Car insurance is a necessary investment for anyone owning a vehicle. With the increasing number of vehicles on the road, having adequate insurance coverage not only ensures legal compliance but also provides financial security in case of accidents, theft, or other unforeseen events.

However, renewing your car insurance on time is just as important as buying it in the first place. In today’s digital era, renewing your car insurance online is a convenient, efficient, and hassle-free process.

This article delves into everything you need to know about How To Renew Insurance Online and other revolving specifics that surround the same. Helping you get started here:

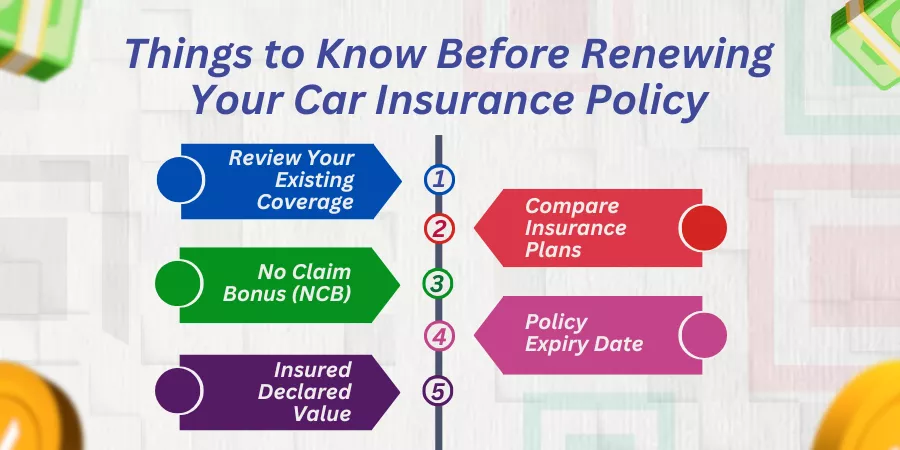

Things to Know Before Renewing Your Car Insurance Policy

Before diving into the renewal process, it’s essential to consider a few crucial aspects to make informed decisions. Being aware of these points ensures you get the best deal and the most suitable coverage for your vehicle.

Let us have a run-down of pointers that are connected with the same:

Review Your Existing Coverage

Before renewing, revisit your current policy to determine whether it still fits your needs. Over time, your coverage needs may have changed due to a variety of reasons, such as driving fewer miles or purchasing a new car. Understanding your coverage requirements is key to ensuring you don’t overpay or under-insure your vehicle.

Compare Insurance Plans

The online renewal process allows you to easily compare different policies across providers. Do not rush into renewing with your current insurer without exploring competitive quotes. This can help you find better deals, added features, or more affordable premiums. Use comparison websites to check offers from different companies and analyze their benefits, add-ons, and discounts.

No Claim Bonus (NCB)

If you haven’t made any claims during the previous policy term, you are eligible for a No Claim Bonus (NCB), which can significantly reduce your renewal premium. It’s important to confirm that your insurer has applied for this benefit when you renew your policy.

Policy Expiry Date

Ensure you renew your car insurance before the policy expires. Driving without valid insurance can result in fines, penalties, or legal issues. Moreover, any coverage gap could lead to higher premiums in the future.

Insured Declared Value (IDV)

The IDV represents the current market value of your car and is the maximum amount your insurer will pay in the event of total loss or theft. At the time of renewal, confirm whether the IDV has been updated accurately. A lower IDV will reduce your premium, but it could leave you underinsured if the need arises to file a claim.

How to Renew Your Car Insurance Policy in the Best Manner Online

Renewing your car insurance online is a straightforward process, but ensuring it’s done in the best possible way requires attention to detail. Follow these steps for a smooth and effective renewal process.

Step 1: Visit Your Insurer’s Website or Mobile App

Start by visiting the official website or downloading the mobile app of your insurance provider. Many insurers have user-friendly digital platforms that make it easy to access your policy details and initiate the renewal process.

For instance, it can be health insurance online or you may want to renew the policy from an auto insurance dealer. You must login on time to avoid a policy lapse on the insurance cover. This way, you can utlize your health insurance on time or envision the process to renew car insurance online in Dubai or UAE.

Step 2: Login to Your Account

Log into your account using your registered credentials such as your policy number or mobile number. If you are using a new insurance provider, you will have to create a new account.

Step 3: Enter Policy Details

Once logged in, enter the details of your current policy such as the policy number, car registration number, and any other information requested by the insurer. This will bring up your existing policy details for review.

Step 4: Review and Update Your Information

Carefully review all the policy details including the coverage, IDV, and NCB. If any updates are needed (e.g., change of address or contact information), make those changes now. Ensure the renewal is aligned with your current needs.

Step 5: Choose Add-ons

Many insurance providers offer optional add-ons such as zero depreciation cover, roadside assistance, or engine protection. Depending on your car’s age, usage, and requirements, you may choose these add-ons to enhance your coverage.

Step 6: Make the Payment

Once you are satisfied with the terms and conditions, proceed to make the payment. You can use various online payment methods such as credit/debit cards, net banking, or mobile wallets. After the payment is confirmed, you will receive a digital copy of your renewed policy via email or the app.

