Structured products play a key role in risk management strategies, offering a range of benefits to investors and businesses.

In this comprehensive analysis, we will explore the benefits, types, and potential risks of structured products for risk management.

Structured products are structured investment instruments designed to meet specific risk-return objectives by bundling different financial derivatives into a single product.

Risk management, on the other hand, involves identifying, assessing, and implementing strategies to mitigate potential risks, ensuring the stability and profitability of an investment portfolio or business.

The role of structured products in risk management is significant.

They provide investors with an array of risk management strategies, such as hedging against market volatility, managing interest rate risk, or protecting against currency fluctuations.

By utilizing structured products, investors can tailor their risk exposure to align with their specific investment goals and risk appetite.

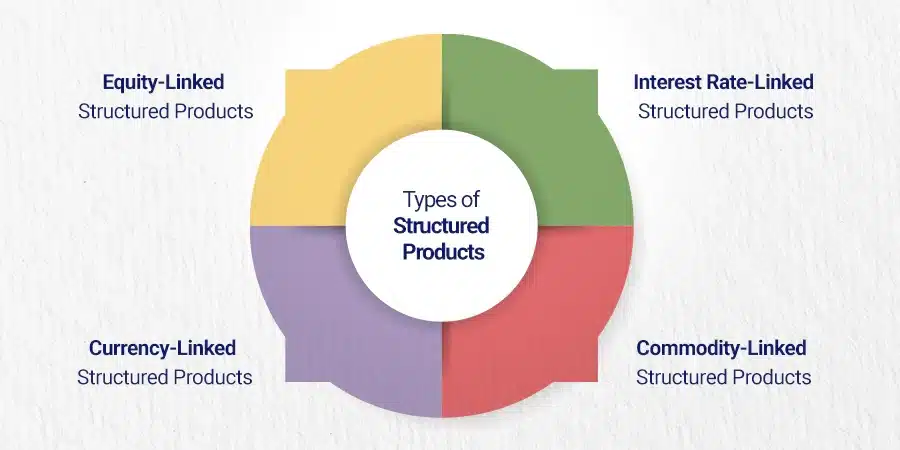

There are various types of structured products available, including equity-linked structured products, interest rate-linked structured products, currency-linked structured products, and commodity-linked structured products.

Each type offers distinct features and benefits, allowing investors to diversify their investment portfolios and access opportunities in different markets.

The benefits of structured products for risk management are numerous.

They enable enhanced risk management strategies by providing tailored solutions to specific risks. structured products facilitate improved portfolio diversification, offering exposure to different asset classes and geographical regions.

They also offer enhanced yield opportunities compared to traditional investments, allowing investors to potentially generate higher returns.

However, it is crucial to acknowledge the potential risks and challenges associated with structured products.

Market risk, liquidity risk, counterparty risk, credit risk, and the complexity and lack of transparency of some structured products can pose challenges for investors.

Understanding these risks and conducting thorough due diligence is essential before incorporating structured products into risk management strategies.

What are Structured Products?

Structured products are financial instruments that are created by combining different financial assets, such as bonds, stocks, mutual funds, and derivatives, into a single product.

These products are designed to provide investors with specific risk-return profiles and investment strategies to suit their needs. With structured products, investors can gain exposure to different assets, such as equities, interest rates, foreign currencies, and commodities, without directly owning these assets.

They can also benefit from customized risk management strategies, enhanced portfolio diversification, and tailored risk exposure.

The aim of structured products is to provide investors with the opportunity to achieve their investment objectives while managing their risk exposure effectively.

By incorporating options or other derivatives, structured products can offer downside protection or enhanced yield opportunities. It is important for investors to fully understand the features and risks associated with structured products before investing.

Market risk, liquidity risk, counterparty risk, and complexity are some of the potential risks that investors should consider. It is essential to carefully evaluate the benefits and risks of structured products and consider how they fit into an overall risk management strategy.

Pro-tip: When considering structured products, it is advisable to consult with a professional financial advisor who can provide guidance based on your specific investment goals and risk tolerance.

