Stagflation can wreak havoc on your investment portfolio, putting your hard-earned assets at risk. Did you know during stagflation traditional investments like stocks and bonds often devalue?

This blog post is designed to guide you on the smartest investment choices during such an economic downturn.

Continue reading for insights that could potentially safeguard your financial future.

Key takeaways

●Stagflation can negatively impact traditional investments like stocks and bonds, making it important to consider alternative investment options.

●Value stocks, real estate, commodities like gold and silver, and even cryptocurrency are recommended investments during stagflation as they have the potential for growth and stability.

●Investing in a Gold IRA can provide tax advantages and protection against inflation during stagflation.

●It's important to diversify your portfolio with different types of investments to reduce stagflation risk and maximize potential returns.

What Are The Best Investments During Stagflation

Stagflation is a tough economic time. It occurs when high inflation and high unemployment come together with slow financial growth.

In these times, commodity prices of things we buy may go up while most people don’t get more money.

At the same time, many people lose their jobs.

This harsh mix can hurt your free cash flow and assets. Most traditional ways to grow money like stocks, bonds or just keeping cash may fail during stagflation periods.

These usual ways may lose value because of fast-rising prices coupled with sluggish growth in business profits.

Effects of Stagflation on Investments

Stagflation is tough on your money. The value of cash drops from high inflation. Stocks and bonds tend to outperform poorly too.

People are less likely to buy things, leading to low company revenue.

This often results in a fall in stock values. Bonds are also unsafe because their fixed returns lose value with the rising price.

Families who earn a set income each month suffer the most as they need more money for basic things like food or rent due to higher costs.

Ideal Investments During Stagflation

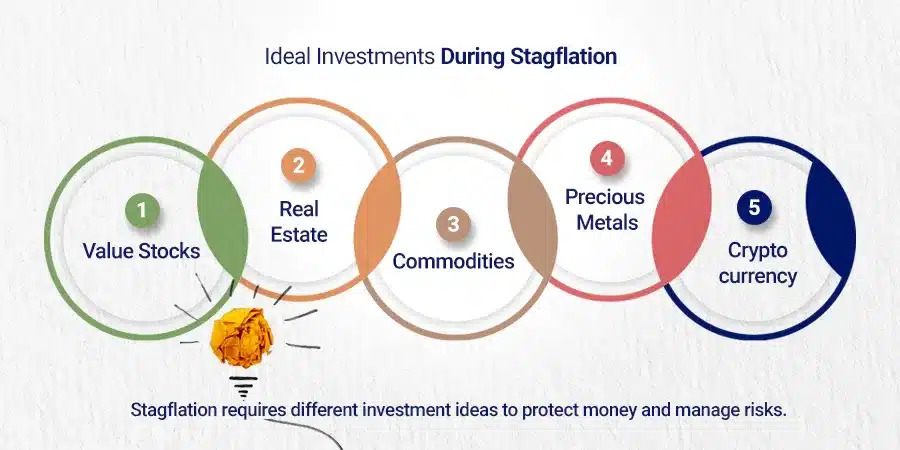

During stagflation, value stocks, real estate, commodities, precious metals, and cryptocurrency are among the ideal investments.

Find out why these assets can help protect your portfolio in turbulent times.

Read more to make the right investment decisions during stagflation.

Value Stocks

Value stocks are a good buy during stagflation. These are shares in firms that trade for less than their book values. In other words, they’re cheap compared to the worth of the company’s real assets.

Investors can gain from value stocks when the economy gets better after a recession. Value stocks may rise faster than other types of investments at this time. They offer an opportunity for growth and profit in times of economic recovery.

Real Estate

Owning a home or land is smart during stagflation. Real estate investments often do better than both stocks and bonds. A house with a fixed-rate mortgage can help fight off the harm of rising prices.

This type of loan keeps your payments the same, even if costs go up. Plus, as prices rise, so does the value of your home! You build more wealth in your property this way.

So, putting money into real estate is a solid plan when faced with stagflation.

Commodities

During stagflation, commodities can be a smart investment choice to help maintain the value of your assets. Specifically, industrial commodities like oil and copper tend to perform well in inflationary environments.

