Investing money can be a complicated task, especially for individuals who wish to align their investments with Islamic principles. The market of Halal investing is growing rapidly as it offers ethical and Islamic faith-based alternatives to conventional investment options.

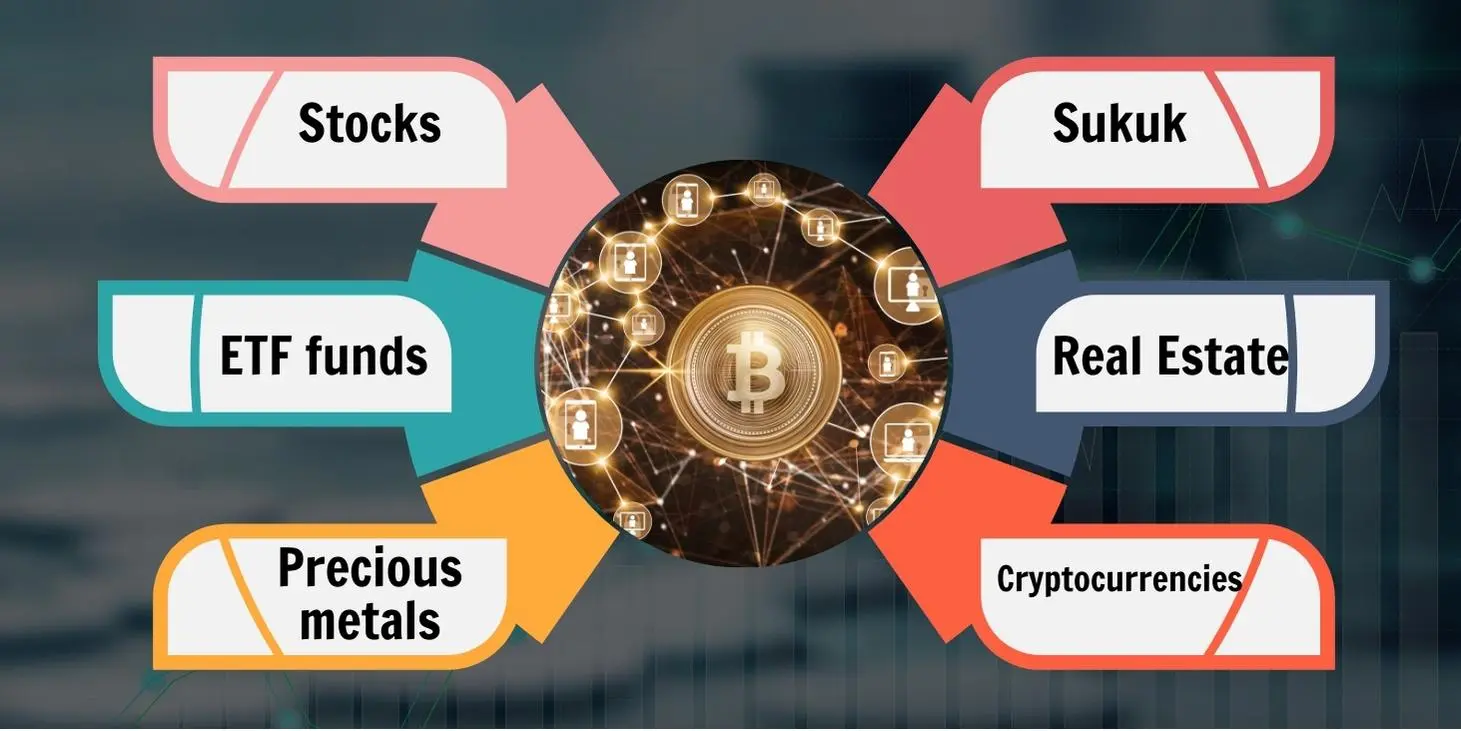

This comprehensive guide will provide you with the best Halal investment options for 2023 covering stocks, mutual funds, ETF funds, cryptocurrencies, and more.