What is Risk Management?

Risk management is the process of identifying, assessing, and prioritizing risks in order to minimize or mitigate the negative impact they can have on an organization or individual.

It involves analyzing potential risks, developing strategies to deal with them, and implementing measures to prevent or minimize their occurrence.

In risk management, it is important to prioritize risks based on their likelihood and potential impact. This helps in allocating resources and developing effective risk mitigation strategies.

By identifying and addressing risks in a proactive manner, organizations can minimize financial losses, protect their reputation, and ensure the continuity of their operations.

Effective risk management requires a thorough understanding of the specific risks faced by an organization or individual, as well as the ability to monitor and adapt to changing circumstances.

It involves gathering and analyzing relevant data, conducting risk assessments, and implementing risk control measures. Regular review and evaluation of risk management processes are also essential to ensure their continued effectiveness.

By implementing risk management practices, organizations can make informed decisions, effectively allocate resources, and safeguard their interests.

It allows for proactive planning and preparation, enabling businesses to navigate an uncertain financial situation and respond effectively to potential threats.

The Role of Structured Products in Risk Management

Structured products play a vital and indispensable role in risk management by offering a diverse range of strategies and tools.

These products assist investors in safeguarding their investments and minimizing potential losses.

One of the principal functions of structured products is to provide downside protection, allowing investors to limit their exposure to market volatility.

These products ingeniously combine different financial instruments to create a personalized solution that aligns with the investor’s risk tolerance and objectives.

Furthermore, structured products can be tailored to suit specific market conditions and present the potential for elevated returns.

Moreover, structured products provide investors with the opportunity to diversify their portfolios by spreading risk across various assets.

By investing in different structured products, investors can effectively manage risk and reduce their reliance on any single investment.

In addition, structured products offer investors access to an underlying asset, including equities, bonds, commodities, and currencies.

This empowers investors to customize their risk management strategies in response to specific market conditions and opportunities.

A noteworthy fact from the Global Structured Products Association report states that the global market for structured products attained a significant performance value of $10.75 trillion in 2020.

This figure reflects the growing importance of these products in risk management strategies.

How do Structured Products Help Manage Risk?

Structured products help manage risk by offering enhanced risk management strategies. By combining various underlying assets or derivatives, structured products allow investors to create customized risk profiles that align with their specific investment goals.

For example, investors can use structured products to protect against market downturns or to enhance potential returns in a specific market condition.

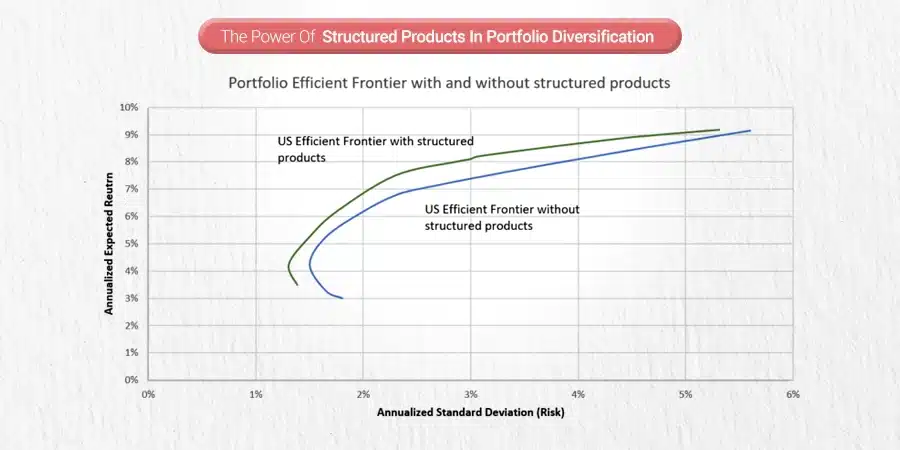

In addition, structured products contribute to improved portfolio diversification.

By investing in a variety of underlying assets or derivatives, investors can reduce the correlation between different components of their portfolios.

