Investing in financial markets can seem daunting, especially when it comes to complex products like autocallable structured notes. These are sophisticated investment instruments that allow for high coupon payments influenced by an underlying asset’s performance.

This blog removes the complexity of these structured products by simplifying and explaining their key features, variants, and benefits.

Let’s dive in and demystify these potentially lucrative investment opportunities!

Key takeaways

● Autocallable structured notes are complex investment instruments that offer high coupon payments influenced by an underlying asset's performance.

● These notes consist of a bond with no interest and a series of options, but they come with the risk of losing all invested money if the assets perform poorly.

● Understanding the basics, key features, and variants of autocallable structured notes can help investors make informed decisions and potentially earn higher returns.

Understanding Autocallable Structured Notes

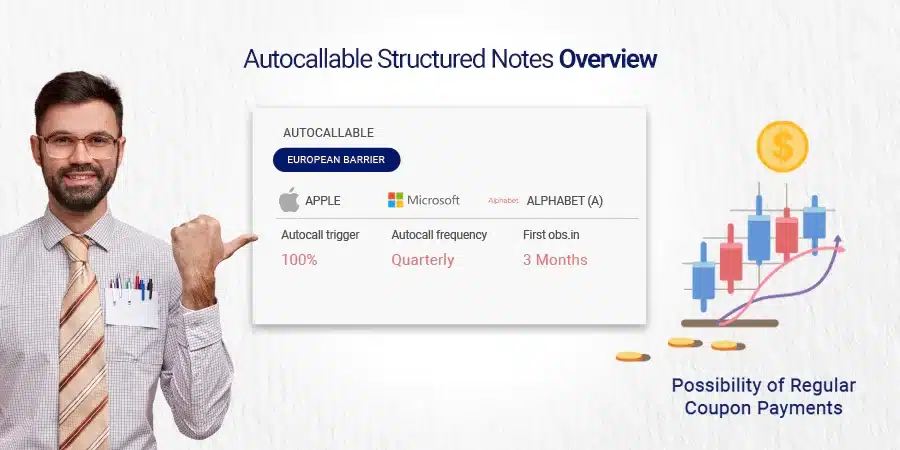

Autocallable structured notes are a type of high-paying bet. They link to an asset like stocks or indices. The name ‘autocallable’ means the issuer can pull back the note if the linked asset hits a certain price, known as the strike price.

This kind of note has two parts. One part is a bond that pays no interest and another part is a series of options. These options bring in money when markets move in ways you bet on.

But risk comes from assets that may not do well or fall under their starting prices. This could lose all your money invested in notes, making these tools for savvy investors only.

The Basics of Autocallable Structured Notes

Autocallable structured notes are a type of investment product that offer high coupon payments to investors and are linked to the performance of underlying securities, such as a basket of stocks or equity, an equity index, a commodity, a commodity index, or a foreign currency.

Description

Autocallable Structured Notes are a type of investment tool. They can give high coupon payments to investors. These notes use an underlying asset for their value.

The asset could be a basket of stocks, indices, or individual stocks. The issuer has the right to take back the note before its end date.

This is known as auto-call. It happens if the price of the underlying asset goes higher than the strike price on a set date.

If this doesn’t happen, you own the notes until maturity or early redemption.

Payoff

The payoff from Autocallable Structured Notes depends on how well the underlying securities do. If it hits the autocall barrier, the issuer pays back your money and a nice high coupon.

This can happen at any coupon date, which is set by you when you buy the note. But if the asset drops too much in value, you could face the risk of loss at maturity time.

This happens if it goes below the strike price–the first amount set for what counts as “too low”.

Risk Analysis

Risk is a big part of investing in autocallable structured notes. It can be high or low. If the stock prices drop below the trigger level, the investor could lose money.

This is known as downside risk. There are other types of risks too. The issuer’s credit risk is one to think about.

If they don’t have enough money, they may not pay you back. Market events like mergers and trading stops can also cause problems for investors.

Investors should look at all these risks before putting their money into autocallables. They should also keep an eye on things after they invest to make sure nothing bad happens.

