities for diversification and growth over time.

How IRAs offer tax advantages

The main advantage of an IRA is its potential tax benefits. Depending on the type of IRA account – traditional or Roth – these retirement accounts offer either upfront deductions on contributions or tax-free withdrawals during retirement respectively.

A traditional IRA offers immediate deductions on contributions up to certain limits each year based on your income level.

This means that money invested into this type of retirement account will grow free from taxes until it’s withdrawn at retirement age when it’s then taxed at ordinary income rates.

A Roth IRA, however, works slightly differently – there are no immediate deductions available but instead, all withdrawals made after reaching 59½ years old are completely free from federal taxes provided certain conditions are met.

Having a robust retirement strategy in place is crucial for a comfortable and secure future no matter where life takes you.

With the right knowledge and tools like Quadra Wealth’s structured notes, the journey toward financial independence can become a much smoother and more rewarding experience.

Key takeaways

Retirement planning in the UAE can be different from other parts of the world, but an Individual Retirement Account (IRA) is a great option to consider. IRAs offer tax advantages and flexibility with investment choices, allowing you to invest in various types of assets including mutual funds, stocks, bonds, ETFs, and more which provides ample opportunities for diversification and growth over time. With Quadra Wealth's structured notes and the right knowledge and tools in place, achieving financial independence through retirement planning can become a much smoother experience.

Investment Strategies for Retirement Savings

Retirement savings require more than just saving money. Smart investment strategies can help your savings grow over time.

One of the best ways to achieve this is through investing in a low-cost mutual fund.

Advantages of Investing in Low-Cost Mutual Funds

The mutual fund is perfect for those who want to invest but lack the time or expertise to manage their own portfolios.

Mutual funds offer investors a diversified portfolio of stocks, bonds, or other assets managed by professional fund managers at lower costs compared to individual stock trading.

The key advantage here is diversification – since your money is spread across various investments, you’re less likely to lose all your savings if one investment performs poorly.

Moreover, mutual funds often lower costs compared with individual stock trading because they involve fewer transaction fees.

Role of Diversification in Optimizing Return on Investments

Diversification doesn’t just protect against risk; it also plays a crucial role in optimizing returns on investments.

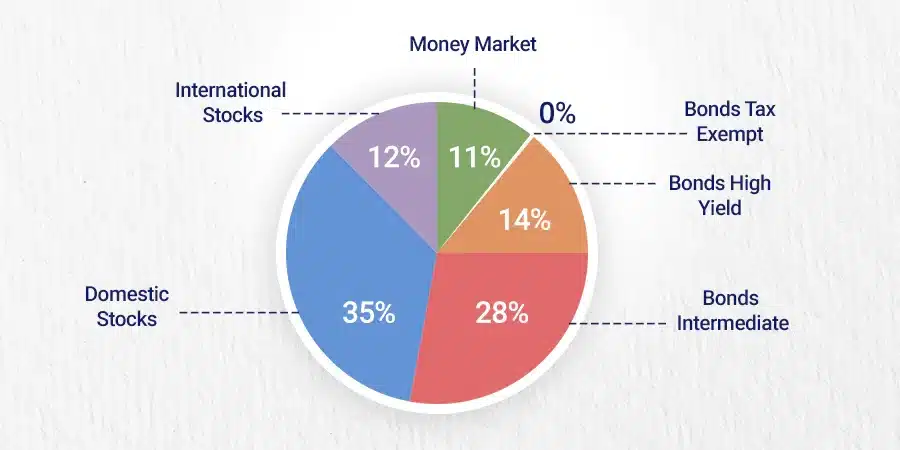

By spreading your investments across different asset classes (stocks, bonds, etc.), sectors (technology, healthcare, etc.), and geographical regions (UAE market vs international markets), you increase chances of capturing gains wherever they occur while reducing potential losses.

A well-diversified portfolio helps balance risk and return – an essential aspect when planning for retirement where steady growth matters more than short-term gains.

Remember, that the low-cost mutual fund offers many benefits including diversification and reduced costs, but like any investment strategy, there’s no guarantee of profits.

Before investing, it’s important to consult a financial expert for advice. And remember: patience is key. Successful investing isn’t an overnight success story but rather a long-term commitment to discipline and consistency.

Key takeaways

The article discusses the importance of smart investment strategies for retirement savings, with a focus on the low-cost mutual fund as an effective way to achieve consistent growth. Diversification is emphasized as a key factor in optimizing returns and reducing risk, while patience and consulting with a financial advisor or a retirement planner are important aspects of successful investing.

