Auto Callable Structured Product Investment: Maximizing Returns with Conditional Redemption

Investing in structured notes involves a lot of complexity. Autocallable structured products are investment instruments that provide high coupon payments based on the performance of the underlying asset.

This blog helps you understand autocallable structured notes as an investment, as well as their features, benefits, and risks.

Autocallable Structured Product

Autocallable structured products are also known as autocallable structured notes or autocallable notes. Autocallable structured products as its name suggests are automatically callable before the maturity date by the issuer when the underlying asset or reference asset is at or exceeds the initial level or predefined level on a specified observation date. The investor will receive the initial investment and a pre-determined premium in the form of a coupon. The autocallable note may be redeemed early or early redemption in this case.

The autocall is carried out on the specified observation date which can be quarterly, semi-annually, or annually. The autocallable structured product can mature only on the autocall dates. The underlying asset can be common stocks or equities, baskets of stocks, stock market indices, foreign currency, commodities, commodity indexes, or other asset classes.

Autocallable Notes are capital protection products. The potential returns on the autocallable notes are high as they pay a coupon much higher than other coupons available during maturity. However, the value of the underlying asset must be at or above the pre-determined level on the specified observation date for the note to pay a coupon. Autocallable notes provide a balance between capital protection and potential for higher returns.

Key Features Of Autocallable Note

Key Features Of Autocallable Note

High Coupon Payments

Autocallable structured products provide high coupon payments. An automatic call option is triggered when the underlying asset’s price on the specified observation date surpasses the strike price. In this case, the investors receive a substantial coupon. In case the auto-call fails, the coupon value increases to the nearest multiple on the next auto-call date.

Put Option With Soft Capital Protection

The autocallable structured products embed a put option with the trigger level of the underlying asset to a fixed price, known as the knockdown level. If the underlying asset’s price falls below the knockdown level, then the put option is triggered, which provides soft capital protection.

Low Minimum Investment On the Secondary Market

Autocallable structured products have a low minimum investment requirement on the secondary market. The low minimum investment makes them accessible to a wide range of investors. The autocallable notes can be purchased in portions in the secondary market for $1000 or multiples of it.

High Credit Quality

Autocallable notes are issued by banks with an investment-grade credit rating. Autocallable structured products prioritize high credit quality. However, investors need to consider various factors beyond credit quality when making investment decisions.

Contingent Downside Protection

Auctocallable notes have a barrier level that provides downside protection to the investor. The downside protection helps the investor mitigate losses due to market volatility or market downside.

Short to Medium-Term Investment

Autocallable notes are usually designed for short to medium periods that is 1 to 3 years. The auto-call assessments are done during the observation dates and the issuer will redeem the notes when all the pre-defined conditions are met.

Are Autocallable Structured Notes Suitable for You?

Autocallable structured notes are suitable for investors who are

Looking For Enhanced Yield Opportunities

Autocallable structured notes have higher yields than traditional bonds making them more appealing to investors. This is the most distinguishing feature of autocallable notes.

Seeking to Diversify Their Investment Portfolio

Investors looking to diversify their portfolio can invest in autocallable notes. This provides the investor with a large opportunity to diversify their portfolio.

Knowledge Concerning How Options Work

Autocallable structured notes mostly invest in options. The knowledge of options will help the investor understand how the structured products work.

Example of How Auto-Callable Yield Notes Work

Let us consider an autocallable note with a duration of 3 years. The strike price of the underlying asset is set to 100%. The coupon starts at 10% and can grow to 20% and 30% in the next 2 years if the auto-call feature is not triggered. There is also a soft capital protection mechanism in place.

Let us consider this scenario in detail:

Investment Period: 3 years

Strike Price of the Underlying Asset: 100%

Coupon Growth: 10% and increases to 20% and 30% in the next 2 years if the auto-call feature is not triggered.

Auto-Call Feature: when the auto-call is not triggered on the observation date, the coupon will grow as mentioned above.

Soft Capital Protection: The put-knockdown level is set at 60%. If the underlying asset’s price goes below 60%, then the put option is triggered which provides soft capital protection.

Let us consider at the end of the first year, if the price of the underlying asset is above the strike price, the auto-call is triggered which results in automatic maturity of the note, and investors receive their principal along with any accrued coupon payments.

Let us consider in the first year the underlying asset is below the strike price, then the auto-call is not triggered, and the coupon grows. At the end of the second year, assuming the underlying asset has not yet reached the strike price, then the note along with the coupon will be received by the investor on the maturity date.

If the stock price of the underlying asset goes below 60%, then the put option is activated. This provides soft capital protection which helps in mitigating downside risk.

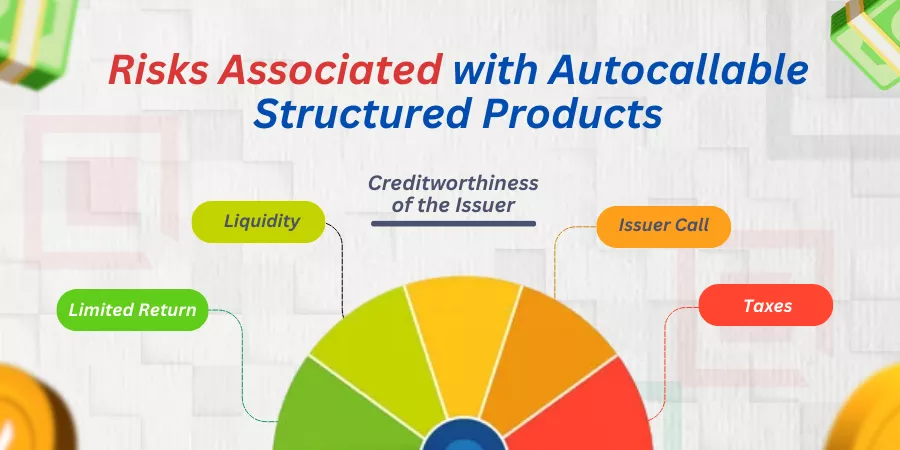

Risks Associated with Autocallable Structured Products

The autocallable structured notes are very appealing, but it is important to note that autocallable notes carry risks.

Limited Return

Autocallable notes are linked to fixed interest rates. They do not provide dividends or participate in the capital appreciation of the underlying stock, which makes the return on investment limited.

Liquidity

Autocallable notes are illiquid. They are difficult to sell on the secondary market. The investor may have to wait until maturity or during the auto-call when the conditions are met to redeem the note.

Creditworthiness of the Issuer

Autocallable notes have credit risk, that is the creditworthiness of the issuer should be considered before investing in the note. The investor may lose the principal and the return on principal if the issuer is unable to meet the terms of the note.

Issuer Call

The issuer calls before maturity when certain conditions are met may make it difficult for the investor to re-invest, also known as re-investing risk especially if the market conditions are not good for re-investing.

Taxes

Investors should consider the tax implications and the terms and conditions before investing. The investor may be required to pay tax even before getting the returns.

Conclusion

Autocallable notes are beneficial income streams for investors looking to diversify their portfolios and potential for enhanced returns. The autocallable notes are linked to the performance of the underlying asset.

The investor should carefully analyze the features and the risks before investing in autocallable notes to make an informed decision. Autocallable notes provide a tailored investment strategy that is beneficial to the investor.

The advice of a financial advisor can be taken before investing in autocallable notes so that the investor can meet his investment objectives and financial goals.