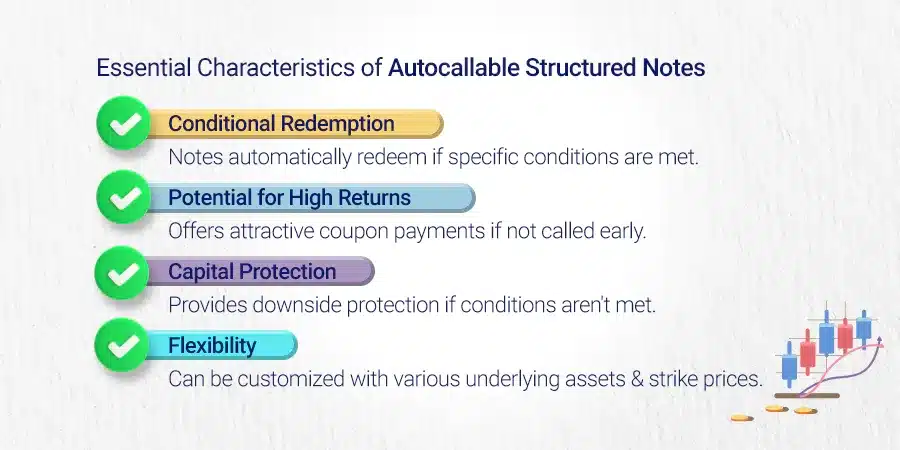

Key Features of Autocallable Structured Notes

Autocallable structured notes have several key features that make them attractive to investors. From equity/interest rate correlation to memory features, these notes offer unique opportunities for investors looking for high coupon payments and capital protection.

To learn more about the different variants of autocallable structured notes and their benefits, keep reading.

Equity / Interest Rate Correlation

Equity and interest rates work together to set the price of autocallable notes. The way they link is called correlation. A high autocallable price comes with a positive correlation between equity and interest rates.

This means that as stocks go up, so do interest rates. The opposite can also happen with a negative correlation. In this case, rising stock prices come with falling interest rates which leads to lower autocallable prices.

Even the time taken for an investment to mature can change this link and affect the price of these notes.

Memory Feature

The Memory Feature is a big part of autocallable structured notes. It helps an investor get more money over time. Every missed coupon gets added up.

When the note calls, you get all those missed coupons at once. This feature makes the notes different from other kinds of products like them. It also pushes investors to keep the notes longer so that they can earn more from the asset linked to it.

This may give higher returns than regular fixed-income things you can put your money in.

Put Feature

The put feature in autocallable structured notes is like a safety net. It gives soft capital protection. This means if the price of what you invested in goes down too much, the put option helps out.

The help comes when the price drops below a set level called the knockdown level. These notes also give total capital protection at the end of your initial investment time period.

So, with this feature, no matter how low your asset’s value may drop during this time, you know you won’t lose all your money at maturity. This means that the investor’s capital is no longer protected.

With autocallable structured notes and their put feature, it becomes easy to make a fixed profit without having to guess whether prices will go up or down soon.

Multi-Asset: Worst-Of

Multi-Asset: Worst-Of is a type of autocallable structured note that focuses on multiple asset classes. It involves a basket of assets, and the payoff is determined by the performance of the worst-performing asset within that basket.

This strategy allows investors to benefit from the potential upside in other assets while still being protected if one asset performs poorly. By focusing on the worst-performing asset, Multi-Asset: Worst-Of provides a unique investment opportunity for those looking to diversify their portfolio and potentially earn higher returns.

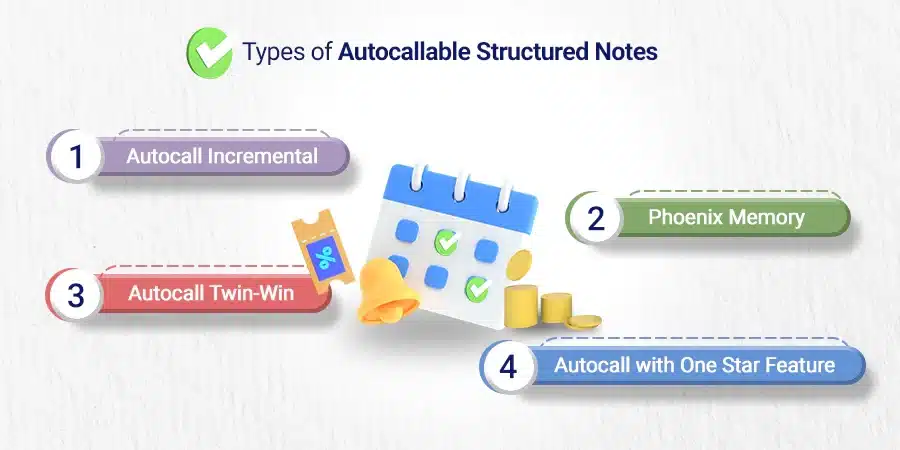

Variants of Autocallable Structured Notes

Autocall Incremental, Phoenix Memory, Autocall Twin-Win, and Autocall with One Star Feature are some of the variants of Autocallable Structured Notes.

