Introduction

With the rise and advent of the internet, the investing landscape is undergoing a paradigm shift indeed. New investment products are on the rise.

The important thing here is that the product must meet the requirements of traditional and modern investors. For an investor belonging to a conservative school of thought, the capital protection norms supersede other factors. For a novel or latest-gen investor, expecting a rise in income levels by engaging with equities or shares doesn’t seem much of a hassle.

That is particularly the reason why structured products are in vogue. A new way of investment, preferred by both traditional and modern investors; these were initially booming in the UK markets way back in the ‘90s now becoming increasingly popular in the US and other geographical domains too.

We have different kinds of structured notes that are in use now. And, autocallable structured products belong to an elite asset class after all.

Let us see a thorough know-how of how things work concerning autocallable notes.

Autocallable notes are popular structured products with underlying securities that offer investors attractive forms of accrued coupon payments.

As like in any other form of structured note, the note comprises a debt element that is embedded with an underlying asset. The asset allocation can involve a basket of stocks, indices, or individual stocks.

Features Of Autocallable Structured Products

One of the enticing features of autocallable structured products is they can called early. The notes provide the issuer the right to withdraw them on specific dates known as auto-call dates. This feature is usually triggered when the asset’s price surpasses the strike price.

Auto-call time ranges can vary but normally it is initiated between 1 and 6 months from the time the notes were issued. In the frequency of these auto-triggers, investors receive attractive forms of coupon payments.

Another attractive feature of autocallable notes is that they provide a reasonable degree of capital protection to investors. These notes are designed in such a way that they automatically mature once specific conditions are met. This way, investors get the potential to receive enhanced yields on their investments.

With an inbuilt auto-call feature these notes are endowed with, product issuers do periodic assessments on how the portfolios are performing. When the underlying price of the embedded assets exceeds their strike prices, the notes are auto-called. That primarily explains how investors get their promised returns on time.

This is a kind of structured product that combines risk analysis with that of yield enhancement. Therefore, investors can seek a balance between capital protection and between earning attractive gains in the market. However, structured products work differently from direct investment plans as terms of interest and principal differ.

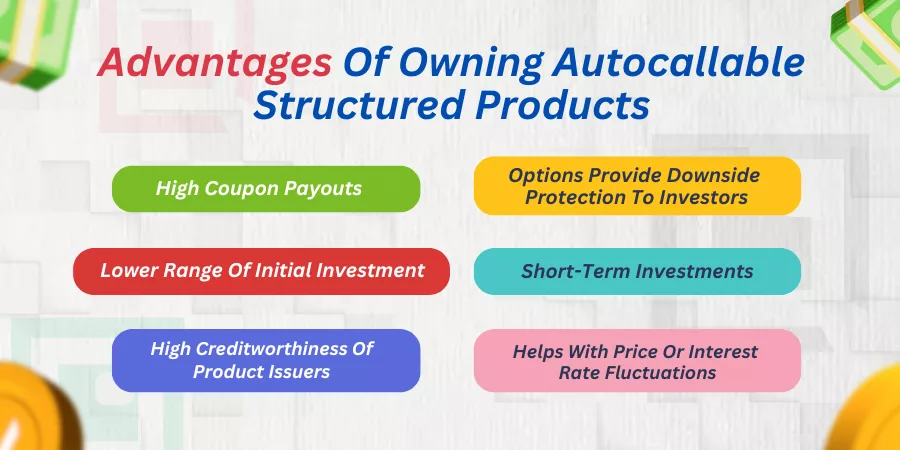

Advantages Of Owning Autocallable Structured Products

High Coupon Payouts

The best benefit an investor can have concerning owning autocallable notes is that he/she can receive high coupon payments and principal amounts once the notes are auto-called.

The investor can have the notes redeemed before maturity as the product issuer does not wait until the notes mature. This is because the order for the autocallable note is the autocall trigger mechanism that is in-built by the product issuing firms of autocallable notes.

As the name suggests, these notes are called off by product issuers as the underlying price of the assets surpasses the initially quoted strike prices. This is when investors receive substantial coupon payments.

If the auto-call or observation dates fail, the payouts accrue to the next observation cycle. The accumulated coupon payments are given away through the term of the investment.

In a nutshell, these notes provide quicker payouts if the preset conditions tied to notes are fulfilled and investors do not wait until maturity dates every time to receive their redemption amounts just like in the case of traditional investing plans.

Options Provide Downside Protection To Investors

The autocallable notes are embedded with call or put options to help the product issuer trigger an autocall every time strike values reach par or above the initial purchase values of the underlying assets.

Unlike traditional investing options, the options mitigate losses and provide investors with soft capital protection.

The products may not provide suitable returns if the preset values of underlying assets are not met. The observation day gets carried forward to the next immediate period of assessment.

Lower Range Of Initial Investment

To initially start with, you can buy autocallable notes for as low as $1000 each. The low level of capital investment lets a broader range of investors participate in the profit-share portfolio.

You can start with $1000 as the initial level and keep adding increments of $1000 each to keep diversifying your investment portfolio. The performance of the underlying asset is what keeps your investment vehicle moving. Therefore, these products offer great exposure to low-investment holders.

High Creditworthiness Of Product Issuers

Autocallable notes are typically issued by investment-grade banks. Therefore, these notes are structured products that are issued by credit-worthy issuers.

The investors must therefore look beyond the scope of creditworthiness of the issuer to go in for autocallable notes. In other words, they must look for various other factors before making their investment decisions on products and services.

Helps With Price Or Interest Rate Fluctuations

As the notes provide coupon payments and they can be auto-called in case of price fluctuations, investors get contingent downside protection from adverse forms of market losses. The in-built auto-trigger option also helps investors get periodic assessments on how their portfolios are performing. In a nutshell, it is important to note pre-determined levels of stock or equity index and keep track of figures as the progressions happen!

