AI in the Stock Markets

Feeling the buzz about “artificial intelligence(AI)” and “stocks” swirling around you? You’re not alone. AI industry is the hottest trend since fidget spinners, and everyone’s wondering: “Should I jump on the bandwagon and invest in some robot overlords?”

Hold on, hold on, let’s not get carried away with Terminator fantasies. Investing in AI stocks is exciting, but it’s like petting a baby T-Rex: cool, and potentially lucrative, but requires some caution. So, let’s break it down, friend-to-friend.

Why AI Stocks are Sizzling?

Machines are taking over! (Not really, but they’re doing pretty amazing things.) AI is powering everything from self-driving cars to personalized medicine, and that ain’t slowing down anytime soon.

Companies using AI are seeing growth like they’re fuelled by rocket fuel. Also, who wants all their eggs in the “basic boring bank” basket? AI stocks add a dash of futuristic spice to your AI portfolio, spreading your risk and potentially boosting your returns.

The future is bright (and probably robotic). Long-term thinking? AI is predicted to reshape entire industries, so investing early could be like buying Tesla stock before Elon decided to launch cars into space.

figure out the best ai stocks for investment?

Let’s face it, robots are taking over. Not the Terminator kind (yet!), but AI is creeping into every corner of our lives, from streaming recommendations to self-driving cars. So, naturally, you’re wondering: what are the best AI stocks to buy? Well, buckle up because we’re about to explore some of the hottest AI stocks to invest in which also catching the attention of investors like you.

Whether you’re a seasoned pro or just getting started, these 10 best AI stocks could be the game-changers your portfolio needs.

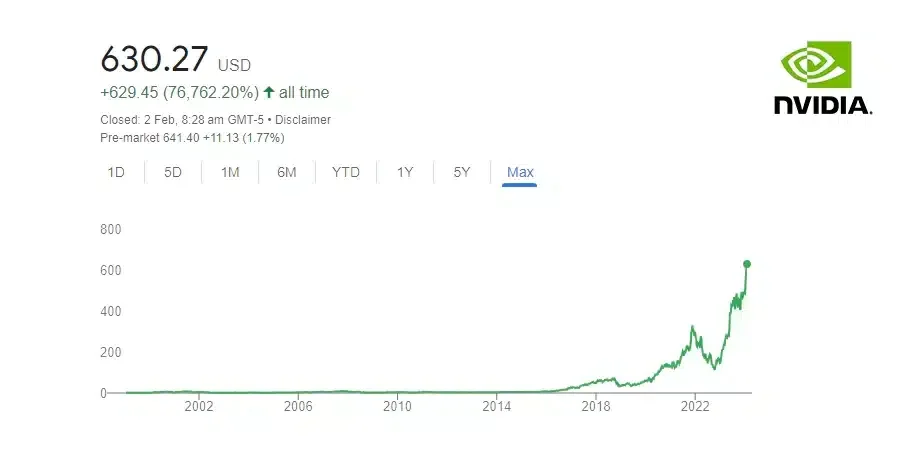

1) NVIDIA -

You know, the graphics card wizard? Turns out, they’re not just about making your games look jaw-dropping. They’re also diving deep into the world of microchips, especially for self-driving cars and all things AI.

Ginseng Huang, the big-shot CEO, is on a mission to make Nvidia the go-to name for AI in every nook and cranny of the industry. And guess what? Over the past year, NVDA has been strutting its stuff as the best-performing AI stock.

Sure, their earnings growth has been a bit meh in the past five years, hanging around 5%, but analysts are whispering about some serious fireworks in the next five.

Now, Morningstar gives them a solid “B” in the financial health department, and word on the street is that their (Earnings per Share) EPS is gearing up for a 34% growth spurt next year. This year, earnings are expected to leap too. Sure, the current forward P/E ratio, it’s over 40, which is double the S&P 500’s P/E.

