Getting your finances in order is always a priority for most. A lot of people turn to investing excess money as a way to grow their wealth as it is all about applying certain strategies to ensure that you get maximum returns.

When you invest, you can utilize a part of your assets while they make more assets.

You can choose from a multitude of investment options like real estate, stocks, and bonds, or even seek out cryptocurrency opportunities.

You can choose between short-term or long-term options or diversify your portfolio with a combination of the two.

Being one of the most affluent countries in the world today, people are looking for the best investment in UAE.

While there are a lot of different investment options available, not all of them are the best for you.

That is why we have created this guide to the best investment options available in the United Arab Emirates.

Quick Summary

In short, this blog provides you with an overview of the best investment options in the United Arab Emirates (UAE). It emphasizes the potential for growth and wealth creation through various investment strategies.

It also covers both short-term and long-term investment options, including bank accounts, fixed deposits, recurring deposits, precious metals, and fixed maturity plans.

Plus it highlights the investment opportunities for expatriates in UAE, particularly in real estate, stock market, mutual funds, exchange-traded funds (ETFs), offshore investments, and structured notes.

Finally, it encourages readers to conduct thorough research and develop a game plan based on their financial goals.

Investments in Dubai

Investing in Dubai is a cut above the rest – and it’s not just ex-pats that the UAE economy is promising for.

It is an exemplary example of progress and sustainable development; it has become an investment hub of choice for countless international investors from all over the world.

There are many options to choose from; stock exchange trading, real estate purchasing and other kinds of asset purchases, private pension plans, funds, and deposits.

However, you should not let Dubai be your only focus; other dynamic towns like Abu Dhabi, Ras Al Khaimah, and Sharjah are also worth a watch as opportunities come up in this true melting pot!

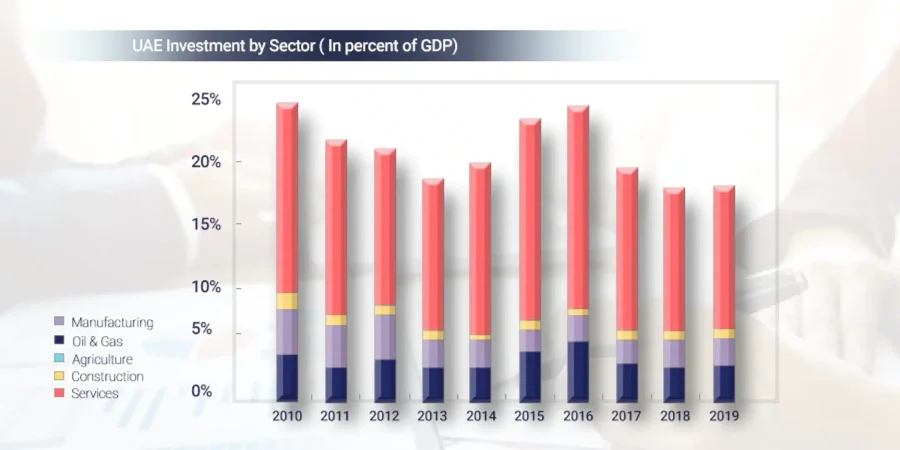

Traditional industries such as oil and gas have garnered high interest from investors who have streamlined the services offered beyond what locals may expect.

Fast forward to 2019, the International Monetary Fund (IMF) saw a great deal of growth in the local economy with a GDP of 3.7% compared to under 3% in 2018

Best Short-Term Investments In UAE

Short-term investment plans offer a great way to meet your short-term financial goals.

They’re focused on providing substantial returns while giving you the ability to remain relatively risk-free if needed.

The fact that they include maturity periods of less than five years means you’ll be able to keep up with your plans without feeling weighed down by long-time commitments.

Since such investments don’t normally have any complicated processes associated with them, it is a good place to start for new investors.

Bank Account

Saving bank accounts is a top choice for many people who are looking to keep their hard-earned money safe.

With such a large number of banks available online and off, they’re also one of the easiest ways to go about storing your money in a risk-free manner.

Banks make it quick and easy to deposit money as well as withdraw it if you need cash fast. There are no fines or fees associated with moving your own money back out of the bank.

Most banks are offering a pretty low return on interest nowadays which means you usually lose out on a percentage of your profits in order to gain the convenience factor.

pros

-

Safety -

Bank accounts make it easy to withdraw cash or transfer funds. -

Using a bank account is easy online and offline. -

Investments in bank accounts are relatively low-risk.

cons

-

Low investment returns -

Money’s purchasing power will decrease over time if interest rates on your bank account don’t keep up with inflation. -

Investing in a foreign currency can be affected by exchange rate fluctuations.

