Investing can be overwhelming, especially with so many options available.

One popular choice among investors is mutual funds, known for their potential to provide diversification in an easy-to-manage package.

This article will guide you through understanding what a mutual fund is, the different types available, and how to make savvy investment decisions based on your personal financial goals.

Ready? Let’s unravel the mystery behind mutual funds!

Key Takeaways

● Mutual funds are investment vehicles that allow individuals to pool their money and invest in a diversified collection of assets.

● There are active and passive mutual funds, each with its own advantages and disadvantages. Active funds aim to outperform the emerging markets, while passive funds aim to replicate the performance of a specific index.

● Different kinds of mutual funds include stock funds (equity mutual funds), bond funds, money market funds, balanced funds, blended funds (mix of value and growth stocks), and target-date funds.

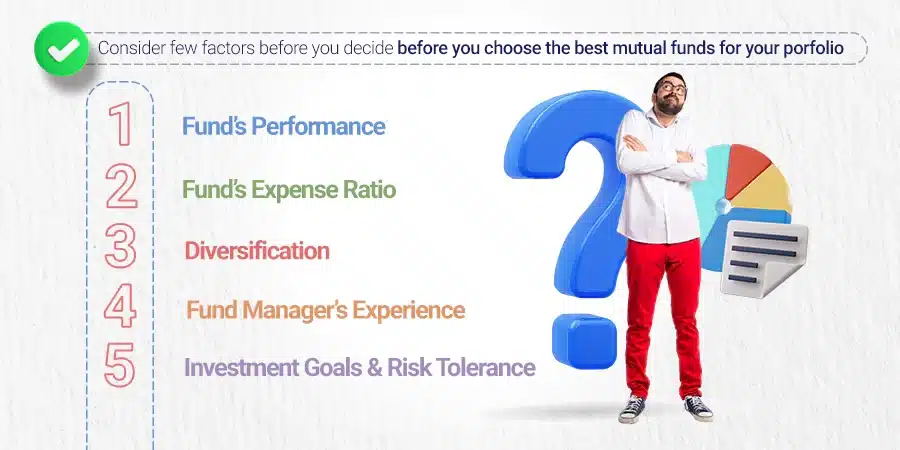

● It's important to consider factors like performance, fees, diversification, fund managers experience, and your own investment goals when choosing the right mutual fund for your portfolio.

Understanding Mutual Funds

A mutual fund is a pooled investment vehicle that allows investors to pool their money together and invest in a diversified collection of assets.

What is a Mutual Fund?

A mutual fund is a pool of money from many people. This money buys lots of assets at once. Assets can be stocks, bonds, index funds, and other things.

A manager makes choices about what to buy for the mutual fund. The goal is to make all investors in the fund more money over time.

Each person owns shares in the mutual fund based on how much they put in. Mutual funds are easy for most people to join and offer a chance to own different types of assets together.

Unlike stocks or exchange-traded funds, mutual funds trade just once per day, and many investors own them as part of a defined contribution retirement plan such as a 401(k) or an individual retirement account, known as an IRA.

The price of a mutual fund share is known as the fund’s net asset value or NAV. Mutual funds offer investors an excellent source of diversification for their portfolios.

These funds typically own hundreds or even thousands of different securities. The securities a mutual fund buys depend on the fund’s investment objectives.

For example, a growth fund will target stocks with above-average growth potential, while an income fund may include both dividend-paying stocks and bonds.

Pros and Cons of Mutual Funds

Mutual fund investments come with several advantages and disadvantages that potential investors should be aware of. Weighing these pros and cons is critical for informed investment decision-making.

- Mutual funds offer diversification, which can help mitigate investment risk.

- Many mutual funds are low-cost options, providing an affordable way for individuals to access professionally managed investments.

- The ability to access a broad range of investments, from stocks to bonds, through a single mutual fund can simplify portfolio management.

- Mutual funds can be a good fit for long-term investors thanks to their potential for higher returns over time.

