Introduction

Choosing the right type of investments vs getting the optimal returns on investment can be a roller coaster ride for most investors who are starting their journey with investments and finance.

The pricing for an investment product is a very important consideration for an investor to procure a financial instrument. Whether he wants to invest in a mortgage or a traditional bond. Or, it has something to do with purchasing stocks and shares from the equity market. Or, if the investor wants to foray into structured notes that comprise a mix of bond and equity. Investors must also be knowledgeable about how options work in the secondary market.

In this parlance, let us understand how autocallable notes pricing is being carried out. Helping you get started with the same:

Autocallable Notes- Explained

Autocallable notes are popular structured notes that can be traded in primary as well as secondary markets. These notes combine debt components and have underlying assets linked to their structures.

The underlier or underlying assets can be reference assets like stocks, a basket of securities, or currencies to name a few. The product issuing firms add a built-in auto-call feature to these notes.

The underliers are put under surveillance every observation period. Once the purchase prices of underliers reach 100% or go above the initial prices, the notes can be auto-called. More often than not, the notes get auto-called before the expiry of the term period of these notes.

The investors get their principal amount and coupon payouts too after the notes are autocalled. The payouts in the form of capital investment and coupons as interest payouts make the autocallable notes enhance yield options.

Sellers also incorporate hedging strategies into the same that leads investors to get exposure in a lower interest rate environment and define the notes’ marketability. The liquidity and the risk of reinvesting in a lower-interest environment are also on the cards.

As the underlying assets perform well, the above-market coupons as distributions from the underlying asset are made available to investors on the whole.

Autocallable Notes Pricing- Methods Explained

There are two types of pricing mechanisms that investment banks, wealth managers, or financial stock-holding firms adapt to when it comes to determining the price values for autocallable notes:

- Pricing Mechanism for the Primary Market

- Pricing Mechanism for the secondary market

Let us have a brief overview of how each of these methods is carried out:

Pricing Of Autocallable Notes In The Primary Market

Autocallable notes are structured notes that can be pre-designed or pre-determined for posh and high-net-worth individuals. They can be retail or institutional investors.

An independent financial advisor or a wealth manager curates or designs the structured notes instead of the type of underlying assets investors can choose all by themselves. You can choose a single stock or a basket of stocks or securities and you can also preset the rate of returns you may want on the underlying assets the notes are getting linked to. The coupon amount refers to the interest rate the investment holder is eligible for.

The structured notes as curated or designed in the primary market cost you anywhere between 100,000 – 500,000 US Dollars. Approximately, we look at values ranging between 0.1 million- 0.5 million USD.

The product issuer discusses the portfolio and its risk tolerance before the notes are designed and handed over. In a nutshell, the autocallable notes are not designed for middle-class retail investors in primary marketplaces.

Pricing Of Autocallable Notes In The Secondary Market

Here, comes the second type of pricing connected with autocallable notes. You can look for the middle-class retail segment buying autocallable notes from banks or financial corporations.

The notes are priced at $1000 as the initial investment and the denominations are available in multiples of 1000’s.

Here, the underliers are fragmented portions of what you find in a primary market setting. The bankers or financial corporations determine the NAVs (Net Asset Values) of every single underlier and then link them to the notes.

These notes are issued by investment banks or financial corporations and cannot be pre-designed by the investors.