Commodities can be pretty “hit or miss” during stagflation. However, oil prices and agricultural commodities tend to be stronger than government bond yields, corporate bonds, and stocks in a stagflationary environment.

As the prices of basic goods rise during stagflation, demand for these industrial commodities usually increases as well. This can lead to higher profits for investors who have exposure to these types of commodities.

Additionally, monetary commodities like gold and bitcoin also have a correlation with inflation during stagflationary periods. These precious metals are often seen as safe-haven investments and their value tends to rise when there is economic uncertainty or high inflation.

Precious Metals

Investing in precious metals, like gold and silver, can be a smart move during stagflation. Precious metals are often seen as a safe haven investment during times of financial uncertainty.

When the economy is experiencing high inflation and stagnant growth, precious metals tend to hold their value or even appreciate. Gold, in particular, is known for its stability and can act as a hedge against a weak dollar.

Many investors choose to invest in gold through a Gold IRA (Individual Retirement Account). This type of account offers tax advantages and provides a structured approach to investing in gold.

So, if you’re looking for an investment option that can weather the storm of stagflation, consider adding precious metals to your portfolio.

Cryptocurrency

Cryptocurrency is considered the best investment for stagflation. Stagflation is a period when inflation is high along with a recession or depression.

Traditional investments like stocks, bonds, and cash tend to lose value during stagflation.

Cryptocurrencies, on the other hand, are decentralized digital crypto that are not controlled by any government or central authority.

They offer a potential hedge against traditional financial systems and can provide opportunities for growth even in challenging economic times like stagflation.

However, it’s important to note that investing in cryptocurrencies can be risky and volatile, so it’s crucial to do thorough research and consult with a financial advisor before making any investment decisions.

Why Precious Metals are Recommended During Stagflation

During stagflation, when the economy is facing a combination of high inflation and economic stagnation, traditional investments like stocks and bonds tend to lose value.

That’s why investing in precious metals like gold and silver is recommended during this period. Precious metals have historically retained their value and even appreciated during times of economic uncertainty.

This makes them a safe haven for investors looking to preserve their wealth. In addition, precious metals are tangible assets that can be physically stored, providing a sense of security during turbulent economic times.

So, if you’re concerned about protecting your investments during stagflation, adding some precious metals to your portfolio could be a smart move.

Gold IRA: A Good Investment During Stagflation?

Investing in a Gold IRA is considered a good choice during stagflation. It’s recommended to invest in precious metals, especially gold, during this economic situation.

A Gold IRA allows you to have direct control over your assets and more options for buying and selling gold. Plus, it offers tax advantages while the value of your assets grows.

Working through a reputable Gold IRA company ensures that you’ll have no trouble finding buyers when you decide to sell your metals.

So, if you’re concerned about protecting your investments during stagflation, consider investing in a Gold IRA.

Pros and Cons of Directly Buying Precious Metals

Investing in precious metals like gold directly can offer many advantages, yet it also carries its own set of drawbacks. Understanding these pros and cons can help in making a sound decision.

- Control Over Assets: Buying precious metals directly gives investors total control of their assets. They can decide when to buy or sell with complete autonomy.

- More Options: There are more options for buying and selling when you buy precious metals directly. Investors can buy from a variety of sources and sell to willing buyers at market prices.

- Diversification: Precious metals can diversify an investment portfolio, acting as a hedge against stagflation.

- Storage Issues: Directly bought precious metals need secure storage, which can be an issue for many investors. There might be additional costs for secure storage facilities.

- Locating Buyers: Unlike a Gold IRA, selling directly bought metals might require finding a buyer, which can be challenging at times.

- Price Fluctuations: The prices of precious metals can fluctuate, potentially leading to financial losses.

Pros and Cons of Investing in Gold IRAs

Investing in Gold IRAs can have its own set of advantages and disadvantages. It is essential to weigh these pros and cons before making an investment decision.

- Gold IRAs offer a hedge against inflation and currency devaluation, which is beneficial during stagflation.

- The value of gold tends to rise during times of economic uncertainty, potentially increasing the value of your Gold IRA.

- Investing in a Gold IRA can provide tax advantages, thanks to its structure.