- Mutual funds typically come with higher initial investment requirements compared to other investment options, which can be a barrier to entry for some investors.

- Fees associated with mutual funds can negatively impact overall returns, especially if they're higher than average.

- Holding mutual fund shares in non-retirement accounts can lead to capital gains distributions, which can be a tax disadvantage for some investors.

- Mutual funds, especially stock mutual funds, can be more volatile compared to other investment options like bonds or money market funds.

Active vs. Passive Mutual Funds

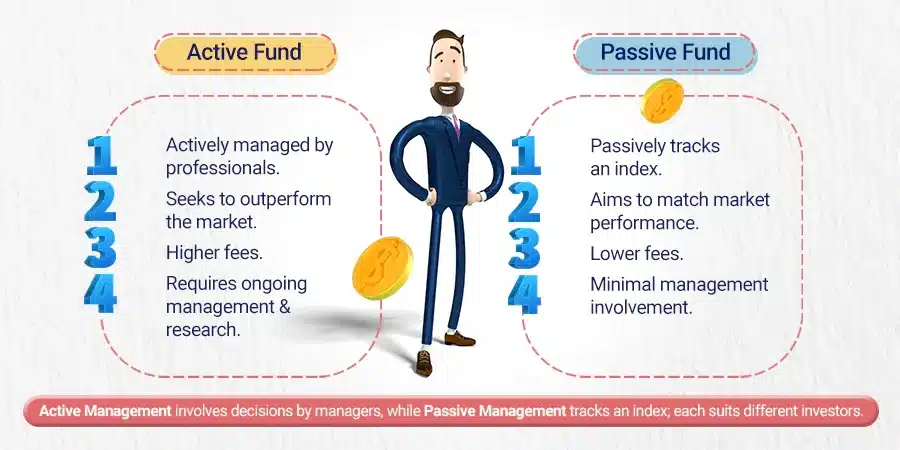

When it comes to mutual funds, there are two primary strategies: active and passive management. Each approach has its advantages and disadvantages and they cater to different types of investors.

Active Mutual Funds | Passive Mutual Funds | |

Definition | Actively managed funds by fund managers who aim to outperform the mutual funds market. | Passive mutual funds, such as index funds, aim to replicate the performance of a specific market index. |

Costs | Active mutual funds tend to have higher mutual fund fees and expenses compared to passive funds. | Passive mutual funds have lower costs compared to active funds. |

Tax Efficiency | Active mutual funds are not as tax-efficient due to their high turnover. | Passive mutual funds are generally considered more tax-efficient because they have lower turnover and capital gains distributions. |

Risk and Return | Active funds aim for higher returns but come with higher risk. | Passively managed funds offer lower risk but the return is equivalent to the market’s performance. |

Best For | Investors who are willing to take on more risk for potentially higher returns. | Investors looking for a low-cost, low-risk investment that tracks a specific market index. |

In conclusion, the choice between active and passive mutual funds depends on an investor’s risk tolerance and investment goals.

Types of Mutual Funds

There are several types of mutual funds including stock mutual funds, bond mutual funds, money market mutual funds, balanced funds, and target-date funds.

Stock Mutual Funds

Stock mutual funds, also known as equity mutual funds.

You buy shares in stock funds. They put money in many stocks.

Those stocks can be of all sizes like big, middle, or small ones. Also, there are growth, value, and blend-style funds to choose from.

Stock funds give you a mix of different kinds of companies’ stocks to have in your fund. You can get high returns from this kind of investment.

Yet, it also comes with more risk than other types of mutual funds.

Bond Mutual Funds

Bond funds are investment funds that focus on investing in bonds. They can offer diversification and potentially lower risk compared to stocks.

The bond fund can be categorized into different types based on the types of bonds it invests in, including corporate and government bonds, or municipal bond funds.

Some bond funds may have a specific investment objective, such as generating income or capital preservation.