Micro-Financial Habits and Roth Functionality

Micro-Financial Habits and Roth Functionality

Want to achieve financial independence? Adopting micro-financial habits can be a game-changer.

These small but meaningful actions provide options to better manage your finances daily. From tracking expenses to setting up automatic savings, these practices help you stay on top of your financial health.

- Micro-savings: Set aside small amounts regularly into a separate account designed for saving.

- Budgeting: Create a plan for where your money will go before you spend it.

- Cut down unnecessary expenses: Cancel unused subscriptions or opt for cheaper alternatives wherever possible.

Besides micro-financial habits, understanding the Roth functionality is crucial in retirement planning.

A Roth IRA (Individual Retirement Arrangement) provides the potential for tax-exempt growth and withdrawals during retirement if the requirements are met.

Contributions to a Roth IRA may not be deductible, yet its gains can accumulate tax-free, and withdrawals in retirement could potentially be free of taxation if certain criteria are met. (source)

Benefits of Adopting Micro-Financial Habits

The benefits of incorporating micro-financial habits into one’s lifestyle are manifold: they promote disciplined spending, encourage regular saving, facilitate investment decision-making, enable debt management, and ensure that individuals live within their means while striving towards their long-term financial goals.

Guidance Provided by Roth Functionality

Apart from offering potential tax advantages during the retirement phase, the Roth functionality provides guidance on making effective decisions about conversions from traditional IRAs or other eligible retirement plans to Roths, as well as managing existing retirement accounts effectively.

This helps investors maximize their after-tax returns over time, which ultimately leads them closer to achieving their desired post-retirement income levels. (source)

“Take control of your financial future with micro-financial habits and Roth IRA functionality for tax-free growth and withdrawals in retirement.

Lifestyle Changes for a Better Retired Life

It’s essential to take into account lifestyle modifications that can contribute to a more joyful and healthier life during your senior years. By adopting certain habits now, you can set yourself up for a better retirement.

The Importance of Physical Activity in Retirement

Staying active is crucial for maintaining overall health and wellness as we age. Regular exercise reduces the risk of chronic diseases, enhances mobility, flexibility, and balance, and improves mood.

Finding an activity you enjoy and committing to it is key to staying active, which can improve your overall health and quality of life in retirement.

The Impact of Nutrition on Quality of Life in Retirement

A balanced diet is essential for a healthy retirement. Consuming nutrient-rich foods like fruits, vegetables, whole grains, and lean proteins ensures your body gets the required nutrients to maintain optimal health.

Consider consulting a registered dietitian to create a personalized eating plan that aligns with your individual needs, preferences, and medical conditions.

Check out this guide from the Academy of Nutrition and Dietetics to get started on your journey toward better nutrition.

Aside from these two key factors, there are other surprising habits that can greatly improve your post-retirement lifestyle:

- Social Engagement: Staying socially active helps keep your mind sharp and reduces the risk of dementia, according to studies. Join clubs, participate in community activities, and stay connected with others to avoid the isolation and loneliness that often come with aging.

- Mental Fitness: Just like your body, your brain needs a workout too. Engage in mentally stimulating activities like puzzles, reading, writing, or learning a new skill to help preserve cognitive function.

- Sleep Hygiene: Quality sleep is vital for good health and well-being throughout your lifespan, and it’s particularly important for older adults. Ensure your bedroom is conducive to sleeping, follow a consistent sleep-wake schedule, manage stress effectively, and ensure a restful night’s sleep every time.

- Routine Health Checks: Regular check-ups with doctors, dentists, and optometrists are crucial for the early detection and treatment of potential health issues, ensuring a long and healthy retirement.

Implementing these changes into your life may appear challenging initially, however making small modifications every day can lead to noteworthy results in the long run.

Remember, the goal isn’t perfection, but progress towards a healthier and happier retirement.

Key takeaways

Planning for retirement is not just about finances but also involves lifestyle changes such as staying physically active and consuming a balanced diet. Social engagement, mental fitness, quality sleep, and routine health checks are other habits that can greatly improve post-retirement life. Taking small steps every day towards these changes can lead to progress toward a healthier and happier retirement.

Learning From Financial Minds And Implementing Income Strategies

Retirement planning is not just about putting away cash; it’s also about boosting your riches. To achieve this, learn from the best financial minds and implement practical income strategies.

These two aspects can significantly contribute to building robust and sustainable wealth for a lifetime, ensuring a secure future.

