What is Debt Ceiling?

Debt Ceiling, also known as the debt limit, is the highest amount of money that the United States can borrow cumulatively to fulfil its current legal obligations. It’s an important financial term, often misunderstood, plays a key role in strengthening a country’s economy.

It has been increased many times over the years to escape the worst-case scenario: a lapse of the U.S. government on its debt.

Want to know more about what is debt ceiling? This article presents a snapshot of the term, “Debt Ceiling.” Stay connected to understand why the debt ceiling matters, how it works, and and how consulting a financial planner can help you avoid the outstanding debts.

How Does the Debt Ceiling Work?

Before the creation of the debt ceiling, Congress had full control over the federal debt and country’s finances. The debt ceiling was formed in 1917, during World War 1 to ensure the federal government’s financial accountability.

In the long run, the debt ceiling has been increased whenever the United States hit the debt limit. When the ceiling is reached and the government remains unable to repay interest payments to bondholders, the United States would be considered a defaulter, increasing the cost of its debt and lowering its credit rating. Moreover, the government accountability office can raise or suspend the debt ceiling.

There is political debate over the debt ceiling if it is legal. According to the 14th Amendment of the Constitution, “The validity of the public debt of the United States, authorized by law….shall not be questioned.” Most democratic countries do not have the debt ceiling, making the United States a notable exemption.

“$36.22 trillion (132.5 trillion AED) was the approximate amount of the national debt as of Feb. 21, 2025. In 2023, the debt ceiling was suspended until Jan. 2, 2025, when it was reinstated at 36.1 trillion (132.5 trillion AED). As the debt ceiling is a political issue and it has already been breached, the Treasury Department could suspend the limit or use extraordinary measures to avoid default.”

Advantages and Disadvantages of the Debt Ceiling

Advantages

Here’s a picture of some of the key benefits of the debt ceiling:

Nation’s finances remain in check by maintaining a debt ceiling. The spending cap maintenance enables the U.S. Treasury to easily issue bonds without consulting Congress every time the federal government requires to increase money – quite a tedious task.

The government borrowing cap sets clear limits, supporting the efficient monetary policy approval process. The debt ceiling suspension could cause economic deterioration. And raising the debt ceiling gives a country more flexibility to continue financing federal operations. In simple words, it strengthens policy makers’ financial ability to execute governmental projects with certain government funds.

It also allows funding to various crucial social programs. In the United States, it means that the government can allocate funds to Medicare and Social Security benefits, which are essential for both retirees and qualifying recipients.

Disadvantages

Certain disadvantages of the debt ceiling are as follows:

The budgetary ceiling is widely unstable, so it can be raised easily. In fact, it has been elevated many times, sparking doubts on whether it’s an effective tool to ensure financial responsibility. The U.S has received record high levels of debt over time.

However, raising the debt limit impacts the country’s reputation adversely in the global market. As such, it may result in a downgrade of the credit of the United States, while adding to the overall cost of government debt.

Lastly, some people assume that the debt ceiling is unlawful. Critics are of the opinion that the 14th Amendment needs the government to meet its fiscal obligations. Maintaining a debt ceiling ( or having to raise it) exerts pressure on the country’s capacity to repay its bills.

Debt Limit Showdowns and Shutdowns

The debt ceiling has led to several showdowns that brought about government shutdowns. The clash is usually between Congress and the White House, and the debt ceiling serves as a bargaining tool to encourage your financial plans.

For instance, in 1995, the Republican members of Congress whose opinions were voiced by the then-House Speaker Newt Gingrich, employed the risk of refusal to permit an increase in the debt ceiling to discuss increased government spending cuts.

Then-President Bill Clinton declined to reduce spending, which caused a shutdown of the government. Finally, Congress and the White House consented to a balanced budget with minimal tax increases and spending cuts.

