Introduction

Are you an investor who has just started your journey in the field of investments? Well, then, you are in the right place. Here, you may be a kind of investor who wants everything to be self-made. And, you have the spark to get self-started in whichever field you may want to dabble in. Else, you might be an over-cautious investor who might need some kind of hand-holding support to get your investments charted out for you correctly.

For a self-made investor, the pondering question in most of your minds remains- “Can I Manage My Own Investment Portfolio?”. The answer is yes, you can. Let us unveil tips and techniques on how this can be done more comprehensively. Helping you get started here:

What does managing your own portfolio mean?

Managing your own portfolio refers to you getting self-started in the field of investments and finances. You may do some kind of research on fully automated websites that help you dabble with investments on your very own. Then, you approach each and every website owner to check if you can grab lucrative deals to have the software plugin get installed at your home offices or at your commercial office complexes, where you run your business endeavors.

You then ask a software professional to install the website for you so as to get started. Here are the steps that are then required from your end. Let us have a rundown of what needs to be done as startup steps for you to move further down the line:

A- Choosing what to invest in

What are the assets you are going to choose from? You can feel free to choose between ETFs, equities, bonds, market-linked funds, stocks, and so on.

B- Allocation of assets in a streamlined manner

Here, you must choose how you want your assets to be allocated. You can choose your investments based on two important factors:

- Based on the level of your risk tolerance

- Financial objectives- Short-term, mid-term, and long-term goals

A short-term goal can be to clear an impending semester fee for your college tuition. For a young investor, the mid-term financial goal can be to purchase a second-hand or a brand new car. And, your long-term goal can be to invest in your own home.

C- Monitoring performance of these assets

Once your asset allocation is done, things do not stop here. You must constantly monitor how your assets are performing in the market.

You find bullish trends or a rising market for shares and equity products. At the same time, you can also witness a falling price trend known as the bearish market.

For bonds, you must be on the lookout for interest-rate variances.

For capital safe products, you may look for the overall net asset value of your funds. This way, you must constantly be on the lookout for how your assets are performing under varied market conditions.

D- Making suitable adjustments

The last and final step requires you to rebalance your assets from time to time. You can sell low-performing assets and try procuring profitable funds. This way, you rebalance the not-so-well-performing derivatives with better-performing ones. This way, your investment portfolios tend to stay intact, and you would not incur heavy capital losses in the long run.

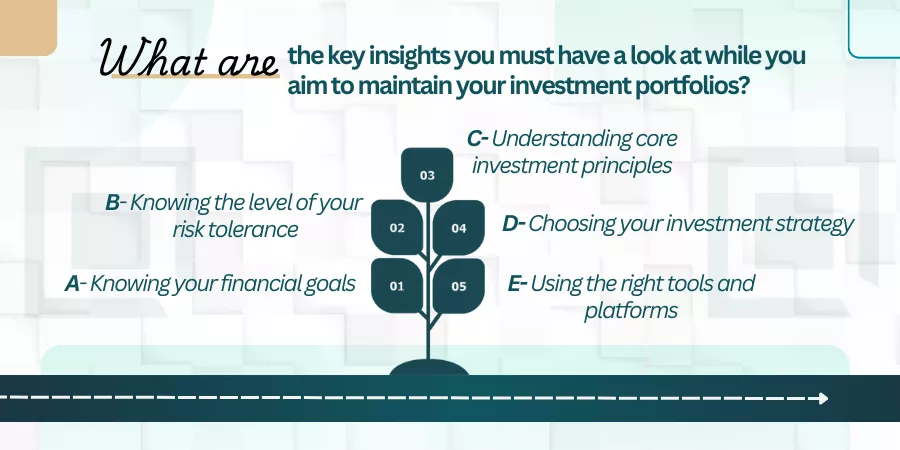

What are the key insights you must have a look at while you aim to maintain your investment portfolios?

In the previous segment, we had discussed how you maintain your investment portfolios on your very own. However, you require certain key insights on how you can do this on a much better pedestal.

Here are the key insights you may have a look at while you aim to maintain investment portfolios on your very own. Helping you through with a rundown of pointers that pertain to the same:

A- Knowing your financial goals

Bifurcating your financial goals must be grouped age-wise. Say, for instance, buying a new home can be a long-term goal for an investor who is just out of college. While for an investor who is 40-plus, an early retirement plan might be a financial goal on a long-term pedestal. Therefore, your financial goals and objectives keep shifting as you age.

You must chart out your financial goals accordingly. You must also choose time-horizon investments that perfectly align with the financial goals or objectives you have in mind.

A short-term goal of yours, wanting to buy your very own car, requires you to choose an investment plan that ranges from 3 to 5 years. This is a short-term investment plan that you are looking at.