This diversification helps spread the risk across different asset classes, reducing the potential impact of a single investment on the overall portfolio performance.

Furthermore, structured products provide tailored risk exposure. Investors have the flexibility to choose structured products based on their risk appetite and investment objectives.

They can select products that offer specific risk-reward profiles, such as capital protection or enhanced yield opportunities. This allows investors to align their investments with their desired level of risk exposure.

Benefits of Using Structured Products for Risk Management

By utilizing structured products for risk management, investors can experience several advantages. These products offer a range of customizable features and structures, allowing investors to tailor their risk exposure according to their specific needs and risk appetite.

This can help mitigate potential losses and enhance risk management strategies. One key advantage of structured products is improved portfolio diversification.

These products offer a wide variety of underlying assets, such as stocks, bonds, currencies, or commodities. By investing in different types of structured products, investors can diversify their portfolios and spread their investments across various market sectors, reducing the overall risk.

Furthermore, structured products provide investors with the opportunity to have tailored risk exposure. They offer different risk profiles and payoffs, enabling investors to select products that align with their investment goals and risk tolerance.

This allows investors to choose the level of risk they are comfortable with and design their investment strategies accordingly. Another advantage of utilizing structured products is the potential for enhanced yield opportunities.

Compared to traditional investment products, structured products can provide higher returns by utilizing derivative instruments and alternative investment strategies.

This offers investors a chance to earn more on their investments and potentially increase their investment returns.

Overall, structured products offer a range of benefits for risk management. They allow investors to mitigate potential losses, diversify their portfolios, tailor their risk exposure, and seize enhanced yield opportunities.

By incorporating these products into their investment strategy, investors can potentially enhance their risk management strategies and achieve their investment goals.

Types of Structured Products

Structured products offer a wide range of advantages when it comes to risk management. In this section, we will delve into the different types of structured products and explore their unique characteristics.

From equity-linked products to interest rate-linked ones, currency-linked options to commodity-linked alternatives, we will uncover the diverse opportunities these products bring to the table.

So, fasten your seatbelts as we navigate through the world of structured products and unlock the potential they hold for effective risk management.

Equity-Linked Structured Products

Equity-Linked Structured Products provide investors with exposure to the performance of a specific equity or equity index. These products are designed to offer potential returns based on the movement of the underlying equity, while also providing downside protection through various structures.

One example of an equity-linked structured product is an equity-linked note, which combines a debt instrument with an equity derivative. This allows investors to take advantage from any potential appreciation in the underlying equity while still receiving periodic interest payments.

Another type of equity-linked structured product is an equity-linked certificate of deposit, which offers a fixed return linked to the performance of an equity index.

This product provides investors with the opportunity to earn a return that is tied to the performance of a basket of stocks, providing diversification and potentially higher returns than traditional fixed-rate instruments.

Equity-linked structured products can be an attractive option for investors looking to participate in the equity markets while also managing their risk exposure. These products offer the potential for higher returns compared to traditional fixed-rate instruments, while also providing downside protection.

However, it’s important to note that equity-linked structured products also come with their own set of risks. The value of these products can be influenced by factors such as market volatility, interest rates, and the performance of the underlying equity.

It’s crucial for investors to carefully consider their risk tolerance and investment objectives before investing in equity-linked structured products.

Interest Rate-Linked Structured Products

Interest Rate-Linked Structured Products offer investors a unique way to take advantage of changes in interest rates while managing their risk.

Definition: | An interest rate-linked structured product is a financial instrument whose value is linked to changes in interest rates. |

How it works: | These products typically combine a fixed-income component, such as bonds or notes, with derivative contracts. |

Benefits: | Interest rate-linked structured products can provide investors with the opportunity to earn higher yields compared to traditional fixed-income investments. |

Risk management: | These products can help investors manage interest rate risk by offering protection or enhanced returns based on the direction and magnitude of interest rate movements. |

Types: | Interest rate-linked structured products can be designed to provide fixed or floating interest payments, and they can be structured to participate in both upward and downward interest rate movements. |

Considerations: | Investors should carefully review the terms and conditions of these interest rate-linked structured products, including any caps or floors on returns, maturity dates, and the issuer’s creditworthiness. |

Pro-tip: Before investing in interest rate-linked structured products, it is advisable to consult with a financial advisor to ensure they align with your investment goals and risk tolerance.

