The Idea Of Best Online Retirement Income Calculator

For, Samantha, 40, an accomplished senior consultant, the thoughts of retirement started to cross her mind.

While colleagues discussed deadlines and promotions, her mind pictured beaches, leisure afternoons, and pursuing all the passions that were resting there in one corner of her heart. She didn’t want this to be just a dream.

Samantha was aware to achieve this feat, she needed meticulous planning and consistent execution.

Retirement planning had become her new side hustle and financial calculators became her new best friends.

She researched several investment options, considered early retirement possibilities, and even enrolled in online courses on sustainable living.

It was numbers and crunching, that would eventually enable a future filled with purpose, passion, and maybe even a little adventure.

The journey was as important as the destination, and Samantha, with a spark in her mind and a notebook in hand, was determined to reach her retirement goals.

What Is Retirement Planning?

Picture yourself laying on a hammock on a lazy afternoon in your garden, free from the daily grind. Retirement planning is all about making that picture a reality.

It’s like packing a picnic basket. Just as you want your picnics to be worry-free by being ready with everything in your basket, the same goes with retirement planning.

Just like estimating how much food you’ll need, pack delicious options for the picnic, similarly, you do need to figure out how much money you’ll need during retirement years, right?

So in retirement planning, you explore savings options and make wise investment choices today to ensure a comfortable tomorrow.

It’s not overwhelming, just a smart and conscious way to prepare for a worry-free tomorrow.

What Are Retirement Planning Calculators?

Retirement planning calculators are online tools or software programs designed to help individuals estimate how much money they need to save for retirement and how various factors such as savings rate, investment returns, retirement age, and life expectancy can impact their retirement savings goals.

These calculators typically consider factors such as current age, desired retirement age, current savings, expected rate of return on investments, expected inflation rate, and projected expenses in retirement.

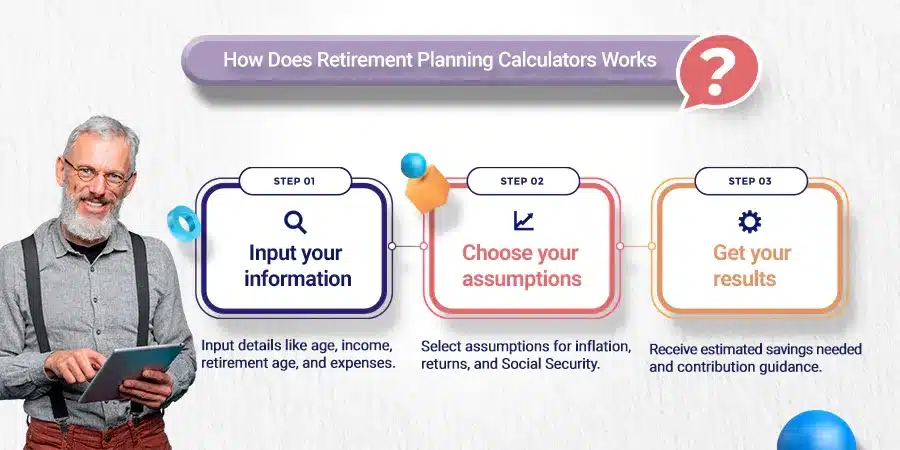

Here's How Best Online Retirement Income Calculator Work

- Input your information: You’ll need to enter details like your current age, annual income, desired retirement age, and expected retirement expenses. Some best retirement calculators may also ask for information about your current savings, investments, and debts.

- Choose your assumptions: You can usually specify assumptions about inflation, investment returns, and Social Security benefits. These assumptions will affect the calculator’s output.

- Get your results: The calculator will estimate the amount of money you’ll need to save to reach your retirement goals. It may also provide information about how much you need to save each month or year.

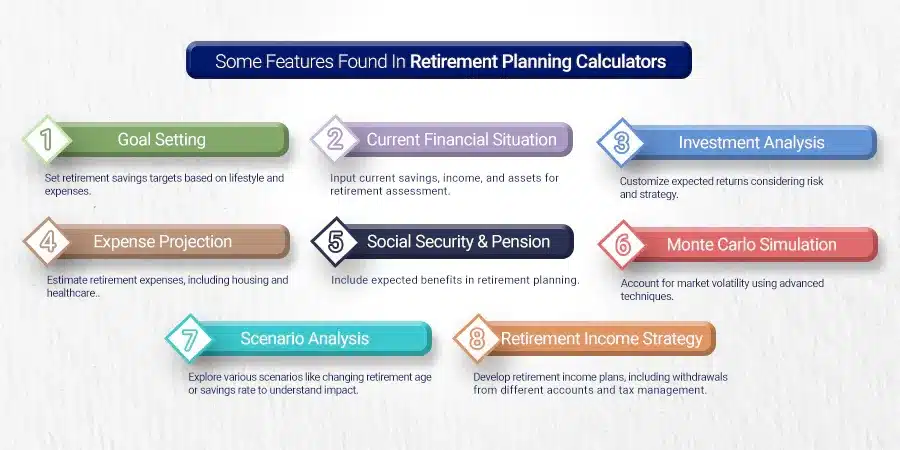

Common Features Found In Retirement Planning Calculators

- Goal Setting: Users can set their retirement savings goals based on their desired retirement lifestyle and expected expenses.

- Current Financial Situation: Users input their current savings, income, and other financial information to assess their current retirement readiness.

- Investment Analysis: Online retirement calculators often allow users to input their expected rate of return on investments and adjust it based on their risk tolerance and investment strategy.