Autocall Incremental

Autocall Incremental is a variant of Autocallable Structured Notes that offers investors the opportunity to generate a fixed return without predicting when or how much the increase will be.

This means that even if there is only a small increase in the underlying asset’s value, investors can still earn a fixed return. It provides a way to potentially benefit from market trends without having to accurately time them or rely on significant increases.

Accrual coupon style autocallables are one type of Autocall Incremental that reduce jump risk by gradually accruing the coupon rate over time rather than relying on large jumps in value.

Autocall Twin-Win

Autocall Twin-Win is an autocallable structured note that offers lower jump risk compared to other similar products. It has an autocall barrier, which is typically set at or around the original price of the underlying asset.

This means that even small appreciations or no movement in the underlying can trigger an early redemption and a high coupon payment. Autocall Twin-Win, with its accrual coupon style, reduces jump risk by regularly monitoring the value of the underlying relative to a defined coupon barrier and accruing the coupon rate over time.

It’s a good option for investors who want to minimize their jump risk while still potentially earning high coupon payments.

Autocall with One Star Feature

Autocall with One Star Feature is a type of autocallable structured note. It works similarly to other autocallables, with a barrier set at or around the original price of the underlying asset.

The one-star feature refers to the fact that this particular variant only has one level for potential early redemption. If the underlying asset reaches or exceeds a pre-determined level before maturity, the note will be automatically called and investors will receive their principal along with any accrued coupon payments.

This can provide an opportunity for investors to earn high coupon payments if the underlying asset performs well during the investment period. However, it’s important to note that these notes carry risks such as issuer credit risk and market volatility.

Step-down Autocallable Notes (SANs)

Step-down Autocallable Notes (SANs) offer enhanced yields and are a type of autocallable structured note with step-down features.

What are SANs?

Step-down Autocallable Notes (SANs) are a type of investment product that falls under the category of Autocallable Structured Notes. SANs offer investors the opportunity for early redemption at a predefined cash amount as well as high coupon payments.

The performance of the underlying asset, which can be a single asset or the worst-performing asset in a basket, determines when these opportunities for early redemption and coupon payments arise.

SANs have regular observation dates, usually once a year, to determine if any of these events will occur.

How to do SANs Work?

SANs work by offering investors high coupon payments and the potential for early redemption. Here’s how they work:

- Performance of the underlying reference asset: The timing of early redemption and coupon payments is determined by the performance of the underlying asset.

- Structured as bonds, options, or swaps: SANs can be structured as either bonds, options, or swaps, each with its own advantages and risks.

- Shorting a vanilla option: Autocallable investors are short a vanilla option and must settle the option with the issuer if the callable event does not occur on the expiry date.

- Payout based on asset performance: The payout for SANs can be based on either the worst performance or the average value of each asset in the basket on the expiry date.

- Calculation of redemption amount: The redemption amount for SANs is calculated based on factors such as gearing, downside, and put barrier.

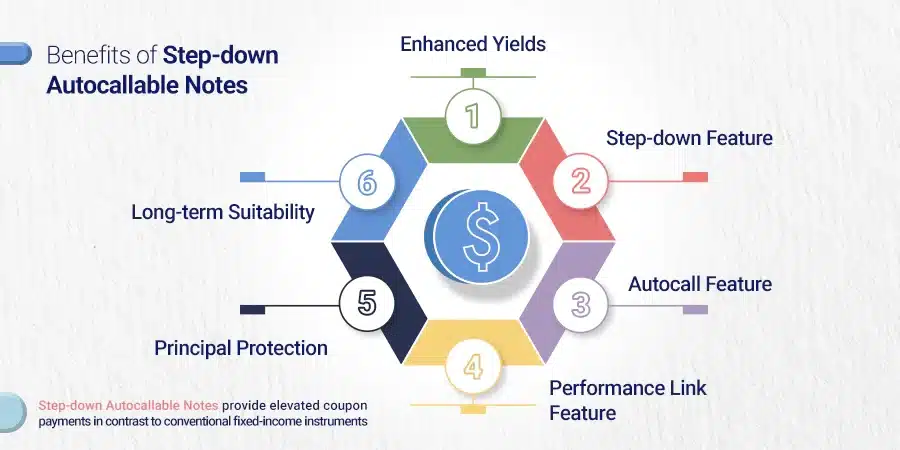

Benefits of SANs

SANs offer higher coupon payments compared to traditional fixed-income products.