Currency-Linked Structured Products

Currency-linked structured products refer to a diverse range of financial instruments designed to provide investors with exposure to the performance of a particular currency or a currency pair.

With the aim of enabling investors to capitalize on fluctuations in currency exchange rates, these products present an opportunity for profit.

Commodity-Linked Structured Products

To understand Commodity-Linked Structured Products, let’s look at the following table that showcases their characteristics and benefits.

Type | Description | Benefits |

Commodity-Linked Structured Products | These are financial instruments that are tied to the performance of commodities such as gold, oil, or agricultural products. | – Provide exposure to the price movements of commodities – Diversify investment portfolio with commodities – Potential for higher returns due to commodity price volatility – Hedge against inflation risks – Tailored risk exposure to specific commodities |

Commodity-Linked Structured Products allow investors to participate in the performance of various commodities without directly owning them. They offer the advantage of diversification and the potential for enhanced returns.

Investors can choose products that are linked to specific commodities based on their investment goals and market expectations. By investing in Commodity-Linked Structured Products, investors can gain exposure to the price movements of commodities such as gold, oil, or agricultural products.

This allows them to gain an advantage from potential price increases and hedge against inflation risks. Furthermore, structured products provide tailored risk exposure, enabling investors to manage their risk exposures effectively.

It’s important to note that investing in Commodity-Linked Structured Products involves market risks and the potential for capital loss. The performance of the structured products is directly linked to the performance of the underlying commodities.

Therefore, it is crucial to carefully evaluate and understand the risks associated with investing in structured products.

Benefits of Structured Products for Risk Management

Structured products offer a multitude of advantages for risk management, providing investors with enhanced strategies, improved diversification, tailored risk exposure, and enhanced yield opportunities.

This comprehensive analysis will delve into the advantages these products bring to risk management practices. With real-world examples backed by reliable sources, we will explore how structured products contribute to mitigating risks and maximizing returns.

Get ready to unlock the potential of structured products in managing risk like never before!

Enhanced Risk Management Strategies

Enhanced risk management strategies are crucial for financial stability and success. Structured products can play a vital role in achieving these strategies. Here are some ways in which structured products enhance risk management:

- Customization: Structured products offer the flexibility to design tailor-made solutions to address specific risk management needs. They can be customized to suit the enhanced risk management strategies, risk appetite, investment horizon, and financial goals of investors.

- Diversification: By investing in a variety of structured products, investors can diversify their risk exposure. This helps to mitigate the impact of any potential losses and achieve a more balanced portfolio, thereby enhancing risk management strategies.

- Capital Protection: Some structured products offer capital protection features, ensuring that investors’ principal investments are safeguarded even in adverse market conditions. This reduces the risk of significant losses and contributes to enhanced risk management strategies.

- Risk/Return Optimization: Structured products allow investors to optimize the risk/reward trade-off according to their risk preferences and enhanced risk management strategies. They offer the opportunity to enhance returns while managing risk effectively.

- Hedging: Structured products can be used as effective hedging instruments to protect against price fluctuations, interest rate changes, or currency risks, thus contributing to enhanced risk management strategies. They provide a means to offset potential losses in other investments.

- Structured Payoffs: Structured products often offer unique and innovative payoff structures that provide additional risk management gains. These structures can be linked to specific market conditions or performance benchmarks, allowing investors to participate in market movements while managing risk and implementing enhanced risk management strategies.

By incorporating structured products into risk management strategies, investors can achieve enhanced risk management and optimize their investment portfolios.

Improved Portfolio Diversification

One of the benefits of structured products for risk management is improved portfolio diversification.

Structured products allow investors to diversify their portfolios by providing exposure to an underlying asset, such as equities, interest rates, currencies, and commodities.