- A Gold IRA can add diversification to your retirement portfolio, reducing the risk of loss during stagflation.

- Gold IRAs often have higher fees than traditional IRAs, including setup fees, storage fees, and insurance costs.

- The price of gold can be volatile and may fluctuate drastically, affecting the value of your Gold IRA.

- There can be severe penalties for early withdrawals from Gold IRAs, making it less liquid than other investment options.

- Not all types of gold are allowed in a Gold IRA, limiting your options for investment.

It’s important to note that traditional investment strategies like stocks, bonds, and cash often lose value during stagflation. Hence the appeal of Gold IRAs is that they offer a structured approach to investing in gold and are typically less impacted by stagflation.

Other Considerations When Investing in Gold

Consider these important factors when investing in gold:

- Gold storage: Determine how and where you plan to store your gold. Options include a safe at home, a safety deposit box at a bank, or using a trusted custodian.

- Accessibility: Ensure that you can easily access your gold when needed. Consider the convenience and costs associated with buying, selling, and storing gold.

- Authenticity: Be cautious of counterfeit gold coins or bars. Work with reputable dealers and verify the authenticity of the gold you are purchasing.

- Insurance: Protect your investment by considering insurance coverage for your gold. This can provide financial security in case of theft or damage.

- Market conditions: Stay informed about emerging markets and fluctuations in the price of gold. Monitor global events, economic indicators, and inflation rates to make informed investment decisions.

- Diversification: Remember that while owning physical gold can be beneficial during stagflation, it’s important to diversify your portfolio with other investments as well. This reduces stagflation risk and maximizes potential returns.

- Investing in real estate can help combat asset devaluation during stagflation.

- Commodities trading, especially in industrial commodities like oil and copper, can maintain asset value during stagflation.

- Gold and other precious metals are recommended investments during stagflation as they tend to remain stable during financial uncertainty and can appreciate in value during a weak dollar.

1. Strategies for Beating Stagflation - Short Selling: Take advantage of declining stock prices by betting against companies you believe will lose value. This can potentially generate profits even during a market downturn.

- Diversification: Spread your investments across different asset classes to reduce risk. Consider investing in a mix of stocks, bonds, real estate, and commodities to balance your portfolio.

- Value Stocks: Look for undervalued companies with strong fundamentals. These stocks tend to perform well when the economy recovers after a recession. You have to make sure you’re not falling into a trap by assuming stagflation stocks are undervalued when they’re not.

- Defensive Stocks: Invest in companies that provide essential goods and services, such as those in the consumer staples or healthcare sectors. These sectors are less affected by economic downturns.

- Gold and Other Precious Metals: Allocate a portion of your portfolio to gold and other precious metals. These assets tend to hold their value during times of financial uncertainty.

- Bonds: Consider investing in government bonds or high-quality corporate bonds. These fixed-income securities can provide stability and income during stagflation.

- Traditional investment strategies like stocks, bonds, and cash tend to lose value during stagflation.

- Retirement accounts such as IRAs are also at risk of losing value during stagflation.

- Investing in real estate can help combat asset devaluation during stagflation.

- Commodities trading, especially in industrial commodities like oil and copper, can maintain asset value during stagflation.

- Gold and other precious metals are recommended investments during stagflation as they tend to remain stable during financial uncertainty and can appreciate in value during a weak dollar.

Strategies for Beating Stagflation

Investors can implement short selling and diversification as effective strategies for beating stagflation.

Short Selling

Short selling is a strategy used to make money when the value of a stock or other asset decreases. During stagflation, where the economy experiences both inflation and stagnant growth, short selling can be an effective way to beat the negative effects on investments.

By borrowing stocks and then selling them at a high price before buying them back at a lower price, investors can profit from falling prices. This strategy allows investors to take advantage of declining markets and protect their portfolios from losses during periods of economic uncertainty.

However, it’s important to note that short selling carries risks and should only be undertaken by experienced investors who understand the potential downsides.

Diversification

Diversification is an important strategy to consider during stagflation. By diversifying your investments, you spread out your risks and reduce the impact of any one asset performing poorly.

