Can SIP make you rich? Systematic Investment Plans can help in wealth creation. Through mutual fund SIP, achieve financial goals and become rich.

Convinced we are that there are no shortcuts to Socio-economic prosperity! Whether you aspire to create wealth through your enterprises, or ventures, or rise the corporate ladder quickly, earning wealth will not necessarily lead to wealth creation.

Unless you consciously reinvest to grow what you have earned, a dream to create a vast and deep pool of wealth will remain a distant one.

Given the vast scope that wealth creation, this topic, calls for hours of discussion and can run into pages of write-ups!

To cut the long story short, it takes more than just earning money to create that sustainable wealth.

Can SIPs make you rich?

Asset philosophies swear by SIPs for long-term wealth accumulation, and they are correct to a large extent. While Systematic Investment Plans (SIPs)s are not magic wealth generators, they are a proven and empowering way to create wealth.

The working of SIP is simple, savings that get compounded eventually. SIPs don’t make you wealthy instantly, but they build a strong foundation for your wealth creation.

But how? SIP in a mutual fund is the way of investing if you want to become rich as this invested amount or sum of money grows exponentially if sip for 10 years or more is consistently maintained.

Way of investing in mutual funds can help understand how sip amount is a popular finance module as mutual fund ventures are of multiple types like sip in an equity fund, sip in a debt mutual fund, flexi-cap funds, etc.

Feature of sip equity mutual funds even offer higher price and make profits but one needs to understand that situations do not guide SIP.

SIP further helps to generate a safe portfolio with high percentage of returns, it requires you to invest and commit to the fund for long term growth even if you choose to put in small amount of money.

Think compounding!

Imagine, earning money not only on your contributions but also on your returns. Yes, that’s what compounding does and with SIPs, you can harness this power.

In SIPs, you invest a fixed amount periodically say daily, weekly or monthly and your returns get re-invested. Over some time, the snowball effect multiplies your corpus significantly.

Also Read: How to invest in the stock market?

Your financial success begins with a conversation – book your advisory session now

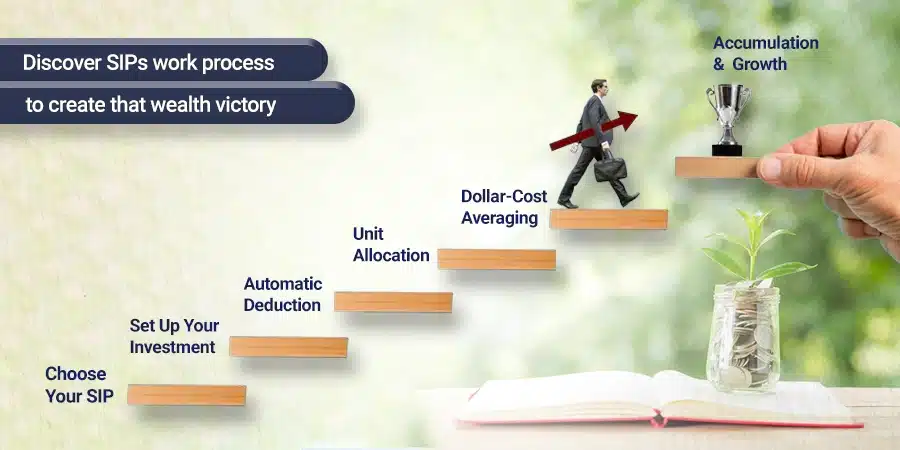

How do SIPs work to create that wealth?

Let’s understand step by step the way SIP works, how to invest, what happens after you invest and all other aspects,

- Choose Your SIP: You’ll decide on a mutual fund scheme that aligns with your risk tolerance and financial goals. There are various types of mutual funds like equity, debt, or balanced funds. Market before every investment shall show you your disciplined approach towards investment and overall return prediction with a limited sum of money.

- Set Up Your Investment: You’ll determine the amount you want to invest per instalment. It can be a small sum, like $20 or ₹100, depending on your comfort level. You’ll also choose the transaction frequency – daily, weekly, monthly, or quarterly. The pointers that are to be kept in mind while setting up your sip schemes are the average cost of investment, past performance of the fund, mode of investment, the 10-year investment period future plans of the fund and note that returns on investments should remain as high as possible with low risk probability. If you work these out well, you shall notice that your fund emerged as a popular investment in the long run.

- Automatic Deduction: Once you set it up, the chosen amount will be automatically deducted from your bank account at the chosen frequency. This ensures you stay determined and consistent with your investments and become a crorepati. SIP is one towards investment and overall finances but the investment plan requires calculative progress and helps to generate risk-adjusted returns.

- Unit Allocation: The deducted amount is used to purchase units of the chosen mutual fund scheme. The number of units you receive depends on the Net Asset Value (NAV) of the fund on that particular day. NAV is the price per unit of the mutual fund.

- Dollar-Cost Averaging: Since the NAV fluctuates, you might buy fewer units when the market is high and more units when the market is low. This helps average out the cost per unit over time, potentially reducing the impact of market volatility.

- Accumulation and Growth: With each SIP instalment, you accumulate more units in the fund. Over time, as the NAV of the fund hopefully increases, the value of your investment grows. You also benefit from compounding, where your returns are reinvested and you earn additional returns.