Get set to explore your path towards financial growth while respecting your values.

Key takeaways

● Halal investing refers to investment options that comply with the Islamic principle, such as avoiding interest-based transactions and prohibited industries.

●Some of the best halal investment options for 2023 include stocks, ETF funds, precious metals like gold and silver, sukuk (Islamic bonds), real estate, and cryptocurrencies.

●Investors should consider factors like risk levels, debt parameters, and adherence to Shariah law when making halal investment decisions.

● Resources like halal stock screeners and robo-advisors specializing in socially conscious investing can help Muslim investors find suitable halal investment opportunities.

What is Halal Investing?

Halal investing refers to investment strategies and options that are in accordance with the Islamic principle. UAE offers a wide range of halal investment options for Muslims who seek Shariah-compliant investments to grow their savings.

Halal investing is a unique form of investing that complies with Islamic law and is shaped by Islamic scholars who provide guidance on topics such as interest, debt, risk, and social responsibility.

It also involves adhering to specific rules and guidelines, such as avoiding interest-based transactions and prohibited industries, while also considering charity obligations and one of the riskiest parameters.

Definition and principles

Halal investing means putting money in a way that fits with Islamic rules. These rules guide what is right, or halal, and what is not right, or haram.

To do this type of investing, you need to avoid businesses linked with things like alcohol or pork. You also should not use investments that earn interest as interest income that goes against Islamic law.

This way of putting money in does more than just follow laws. It shows respect for good work and helps make sure everyone is treated fair and well in the business world.

The importance of alignment with Islamic ethics

Following Islamic ethics is key in halal investing. Halal means “permitted” in Arabic. We apply this term to investments that are okay under the rules of Islam. The goal is not just about making money.

It’s also about using money in ways that do good and avoid harm. That’s why a big part of halal investing is staying away from haram, or forbidden, things like alcohol and gambling businesses or pork products.

So, it matters a lot where your investment goes in terms of what kind of business it supports. In this way, you make sure your choices line up with the Islamic principle.

Rules for Halal Investing

Halal investing is guided by several important rules and principles, including the prohibition of interest, avoidance of prohibited industries, fulfillment of charity obligations, and adherence to risk and debt parameters.

Prohibition of interest

Interest, also known as ‘riba’, is not allowed in halal investing. Islamic laws see interest as unfair and harsh. Any kind of deal with interest is strictly barred.

This rule makes sure no one profits unfairly at the expense of others. For this reason, popular investment options like Islamic bonds or sukuks do not involve earning interest.

It’s very important to study your investments well so they follow Shariah law rules.

Avoidance of prohibited industries

You can’t invest in any business that is part of a banned field. These fields include wine, betting games, and pig products.

For Muslims, we call these areas haram. This term means they go against the rules of Islam. So, those who choose Halal You can’t invest in any business that is part of a banned field.

These fields include wine, betting games, and pig products. For Muslims, we call these areas haram. This term means they go against the rules of Islam.

So, those who choose Halal investing must be careful about where they put their money. They need to check whether a company does something haram before buying its shares or bonds.

investing must be careful about where they put their money. They need to check whether a company does something haram before buying its shares or bonds.

Charity obligations

Muslims are encouraged to fulfill their charity obligations as part of their religious practice. This includes giving a portion of their wealth, known as zakat, to those in need.

Halal investing provides an opportunity for Muslims to meet these charity obligations while making investments. By choosing halal investment options that align with Islamic ethics and promote social responsibility, Muslims can support initiatives that benefit society and contribute to the betterment of communities.

This helps individuals achieve financial growth while also fulfilling their moral duty to help others in need.

Risk and debt parameters

Halal investing involves adhering to certain risk and debt parameters. It’s important to consider these factors before making any investment decisions. Islamic law prohibits excessive risk and speculation, so it’s crucial to assess your risk appetite carefully.