Tips from Leading Financial Experts

Financial experts who have attained great success in the realm of finance are plentiful. Learning from these financial gurus can provide valuable insights into how they’ve achieved their success.

For instance, Warren Buffet advocates for investing in low-cost index funds while Robert Kiyosaki emphasizes generating passive income through real estate planning investments.

- Warren Buffet: Known as one of the most successful investors in history, Buffet advises individuals to invest in low-cost index funds that track broad market indices.

- Robert Kiyosaki: The author of “Rich Dad Poor Dad,” Kiyosaki stresses the importance of acquiring assets that generate passive income like rental properties or businesses.

Income Strategies for Sustainable Wealth

Besides learning from financial experts, implementing effective income strategies, such as diversifying your investment portfolio or setting up multiple streams of income, can help build sustainable wealth.

- Diversification: This investment strategy involves spreading your investments across various asset classes to reduce risk and increase potential returns over time.

- Mutual Funds: A popular choice among investors due to its potential for high returns and professional management.

- Rental Properties: Owning rental properties provides regular monthly income along with potential appreciation value over time.

As a result, it is important to stay informed and actively engage in strategies that can ensure financial security during retirement.

By continuously learning from financial experts and implementing effective income strategies, you’ll be well-equipped to face any challenges that come your way during your golden years.

Key takeaways

The retirement planning process is not just about saving money, but also growing your wealth by learning from financial experts and implementing income strategies such as diversification, investing in low-cost index funds, and acquiring assets that generate passive income like rental properties or businesses. It's important to view a good retirement plan as an ongoing process rather than a one-time event to ensure a secure future during your golden years.

Communication and Its Impact on Post-Retired Life

But, it’s not just about the numbers; communication plays an equally important role in shaping your post-retirement journey. Especially when it comes to finances, having a frank conversation with your significant other is critical for achieving an enduringly peaceful relationship.

The Importance of Communication with Partners About Finance

Money talks are often avoided due to their potential to cause conflict or discomfort. Yet, avoiding these discussions could lead to misunderstandings that may negatively impact your retirement plans.

According to Investopedia, couples who discuss finances regularly have fewer disagreements about money matters and enjoy better overall relationship satisfaction.

- Honesty: Be transparent about all aspects of personal finance – pay income taxes, savings, debts, investments, etc.

- Mutual Goals: Discussing shared goals helps align individual financial habits towards common objectives like retirement planning

- Budgeting Together: Joint budget creation fosters an understanding of each other’s spending habits while ensuring both parties contribute towards shared expenses equitably.

Potential Impact Lack of Communication Can Have on Relationships

Lack of communication on financial matters can create tension between partners leading up to and during retirement years.

A study by TD Ameritrade suggests that almost 40% of divorced Gen Xers cite disagreements over money as the primary reason behind their split – highlighting how vital effective communication around finances truly is.

- Frustration & Resentment: Lack of transparency regarding money management might lead one partner to feel left out, causing resentment over time.

- Insecurity: If one person handles all financial decisions without involving the other party, it might instill feelings of insecurity and lack of control over the future.

To avoid such scenarios in post-retired life, consider seeking help from professionals like Quadra Wealth who specialize in providing comprehensive wealth management services and solutions tailored specifically for expatriates living in the Middle East.

This way, you ensure a smooth transition into your golden years without worrying about any unexpected surprises along the way.

Key takeaways

Effective communication with your partner about finances is crucial for a successful retirement. Open and honest dialogue can help avoid misunderstandings that may negatively impact your plans while avoiding money talks could lead to tension and even divorce. Seeking professional help from experts like Quadra Wealth can ensure a smooth transition into post-retired life without any unexpected surprises along the way.

Early Retirement Through Frugal Living And Aggressive Saving

Want to retire early? It’s possible with a combination of frugal living and aggressive saving strategies. Popular financial independence influencers like Mr. Money Mustache champion these methods.

Living Frugally - The Path to Early Retirement

Frugality isn’t about deprivation; it’s about maximizing value while minimizing waste. It involves conscious spending decisions depending on the financial situation that prioritizes needs over wants. This lifestyle change can free up significant funds for investment purposes.

- Create a budget: A detailed budget helps track income and expenses, identifying areas where you can cut back.

- Avoid debt: High-interest debt like credit cards can erode your savings quickly. Avoid unnecessary borrowing whenever possible.

- Spend smartly: Look for discounts, and buy in bulk, or second-hand items when appropriate to save money without compromising on quality or need.