This means investing in a mix of different types of assets, such as stocks, real estate, commodities like gold and silver, and even cryptocurrency.

Diversification helps protect your portfolio from potential devaluation that can occur during stagflation.

It allows you to take advantage of opportunities in different sectors or industries that may perform well despite the challenging economic conditions. Diversification is a way to help safeguard your investments and increase the likelihood of achieving better returns over time.

How to Protect Your Investments During Stagflation

During stagflation, it’s important to protect your investments. Traditional strategies may not work well during this economic period. One way to protect your investments is by buying real estate, as it can help prevent asset devaluation.

Another strategy is commodities trading, which can maintain the value of your assets. Investing in value stocks can provide growth opportunities after the recession.

It’s also recommended to invest during stagflation in precious metals like gold, as they tend to hold their value during stagflation.

However, cash and bonds are not ideal investments during this time because their yields are often lower than inflation levels.

Frequently Asked Questions

What happens during a stagflation? Is stagflation worse than a recession? Is it good to buy a house during stagflation? What assets do well during stagflation?

What happens during stagflation?

Stagflation is a challenging economic situation that occurs when there is high inflation at the same time as a recession. It can lead to lower income levels, increased unemployment, and less spending by consumers.

During stagflation, the value of stocks, bonds, and cash tends to decline. This means that traditional investment strategies may not work well during this time. Individuals’ purchasing power also decreases because prices rise faster than wages.

Stagflation requires investors to consider alternative options for protecting and growing their money.

Is stagflation worse than a recession?

Stagflation is a condition where there is high inflation during a recession or depression. It’s not just one or the other, but both happening at the same time.

Stagflation can be worse than a normal recession because it causes incomes to decrease, unemployment to rise, and consumer demand to decline.

This means people have less money supply and their purchasing power goes down. Traditional investment strategies may not work well during stagflation, so it’s important to be aware of this economic situation and adapt your investments accordingly.

Is it good to buy a house during stagflation?

During stagflation, buying a house can be a good investment strategy. This is because real estate tends to hold its value better during periods of inflation and economic instability.

While other traditional investments like stocks and bonds may lose value, owning property provides a tangible asset that can serve as a hedge against inflation.

Additionally, low mortgage interest rates during stagflation can make homeownership more affordable and attractive for buyers.

It’s important to consider factors such as location, market conditions, and long-term goals when deciding whether to buy a house during stagflation.

What assets do well during stagflation?

During stagflation, certain assets tend to perform well. These include real estate and commodities like oil and gold.

Real estate can help preserve the value of investments during economic uncertainty, while commodities often see increased demand as a hedge against inflation expectations.

Precious metals like gold are also recommended during stagflation because they tend to remain stable in times of financial turmoil.

Diversifying your portfolio with these assets can help mitigate the impact of stagflation on your investments.

Conclusion

In conclusion, when it comes to the best investments during stagflation, some options to consider are value stock, real estate, commodities like gold and silver, and even cryptocurrency.

Precious metals like gold can be particularly helpful during this time as they tend to remain stable and have the potential for appreciation.

It’s important to diversify your investment portfolios and consider strategies like short selling to protect your investments during stagflation.

Overall, being proactive and staying informed about market trends can help you make smart investment decisions in a challenging economic environment.

FAQs

During stagflation, a solid strategy may include cash and cash equivalents, growth stocks, direct purchases of gold, and investments in the consumer staples sector.

Investing in gold can be a safe move when there’s an economic slowdown. A Gold IRA company can help. But beware of Gold IRA scams.

Asset allocation helps balance risk assets and rewards by spreading your money across different kinds of investments like stocks, bonds, or mutual funds to meet investment needs and goals.

Stagflations are usually hard on both bond market and stock markets due to slow economic growth coupled with rising consumer prices which impact companies’ expenses negatively.

The key factor lies not only in conservatively investing but also in concentrating on sectors that potentially have higher resilience against negative impacts from events like the COVID-19 pandemic or high energy prices causing inflationary periods.

Yes! Events such as the war in Ukraine or changes in housing prices due to shifts in mortgage rates could greatly change the landscape for investors; thus it’s important to account for global economy issues in your best stagflation investing strategy.