Additionally, Shariah-compliant investments avoid interest-bearing instruments and excessive debt levels. This means you should steer clear of companies with high leverage or those involved in activities.

That’s why Islamic law prohibits gambling and other things like alcohol, etc. By maintaining a conservative approach and aligning with ethical principles, you can ensure stability and sustainability in your halal investment portfolio.

Thorough research is key to understanding the financial health of companies and avoiding non-compliant investments.

Best Halal Investment Options for 2023

Discover the top Halal investment options for 2023 that align with Islamic principles and offer potential financial growth. Don’t miss out on these exciting opportunities!

Stocks

Halal investments include stocks of businesses that align with Islamic principles. Muslims can invest in stocks as long as the companies they invest in are not involved in haram activities like alcohol, gambling, or pork products.

However, it’s important to note that certain industries like technology and pharmaceuticals may present gray areas when determining their halal compliance. Thorough research is necessary to ensure that stocks meet Shariah law guidelines.

Halal investing promotes a long-term perspective and encourages investors to have a diversified portfolio for stability and sustainability.

ETF funds

ETF funds and index funds are considered one of the best halal investments for 2023. These funds focus on creating portfolios that follow Islamic law principles.

In Islamic finance, it is important to avoid prohibited industries such as gambling, alcohol, tobacco, and interest-based transactions.

ETFs provide a way for Muslim investors in the UAE who seeking to diversify their investments across different asset classes while still adhering to these ethical guidelines. By investing in halal-compliant ETFs, individuals can support companies that align with their values and promote socially responsible practices.

This makes ETF funds a popular choice among those looking for long-term stability and sustainability in their investments without compromising their religious beliefs.

Precious metals

Halal investment options for 2023 include precious metals like gold and silver. These tangible assets are permitted in Islamic law, making them a viable choice for halal investors.

Investing in precious metals can provide protection against inflation and currency devaluation, which is especially important in uncertain economic times. Moreover, these investments offer portfolio diversification and stability, as they are not subject to the fluctuations of interest-based financial transactions.

So, if you’re looking for a halal investment option that aligns with Islamic principles, consider exploring the potential of precious metals like gold and silver.

Sukuk

Sukuk is considered one of the best halal investment options for 2023. Sukuk also refers to a fixed-income product that complies with Shariah and provides steady returns rather than crazy growth. Sukuk is an Islamic financial bond that complies with the Islamic financial certificate.

They provide a way for Muslims to frequently invest their money while following their religious beliefs. Investing in sukuk can support ethical and socially responsible practices, as these bonds fund projects that align with Islamic principles.

However, it’s important to conduct thorough research to ensure that the Sukuk investments adhere to Shariah law and meet the requirements of Islamic finance.

Real Estate

Investing in real estate is considered one of the best halal investment options for Muslims in 2023. When investing in property, individuals can expect typical annual returns of around 6%, but it can be even higher – up to 10% or more.

What makes real estate appealing is that it allows you to have a tangible asset in the form of a property that can be rented out to tenants. This rental income can then be used to pay off the mortgage, enabling you to build equity in the property.

There is interest in mortgages as banks ask for them, and there are mortgage real estate investment trusts where halal investors earn profits through price changes by charging interest on them. However, Real estate investment trusts (REITs) without mortgages are halal. For commercial properties, investors must avoid leasing to tenants who engage in any type of non-Shariah-compliant business activity.

Additionally, buy-to-let properties can be obtained through Islamic mortgages with just a 25% cash down payment. So, if you’re looking for an investment option that offers stable returns and long-term growth potential while adhering to Islamic principles, real estate could be a great choice for you!

Investing in Land is a physical asset that may act as a hedge against inflation. It can generate a reliable source of income at a greater rate than other investment types while also benefiting from long-term appreciation. Additionally, investing in real estate provides numerous tax benefits but it requires a higher initial investment and limited liquidity.

