Introduction

In a world of growing uncertainties, the woes over investing in the right financial products are no exception indeed. Quite several financial firms promise you everything under the sun but the actual risk factors that lay underlying are often missed.

For instance, you might be promised lucrative returns on investment but not receive the same returns owing to the volatility of the market. Similarly, you may want fair-view info on how different investment products work.

For instance, you would want to know the pros and cons of investing options like equities, stocks, bonds, or structured notes and you want a layman’s understanding of how different investment options work out and how you generate a viable wealth basket that keeps you in a good stead for decades to come.

In this parlance, let us explain more about autocallable notes payoff by also giving you a fundamental understanding of how revolving specifics work.

Autocallable Notes: Meaning Explained

Autocallable notes are popular trading derivatives that help investors get their principal money back along with attractive yields in the form of coupon payments. The autocallable note is like any other form of structured note. You have the note that is linked to the value of an underlying asset. The asset can be a currency, stock, or basket of securities to name a few.

The autocallable notes are designed by product issuing companies with in-built call-off options. In other words, the autocallables can be auto-called as and when the product issuing firm foresees certain movements in the underlying prices of assets.

When the price of the underlying asset reaches par or above the barrier limits as set on the coupons on given observation dates, the auto-call options get triggered. Here, the notes mature and investors get their principal payment or initial investment back along with the coupon payments that accrue on the notes.

In a nutshell, it is to be understood that, the note automatically redeems early as and when the autocall barrier limits are breached from the initial level strike prices.

Autocallable Notes Payoff Mechanism Explained

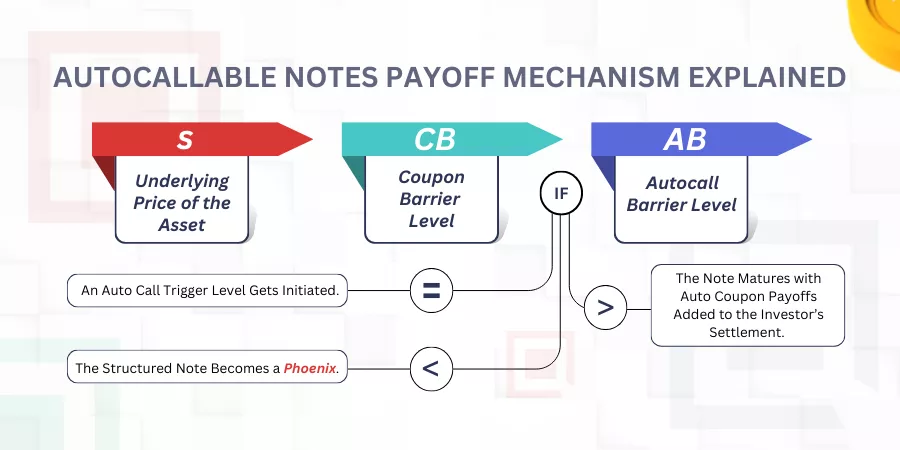

Let us assign some variables to the autocallable notes payoff mechanism. Then, it is easier to understand how things work with autocallable notes.

- Underlying price of the Asset= S

- Coupon Barrier level = CB

- Autocall barrier level = AB

When CB= AB, then an auto call trigger level gets initiated. If CB > AB, then the note matures with auto coupon payoffs added to the investor’s settlement.

On the other hand, when CB < AB, then the structured note becomes a phoenix. It is clearly to be understood that the autocallable is a yield-enhancing product for most of the investors out there.

The investor gets an above-market yield and decides not to collect any coupons if the underlying asset falls below the coupon’s barrier level at a given observation date. The potential returns an investor receives may be higher than that of traditional bonds or fixed-income securities out there.

When you consider rallying in a low-yield environment, the investor may not receive attractive coupons as the structure of the note gets more and more volatile. To offset the volatility, the investor also sells an option that is embedded in the note. This is typically the down-and-in put option. This is how most of the autocallable structure works.

As you have an in-built autocall covering the autocallable notes, their structures do not have fixed periods of maturity. When the notes are auto-called by the product issuing firms, these notes mature and that primarily explains what is the maturity period that remains alive for a said autocallable note.

Autocallable Notes Payoff: Coupon Vs Redemption- Payoff Formulae Explained

This is how the formula version of the payoff works between the Coupon Vs redemption. Let us how things are worked out here:

The observation date is 𝑡𝑖

with i = 1, …, n, we have :

Image courtesy:

As such, when the note has been auto-called, the note automatically matures. Based on calculations investors receive principal payoffs in the form of coupon payments and there are no future payments scheduled on these notes as such.

How Do Auto Call Barrier Levels Behave Through the Term of the Investment?