- Expense Projection: Users can estimate their future expenses in retirement, including housing, healthcare, and other living expenses.

- Social Security and Pension: Some calculators allow users to include expected Social Security benefits or pension income into their retirement plan.

- Monte Carlo Simulation: Advanced calculators may use Monte Carlo simulation techniques to account for market volatility and provide a range of possible retirement outcomes.

- Scenario Analysis: Users can explore different scenarios, such as changing the retirement age or savings rate, to see how it affects their retirement plan.

- Retirement Income Strategy: Online calculators may help users develop a retirement income strategy, including options for withdrawing from different types of retirement accounts (e.g., 401(k), IRA) and managing tax implications.

Benefits Of Using Retirement Planning Calculators:

- Get a starting point: Calculators can help you get a general idea of how much you need to save for retirement. This can help set realistic goals and develop a savings plan.

- Compare different scenarios: You can use calculators to compare different retirement scenarios, such as retiring earlier or later, or spending more or less in retirement. This can help you make informed decisions about your retirement savings.

- Track your progress: Some calculators allow you to track your progress over time. This can help you stay motivated and on track with your retirement goals.

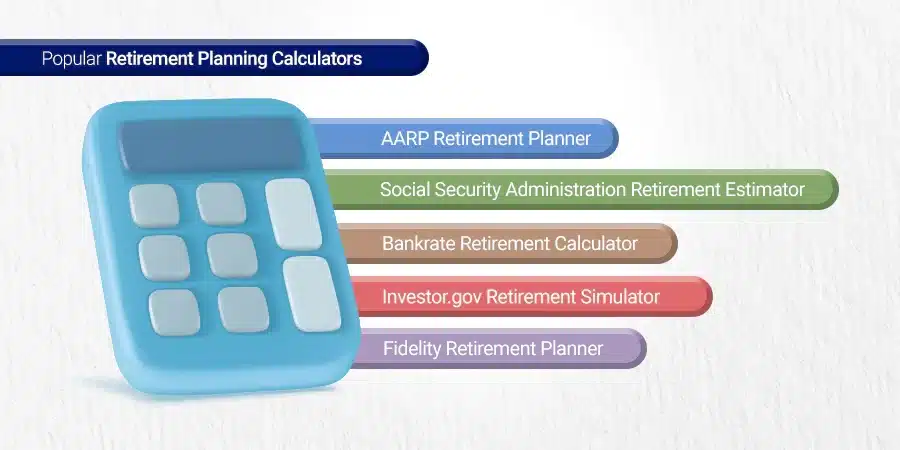

Popular Retirement Planning Calculators

Retirement planning calculators can be daunting, but they don’t have to be! Here’s a breakdown of some popular options and how they can help you:

AARP Retirement Planner:

Key proposition: Comprehensive retirement planning with interactive tools.

Features: Estimates retirement income, expenses, and savings needs. Tracks progress over time. Offers educational material and personalized advice facility is available.

Benefits: User-friendly interface, multi-faceted approach, relevant resources available on one go

Drawbacks: Requires AARP membership, which may be overwhelming and cost-bearing for beginners.

Social Security Administration Retirement Estimator:

Key proposition: Calculates Social Security benefits, can avail Social Security statements

Features: Calculates estimated monthly benefits based on your work history and earnings.

Benefits: Simple and official source for Social Security information.

Drawbacks: Limited functionality, doesn’t consider other retirement income sources.

Bankrate Retirement Calculator:

Key proposition: Flexibility and customization.

Features: Allows for comparing different retirement scenarios, including early retirement and varying expenses. Provides historical market data for guided assumptions.

Benefits: Great customization features, good for exploring different possibilities.

Drawbacks: Can be tricky to use for beginners, and requires careful input of assumptions.

Investor.gov Retirement Simulator:

Key proposition: Educational tool with interactive simulations.

Features: Simulates retirement income and expenses based on various investment strategies and market conditions. Offers educational resources and interactive tutorials.

Benefits: Great for learning about investment strategies and their impact, good for visualizing multiple scenarios.

Drawbacks: Can be time-consuming to explore different options, and calls for basic investment understanding

Fidelity Retirement Planner:

Focus: Detailed planning and professional guidance are available

Features: Analysis of facets of your retirement picture, including Social Security, pensions, and investments. Offers personalized recommendations from Fidelity advisors.

Benefits: In-depth analysis, professional advice, good for complex situations.

Drawbacks: Requires creating a Fidelity account, which may not be suitable for everyone.

Remember:

- No single calculator can answer it all. You will have to work on multiple calculators to understand different scenarios. Choose the one that aligns with you the most

- Treat results as estimates and not the final truth. Consider your specific circumstances, both known and unknown to surface around. Gauge the impact of these scenarios. Consult a financial advisor for personalized advice.

- Start early and as life is uncertain adjust your plan as needed. Retirement should be a journey of consistent and disciplined savings. It’s not a one-day cash stash have an open mind to adapt as your life changes.

Parting Thoughts

These retirement calculators available online are popular choices among individuals looking to assess their retirement readiness, understand how much to save, and develop ways to achieve financial security in retirement.

Users of it should keep in mind that these tools provide estimates based on various assumptions and may not factor in for all individual circumstances.

Hence one should use them as a starting point and largely for guidance. Once you get the entire concept, adjust it based on your financial goals and situations.

For retirement to be fruitful, the earlier one starts, the better.