A thorough understanding of land and market trends is necessary. To look after tenants, consistent attention, maintenance, and administration are essential.

Cryptocurrencies

Cryptocurrencies are a part of the best halal investment options for 2023. They can be attractive to investors because they offer interest-free solutions, as Islamic law prohibits interest-based financial transactions.

However, it is important to conduct thorough research and ensure that cryptocurrencies meet the requirements of Shariah law and are considered halal. Some cryptocurrencies aim to be transparent, ethical, and compliant with Islamic principles by implementing features such as blockchain technology for transparency and decentralized governance structures.

However, some cryptocurrencies are Shariah compliant, and the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) has approved them. The cryptocurrency rules are the same as those for the Islamic Forex market; that is, trades should be held on the same day, and no interest should be involved.

Including cryptocurrencies in a halal investment portfolio can provide diversification Halal investing opportunities while adhering to Islamic principles.

Halal Investment Resources

Halal Investment Resources provides valuable tools and platforms for investors looking to align their investments with Islamic principles, including halal stock screeners and the best robo-advisors for socially conscious investing.

Halal stock screeners

Halal stock screeners can help Muslim investors find stocks that align with Islamic law. They focus on portfolios that follow the principles of halal investing basics and exclude companies involved in prohibited industries such as gambling, alcohol, tobacco, and interest-based financial transactions.

Some well-known halal stock screeners include Zoya, Islamicly, Musaffa, Wahed, and Halal Invest. These platforms analyze financial data to determine whether a company’s operations comply with Islamic finance principles.

By using halal stock screeners, Muslim investors can ensure that their diversified investments are in line with their religious beliefs and values.

Best Robo-Advisors for Socially Conscious Investors

Looking for a robo-advisor that aligns with your values? Check out these top picks for socially conscious investors:

- Wahed: Wahed is a leading robo-advisor offering Halal investment management options. They follow strict Islamic principles and provide diversified portfolios consisting of Halal stocks and Sukuk bonds.

- Simply Ethical: Simply Ethical is another popular robo-advisor specializing in ethical investing and socially responsible investing. They offer Sharia-compliant investment options, including Islamic equity funds and global sukuk funds.

- Azzad Asset Management: Azzad Asset Management is an investment firm focused on socially responsible investing from an Islamic perspective. With their robo-advisor platform, investors can access diversified Halal portfolios tailored to their risk tolerance and financial goals.

- Saturna Capital: Saturna Capital is a recognized leader in the field of Islamic finance. Their robo-advisor platform offers Sharia-compliant investment options, including equity mutual funds that adhere to Islamic principles.

- ShariaPortfolio: ShariaPortfolio is a registered investment advisor specializing in Halal investing solutions. They offer personalized portfolios composed of Sharia-compliant investments, such as stocks, ETFs, mutual funds, and structured products.

Building a Halal Portfolio

Building a Halal Portfolio involves assessing business models, researching company operations, and analyzing financial ratios.

Assessing Business Models

Assessing the business model is an important step in halal investing. Here are key factors to consider:

- Evaluate the type of products or services offered by the company.

- Look at the supply chain and ensure it is free from haram practices or ingredients.

- Consider the overall impact on society and whether it aligns with Islamic values.

- Assess the company’s sources of revenue streams and sources of investment income, ensuring they are halal.

- Check if the company has any involvement in interest-based transactions or debt.

- Examine the company’s corporate governance practices and ethical standards.

- Research if the company is involved in any prohibited industries such as alcohol, gambling, or pork products.

Researching Company Operations

Researching company operations is important when building a halal portfolio. It helps identify halal investment options and ensures investments align with Islamic principles. Here are key considerations in researching company operations:

- Evaluate the company’s finances.

- Assess the business model.

- Analyze financial ratios.

- Avoid investing in businesses engaged in haram activities like alcohol, gambling, and pork.