Step 7: Download and Save Your Policy

Make sure to download the soft copy of your renewed car insurance policy and save it in a secure location. Many insurance companies also offer the option to request a hard copy, though digital copies are equally valid and widely accepted.

Documents Needed in Case You Want To Change the Insurance Provider

Switching insurance providers can be beneficial if you’re looking for better service, lower premiums, or enhanced coverage. Here’s a list of documents you’ll need if you opt to change your car insurance provider:

Vehicle Registration Certificate (RC)

The RC contains essential details about your vehicle, including its make, model, and registration number, which will be required by the new insurer.

Previous Insurance Policy

A copy of your existing or expired policy is necessary to verify your claim history and NCB eligibility.

No Claim Bonus Certificate

If you’re switching providers, ensure that you get your NCB certificate from your previous insurer. This will allow you to transfer your NCB discount to the new policy.

Identity Proof

Any government-issued identity proof, such as a passport, driver’s license, or a copy of a Social Security Certificate or SSC, is required by the insurer for verification purposes.

Address Proof

You must submit copies of your address proofs like DL containing complete info of your residential address. You can also produce a rental deed from your landlord in lieu of the same. Otherwise, you can also produce utility bills that clearly state the residential address you stay in.

Passport-sized Photograph

You must produce a recently taken smudge-free passport-size photograph to prove your identity at the insurer’s office. You can also take a web-based photo if the office outlet lets you do so.

Factors Affecting Car Insurance Premium

Several factors contribute to the premium amount you’ll need to pay during the renewal process. Understanding these factors can help you reduce costs where possible.

Helping you through a run-down into the same:

Age and Condition of the Vehicle

The older your vehicle, the lower its market value (IDV), which in turn reduces the premium amount. However, older cars are more likely to need repairs, which can increase the cost of add-ons like breakdown assistance.

No Claim Bonus (NCB)

The longer you go without filing a claim, the greater the discount you can enjoy on your renewal premium. NCB can reduce your premium by up to 50% in some cases.

Location

Your location also affects the premium. Cars in urban areas, where the risk of theft or accidents is higher, often carry higher premiums compared to those in rural areas.

Type of Coverage

Comprehensive insurance costs more than third-party insurance because it covers a wider range of incidents. However, if you want more robust protection, a comprehensive policy with additional coverage is a better choice.

Driving Record

A clean driving history can help reduce your premiums, while any history of accidents, claims, or violations can lead to higher renewal premiums.

Add-ons Chosen

Each add-on, such as zero depreciation or engine protection, increases your premium. You should select only those add-ons that are necessary based on the age and condition of your car.

Vehicle’s Make and Model

Luxury or high-end cars attract higher premiums due to their cost of repair or replacement. On the other hand, budget vehicles may come with lower premiums.

An overview of Policy renewal at the UAE

To renew policies, you must know the nuances of handling your documentation online. A health Insurance policy document might differ from the documentation procedures to renew car insurance online.

Similarly, you must have a thorough look at the current insurance in the uae or dubai if you want to have an overview on how norms or conditions differ from one geographical domain to another. This is with respect to a policy renewal procedure, say like a medical insurance or a car dealer insurance you may have to pursue via online mediums.

You can feel free to approach insurance brokers or the uae insurance authority to know the time of policy renewal, its lapse and grace period to avail no-claim bonuses or any other tax waivers you may be eligible for.

If you fail to renew travel insurance or home insurance from the Emirates or AED, an insurance service company provides 30 days of grace period to avail the best plan on a renewed note. However, you must contact an insurance service provider who allows you to renew your policy documentation without you having to pay fines or too.

The Bottom Line

Renewing your car insurance online is a seamless and efficient way to ensure your vehicle remains protected. By understanding your coverage needs, comparing policies, and being aware of the factors affecting your premium, you can make informed decisions that save both time and money.

You must always keep your documents ready and be mindful of your renewal dates to avoid penalties. Remember, taking a proactive approach toward car insurance renewal will ensure continuous protection and peace of mind as you navigate the roads.

What are your thoughts on this? Do let us know in the comments below!

Frequently Asked Questions

What happens if you forget to renew your car insurance on time?

If you forget to renew your insurance, you risk driving without coverage, which can lead to fines, penalties, and higher premiums in the future. Always set a reminder to renew your policy before it expires.

Can you renew your car insurance after it has expired?

Yes, most insurers allow you to renew your insurance after it has expired, but this could require a vehicle inspection and a higher premium. It’s best to renew on time to avoid these hassles.

Is it possible to switch your car insurance provider during renewal?

Yes, you can switch to a different insurance provider when renewing your car insurance. Make sure to compare policies and have the necessary documents ready for a smooth transition.

Will your No Claim Bonus (NCB) be affected if you change your insurance provider?

No, your NCB is transferable. When switching providers, ensure that your previous insurer provides you with an NCB certificate, which will allow you to enjoy the same discount with your new insurer.

Would you be able to renew your policy without changing the current policy?

Yes, if you’re satisfied with your current policy, you can simply log into your insurer’s website or app, review the details, make the payment, and renew without any changes.