This diversification helps reduce the overall risk in the portfolio by spreading it across multiple asset classes and market sectors, leading to improved portfolio diversification.

Fact: Studies have shown that a well-diversified portfolio can help improve returns and manage risk more effectively compared to a concentrated portfolio.

Tailored Risk Exposure

When it comes to risk management, tailored risk exposure is an important aspect to consider. This involves customizing the level of risk exposure based on specific needs and preferences. By implementing structured products, individuals and companies can achieve this tailored risk exposure more effectively.

Benefits of Tailored Risk Exposure using Structured Products |

1. Customization: Structured products allow for the creation of customized risk profiles, aligning with individual risk tolerance and investment objectives. |

2. Diversification: By using various types of structured products, investors can diversify their risk exposure across different asset classes and markets. |

3. Risk mitigation: Tailored risk exposure enables investors to mitigate specific risks that are of concern to them, such as interest rate risk or currency risk. |

4. Enhanced returns: By actively managing risk exposure, structured products can potentially provide enhanced returns compared to traditional investment strategies. |

It is important to note that tailored risk exposure should be approached with careful consideration and understanding of the underlying risks involved.

Proper analysis, assessment, and monitoring are essential to ensure that the desired level of risk exposure is achieved without compromising other financial goals.

When incorporating structured products for tailored risk exposure, individuals and companies should work closely with experienced financial advisors to develop a comprehensive risk management strategy.

This will help to ensure that the chosen structured products align with specific risk profiles and financial objectives.

Enhanced Yield Opportunities

When considering the sub-topic of “Enhanced Yield Opportunities” in the context of structured products for risk management, it is important to assess the potential gain and opportunities for increased returns.

| Structured products offer a variety of opportunities to enhance yields through different strategies and features. |

1. | Structured products provide the potential for higher yields compared to traditional investment options. |

2. | Through structured products, investors can capitalize on various market conditions and take advantage of favorable interest rates, exchange rates, or commodity prices to maximize returns. |

3. | These products often offer attractive coupon rates, allowing investors to earn regular income in addition to potential capital appreciation. |

4. | Structured products can be tailored to meet specific yield requirements, providing investors with the flexibility to achieve their desired level of returns. |

5. | Investors can also explore options like principal-protected notes or barrier options, which offer the potential for enhanced yields while protecting the initial investment. |

When examining the concept of “Enhanced Yield Opportunities” within the framework of structured products for risk management, it is vital to evaluate the potential advantages and chances for increased returns.

| Structured products present a range of opportunities to enhance yields through diverse strategies and features. |

1. | Structured products offer the potential for higher yields compared to traditional investment options. |

2. | These products frequently provide attractive coupon rates, enabling investors to earn regular income alongside potential capital appreciation. |

3. | These products frequently provide attractive coupon rates, enabling investors to earn regular income alongside potential capital appreciation. |

4. | Structured products can be customized to fulfill specific yield requirements, granting investors the flexibility to achieve their desired level of returns. |

5. | Investors can also explore options like principal-protected notes or barrier options, which present the potential for enhanced yields while safeguarding the initial investment. |

Potential Risks and Challenges

When examining the potential risks and challenges of structured products for risk management, several key factors come into play. We’ll dive into the realms of market risk, liquidity risk, and counterparty risk.

We’ll also explore the complexities and lack of transparency that can arise when dealing with these products. Additionally, we’ll summarize both the advantages and risks involved in implementing structured products within risk management strategies.

Join us as we navigate the intricate landscape of structured products and uncover the considerations necessary for effective risk management.

Market Risk

Market risk is a significant consideration when it comes to structured products. This risk refers to the potential losses that can occur due to changes in market conditions, such as fluctuations in prices or interest rates.

The market risk associated with structured products stems from their underlying asset or indices and can impact the value of the investment. The structured product can help manage market risk by offering different features, such as principal protection or participation in market gains.

These products often provide investors with exposure to a specific market or asset class, allowing them to take advantage of potential returns while also providing some level of downside protection.

It’s important to understand the level of market risk associated with a particular structured product.

