Diversification and Beyond

Are you now looking for Smart Investment Structured Notes vs ETFs Compared avenues beyond bonds, deposits, stocks, or mutual funds?

Having been investing for some time and that you are aware of your risk tolerance, are you looking to diversify your portfolio?

Well, there are basketful financial products available, each offering its own set of benefits and limitations. However, more often, investors get intrigued by the financial jargon with which these investments come coated.

Though what lies beneath the seemingly complex instrument, is more often a blend of basic financial instruments like bonds, stocks, and commodities in varied proportions.

The blend there is to ensure the investor gets best of the all the components, though it’s not without risk.

Confused about where to diversify? Don’t worry!

As one begins the investment journey, the investor eventually gets familiar with the markets and gains confidence in due course of time.

It is at this juncture the lookout for more investing options to fill in the gaps of risk-reward fits in the portfolio mix. Two prominent choices that investors usually get exposed to the Structured Notes vs ETFs products.

While both offer exposure to various underlying assets, they differ significantly in structure, functionality, and suitability for different investor profiles.

This blog will help you understand the two products, analyze their benefits and drawbacks, and compare them on multiple parameters.

This for sure will raise your awareness if you are new to investing here.

What are Structured Notes?

Structured notes are debt instruments issued by financial institutions, often linked to the performance of underlying assets like stocks, indices, or commodities.

They are a type of investment product that combines features of both bonds and derivatives. They offer a customized investment experience with various features tailored to specific needs and goals.

Structured products provide investors with tailored exposure and clarity of risk and return.

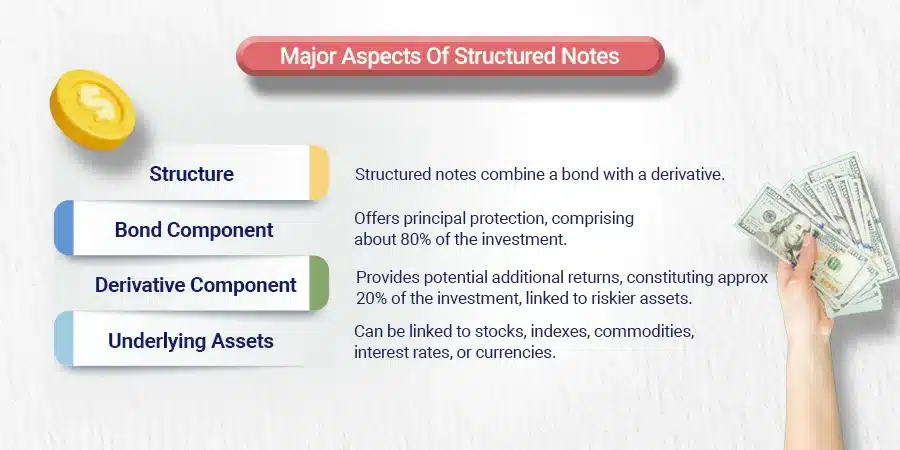

Here are the major aspects of structured notes

- Structure: They are hybrid securities, combining a traditional bond component with a derivative component.

- Bond component: This makes up a larger portion of the investment, almost 80% of the investment size. It offers principal protection, similar to a regular bond.

- Derivative component: This component, which is around 20% provides the potential for additional returns based on the performance of the underlying asset class. These assets are usually riskier, with high return potential.

- Underlying assets: Structured notes can be linked to various assets, including stocks, indexes, commodities, interest rates, and currencies.

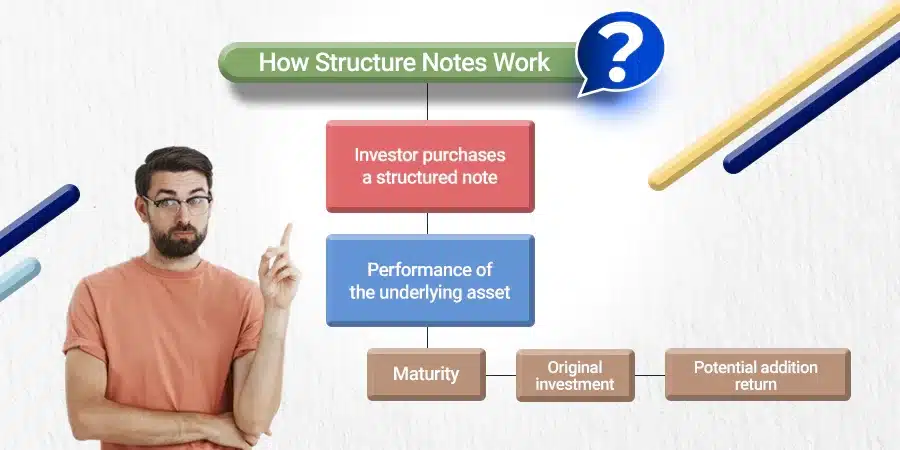

How structure notes work

- Investor purchases a structured note: You invest a certain amount of money in the note, just like buying a bond.