- Investors can benefit from enhanced yields with SANs.

- The step-down feature of SANs allows for decreasing coupon rates, providing the potential for higher returns.

- The autocall feature of SANs allows for early redemption, providing liquidity to investors.

- SANs are linked to the performance of an underlying asset, allowing investors to participate in potential upside gains.

- The structure of SANs provides principal protection at maturity, reducing downside risk.

- SANs can be suitable for long-term investments, offering a balance between capital protection and potential returns.

Risks of SANs

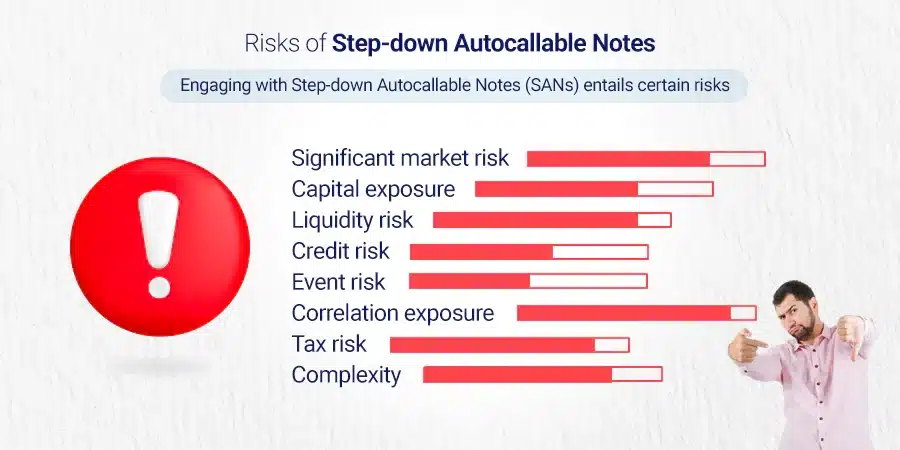

Investing in Step-down Autocallable Notes (SANs) comes with some risks, including:

- Significant market risk: SANs are dependent on the performance of the underlying stocks or assets. If the market experiences a downturn, it can negatively impact the value of the investment.

- Capital exposure: SANs may expose investors to potential losses if the underlying assets do not perform as expected. Mark-to-market losses can occur during the investment period.

- Liquidity risk: SANs are not as liquid as traditional investments like stocks and bonds. It may be challenging to sell or exit the investment before maturity if needed.

- Credit risk: The creditworthiness of the issuer is an important factor in SANs. If the issuer encounters financial difficulties or defaults, it can lead to a loss of principal and coupon payments.

- Event risk: Certain events, such as mergers or trading suspensions of the underlying stock, can impact the performance of SANs and potentially result in losses.

- Correlation exposure: The correlation between different underlying stocks or assets in a basket can affect the performance and redemption outcomes of SANs.

- Tax risk: The tax treatment of income and gains from SANs may vary depending on jurisdiction and individual circumstances. Investors should consider consulting with a tax professional for guidance.

- Complexity: SANs are complex financial instruments that require thorough understanding and monitoring. Lack of knowledge or misunderstanding can result in unintended consequences or missed opportunities.

Conclusion

In conclusion, understanding autocallable structured notes is vital for investors looking to diversify their portfolios and potentially earn high coupon payments.

By grasping the basics of this investment product, including its description, payoff structure, and risk analysis, investors can make informed decisions about their long-term investments.

Additionally, exploring the key features and variants of autocallable structured notes provides investors with more options to tailor their investment strategy to their specific needs and goals.

With careful consideration of the benefits and risks associated with these products, investors can navigate the world of structured notes confidently.

FAQs

Autocallable structured notes are financial instruments that offer potentially high returns based on the performance of an underlying asset, such as a stock or index, with the option to be called (redeemed) early.

Autocallable structured notes have the ability to work by providing investors with regular coupon payments as long as the underlying reference asset meets certain conditions. If those conditions are met before maturity, the note may be redeemed early, resulting in a return of principal plus any accrued coupons.

The risks associated with autocallable structured notes include market risk, where the value of the underlying asset can fluctuate; credit risk, which is the risk of default by the issuer; and reinvestment risk if you need to reinvest your funds after an early redemption.

No, autocallable structured notes may not be suitable for all investors due to their complexity and a higher level of risk compared to more traditional investments. It’s important to carefully consider your investment goals and seek advice from a financial advisor before investing in these products.