This can be determined by analyzing the historical performance of the underlying asset or indices and considering factors such as volatility and potential market disruptions.

Investors should also be aware that market risk can vary depending on the type of structured product.

For example, an equity-linked structured product may be more susceptible to market fluctuations compared to an interest rate-linked or a currency-linked structured product.

Table: The table content remains intact.

Liquidity Risk

Liquidity risk is a crucial consideration when it comes to structured products. Liquidity refers to the ease with which an asset can be bought or sold in the market without significantly impacting its price.

When investing in a structured product, it is vital to assess the liquidity risk associated with these investments.

One important risk to be aware of is that certain structured products may have limited or illiquid secondary markets, which can make it difficult to sell the investment when desired.

This lack of liquidity can result in delays or difficulties in accessing funds when needed. Moreover, the absence of a liquid secondary market can affect the price at which the investment can be sold, potentially leading to losses.

To effectively manage liquidity risk, investors should carefully review the terms and conditions of the structured product and evaluate the liquidity of the underlying assets.

They should also take into account factors such as the size of the market, trading volume, and the presence of market makers.

It is worth noting that the level of liquidity risk can vary depending on the type of structured product. Some products, such as those based on highly liquid assets like major stock indices or currencies, may have lower liquidity risk compared to products based on less liquid assets like real estate or niche commodities.

In order to determine the suitability of structured products for their risk management strategies, investors should thoroughly evaluate liquidity risk in conjunction with other risks and potential advantages.

Counterparty Risk

Counterparty risk is a crucial factor that needs to be taken into account while dealing with structured products.

This risk is associated with the possibility of the other party involved in a transaction defaulting on their obligations, which can result in financial losses for one party.

Before engaging in any structured product transaction, it is of utmost importance to evaluate the creditworthiness and financial stability of the counterparty.

To mitigate counterparty risk, it is advisable to diversify the counterparties across different institutions and use collateral and credit derivatives.

The impact of counterparty risk on structured products can be significant. In the worst-case scenarios, default by a counterparty can lead to the loss of the principal investment or even the complete collapse of the structured product.

Investors should conduct a thorough assessment of the counterparty’s credit rating, financial health, and track record in fulfilling obligations.

It is also essential to keep a close eye on the financial markets and stay informed about any developments that could potentially affect the stability of the counterparty.

To effectively manage counterparty risk, investors can consider implementing risk management strategies like using derivatives to hedge funds the exposure to a specific counterparty or utilizing collateral agreements to secure the transaction.

Additionally, conducting comprehensive due diligence and constantly monitoring the counterparty’s financial performance can significantly reduce the likelihood of counterparty default.

Complexity and Lack of Transparency

The consideration of complexity and lack of transparency is paramount when it comes to structured products.

These financial instruments can be intricate and challenging to fully grasp due to their layered nature and the use of derivatives.

The absence of transparency stems from the intricate structures involved, which makes it hard for investors to assess the true risks and costs associated with these products.

When investing in structured products, it is crucial to be mindful of the potential financial crisis related to complexity and lack of transparency.

These may include concealed fees, unclear pricing structures, and obscure underlying assets.

Investors should carefully evaluate these factors and thoroughly examine the product documentation before making any direct investment decisions.

To mitigate these risks, it is essential to conduct thorough due diligence, seek independent advice, and ensure a clear comprehension of the product’s structure and underlying assets.

It is also advisable to closely monitor these investments and stay informed about any changes or updates provided by the issuer.

By recognizing and addressing the complexity and lack of transparency associated with structured products, investors can make more informed decisions and better manage their risk exposure.

Summary of the Benefits and Risks of Structured Products for Risk Management

Structured products offer several advantages for risk management. Firstly, they enhance risk management strategies by providing innovative solutions to manage and mitigate various risks.

Secondly, they improve portfolio diversification by offering exposure to different asset classes or investment strategies. Thirdly, structured products allow for tailored risk exposure, enabling investors to select products that align with their risk tolerance and investment objectives.