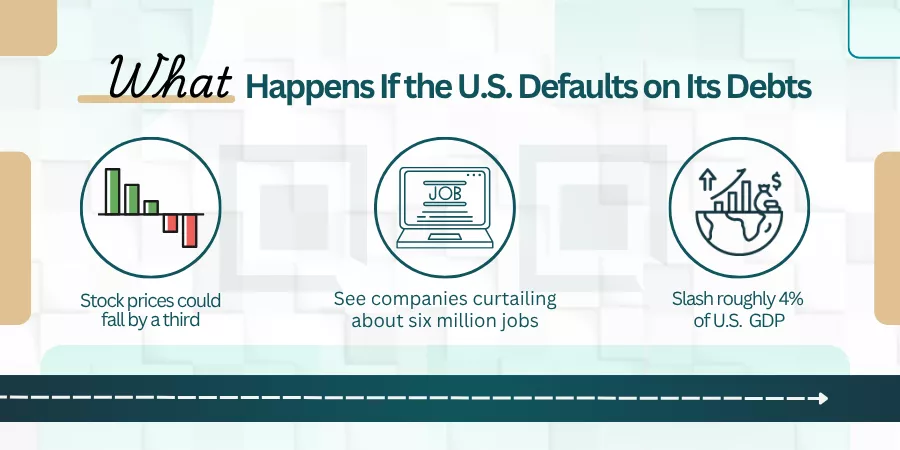

What Happens If the U.S. Defaults on Its Debts

The government’s failure on its debts would create upheaval in the global financial market as the borrowers lose confidence in the U.S.

According to credit analysis firm Moody’s Analytics, a four-month default would:

· Stock prices could fall by a third

· See companies curtailing about six million jobs

· Slash roughly 4% of U.S. gross domestic product (GDP).

Moreover, the analysis demonstrates a default on U.S. Treasury Bonds may result in a downturn comparable to the Great Recession.

A collapse in the perceived reliability of the U.S. Treasury or a credit freeze would surely trigger a substantial drop in the greenback and massive withdrawal of American investments by foreign investors. Even the risk of default can disrupt financial markets.

In 2011, Then-President Obama and House Republicans barely avoided the debt ceiling, a turmoil that witnessed stock prices decline and volatility spike, provoking credit agency S&P Global Ratings to drop the U.S. credit rating for the first time. The disorder also weakened small business optimism and consumer confidence.

In addition to causing economic uncertainty, a U.S. debt default would suspend the ceiling and hamper the government from performing crucial functions, such as maintaining national defense, issuing Social Security and Medicare benefits, and delivering adequate funds to the public health system.

2023 Debt Ceiling Crisis

In early 2023, some Wall Street Analysts and economists predicted that the election of Californian Republican Kevin McCarthy to House Speaker indicated the possibility that lawmakers may not approve of raising the debt ceiling, increasing the risk of a U.S. debt default.

As part of their assistance to appoint McCarthy, conservative-faction Republicans suggested that they would not vote to raise the debt ceiling without considerable federal expenditure cuts, paving the way for political deadlock that might disrupt the financial system before the upcoming fiscal year that began on Oct. 1, 2023.

Last Words

The debt ceiling is a crucial mechanism developed to reinforce financial responsibility. It sets boundaries for government borrowing and federal spending limit to fulfill financial obligations.

When the governments fail to pay debt and request repeatedly to enhance the limit, it may lead to economic uncertainty. Also, any failing to increase the debt ceiling may result in financial market disruptions, delayed payments, and government shutdowns.

So, understanding what is debt ceiling is essential for anyone interested in economic stability. Stay tuned to see how future changes could impact the economic stability. Need more help regarding fiscal matters such as wealth management? Quadrawealth financial advisors are there to provide financial plans to help you avoid the debt crisis.

FAQs

Q1. What is the Current Debt Ceiling?

A: The debt ceiling is $36.1 trillion. It was halted in 2023 and restored on Jan. 2, 2025, at the level of the national debt. The national debt exceeded the limit on Jan. 13, 2025, and the Treasury has to take “extraordinary measures” to meet its debt obligations until the ceiling is lifted again or suspended.

Q2. How Many Times Has the Debt Ceiling been Lifted?

A: According to the U.S. Department of the Treasury, the debt ceiling was raised revised, or extended 78 times since 1960. It took place 29 times under Democratic presidents and 49 times under Republican presidents.

Q3. What Happens if the Debt Gets So High?

A: Breaching the debt limit and overdoing interest payments can cause profound economic disruption. The U.S. government would default, increasing the amount of debt and lowering its credit rating. It could decline the U.S. economy.