Fixed Deposit

The UAE is a great place to be, allowing one to invest in a diverse array of financial products. FDs offer a lot and can really benefit an investor who is looking to safeguard their money and minimize risk while also limiting volatility.

If you’re looking for such an investment opportunity with low risk then you should opt for fixed deposits. Here, you can invest your money for up to 10 years.

Of course, it’s always possible to withdraw early, but some fees will be deducted from your initial deposit if you do so; therefore we would suggest investing a manageable amount for a shorter term is a better choice than investing a large sum that you may need before maturity as you could lose out on a decent sum of interest.

pros

-

Fixed returns -

Safe investments as they are typically protected by deposit insurance. -

Fixed deposits offer different terms and maturity periods, allowing you to choose an option that suits your short-term investment goals.

cons

-

Withdrawing the funds before maturity may result in penalties or loss of interest. -

Inflation risk. -

Limited potential for higher returns

Recurring Deposit

There’s some really great news for those who haven’t saved enough for retirement yet or are simply unsure of how to get started. Some banks have monthly dividends that allow you to put as much money aside as you like, without having to save a fortune at just once! So if you need more time to build your bankroll, consider recurring deposits.

The idea behind this is to provide people with the ability to make small but consistent investments over time. It is important to note that the rate of interest you earn on this type of investment is taxable.

pros

-

Regular savings -

Disciplined approach -

You can choose the amount and duration of the recurring deposit according to your financial capabilities and goals.

cons

-

Limited returns: Recurring deposits typically offer lower interest rates compared to other investment options. -

Taxable interest

Precious Metals

As far as a low-risk way to diversify your portfolio goes, precious metals can be great options to consider when it comes to making wise investment decisions.

Gold is known for being especially liquid and one of those safe bets that investors often turn to for short-term needs.

When used over the long term, though – their prices tend to skyrocket!

This is why many people believe that precious metals make excellent investments when it comes to hedging against inflation.

pros

-

Safe and Hedge against inflation: Precious metals have historically maintained their value or even appreciated during periods of inflation. -

Diversification and reducing overall risk.

cons

-

Volatility. -

Storage and security -

Limited income potential

Fixed Maturity Plans

They are ideally short-term investment options. They come with a fixed tenure and make up a lot of investors’ portfolios if they’re looking for investments that have liquidity and instant liquidity benefits to them.

Although returns from FMPs don’t necessarily happen on a regular basis, many people choose this option because they’re looking for a lump-sum solution.

pros

-

Liquidity -

Potential for higher returns -

Diversification

cons

-

Lack of flexibility -

Market risk -

Lack of transparency

Best Investment In UAE For Expats

UAE is truly a gem for ex-pats looking to invest their money in a way that not only brings them great returns but also allows them to be well taken care of.

Not only does the country have flexible taxation laws but the business realm is particularly vibrant— there are multiple types of investments one can make through either doing it directly or going through an investment agency.

Any resident or interested ex-pat investor will find that there are plenty of things to delve into when it comes to investing.

Real Estate

People who are interested in getting a real estate investment property in the UAE may want to start by researching the current economic growth of the area they are considering.

The UAE has increased cash flow, therefore investing in property will be the most lucrative idea for investors.

On top of economic growth, Abu Dhabi and Dubai are two examples of some of the finest sightseeing destinations for tourists from all over Asia and globally, bringing more revenue to both economies as well as properties within these areas! And the best part?

Rental gains are soaring in Dubai (roughly 6-10%), meaning you can avail yourself more space in Dubai with AED 1 million than multiple other cosmopolitan cities.

UAE’s real estate market has been booming because of the surge of investors from all over the globe.

A perfect blend of historical and modern infrastructure with a rapidly growing economy has earned people’s trust to invest in this beautiful city.

Summing up— all the important developments alongside population growth make sure that when you invest in real estate, you will receive excellent returns.

pros

-

Tangible asset -

Potential for capital appreciation -

Generate a steady stream of rental income -

Diversification

cons

-

High initial costs -

Illiquid investment -

Market fluctuations -

Maintenance and management

Stock Market

Investing in stocks is an excellent investment for ex-pats living in the UAE.