But, with Nvidia’s growth story, that number suddenly seems a bit more reasonable. Oh, and here’s a sweet bonus – NVDA’s into share buybacks. Their buyback yield sits at a cool 0.8%, which is the value of the stock they scoop up divided by the company’s market cap. Not too shabby, right?

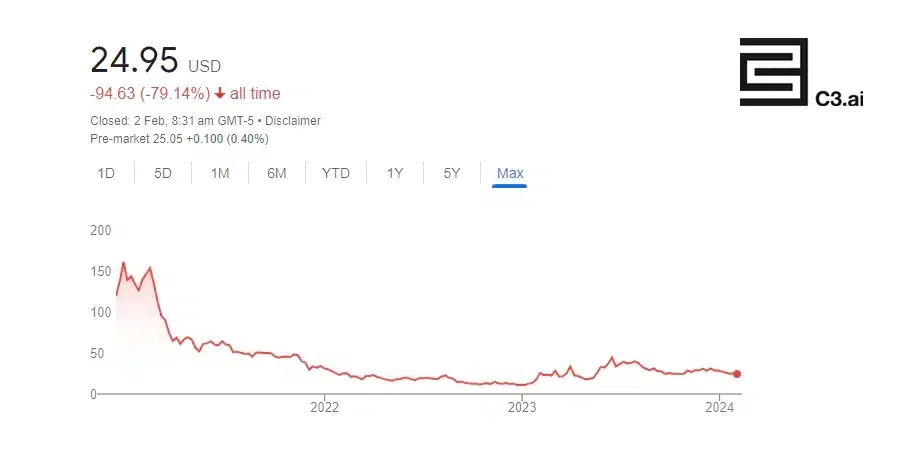

2) C3.ai Inc. –

These guys are all about rolling out AI applications on a grand scale, making them one of the few pure-play AI stocks that dive headfirst into creating AI projects. And get this, they only started trading in 2020, so they’re the newbies in town, but boy, have they been making some noise.

Now, their stock journey since hitting the market has been a bit like a rollercoaster – ups, and downs, But hey, over the past year, C3.ai has been flexing its muscles and snagging the top spot in the industry for expected growth. Analysts are tossing around predictions of some serious EPS growth in the next half-decade.

Sure, they haven’t chalked up a profitable year just yet, but the word on the street is that 2025 might be the year they turn that corner, with a predicted 12 cents per share in profits.

But, let’s keep it real – this stock is like the wild child of the investment world. It’s got some great qualities, no doubt, but it’s still riding the speculative wave. With its short history, we’re a bit limited on metrics to predict its future. Even though it’s had a recent rally, it’s still doing a bit of catch-up from its 2020 high.

Morningstar gives it a “C” in financial health, so it’s not exactly sipping champagne in the financial stability department. Keep your eyes peeled, because this one’s still finding its rhythm in the market dance.

3) PALO ALTO Networks Inc. –

With cybersecurity needs skyrocketing, Palo Alto is like the superhero guarding the networks and clouds that all those fancy AI projects call home. They’ve got the digital fortress to keep things safe and sound.

Now, if we peek at their stock performance in 2023, it’s been a bit like a rocket taking off – soaring high and hitting all-time highs.

Morningstar even gives them a solid “B” in the financial rating department, so you know they’re not just playing around. Sure, they haven’t thrown a profitable party just yet, but next year, they’re eyeing a 17.3% rise in EPS – talk about aiming for the stars!

Now, their P/E ratio is doing a bit of a dance since they’re just dipping their toes into profitability. It’s a bit high, but the forward P/E is trying to keep it real, though still on the pricey side. But here’s the kicker – if they hit that magical $10 per share in earnings in a few years, the current price is like a golden ticket at 25:1.

That’s the bet investors are placing. Oh, and PANW is also into the buyback game. Their buyback yield is a respectable 0.8%, showing that they’re not just about protecting digital realms but also giving back to the shareholders.

4) Amazon.com Inc. (AMZN) -

We’re not just talking about your go-to place for online shopping. Amazon’s like the wizard behind the curtain, pulling some serious strings in cloud computing and data storage.