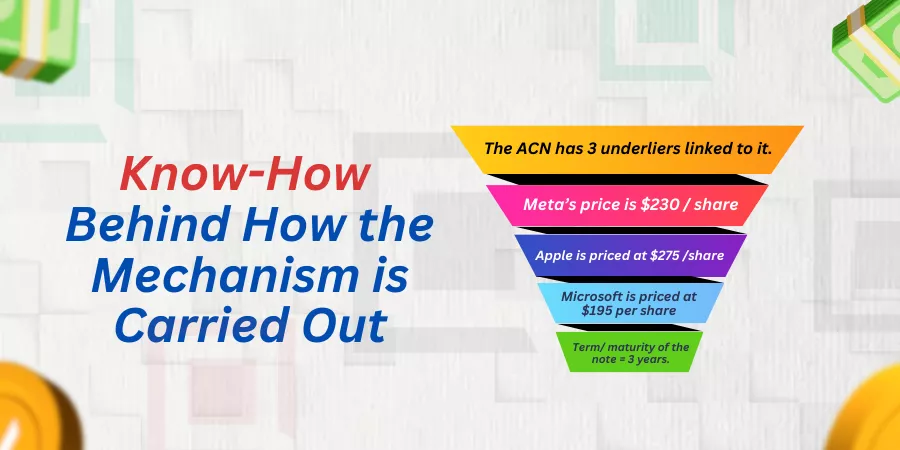

Know-How Behind How the Mechanism is Carried Outt

The process know-how behind how autocallable notes are priced how the observation dates are determined and how the notes are finally auto-called cover a part of this segment.

Helping you analyze the correlation between different elements that work hand-in-hand concerning the reference asset, principal investment, and the principal protection, these products offer to investors on the whole:

- The Auto-callable note has three underliers linked to it.

- The underlying assets can be shares of Meta/ Facebook, Apple, and Microsoft whose initial levels are as follows

- Meta’s price is $230 per share

- Apple is priced at $275 per share

- Microsoft is priced at $195 per share

- Term/ maturity of the note = 3 years.

- Observation date- Every quarter comprising 3-6 months

- Barrier level points out to initial purchase points covering each underlier

Scenario 1:

The 1st periodic assessment or observation happens for the underliers. Post the assessment or observation period the purchase values of the underliers stand as:

- Meta or Facebook’s share reaches $250 per share

- Apple slumps to $230 per share

- Microsoft is priced at $195 per share

Out of the three underliers, the apple share slumps and can incur potential losses to investors. Therefore, the auto-called date stands canceled.

Scenario 2:

Now, the 2nd periodic assessment takes place on the next observation date. The shares are valued as under:

- Meta’s share is valued at $200 per share

- Apple’s share now reaches the same purchase point i.e. $275 per share

- And, Microsoft reaches an all-time high of $300 per share

Although you find that Apple has reached 100% of its initial price and Microsoft soars high, the note will still not get auto-called. Do you know why?

That is because the value of Meta failed to reach 100% of its purchase price. As the parity is low concerning Meta or Facebook’s shares, the note cannot get auto-called during the 2nd quarter too.

Scenario 3

Now, we are heading towards the third observation date. The shares are valued as such during this point of time:

- Meta reaches its price of $230 per share

- Apple is priced at $275 per share and

- Microsoft reaches a sale point of $200 per share

Here, Meta and Apple reach 100% of their initial purchase price values and Microsoft marginally increases by $5 per share. However, all three underliers reach the barrier limits or purchase points as were set in the beginning.

The notes are auto-called in this observation period. And, investors receive their original principal amount, and the rate of returns is pro-rated for 18 months as it is 6 months covering each observation. The coupon rates are calculated and investors receive them as coupon payments.

The Bottom Line

Every investment plan has its own set of pros and cons. The investor must therefore weigh the risk factors against the volatility of the growing markets and only then determine the return on investments they get from each financial or investment plan.

In other words, the investor may have to gauge the downside risks vs the volatility of the underlying assets before going in for a structured plan. Autocallable notes are suitable for investors who are looking for short or medium-term investment plans.

Investors must be knowledgeable concerning how options work as structured notes are not direct investments in the underlying assets but a mix of debt and derivatives. And, these notes are not fixed-income products or traditional bonds. Although the notes provide contingent downside protection against the investing plans, the investor may not receive potential returns when they find adverse developments affecting the underlying securities.

The credit rating or the creditworthiness of the issuer must also be analyzed to know if the investors can receive their dividends or distributions as the conditions are met.

Approaching a financial advisor is better for a newbie investor who may not have exposure to different market segments. The investor gets well-informed guidance on what needs to be done in the first place. The investors should consult their tax advisor to procure information regarding the tax implications each investment plan is covered with.

Above all, investors must read the terms and conditions on the initial offer documents before signing in on the dotted lines!