It’s what many people think of beginning with since stock market investments are something most people can get familiarized with right away and there’s no experience needed.

While it may be easy to learn, there are some pretty important things that you need to know before even thinking of investing in stocks so that you don’t become part of a very close statistic!

For one thing, it’s essential to do your research properly so that you have at least some sort of understanding or knowledge of what the stock market is like and how it works to avoid any kind of risky investment strategy.

Stock market transactions tend to be quite volatile, so they aren’t the finest investment options if you want something safer and less risky.

If you’re not sure how trading works right now, talk to a financial advisor.

pros

-

Potential for high returns -

Liquidity -

Diversification -

Professional management

cons

-

Market volatility -

Risk of loss -

Need for research and knowledge -

Emotional investing

Mutual Funds

Mutual funds are quite easy to understand once you break them down. Put simply, they are investments with multiple stocks typically integrated into one account.

So, what exactly makes mutual funds so great?

There are numerous advantages for investors— some of which include portfolio diversification, economies of scale (EOS), and liquidity— all important things to look at concerning your investment portfolio and its future potential earning power.

Mutual funds are an excellent option for dipping your toes into the stock market without having to make a huge initial investment.

They are a great way to get involved gradually and focus on solid companies that have proven themselves over time.

By splitting the money of many investors between various companies, mutual funds tend to spread out the risk and help keep their investors’ investments protected.

Small investors can also win big with a small investment in mutual funds.

Partnering up with an experienced and proven company helps you keep costs down and maximize your profits.

The best way to build your wealth over time is by planning ahead, diversifying your deal, and letting the professionals do their thing because they have been doing it for years!

pros

-

Professional management -

Diversification -

Access to different markets and sectors -

Liquidity

cons

-

Fees -

You have limited control over individual investments in mutual funds -

Market risk and there is no guarantee of returns -

Potential for underperformance

Exchange Traded Funds (ETF)

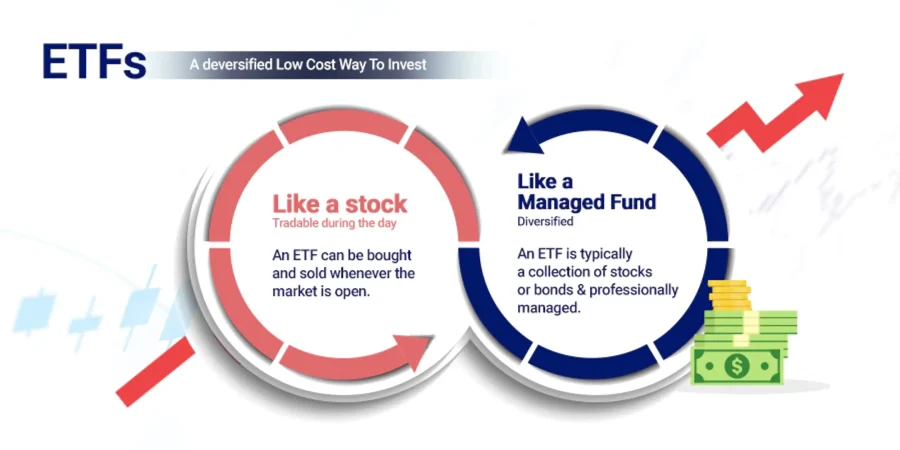

Both experts and amateur investors can find a wonderful way to increase their investment portfolio’s value: exchange-traded funds (ETFs).

They currently not only allow traders to enjoy greater gains, but they also allow them to contribute less to their trading efforts because the trading costs are significantly reduced.

These can be a real asset to your portfolio if you’re looking for a more cost-effective way of trading- and it may also be the product you need if you’re looking to develop multiple streams of income within your portfolio that has the added advantage of being able to grow organically over time.

pros

-

Diversification -

Intra-day liquidity and flexibility in buying or selling shares -

Lower expense ratios compared to actively managed mutual funds -

Investors can see the underlying assets in ETFs on a daily basis

cons

-

Market volatility and the value of the investment can fluctuate -

It is possible to incur brokerage commissions when buying and selling ETFs -

Tracking error -

When investing in ETFs, you rely on the index or sector the ETF tracks, and individual stock selection is not possible

Offshore Investments

There are a number of financial institutions in the UAE that can help you explore potential opportunities for offshore investment advice and planning.

Owning a diversified portfolio of assets outside your motherland can help reduce risk which is especially important when taking on investment portfolios in general.