Short-Term Investments

Auto-callable notes are short-term investments ranging from 1 month and 3 years. These are notes that are auto-called as and when prices touch specified limits. Therefore, investors get an opportunity to realign their portfolios from time to time.

Downsides That Are Associated With Autocallable Notes

Limited Loss Of Principal

Although these notes predominantly support capital protection, investors may lose if the prices fail to go above strike rates or pre-determined autocall barrier values set while the notes are designed. This means investors may lose a portion of their capital money in case of adverse market conditions.

Returns Linked To The Performance Of Underlying Assets

These notes are directly linked to the performance of underlying assets to which the notes are embedded. Therefore, interest or coupon payouts may not always be fixed or exact. The interim returns vary from one auto-call period to another. The potential earnings through direct investment in the underlying asset may be much above what investors receive from notes.

Limited Liquidity

The autocallable notes are not designed to be sold in secondary markets that easily. This means the investor may have to hold the notes until they mature. When investors try selling the notes before maturity, they must be prepared to face volatility of the underlying assets due to:

- rising/falling price of underlying or reference asset

- interest-rate fluctuations

- dis proportional distributions from the underlying asset

Issuer Call

Autocallable notes can be withdrawn by product issuers before the notes mature. Therefore, investors may be forced to reinvest in sources that may provide them with a lower interest rate environment than what was offered to them while the notes were designed.

Tax Implications

Investors must be wary about tax implications concerning autocallable notes. This is because the potential returns from the notes may be treated as ordinary income and taxed accordingly instead of having them deemed as capital gains. The investor must consult their tax advisors before going ahead with the same.

In a crux, the risks associated with autocallable structured products must also be gauged by investors who may look to invest in them. The balance between capital protection and potential incomes is what keeps on changing concerning structured notes.

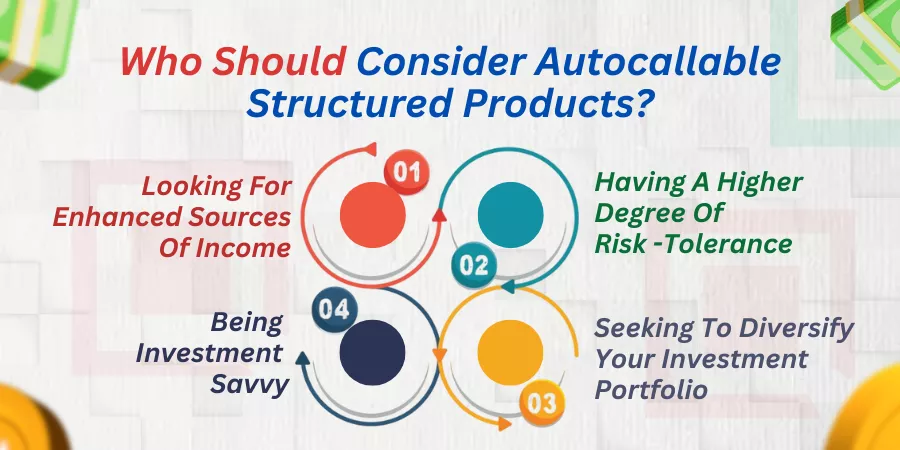

Who Should Consider Autocallable Structured Products?

Autocallable structured products are meant for those of you who are:

Looking For Enhanced Sources Of Income

As an investor, you may find callable notes attractive as they provide the potential for enhanced yields over fixed-income bonds or securities as such. Coupon payouts are done as and when autocall options are triggered. Therefore, the yields can comprise the principal amount along with any accrued coupon payoffs.

Having A Higher Degree Of Risk-Tolerance

These notes are suitable for those of you who are willing to give up on a portion of or the complete value of your initial principal money. The prices of underlying assets can fluctuate below or above barrier limits that have been set.

Although the put option auto-calls the investment, the downside of investors losing a part of their capital investment is definitely on the cards. Therefore, the autocallable feature is for those of you who can handle a higher proportion of risk tolerance.

Seeking To Diversify Your Investment Portfolio

As like in any other form of structured note, an autocallable note also has a debt element that is linked to equity. You also have the flexibility to include an individual stock or a basket of stocks embedded in your note. Therefore, investing in autocallable notes is meant for those of you who may want a diversified form of investment portfolio under the same umbrella.

Being Investment Savvy

Investors who have a decent knowledge of how ‘call’ or ‘put’ options work in equities or stock exchange markets can give these notes a try. Therefore, you must be knowledgeable concerning how options work and you must stay comfortable while the underlying assets are doing their job in the market. This is when you understand the product’s financial goals and risk elements that are involved.

Key Takeaways From Autocallable Notes

As potential gains are linked to prices of the underlying assets, your rate of returns may not be fixed but variable. The notes carry risks that the issuer may not have been notified of as they may be a secondary market domain. The underlying securities’ developments are made known to the investors only at the end. As long as the underlying asset reaches or exceeds set limits, investors can continue enjoying their gains.

You can make your investment vehicle work if you have a diversified range of financial instruments wherein the loss of one can offset the gain of another. It is therefore essential for investors to know how dividends or distributions of potential gains work.

The developments affecting the underlying securities are also a key factor investors must keep a note of. As the notes get auto-called, the redemption is limited to the coupon amounts, and the principal and the investor will not participate in further gains of the asset portfolio.

The Bottom Line

Autocallable notes have risk elements as well as rewarding options. The investor must read through the terms and conditions of the initial offering letter before signing on the dotted lines.

Approaching a wealth manager or an investment banker is a must-do before you foray into structured products. You must assess your risk tolerance before you know if the structured notes are meant for you or not. The issuer’s credit-worthy image also determines when you want to participate in the gains or not.