It is to be noted that the auto call barrier levels can be fixed as well as variable through the span or term of the investment. This is mainly because the auto call barrier limits can be breached at higher or lower rates concerning the values of underlying assets the structure is linked to.

The matrix prices as calculated with the above-stated formulae are gathered at each given observation date. By observation date, we mean the date on which the product issuing firm analyses the pricing aspect of the investment note.

As an investor who would love to safeguard your investment, you can prepare structured sheets that depict auto barrier prices at every given observation date. This way, you can chart out how your investment chart is moving towards.

Risk Analysis Of Autocallable Notes

The prices of underlying securities can rise or fall concerning the volatile market conditions the notes are subject to. Therefore, investors must be wary of the fact that they may receive their enhanced principal amount in the form of coupon payoffs during said observation period. The basket of stocks is estimated at a pre-determined level here as compared to that of a direct investment plan.

On the contrary, when the price of the reference asset slumps below the set barrier limits, then the callable notes may cause contingent losses for the investor. You may either lose a partial or the entire investment amount that you had paid to the issuer in the beginning.

Market risks can also lead to price fluctuations concerning prices of zero coupon bonds along with their interest rates. The creditworthiness of the issuer must also be taken into consideration for your investment.

Therefore, the investors must carefully evaluate the risk factors concerning autocallable notes before they would want to zero in on the same!

Equity Or Interest Rate Correlation

The Equity-interest correlation is popularly abbreviated as the EQ/IR ratio. Here, we talk about the correlation between equity and interest rates.

Determining the EQ/IR Ratio precisely is quite the need of the hour because the autocallable prices are primarily designed after the ratios are arrived at.

As the note is redeemed at an unknown observation date and this is dependent on the future prices or performance of the underlying stocks, learning the correlation between EQ/IR is important for both issuers and investment holders.

Sellers who are interested in hedging autocallable notes must also possess a thorough knowledge of how the EQ/IR ratios work. Here there are two scenarios:

- The EQ/IR correlation can be positive

- The EQ/IR correlation can be negative

Let us have an understanding of how each scenario works:

The EQ/IR Correlation Is Positive

When the EQ/IR correlation is positive and when the underlying value of the asset increases, its corresponding interest rate also increases. Here, the seller can hedge some of his 2-year bonds with one-year bonds amongst investors.

Because of the reduction in tenor or what is otherwise known as an earlier redemption, the seller may lose on the interest rates or what is known as the IR.

The autocallable seller sells the bonds that have decreased more in value over bonds wherein the price fluctuations are lower. On a similar note, when the underlying asset reduces, the interest rate also reduces. As the underlying asset decreases, the probability of an earlier redemption of the asset also reduces. Here, the seller will sell more of his one-year bonds to buy more of two-year bonds.

The process also explains how hedging of autocallable notes is primarily being carried out.

The EQ/IR Correlation Is Negative

When the EQ/IR correlation is negative, and when the price of the underlying asset increases, the interest component tends to decrease. In this autocallable feature, the investor/ seller can sell more of his two-year bonds to buy one-year bonds.

Through IR rebalancing, the seller gains profits as he sells the bonds that have increased more in value to purchase bonds that have increased less.

On a similar note, when the underlying asset reduces in price, the corresponding interest component increases. Therefore, a decrease in the value of the underlying assets may also decrease the possibility of an earlier redemption in the form of auto calls. Therefore, the investor can sell more of his 1-year bonds to purchase 2-year bonds.

Through IR optimization, the seller again incurs profits on the trading transaction because he has sold the bonds that have reduced less over bonds that have reduced even more.

To finally sum up, it is to be noted that the autocallable prices can be higher with a positive EQ/IR correlation and the prices reduce when the same correlation goes negative.

The Bottom Line

Hedging of autocallable notes must be done by exercising an extreme level of care and auction. The investor must calculate the EQ/IR ratios before selling his bonds in favor of some other bonds that are performing well in the market.

As an investor, you can create templates that depict the pricing models of these autocallable notes under different simulations. This way, you can analyze the cost of the notes vis-a-vis the payoffs you may receive at the end of the scheme.

Autocall notes can also have a call and put options. The timeline warranty must carefully be judged after analyzing different types of market conditions your investment notes are subject to. This way, the investor can earn high coupon payments and also avail a soft capital protection to his investment amount.

Auto Callable notes are not designed for those investors who are highly risk averse. These are Structured products that do not suit all types of investors because they combine debt with equity and work under complex conditions the investor must be wary of.

Knowing the complete set of risk factors helps you stand ahead of your peers who do not have any kind of knowledge on the same. It is always better to understand the financial product thoroughly before you aim to sign on the dotted lines.