- Performance of the underlying asset: If the underlying asset performs well, the derivative component generates a return, it then boosts your overall gain which is beyond the principal invested.

- Maturity: When the note reaches its maturity date, what you receive is

- Original investment: Guaranteed even if the underlying asset loses value. The bond component eventually grows to the size of the original investment.

- Potential additional return: Based on the performance of the derivative component. This component usually generates high returns.

Unique features of structure notes

- Principal protection: Certain notes offer protection against losses in the underlying asset, up to a predefined level. The bond component also ensures that the principal is protected.

- Income generation: Some notes offer regular coupon payments, providing a potential income stream.

- Limited upside potential: Compared to directly owning the underlying asset, structured notes may cap potential gains.

- Complexity: The structure and terms of each note can be complex, requiring careful evaluation before investing.

- Issuer credit risk: Investors rely on the issuing institution’s creditworthiness to receive promised returns.

What are Exchange-Traded Funds (ETFs):

Exchange-traded funds, or ETFs, are like a one-stop shop for diversification.

They are a bundle of a variety of investment vehicles, like stocks or bonds, into a single package that trades on the stock exchange.

This allows investors to invest in different parts of the market conditions without having to buy individual securities, reducing risk.

ETFs usually have lower fees and offer flexibility, making them a popular choice for retail investors of all risk profiles.

How do ETFs work?

Most ETFs track a specific index, which is like a benchmark representing a specific portion of the market (like the S&P 500, which tracks 500 large companies in the US).

So, when the companies in the index perform well, the price of the ETF generally goes up, and vice versa.

Here’s a breakdown of how an ETF works:

- Creation: An authorized participant (like a large financial institution, or fund houses) buys a basket of underlying securities (e.g., stocks) that match the ETF’s target index.

- Shares are created: These underlying securities are then bundled into “creation units” and exchanged with the ETF provider for shares of the ETF.

- Trading: The ETF provider then lists the ETF on a stock exchange, allowing investors to buy and sell shares throughout the trading day, just like individual stocks.

- Tracking the index: The ETF manager continuously monitors and adjusts the holdings within the ETF to ensure it closely mirrors the performance of the target index.

Unique Features of ETFs

- Diversification: ETFs hold a basket of assets, spreading risk and reducing exposure to individual companies or sectors.

- Transparency: Holdings and performance are readily available, allowing for informed investment decisions.

- Liquidity: ETFs trade throughout the day, offering easy entry and exit from positions.

- Market risk: Exchange traded fund performance is directly tied to the underlying assets, exposing investors to market fluctuations.

- No income guarantees: While some ETFs provide distribute dividends, they are not guaranteed.

Choosing the Right Fit, Structured Notes Vs ETFs

The choice between Structured Notes vs ETFs depends on your financial goals linked to the investment, risk tolerance, and investment experience. Here’s a brief comparison between Structured Notes vs ETFs to help you arrive at a decision

Feature | Structured Notes | ETFs |

Investment type | Debt instrument | Basket investment |

Underlying exposure | Linked to various assets (stocks, indices, etc.) | Tracks a specific index, sector, or strategy |

Principal protection | May offer protection, depending on the note | No protection; exposed to market risk |

Income generation | May offer regular coupon payments | No guaranteed income; may distribute dividends |

Upside potential | Limited; capped by the note’s terms | Uncapped; reflects underlying asset performance |

Complexity | Complex structure and terms | Relatively simple and transparent |

Risk | Issuer credit risk, market risk | Market risk |

Fees | May have higher fees than ETFs | Typically lower fees |

Parting Thoughts

Structured Notes vs ETFs both are a blend of multiple financial instruments.

They can add much-needed diversification to one’s portfolio as per the investor’s risk tolerance.

Understanding the key features of these investments will put you in a comfortable mindset.

Conducting your research and taking the help of a financial advisor will aid in understanding the product and also where exactly your portfolio stands in the scheme of things.

Happy Investing!