Analyzing Financial Ratios

Analyzing financial ratios helps in building a Halal portfolio. Here are important ratios to consider:

- Debt-to-equity ratio: This shows the proportion of debt to equity in a company’s capital structure.

- Current ratio: It measures a company’s ability to pay its short-term liabilities with its short-term assets.

- Return on equity (ROE): This ratio indicates how efficiently a company utilizes its shareholders’ investments.

- Price-to-earnings (P/E) ratio: It compares a company’s stock price to its earnings per share, indicating if it is overvalued or undervalued.

- Dividend yield: This measures the return on investment through dividends received.

Benefits and Risks of Halal Investing

Halal investment guidelines offer several benefits for Muslim investors. Firstly, it allows them to align their investments with their religious beliefs and values.

By avoiding haram activities such as alcohol, gambling, and pork products, investors can feel confident that their money is being used ethically.

Secondly, halal investing promotes long-term stability and sustainability. By focusing on businesses that are not engaged in haram activities, investors can reduce the risk of negative events impacting their investments.

Thirdly, halal investing provides an opportunity for social impact. Investing in industries that promote positive societal outcomes allows Muslim investors to contribute to the betterment of society.

However, there are also risks associated with halal investing. One potential risk is limited investment options. Avoiding interest-bearing instruments and prohibited industries may restrict the range of available investments compared to traditional investment strategies.

Additionally, secondary market volatility can affect all types of investments, including those aligned with Islamic principles.

It’s important for investors to have a clear understanding of their risk appetite and diversify their portfolio accordingly to manage these risks effectively.

In conclusion, halal investing offers unique benefits by allowing Muslim investors to align their financial decisions with Islamic principles while promoting stability and social impact.

However, it does come with its own set of risks that should be considered carefully before making investment decisions.

Conclusion

In conclusion, halal investing offers a range of options for Muslims seeking ethical and profitable investments. By adhering to Islamic principles and avoiding prohibited industries, investors can choose from stocks, ETF funds, precious metals, sukuk, real estate, and cryptocurrencies.

It’s important to research each investment option carefully and consider factors such as risk levels and debt parameters. For professional financial advice on Halal investment management, you can reach out to our registered financial advisor.

With the right approach and understanding of halal investment guidelines, individuals can build a portfolio that aligns with their values while growing their wealth for the future.

FAQs

What are some of the best Halal investment options for 2023?

The top Halal investment selections for 2023 include Forex trading through swap-free accounts, investing in Islamic bonds (Sukuk), and placing funds in Sharia-compliant funds handled by fund managers.

Can I invest in cryptocurrencies such as Bitcoin and Ethereum following Sharia rules?

Yes! There are ethical alignment opportunities with certain cryptocurrencies like Bitcoin, Ethereum, Ripple, and Litecoin. When investing make sure to avoid non-compliance or Haram products.

How can I start investing if I am a beginner?

Beginners who wish to invest in respecting Islamic rules can begin using platforms like RoboForex’s swap-free account and XM’s Islamic account. Following guidelines from resources like IslamicFinanceGuru may also be helpful.

Are there any high-risk investments that abide by sharia law?

Investing in start-ups could involve higher risk factors but is potentially rewarding if done properly within the scope of Sharia law using platforms like Seedrs.

Can real estate fall under halal investment options?

Absolutely! Investing money into buy-to-let properties is a popular method among Muslims wanting to grow their portfolio while being compliant with Shia laws. They can use the crowdfunded buy-to-lets platform Yielders or Introcrowd which provides Shariah-compliant land investments

Can traditional finance practices align with Shari’ah principles?

While traditional methods might not always comply fully due to aspects such as paying or charging interest (Riba), many financial institutions offer Shariah screening tools. This helps ensure your investment choices stay away from sin stocks involving alcohol, gambling, pork, tobacco industries, etc., aligning better with Shari’ah practices.