They’re laying down the foundation for building, training, and launching AI projects. Oh, and have you met Alexa and Echo? It’s like having a digital buddy that knows everything.

However, the growth game has been a bit tricky for them, and in 2022, the stock took a bit of a rollercoaster ride, losing almost half its value. But hey, 2023 is the year of the comeback, with earnings on the rebound.

Sure, the stock isn’t exactly in the bargain bin – the P/E ratio is a bit on the high side. But wait for it – the forward P/E is trying to strike a deal that’s a bit more pocket-friendly.

And here’s the exciting part – analysts are placing their bets on a whopping 63.3% growth in earnings next year. Oh, and Amazon’s not just about making big moves in the tech world; they’re also playing the buyback game.

Their buyback yield is a cool 0.3%, showing that they’re not just about looking ahead but also giving a little love to their shareholders. Amazon might just be your front-row ticket to the tech extravaganza. Keep your eyes on this one!

5) Synopsys Inc-

Alright, let’s talk about Synopsys – the unsung hero behind the scenes for microchip makers. They’re like the fairy godmother of design automation software, making sure those microchips get their magical touch.

Now, what makes Synopsys stand out? Picture this: recent earnings growth that’s been turning heads, expected future growth that’s got analysts buzzing, and a stock price that’s been on a long-term uptrend – it’s the triple treat.

They’ve been flexing the strongest earnings growth muscles over the past five years among all the cool stocks on this list. Looking into the crystal ball, analysts are predicting a solid 13.8% EPS growth for next year.

And get this, Morningstar gives them an “A” in financial health – it’s like they aced their financial report card. Oh, and let’s not forget the share buybacks that have been the unsung heroes in boosting the share price. Their buyback yield is a respectable 1.4%, showing they’re not just about designing software; they’re also playing the investment game.

Sure, their P/E might be playing in the high-roller’s club, but here’s the twist – the forward P/E is doing the tango with expected future earnings, making it a bit more pocket-friendly. Synopsys is like the MVP in the tech world, bringing the perfect mix of design prowess and financial finesse to the table. Keep an eye on this one – it’s the dark horse that might just steal the show!

Also Read: What Is Shariah Compliant Investment? “The Ultimate Guide to Making Money the Islamic Way”

6) Cadence Design Systems (CDNS)

Cadence Design Systems designs automation software for microchip manufacturers. The wizards behind the scenes, provide automation software for the brains of microchip manufacturers. They’re used not only in microchips but also in AI, machine learning, and 3D tech. It’s like they’re powering the future, one chip at a time.

Now, how’s the stock doing? Well, in 2023, it’s been doing a little victory dance, trending higher and getting cosy near its all-time high from earlier this year. The financial whizzes at Morningstar even gave it a solid “A” rating – it’s like they’re acing the financial game.

Earnings growth? They are throwing confetti in the air, predicting strong yearly growth for the next five years, with a standout 15.7% EPS growth on the horizon for next year. Cadence is like that high-growth stock that knows how to keep it real.

And guess what? They’re not just about software magic; they’re also in the share buyback game. The buyback yield over the last year is a respectable 1.4%, and they’ve been buying back shares every year since 2014. It’s like they’re saying, “Hey, shareholders, we got your back!”

7) Microsoft (MSFT)

Now, why is Microsoft a player to watch? When it comes to the AI market, MSFT is a bit more like the seasoned pro, making it a less risky bet compared to some others on this list.

They’re even working on their own AI chip. Morningstar even gave them an “A” in financial health – it’s like they’re acing the financial report card.

Earnings growth?

Analysts are throwing confetti, predicting a sweet 13.5% EPS growth next year. Numbers time – the current P/E and forward P/E are in line with what you’d expect from tech giants with solid growth on the horizon. It’s like they’re– not too hot, not too cold, just right.