Also read: 6 signs it’s time to hire a financial advisor for your finances

Become rich through mutual fund sip by understanding sip calculator and start investing as you time the market your lakhs will turn into crore working on a compound interest method. Your financial success begins with a conversation – book your advisory session now.

Mutual Funds in India help you become rich as sip helps invest rs in the investment horizon and returns on investments through SIP keep rising with time spent in market.

Even though investments through sip are subject to market risks, invest at regular intervals, guide sip investments, plan and invest and use a sip calculator to do so and you may be able to enjoy the benefits of investing without the risk factor affecting you.

Can SIP Make you Rich? Benefits of SIP investment

Systematic Investment Plan (SIP) offers several benefits to invest in mutual funds looking to build wealth over time while minimizing risks. Here are some of the main advantages of investing in SIP.

- Discipline and Regular Investing: SIP instils discipline in monthly sip by encouraging them to invest a fixed amount regularly, typically monthly. This disciplined approach helps inculcate a saving habit and ensures that every investment opportunity that would stay committed to their investment goals over the long term.

- Rupee Cost Averaging: SIP allows regular investment habits to benefit from rupee cost averaging. Since the investment amount remains constant, more units are purchased when prices are low and fewer units when prices are high. This averaging helps reduce the impact of market volatility on the overall investment, potentially lowering the average cost per unit over time.

- Power of Compounding: SIP harnesses the power of compounding by reinvesting the returns earned on investments. Over time, even small, regular investments can grow significantly due to compounding, where returns generate further returns.

- Affordability and Flexibility: SIPs offer the flexibility to invest small amounts regularly, making it accessible to investors with varying income levels. Investors can start with as little as a few hundred rupees per month, making it a suitable option for individuals with limited resources.

Your financial success begins with a conversation – book your advisory session now - Diversification: SIPs allow investors to diversify their investment portfolio across various asset classes such as equity, debt, and gold. Diversification helps spread risk and potentially enhances returns by investing in different avenues with varying risk-return profiles. Investing in equity may be risky in some cases so it is always important to diversify your portfolio according to your goals of another sip plan as mutual fund investments are subjected to market risks.

- Long-term Economic Benefits: SIPs are ideally suited for long-term capital formation as they encourage investors to stay invested over extended periods. By staying invested through market ups and downs, investors may benefit from the market’s long-term growth potential and achieve their financial goals.

- Convenience and Automation: SIPs offer convenience and automation in the investment process. Once set up, investments are automatically debited from the investor’s bank account and allocated to the chosen funds. This automation reduces the hassle of manual investment and ensures regularity in investing.

- Professional Fund Management: SIP investors gain access to professional fund management expertise offered by mutual fund companies. Fund managers actively manage the funds, making investment decisions based on thorough research and market analysis, which may potentially generate better returns for investors.

- Liquidity: Funds through SIP offer liquidity as investors can redeem their investments partially or fully at any time, subject to the terms and conditions of the scheme. This liquidity feature provides investors with the flexibility to access their funds in case of emergencies or changing financial needs.

SIP can make you rich? The answer isn’t a simple yes or no. They’re not a shortcut to a billionaire’s lifestyle, but sip in mutual funds are a powerful tool for building wealth steadily and reaching your long-term financial goals.

Invest through SIP like planting a money tree: with regular care and time, you can watch your wealth blossom and reach heights you might not have imagined possible. So, are you ready to cultivate your financial future? Start a SIP today and watch your money grow!

Cryptocurrency Investments

While the exact details of his holdings are not public, Musk has been a vocal advocate for cryptocurrency, influencing markets with his tweets. Here are some digital currencies he’s shown interest in:

- Bitcoin: For many uninitiated crypto is Bitcoin. The world’s first and most valuable cryptocurrency, Bitcoin has gained significant traction with Musk’s endorsement. Tesla and SpaceX, both have invested in Bitcoin. However, their holdings may have fluctuated.

- Ethereum: The second-largest cryptocurrency by market cap, Ethereum is known for its smart contract functionalities. While Musk’s holdings are unclear, his companies’ involvement hints at a possibility of private equity.

- Dogecoin: This meme-based cryptocurrency has seen wild price swings, and it usually swings after Musk’s tweet. While it is not yet in the Ivy League as Bitcoin or Ethereum, it underlines Musk’s playful and unpredictable fortune style.

FAQs

No, SIP mutual funds don’t guarantee to make you wealthy. Market fluctuations or individual funds’ performance can impact returns. However, SIPs offer a consistent approach to adding value in mutual fund units with best sip over the long term.

Again, a subjective question, how long is long? There’s no fixed timeframe for getting rich with SIPs. It depends on the amount you invest, the chosen SIP plan’s performance, and the overall market conditions. However, the longer you stay invested, the greater are chances for wealth accumulation through compounding.

Absolutely! SIPs are the most humble and accessible way to invest in the stock market. You can start with a small amount that fits your budget and gradually increase it as your income grows. Even small, consistent investments can lead to significant wealth accumulation over time.

SIPs are for all risk profiles. With a wide range of mutual funds available, you can choose the one that aligns with your risk tolerance. Equity SIPs stand a chance for higher returns with higher risk, while debt SIPs offer lower volatility and steadier returns.

SIPs offer dollar-cost averaging, which helps you potentially reduce the impact of market volatility. Additionally, SIPs instil financial attitude by automating your investments and encouraging regular saving.