A medium-term investment plan can have an investment scheme that covers you for 10-15 years. Here, you want to save to fund your kids’ education expenses. Or, you may look for home loans that can allow you to purchase a brand new home for your newly married wife or spouse.

A long-term financial goal spans over 15 years until 30 years. You may want to invest in whole life or universal insurance policies. Or, you may plan for your retirement. Or, you must have the setup running to legally distribute your properties amongst your kith and kin. We call it Estate Planning in investment parlance.

B- Knowing the level of your risk tolerance

This is the 2nd penultimate step that goes into the making while you want to go on your self-drive investment mode. You must make independent efforts to know what your risk tolerance is.

Here is a checklist that allows you to assess the level of your risk tolerance:

- How much money are you willing to invest via feasible investment plans?

- How much money can you financially assimilate in case you experience market losses in your kitty?

- How much market risk can you emotionally handle?

You can visit websites like Morningstar, Vanguard, Schwab, and other user-friendly domains and download self-assessment risk tolerance worksheets to have a clearer picture of the same.

C- Understanding core investment principles

You must understand strategic principles in investments so that you know that you are steering your wheel in the right direction indeed. Here are three main principles that need briefing on:

- Diversification- You must diversify investment portfolios so that you get a well-balanced wealth basket that you aim to pursue in the long run. Avoid putting all your money into tech stocks or stand-alone bonds. You can diversify your wealth basket by including a mix of equities, shares, bonds, commodities, and market-indexed funds for a more wholesome and holistic growth of your investing strata.

- Compounded growth- You can reinvest your profits and interest earnings on investment portfolios and leave portfolios untouched so that your interest rate compounds over a period of time.

- Cost of the portfolio- Here, you must avoid investment products that levy heavy costs or charges for the initial or ongoing setup. These costs can neatly eat away the returns on your investment portfolios.

D- Choosing your investment strategy

You must choose your investment strategies wisely and diligently. Are you looking for a hands-off or passive method for monitoring your investment portfolios? Then you can choose ETFs or Index Funds. These are investments that require low-key maintenance and can be managed effectively too.

Are you an investor who wants to actively monitor your investment funds? Then, you can look for intraday trading options that allow you to check the prices of your stocks or shares daily. Although you get better rewards when you sell stocks or shares in a rising market, you can incur losses too when your stock indexes fall in value under bearish market scenarios.

Investors can use a fleet of dollar-averaging tools to ease out their market risks considerably.

E- Using the right tools and platforms

As a self-starter, it would also be a wise idea when you get hands-on to the right set of tools and platforms to have your investment journey up and running.

Here, you can approach online brokers like Fidelity, Vanguard, Shwab and Robinhood that offer hands-off and off beat investment stragies to newbie investors.

Secondly, you can configure your very own set of DIY investment strategies to manage and monitor your investment portfolios effectively.

Finally, you can use platforms like Morningstar or Personal Capital to help you monitor the performance of your investment portfolios.

F- Stay financially disciplined and committed

As a new investor, you must continue reading blogs and articles from well-renowned blogs and investment newsletters. You can log in to https://quadrawealth.com/articles/ to get informative investment blogs for starters and seasoned investors out there.

You must remain financially disciplined to stash out your funds in lieu of investment portfolios. This way, you show your commitment and loyalty to see your portfolios grow exponentially.

You can also listen to investment podcasts that are sponsored by Investopedia and Bogleheads on YouTube. This way, you stay abreast with the latest trends and happenings in the field of finance and investments.

The Bottom Line

Newbie or DIY investors must learn financial basics thoroughly and comprehensively. This way, you develop a long-term mindset to investing or creating wholesome wealth generation cum income generating baskets for you and for your family members. What are your thoughts on this? Do mention it in the comments below!

Frequently Asked Questions or FAQs

Can you manage your investments on your own?

Answer: Yes, if you have the confidence and the financial security to get started on your own, then yes, you certainly can start and manage your investment portfolios on your own. Else, you can get in touch with an investment advisor or a fund manager to help you optimally allocate investment funds and assets. As a beginner who is starting to invest from your savings accounts, it might be harder to decide by yourself, you might need some kind of hand-holding support to learn how to invest or understand the intricate nuances of diversifying your portfolios.

Does a self-made portfolio give you peace of mind?

Answer: Here, it is you who should confront to deciding on your investing moves. A passive or hands-free approach can help beginner investors who may not have enough working capital to start with an Investment Fund house or a Financial Banking Corporation.

As an individual investor, you can conform to passive index funds if your level of risk tolerance is lower and you want to spend less on your initial investment. You can improve your level of knowledge by learning more about retirement savings or long-term investment plans while you opt for a self-driven mode of investments.