It is important to note that bond mutual funds can be subject to taxation on distributions received from dividends or interest income from various mutual fund investments.

Money Market Mutual Funds

A money market mutual fund is a type of investment that focuses on short-term, low-risk securities. They aim to maintain a stable net asset value (NAV) of $1 per share.

These funds are often used for cash management and provide easy access to your money.

Money market funds are considered low-risk and are suitable for investors with a short-term investment horizon.

They are regulated by the Securities and Exchange Commission (SEC), ensuring their safety and transparency.

Balanced Mutual Funds

Balanced mutual funds are a type of investment that combines stocks, bonds, and money market instruments.

They aim to provide a balanced portfolio by spreading out the investments across different asset classes.

These funds offer lower volatility and lower overall returns compared to other types of mutual funds. They are considered more conservative because they provide a mix of growth and income investments.

The allocation between stocks and bonds in a balanced mutual fund can vary depending on the fund’s strategy and objectives.

Target-date Mutual Funds

Target-date mutual funds are a type of mutual fund that adjusts its investments based on the retirement date of the investor.

These funds are designed to reduce risk as the investor gets closer to retiring. They provide diversification and portfolio management, making it easier for investors to have a balanced investment strategy.

Target-date mutual funds in the UAE economy can be a cost-effective option, especially index funds with low expense ratios below 0.1%.

However, it’s important to note that holding target-date mutual fund shares in non-retirement accounts may result in capital gains distributions with tax implications.

Top Performing Mutual Funds in 2023

In 2023, some of the best-performing mutual funds include Shelton Nasdaq-100 Index Direct, Voya Russell Large Cap Growth Index Fund, Massachusetts Investors Growth Stock Fund, T. Rowe Price U.S. Equity Research Fund, and Fidelity Large Cap Core Enhanced Index Fund.

Shelton Nasdaq-100 Index Direct (NASDX)

The Shelton Nasdaq-100 Index Direct (NASDX) is one of the top-performing mutual funds in 2023.

It has shown impressive year-to-date performance, with a growth rate of 44.4%. Over the past five years, NASDX has had an annual return of 17.4%, making it a strong contender for investment opportunities.

This fund offers diversification and portfolio management, allowing investors to have a balanced mix of assets and potentially reap higher returns.

Consider NASDX as part of your investment strategy for potential long-term growth and stability.

Voya Russell Large Cap Growth Index Fund (IRLNX)

The Voya Russell Large Cap Growth Index Fund (IRLNX) is one of the best performing mutual funds in 2023, according to Morningstar.

It has a year-to-date performance of 36.2% and a historical performance of 15.7% annually over five years.

This makes it an excellent choice for investors looking for strong returns. With its focus on large-cap growth companies, IRLNX offers diversification and the potential for long-term growth.

Investors can consider IRLNX as one of the right mutual fund investments based on its performance and reputation among top-performing funds in 2023.

Massachusetts Investors Growth Stock Fund (MIGNX)

The Massachusetts Investors Growth Stock Fund (MIGNX) is considered one of the best mutual fund investments in 2023.

It has shown strong performance this year, with a year-to-date return of 18.8%.Over the past five years, MIGNX has had a historical performance of 14.0% annually.

With its track record and association with top mutual funds, MIGNX is an attractive option for investors looking for growth opportunities in a diversified portfolio.

T. Rowe Price U.S. Equity Research Fund (PRCOX)

T. Rowe Price U.S. Equity Research Fund (PRCOX) is one of the top-performing mutual funds in 2023.

Many investors consider it as one of the best mutual fund investments available.

However, it’s important to note that past performance does not guarantee future results.

So, while PRCOX has performed well in the past, it’s always wise to do thorough research and consider other factors before making any investment decisions.

Fidelity Large Cap Core Enhanced Index Fund (FLCEX)

Fidelity Large Cap Core Enhanced Index Fund (FLCEX) is a mutual fund that aims to outperform its benchmark index while providing exposure to large-cap U.S. stocks.