Aggressive Saving - Key to Unlocking Early Retirement

Beyond living frugally, aggressive saving is another crucial strategy for achieving early retirement.

The key to early retirement lies in saving as much money as possible and investing it carefully. Here are some tips on how to aggressively save for retirement.

- Increase your income streams: Consider taking on freelance work or starting a side business alongside your regular job to boost your earnings. Side businesses, rental properties, or dividend-paying stocks could provide additional passive income sources.

- Cut down major expenses: This includes housing costs (consider downsizing), transportation (use public transport instead of owning multiple cars), and food (cook at home more).

The journey towards an earlier-than-expected retirement may seem challenging, but with disciplined financial habits such as adopting frugal living principles and employing aggressive saving tactics coupled with wise investing choices, it will be achieved sooner rather than later.

“Retire early with frugal living and aggressive saving strategies. Create a budget, avoid debt, increase income streams & cut expenses for financial independence.

Taxation as Part of Your Retirement Planning Strategy

Don’t forget about taxes when planning for retirement. Considering taxation as part of your overall strategy can help you optimize earnings and minimize liabilities.

Here are some tips to help you strategize taxes efficiently and save a substantial amount over time.

Understanding Tax Implications on Retirement Savings

Realizing the taxation implications of different types of investments is key to making wise choices about where to invest.

For instance, Roth IRAs offer tax-free growth and withdrawals during retirement, even though they are funded with after-tax dollars.

- Tax optimization

- Strategic planning

- Penalty avoidance

- Missed savings

- Higher taxes

- Compliance risks

Optimizing Earnings Through Tax-Efficient Investments

Investing in certain assets that provide tax benefits efficiency could be a smart move. Index funds or ETFs (Exchange Traded Funds), for example, tend to have lower turnover rates which translate into fewer taxable events, potentially reducing the amount owed at year-end.

- Higher returns

- Wealth growth

- Flexibility

- Higher taxes

- Missed growth

- Inefficient allocation

Minimizing Liabilities with Strategic Withdrawals

Minimizing liabilities plays an important role in effective retirement planning from a taxation perspective. This involves making strategic withdrawals from your accounts when you retire so as not to push yourself into higher tax brackets unnecessarily.

A well-planned withdrawal strategy can save thousands over time by keeping your taxable income low each year.

- Lower taxes

- Preserve savings

- Flexibility

- Higher taxes

- Depletion of savings

- Missed opportunities

The Role of Professional Guidance in Tax Planning

Expert guidance is crucial to navigating these complex issues effectively. Seek advice from financial advisors who specialize in tax planning strategies.

They will guide you through various ways like utilizing deductions, credits, exemptions, etc., thereby saving significant amounts annually.

Remember – every dollar saved is another added back into your portfolio contributing towards a secure future.

“Maximize your retirement savings by strategizing taxes efficiently. Seek expert guidance and consider tax implications on investments for a secure future.

Conclusion

Retirement planning is crucial for ex-pats at the CXO level in the UAE, and starting early is key to ensuring a comfortable retired life.

Consider exploring retirement savings accounts like Individual Retirement Accounts (IRAs) for tax benefits, and investment strategies such as low-cost mutual funds and diversification to optimize returns.

Adopting micro-financial habits and utilizing Roth functionality can also be beneficial, as can lifestyle changes like physical activity and proper nutrition.

Learning from financial experts’ tips and implementing income strategies contribute towards sustainable wealth, along with communication with partners about finances to avoid potential relationship issues.

Living frugally and aggressively saving are keys to unlocking early retirements, and taxation should be considered as part of an overall strategy for retirement planning.

For more information regarding the best retirement plans, check out credible sources like IRS.gov and AARP.org.

FAQs

The 70% rule suggests that retirees will need around 70% of their pre-retirement income to maintain their current lifestyle in retirement.

The best approach involves starting early, saving consistently, diversifying investments, and regularly reviewing your retirement plan to ensure you’re on track.

The five pillars include savings, Social Security benefits, pension plans, investment returns, and passive income, which together form a comprehensive retirement strategy.

The 4% Rule states that you should withdraw no more than 4% from your retirement portfolio each year during retirement to ensure it lasts.

Avoid discussing specific investment products or companies, providing personal financial advice, and discussing the political implications of retirement planning.

Another variation on the I.R.A is aS.E.P. (which is short for Simplified Employee Pension), and there is also a Solo 401(k) option for the self-employed. They came with their own set of rules that may allow you to save more than you could with a normal I.R.A. You can read about the various limits via the links above.