Introduction

Offshore Investments are predominantly meant for expats and foreign nationals who wish to settle abroad. They may have studied and worked in their country of origin while they plan to settle elsewhere post-retirement.

Overseas entrepreneurs also look forward to comprehensive offshore investment solutions to help them juggle their businesses in their country of origin and oversee the business activities of their offshore business units, franchisees, or factory outlets.

On this parlance, let us find out the core Benefits Of Offshore Investments. Helping you get started further on the same:

Why do overseas nationals opt for Offshore investments?

Overseas nationals opt for offshore investments, and these are the compelling reasons that contribute to the same. Helping you with the rundown of the same:

A- Asset Protection

When you buy financial assets for a given value of time, they do not remain the same. These are fully developed investment portfolios that we are talking about. There are factors like currency devaluation, changing interest rates, and market volatility that can impact the overall value of investment portfolios. To prevent assets from losing their value, foreign expats choose offshore destinations to place their funds in.

B- Investment Diversification

Investors need to keep their portfolios looking rich and wholesome. To diversify their investment portfolios, offshore accounts are usually preferred indeed. The expats usually buy real estate assets like mortgage deeds or shares from rising markets like Dubai or Singapore. This way, their portfolios appreciate as the real estate markets appreciate.

C- Tax Optimization

In highly taxed economies like the US, 40% of your earnings on your regular income is collected as taxes. This leaves citizens with less money to plan their future initiatives, like retirement or estate planning. Therefore, investors plan offshore savings in tax-free or lower tax domiciles to take advantage of lower taxes on their financial assets.

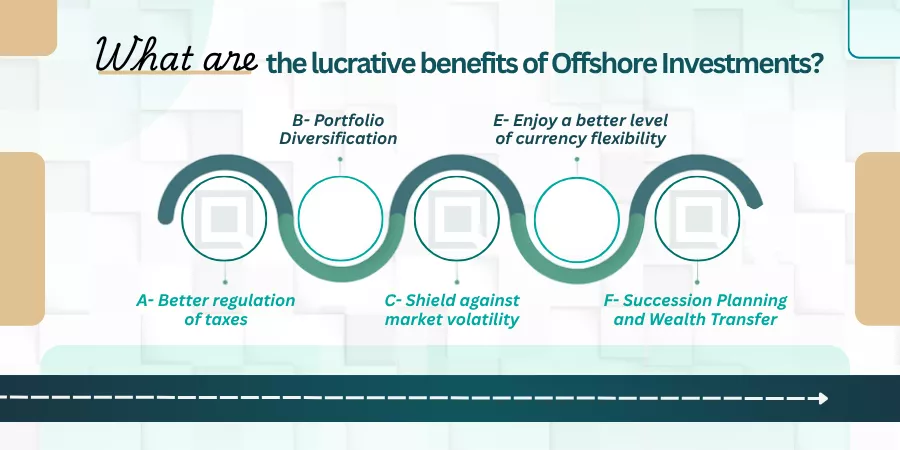

What are the lucrative benefits of Offshore Investments?

Now, we touch down on the main segment of the topic. Here are the primary benefits you achieve when you have multiple investments deposited via offshore accounts. Let us have an overview of each of them:

A- Better regulation of taxes

As you grow older, your financial liabilities will rise. You may encounter more frequent hospital visits, or you may lose your 9-5 job as you age towards retirement. When you choose offshore jurisdictions, you can convert your income into zero bonds, money market funds, and high-paying dividend stocks. This way, you convert your regular income tax slabs into capital gain slabs.

A sizeable reduction in tax liabilities helps you free up your investments for more holistic solutions such as inheritance, retirement planning, and estate or legacy planning. Investors, therefore, plan offshore investments to optimize their tax liabilities if they reside in high-tax countries.

However, you must exercise this clause with a degree of caution, as taxes have to be declared in your home country as well. Tax evasion is illegal and can lead to ugly consequences, too. You must consult a tax advisor before you foray into offshore investment plans.

B- Portfolio Diversification

Offshore platforms give a wide spectrum of opportunities for you to diversify your investment and wealth generation portfolios. You get an:

- Access to global financial markets

- Exposure to different asset classes along with

- Being able to dabble with multiple forms of currencies

And, you can do all of this using a single investment platform. Say, for instance, an offshore investor can invest in US Dollars, Pounds, and Asian funds using a single offshore account.

This kind of portfolio diversification reduces the overall risk of your home country’s currency devaluation and provides geographical resilience over your investments.

C- Shield against market volatility

You get a good shield against market volatility when you choose economic zones that are stable for your offshore investments. In other words, you can customize offshore investments to protect your assets against legal claims, creditors, or political instability if your home country is facing any of them. You must choose trusts, foundations, and insurance wrappers to protect your wealth against an unstable economy or political volatility that might be prevalent in your home country.

D- Access to exclusive investment products

When you choose offshore investment products, you can get versatile options to diversify your portfolios. You can choose sophistical platforms that offer hedge funds, structured notes and private equity. These products may not be available in your home country after all. These investment options appeal to posh investors who look for alternative investments or high yield bonds to their financial kitty.

E- Enjoy a better level of currency flexibility

Offshore investments offer you a better level of flexibility to hold currencies via multiple formats indeed. You can add euros, dollars, pounds, yen and other high-value currencies to help mitigate exchange rate risks. Expat investors find this arrangement useful as they earn in one currency and spend in another.

F- Succession Planning and Wealth Transfer

When you make your portfolios via offshore investments, you are in a better position to handle holistic and long-term investment solutions at ease. By the creation of offshore trusts and fund companies, wealth management and distribution of funds among family members can be done with better precision indeed. These investments facilitate inheritance planning as you avoid lengthy probate, handle legal issues, and distribute wealth across generations seamlessly.

G- Privacy and Confidentiality

Offshore domicles can provide you with a higher degree of financial privacy. Retail and institutional investors value discretion into their financial affairs. You find that regulatory authorities like FATCA and CRS help reduce transparency and maintain the anonymity of your investment portfolios.

H- Expat- Expat-focused solutions

You can look for expat-focused investment solutions to help you transition your working years abroad and your stay in your home country every now and then. When you work abroad, you may not have access to your home country’s investment options. Here, you look for offshore jurisdictions that help you streamline retirement, children’s education, and repatriation affairs quite seamlessly.

I- Enjoy a better level of customization

J- Estate and Legal Planning

You can structure your offshore investments to comply with multiple forms of legal systems. These investment solutions adapt to multi-currency portfolios and take care of currency devaluation or keep interest rate variances resilient from impacting your portfolios. This way, you can distribute the legal proceeds of your properties or estates across beneficiaries that stay in different countries of the world and not necessarily in your home country alone.

The Bottom Line

You have offshore investments suiting the needs of different segments of retail and institutional investors. You must approach an offshore firm to know more about what you get in the offing. What are your thoughts on this? Do let us know in the comments below!

Frequently Asked Questions or FAQs

Explain offshore investing

Answer: When you invest offshore or take investment opportunities in different countries other than your country of residence, we call it offshore investing. You get tax benefits on investment funds and prevent devaluation of foreign currency, which remain factors favourable for investors choosing offshore financial solutions.

You also enjoy tax advantages from your offshore bank accounts. The favorable tax slabs are applied when you convert your idle funds into regulatory investment options. The interest-rate fluctuation reduces, and you get access to international markets or profitable sectors, per se. Your portfolios are regulated and offer tax waivers to expats, too.