This fund has shown strong performance, with a year-to-date return of 19.8% and an annual historical return of 12.3% over the past five years.

It is ranked as one of the top-performing mutual funds in 2023. FLCEX offers investors the advantage of diversification by allowing them to invest in a collection of large-cap stocks through a single fund.

The fund utilizes both active and passive management strategies to enhance returns, making it an attractive option for investors looking for potential growth in their portfolios.

How to Choose the Best Mutual Funds for Your Portfolio

To choose the best mutual funds for your portfolio, it’s important to consider a few factors. First, look at the fund’s performance over time.

Check if it has consistently generated good returns and outperformed its benchmark index. Next, consider the fund’s expense ratio – this is the fee you pay to invest in the best mutual fund. Lower fees can help maximize your returns in the long run.

Diversification is also key when choosing mutual funds. Look for funds that invest in different asset classes like stocks, bonds, and cash equivalents.

This helps spread out risk and protect your investment from market fluctuations. Another factor to consider is the fund manager’s track record and experience.

Research their history of managing similar funds and see if they have been successful in achieving their objectives.

Lastly, take into account your own investment goals and risk tolerance.

Consider whether you’re looking for growth or income, as different funds specialize in these areas.

By carefully evaluating these factors – performance, fees, diversification, fund manager experience, and personal goals – you can find the best mutual funds to add to your investment portfolio.

Alternatives to Mutual Funds

One alternative to mutual funds is ETFs or exchange-traded funds. These investment vehicles offer a similar level of diversification and can be traded like stocks.

To learn more about the benefits and considerations of investing in ETFs, read on!

Exchange-Traded Funds

ETFs, or exchange-traded funds, are investment options that trade on the stock market just like stocks. They can be bought and sold throughout the trading day.

ETFs offer investors diversification by pooling together different securities, such as stocks, bonds, or commodities.

Compared to mutual funds, exchange-traded funds may require more research and monitoring since their prices can change during the day.

However, they also provide flexibility because they can be purchased with smaller investments.

One advantage of ETFs is that they generally have lower expense ratios than mutual funds. Additionally, due to their unique structure, ETFs are often more tax-efficient than mutual funds.

Exchange-traded funds are a popular alternative to mutual funds for many investors because of these advantages.

They allow investors to easily access a diversified portfolio of assets and trade them like shares in real-time throughout the trading day.

With their lower expense ratios and potentially better tax efficiency compared to mutual funds, ETFs offer an attractive option for building a successful investment portfolio.

Can You Lose Money in a Mutual Fund?

The value of mutual funds can decline if the assets held in the fund decline in value.

– Mutual funds can result in capital gains distributions, which may have tax implications.

– Conducting independent research into investment strategies is advised before making an investment decision.

– Past investment product performance is not a guarantee of future price appreciation.

Conclusion

In conclusion, mutual funds are a great option for investors looking to diversify their portfolios.

The top-performing funds highlighted in this article have shown strong performance over the years and can be considered for investment.

Remember to do your own research and consult with a qualified professional before making any financial decisions. Happy investing!

Frequenty Asked Questions

A mutual fund investment pools money from many people to buy stocks, bonds, and index funds.

Financial calculators help you make wise financial decisions about investments, mortgages, home lending products, and more.

You can get sound investment advice from qualified professionals like James Royal or Brian Baker who keep an eye on stock and bond markets daily.

Yes! You can pick the best mutual funds for your 401(k) plans or self-directed IRAs as they are often listed in the offerings.

Looking at U.S News Best Mutual Fund rankings will help you find top-rated funds like VALIC Company Nasdaq Index or Fidelity Large Cap Growth Index based on different parts of the market such as real estate or technology.

Firms like iShares, Fidelity Investments, Vanguard, and Charles Schwab have great choices of mutual funds that could fit with your mutual fund investing needs.