Microsoft isn’t just about growth and AI, they’re also sharing the love with a 0.8% dividend. Plus, they’ve been on a shopping spree, buying back 0.9% of shares in the last year. It’s like they’re saying, “Hey investors, we’re in it for the long haul with you!”

So, if you’re into AI giants that know how to balance growth, dividends, and buybacks, Microsoft might just be your tech crush. Keep an eye on these AI technologies titans – they’re not just making waves; they’re making a splash!

8) KLA Corporation –

KLA manufactures monitoring and diagnostic systems for the semiconductor industry. You can think of them as the tech doctors for those tiny but mighty semiconductors that power everything from your laptop to those cool AI projects we all love. Well, in 2023, it’s been on a bit of a rocket ride, aggressively climbing the charts and cosying up near its all-time high.

It’s like the stock market version of scaling Everest – impressive and a little breath-taking. They’ve been doing the hustle over the past few years, steadily growing like a well-nurtured plant. But, here’s the plot twist – the growth party is expected to slow down a bit over the next five years.

Analysts are predicting a 15.5% decline in earnings next year. But hey, here’s where it gets interesting – it’s more of a value deal now compared to some high-flyers on this list. Now, they’ve been on a shopping spree, aggressively buying back their shares, and the buyback yield is a whopping 5.1%. It’s like they’re saying, “We believe in ourselves, and we’re putting our money where our silicon is.

They’re sharing the love with a 1.1% dividend, and that dividend has been growing like a well-fed puppy each year. Morningstar gives them a solid “B” in financial health – it’s like they’ve got their financial ducks in a row.

Also Read: The Importance Of Investing In Children’s Higher Education

9) Alphabet Inc (Google)

Google’s not just your go-to search buddy; it’s been sprinkling AI magic in its search engine, apps, and even in the cozy corners of your Google Nest for quite a while.

It’s like they’re the behind-the-scenes wizards making things smarter without us even realizing it. Now, about the stock performance – it’s been doing a bit of a slow dance compared to the S&P 500 this year. But wait for it – the real gem is the earnings growth.

Analysts are doing a little happy dance, predicting excellent growth vibes for the next five years, with a star-studded 17.9% EPS growth expected next year.

It’s like they’re laying down the foundation for a future earnings extravaganza.

Now let’s talk numbers – Google’s got an “A” from Morningstar in financial health. And you know what’s cool? The P/E is considerably cheaper than some of its flashy friends. Google is like a budget-friendly tech giant.

But here’s the real kicker – they’re not just about tech prowess; they’re also in the buyback game. With a buyback yield of 4%, it’s like they’re saying, “Hey investors, we believe in ourselves, and so should you!”

Caution Warned

But remember, dear investor, the path to riches is fraught with peril. The market can snatch away fortunes as quickly as it bestows them. Before venturing into this digital drive, heed these words.

Diversify your portfolio: Don’t bet your farm on an individual AI stock. Spread your risk, just like a wise alchemist balances his elements.

Do your research: Delve into the company’s story, its technology, and its financials. Don’t be seduced by mere hype; seek the glint of true potential.

Mind your risk tolerance: Not all Artificial Intelligence stocks are created equal. Some, like dragons, promise high rewards but with scorching risks.

Others, like workhorses, offer steady gains but may lack the thrill of the hunt. Choose wisely, adventurer, for your heart, will guide you as much as your head.

How To Pick AI Stocks

Choose your AI champions wisely! This list highlights top contenders based on growth, potential, and solid metrics like market cap and volume.

In addition to the above requirements, all stocks have at least a $1 billion market capitalization, a price above $5, and a daily average volume of at least 500,000 shares.

Dive in and discover the AI rockets ready to fuel your future!

The Bottom Line

So, go forth and explore the uncharted territories of AI, for within its circuits lies the potential for riches beyond imagination. Just remember, the greatest treasure isn’t always measured in dollars, but in the thrill of the chase, the joy of discovery, and the satisfaction of being a part of shaping the future, one digital byte at a time.