Lastly, these products provide enhanced yield opportunities, allowing investors to potentially generate higher returns than traditional investments option.

However, it is important to be aware of the risks associated with structured products.

Market risk is a significant concern since these products are influenced by market fluctuations and can result in losses.

Liquidity risk is another factor to consider, as some structured products may have limited liquidity and can be difficult to sell.

Counterparty risk is a potential threat, as it depends on the creditworthiness of the issuer or counterparty involved in the product.

Finally, the complexity and lack of transparency in structured products can make it difficult for investors to fully understand the risks they are exposed to.

When considering structured products for risk management, investors should carefully assess the advantages and risks associated with specific products and consider their individual risk appetite and investment goals.

It is advisable to seek professional advice from financial advisors who can provide expert guidance on selecting suitable structured products.

Considerations for Implementing Structured Products in Risk Management Strategies

When considering implementing structured products in risk management strategies, it is important to keep in mind several considerations for implementing structured products in risk management strategies.

- These include:

Determine Risk Appetite: It is crucial to understand the risk appetite of the organization or individual when implementing structured products. This involves determining the level of risk the organization is willing to take and the potential impact on its objectives. - Evaluate the Investment Horizon: The investment horizon is another important factor to consider. Different structured products have different maturity dates and it is important to align the investment horizon with the product’s features.

- Analyze Liquidity Needs: Additionally, analyzing liquidity needs is essential. This involves understanding the organization’s or individual’s liquidity requirements and ensuring that the structured products chosen align with those needs.

- Assess Counterparty Risk: Assessing counterparty risk is also crucial for implementing structured products. It is important to conduct due diligence on the counterparty to ensure their financial stability and ability to fulfill their obligations.

- Consider Regulatory Requirements: Finally, considering regulatory requirements is vital to ensure compliance with relevant laws and regulations in the jurisdiction where the structured products will be implemented.

By carefully considering these considerations for implementing structured products in risk management strategies, organizations and individuals can make informed decisions when implementing structured products in their risk management strategies.

Frequently Asked Questions

Structured products are financial instruments that combine a bond with a derivative component and are designed to meet specific investment objectives. They offer personalized risk-return goals to investors and can help manage exchange risk. Structured products provide capital protection through features like capital protection or buffers. They also allow investors to access new markets and potentially achieve higher yields, making them suitable for diversifying portfolios and minimizing risk.

Retail networks play a crucial role in the distribution of structured products. These products are often sold through retail networks, making them accessible to individual investors. Retail networks provide a platform for investors to access and invest in structured products, enabling them to gain advantage from the potential advantages and risk management strategies offered by these financial instruments.

Derivative components are a key feature of structured products. These components, such as equity options, provide the potential for a return on investment if their value exceeds the initial worth. Derivatives allow structured products to offer enhanced returns and risk management strategies that conventional debt securities may not provide. They enable investors to customize their investments based on their risk appetite and market views.

Structured products with capital protection offer a full or partial return of principal at maturity, regardless of how the underlying assets perform. Principal protected notes (PPNs) provide 100% principal protection if held to maturity. They may have barriers and buffers that act as triggers for contingent or conditional protection. Barriers are associated with contingent protection, where breaching the barrier puts the principal at risk. Buffers provide hard protection, limiting potential principal loss to losses in excess of the buffer.

Structured products come with several risks that investors should be aware of. These include market fluctuations, lack of liquidity, the issuer’s credit rating, and challenges in pricing. Market fluctuations can affect the value of the underlying assets and impact the return on investment. Lack of liquidity may result in a potential inability to sell or trade structured products easily. The credit rating of the issuer determines the strength of the principal protection guarantee. Pricing structured products accurately can be complex due to their unique terms and structures.

Financial advisers, like Park Place Financial, can provide valuable assistance in understanding structured products and implementing customized investment plans. They analyze financial situations, offer recommendations based on data insights and academic principles, and help investors navigate the complexities of structured products. As fiduciaries, they prioritize acting in the client’s best interest and provide transparency in financial guidance, ensuring informed decision-making and risk management.