These firms provide investors like you with financial planners who will advise you on how to diversify your portfolio in a way that will help meet your specific financial needs.

pros

Tax benefits

Asset protection

Diversify your portfolio by accessing international markets and currencies

Offer increased privacy and confidentiality compared to domestic investments

cons

Regulatory complexities

Higher costs

Risk of fraud or scams

Reputation concerns

Structured Notes

They can provide with you the potential to increase your investment returns during a short period.

They are based on the price of any underlying asset – be it stock, commodity, interest rate, or currency.

Their investing value fluctuates according to changes in market trends and values.

Their basic features include comparatively early maturity, regular interest, and principal payments.

It’s very important to know that structured notes are high-risk financial instruments.

When looking for such financial carriers, choose those who treat you fairly and offer diversification.

pros

-

Customization -

Diversification -

Principal protection -

Potential for enhanced return

cons

-

Complexity -

Lack of liquidity

Closing Thoughts

As increasingly globalized societies emerge modern-day ex-pats are paying more and more attention to their future financial well-being.

Unlike saving money in the bank, some of the above-mentioned investment options will allow ex-pats to invest their hard-earned money

in the right place by securing their future financially. Regardless of what you are looking for, the above investment options will surely accommodate your needs.

However, it is still important to do your research and have a game plan in place.

For instance, if you have a large sum of cash that you need to invest, then looking for a higher return and taking more risk might be the way to go.

Alternatively, if you are just starting out, then you might want to stick with a safer investment option.

If you are planning for the future, it is essential to plan for the kind of future you want.

Planning for the future is not just about putting money into your bank account. It is about saving for your retirement, your children’s education, your health, and much more.

At Quadra Wealth Management, we can help you with the best investment in UAE to secure your future.

We will go through a range of investment options so that we can advise you on the best plan based on your financial goals.

Frequently Asked Questions

What are the best investment options available in the United Arab Emirates?

The guide mentions several investment options such as real estate, stocks, bonds, cryptocurrency opportunities, bank accounts, fixed deposits, recurring deposits, precious metals, fixed maturity plans, mutual funds, exchange-traded funds (ETFs), offshore investments, and structured notes.

What are the best short-term investment options in the UAE?

The guide suggests short-term investment plans like bank accounts, fixed deposits, recurring deposits, and precious metals as good options for meeting short-term financial goals.

Is bank accounts a good investment option in the UAE?

Bank accounts are a popular choice for keeping money safe and easily accessible. However, they typically offer low returns on interest, so they may not be the best option if you’re looking for higher profits.

What are fixed deposits, and how do they work in the UAE?

Fixed deposits allow you to invest your money for a specific period, usually up to 10 years, and earn interest on it. Withdrawing funds before maturity may incur fees. It is recommended to invest a manageable amount for a shorter term to avoid losing out on interest.

What are recurring deposits, and how do they help with saving for retirement?

Recurring deposits allow you to make small but consistent investments over time, which can be beneficial for individuals who haven’t saved enough for retirement. However, the interest earned on recurring deposits is taxable.

Why is real estate considered a good investment in the UAE?

The UAE, especially cities like Dubai and Abu Dhabi, has experienced significant economic growth and attracts tourists from around the world. This growth, along with rental gains, makes real estate investment lucrative in the region.

Is investing in the stock market a good option for expats in the UAE?

Investing in stocks can be a good option, but it’s important to have a proper understanding of the stock market and do thorough research before making investments. Stock market transactions can be volatile and carry higher risk.

What are mutual funds, and why are they recommended for small investors?

Mutual funds pool money from multiple investors and invest in a diversified portfolio of stocks. They offer advantages such as portfolio diversification, economies of scale, and liquidity. They can be a suitable option for small investors looking to gradually enter the stock market.

How can offshore investments benefit investors in the UAE?

Offshore investments can help reduce risk by diversifying one’s portfolio and providing access to global investment opportunities. Financial institutions in the UAE can offer advice and planning services for offshore investments.

What are structured notes, and how it enhance potential returns?

Structured notes are financial instruments whose value is based on the price of an underlying asset and Customizable features to suit individual investment preferences. They have the potential for enhanced returns based on the performance of the underlying asset.

How should I plan for my future financial well-being in the UAE?

Planning for the future involves more than just saving money. It includes considering retirement, education, healthcare, and other financial goals. It’s important to do thorough research, have a game plan, and consult with professionals like Quadra Wealth Management for personalized advice.