Are you worried about how to prepare for a comfortable retirement? It’s an understandable concern, given that the average American retiree spends about 20 years in retirement. This blog post is your ultimate guide; we’ve got a step-by-step breakdown of what you need to do today to ensure you can rest easy tomorrow.

Ready to secure your future? Dive in!

Key takeaways

● Learn about your money. Know what you have and owe. This helps in planning for retirement.

● Get rid of debt before you retire. It makes life easy later.

● Start saving now in a retirement account like a 401(k) or traditional individual retirement account(IRA) to prepare for full retirement age.

● Use all the help from your job, like matching funds in your 401(k), to save even more money.

● Think about how you want to live when retired. This will guide where and how much you need to save.

● Figure out new costs that might come up after retiring, such as health matters or travel plans.

● Keep track of different investments to grow wealth safely over time without losing it all if one fails.

● Understand that social security administration benefits pay only some part of living expenses during retirement years but are helpful nonetheless.

● Make sure tax planning is part of an overall retirement plan so less cash goes toward income taxes while more is left for personal needs.

Steps to Start Preparing for Retirement

Begin your journey to retirement by first understanding your current financial situation. Make an effort to pay off any outstanding debts as these can be a hurdle in your planning process.

Prioritize contributing to a retirement account such as IRAs or 401(k) plans, especially if your employer offers a match contribution. Lastly, envision the type of lifestyle you want during retirement, this will help guide all other decisions when it comes to saving and preparing for that phase of life.

Understand Your Financial Situation

You need to know what money you have now. Look at your bank accounts and any savings. Write down how much you owe on your credit cards or house. Figure out how much cash goes into your pocket every month from your job or other places.

Track where each dollar is spent, such as for food, travel, fun things, or bills. This will show where you could cut costs if needed. Seeing all this money stuff in one place can be very helpful in planning for retirement life.

Pay Off Outstanding Debts

Getting rid of debts must be a part of your retirement planning. This step is crucial. Large credit card balances and home mortgage payments can cause stress during retirement. You need to set a goal to pay off these debts before you retire.

Make sure you work on loan payments as well. Paying them off reduces your monthly expenses in retirement. Having less debt means having less financial stress during retirement. Do this and you are one step closer to being ready for a happy, worry-free life after work!

Contribute to a Retirement Account

Start saving in a retirement account right now. This is a key part of getting ready for retirement. Think about doing it if you are not already. Try to put as much money as you can into your retirement account.

The law lets people who are 50 or older save even more money. It’s called catch-up contributions. You can get the most out of your savings when you do this. Keep an eye on all your accounts too! Put them together and look at your choices often to make sure you’re making the best decisions.

Take Advantage of Employer Match for 401(k) Plan

Your boss can help you save for retirement. Many jobs offer a 401(k) plan. You put money in, and your boss might add some too. This is called an employer match. If your job gives this to you, make sure to use it! It’s a smart way to grow your savings fast for when you retire.

Don’t miss out on free money from your employer that will help secure your future days of rest and fun after your work life ends!

Envision Your Retirement Lifestyle

Think about how you want to live when you retire. Do you see yourself living near the beach? Or maybe in a big city? Picture what kind of home you want to have. Maybe it’s a condo or perhaps a small house.

Consider if travel is part of your plans. You might dream of taking trips around the world! Also, think about what hobbies and activities you’ll enjoy. Fishing, golfing, volunteering – there are so many ways to spend your time! Understanding your retirement lifestyle now will help prepare for it better later on.

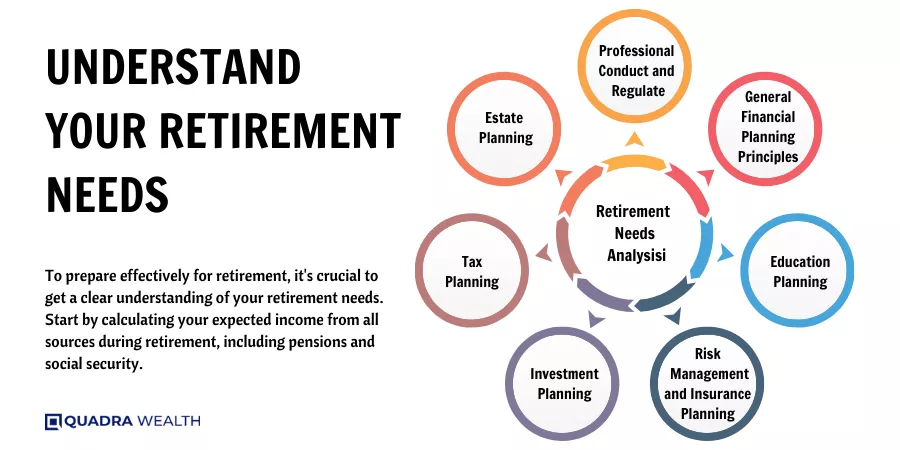

Understand Your Retirement Needs

To prepare effectively for retirement, it’s crucial to get a clear understanding of your retirement needs. Start by calculating your expected income from all sources during retirement, including pensions and social security.

Next, estimate the expenses you’ll likely face in retirement – remember not just day-to-day living costs but also discretionary expenses like travel or hobbies. Consider any potential medical costs in your forecast too; future healthcare is often underestimated yet can be a significant part of retirement budgeting.

All these steps will help you visualize what financial resources you need to maintain your desired lifestyle after retiring.

Calculate Your Expected Retirement Income

Knowing your retirement income is key. Here are steps to figure it out:

- Gather all your data. Take note of all your sources of money for later years.

- Put Social Security in the mix. Many people get this help when they retire.

- Add pension plans if you have any. Some jobs still offer this old-style benefit.

- Don’t forget your 401(k) or IRA accounts. These savings will play a big part.

- Think about other assets too, like a home or business you could sell.

Estimate Your Retirement Expenses

Planning for future expenses is a key step in retirement readiness.

- Focus on your current monthly costs. This gives a clear picture of where money goes right now.

- Look at each expense and ask if it will be there when you retire. Examples might include your home mortgage or loan payment.

- Think about new costs that might come up after retiring, such as healthcare needs.

- Factor in inflation over time, as this can raise your living costs.

- Use financial apps or websites to help figure out future expenses.

- Talk with retirees to learn from their experiences and get real-life examples of retirement costs.

- Adjust for changes in income, like Social Security benefits or funds from retirement accounts.

- Plan for unexpected costs by having some savings set aside just in case.

- Review this estimate yearly to keep it accurate and useful.

Consider Future Medical Costs

You need to think about medical costs in retirement. As you get older, health problems may arise. Your healthcare bills could be high. You should plan for these costs now. Look at your current expenses and cut what you can.

This gives you more money to save for future health needs. Also, it’s smart to bring together all your retirement accounts and look at their payout choices and rollover options. Think about the type of life you want when retired, this includes your health needs too! And finally, imagine how much money you might need for these medical costs and make sure that money is available in the future.

Financial Strategies for Retirement

Implement a variety of financial strategies for your retirement. Start by diversifying your investments to reduce risk and increase potential returns. Understand the roles Social Security benefits play in your retirement income, ensuring you’re optimizing these benefits.

Pay attention to Required Minimum Distributions from certain retirement accounts after reaching age 72 to avoid hefty penalties. Finally, strive to optimize the after-tax rate of investment returns, considering tax planning as part of your overall strategy.

Diversify Investments

Spreading your money in different places is called diversifying investments. This step keeps your retirement savings safe. Stocks, bonds, mutual funds, and other assets are good to consider.

If you are young, taking more investment risk can help grow your wealth faster. But if retirement is near, aim for safer options. Review your retirement plan often and shift things around when needed.

Understand Social Security Benefits

They are a key part of retirement. They give you money each month. This helps pay for things like food, housing, and health care. However, these benefits may not cover all costs in retirement.

You need to know how much you will get from Social Security. This is based on what you earned during your working years. It’s good to have other savings too, so that your Social Security checks aren’t your only income in retirement.

Consider Required Minimum Distributions

You must take money from your retirement accounts every year. This is called a Required Minimum Distribution (RMD). Start these when you become 72 years old. Not taking out the right amount can lead to high taxes.

It’s wise to plan ahead and be ready for this part of retirement.

Optimize After-Tax Rate of Investment Returns

To make the most of your money, focus on after-tax returns. After-tax return is what you keep after paying taxes. It’s a key part of planning for retirement. You can raise this rate by using tax-efficient strategies.

Tax-sheltered accounts like 401(k)s and IRAs are great tools.

Choose smartly when to withdraw from these accounts too. Take out money in lower-income years to save on taxes. If you do so, you will have less tax to pay and more cash left for your needs.

Retirement Lifestyle Considerations

When preparing for retirement, it’s essential to evaluate your current living situation and consider options like downsizing. Part-time work or side jobs can provide additional income and keep you active in your community.

Finalize a vision that outlines the lifestyle you want during retirement – this will help guide financial decisions and strategies suitable for achieving those retirement goals.

Evaluate Your Living Situation

Think about where you want to live when you retire. It plays a big part in how much money you’ll need. You might choose to move to a smaller house or even a different city, which can lower your costs.

Or, if you like where you live now, find ways to cut back on other things so you can stay there.

Consider Part-Time Work or Side Jobs

Think about getting a part-time job or doing side work after you retire. This can bring in extra money. You might even find new things you enjoy doing. It will not only help to build your bank balance but also keep you active and busy.

Having a job to do can also make life more fun for many people when they stop working full-time. Work does not have to feel like work if it’s something you love!

Finalize Your Vision for Retirement

Retirement is a new start. It needs good plans. Make sure you have enough money saved. Enjoy your golden years with peace of mind. If you are serious about your retirement, then reach out to a financial advisor/ financial planner to set a roadmap for you. Your dream can come true if planned well ahead of time!

Conclusion

Knock-out options can be strong tools in investments. They protect against large price swings and manage risks better. Yet, these options also limit how much money you can make. So, understanding them well is very important before using them for investing money.

FAQs

The first step to prepare for retirement is shaking off financial fear and starting with a quick assessment of your net worth, then making plans on how to grow it.

You can set your financial goals by using tools like a personal retirement calculator or an IRA selector tool, which helps you plan your investment strategy based on risk tolerance and investment horizon.

Healthcare costs are key in planning since they rise during retirement age; thus, considering Medicare or long-term care insurance and having health savings accounts may be necessary steps.

Yes! Small businesses can use resources such as Merrill Edge Self-Directed, Merrill Guided Investing or consult advisors at Bank of America Corporation to establish their own business’s retirement plans.

You should aim to live a debt-free life in retirement so that all investments and other income sources go towards maintaining a a lifestyle rather than paying off debts like credit card bills or loans.

Not necessarily! Some people choose part-time jobs after their full-time career ends, while others might opt for remote jobs – both these options allow retirees to to maintain activity levels while also adding some extra funds to their retirement savings.