Are wealth management fees really worth it? This question often surfaces when individuals with significant net worth consider professional financial advice.

The query of whether or not to pay for a certified financial adviser or wealth manager is becoming more pressing with the development of robo-advisors and self-investment tools.

In this comprehensive guide, we will delve into the fee structure of wealth management services, comparing costs between automated solutions and human advisors.

We’ll also explore how transparency in fixed-fee arrangements can significantly impact your financial circumstances. But remember that a good advisor offers much more than just investment guidance.

From minimizing tax outflows to crafting an estate plan tailored to individual circumstances, their expertise could be invaluable. So are asset management fees worth it? Let’s find out together.

Are Wealth Management Fees Worth It

High-net and ultra-high-net-worth people, particularly those in the UAE, often face a dilemma regarding whether or not to pay wealth management fees.

The crux of this discussion lies in weighing the benefits offered by professional wealth advisors against their costs.

Comparing Costs of Robo-advisor and Professional Advisors

Robo-advisors have been gaining traction as a more affordable option to traditional financial advisors in the digital age. They offer automated investment guidance at a fraction of the cost charged by human advisors.

However, while they may be cheaper, robo-advisors lack the personal touch and bespoke service that comes with hiring a professional advisor from wealth management firms like Quadra Wealth.

A study conducted by Vanguard found that hiring a financial advisor can add about 3% net value to your portfolio annually through smart tax planning strategies alone – a return that could easily justify paying for expert advice.

Potential Value Derived from Expert Advice

Beyond just managing investments, experienced wealth managers provide comprehensive services tailored to individual needs – an aspect where robo-advisors fall short.

For instance, understanding complex international tax laws or estate planning requires expertise beyond algorithms.

Quadra Wealth’s team provides consistent growth to clients’ portfolios through structured notes – something not commonly offered by most robot platforms.

This kind of personalized attention is what makes many believe that despite higher upfront costs, ultimately advisory fees prove worthwhile when considering long-term gains derived from such specialized guidance.

- Professional advisors provide holistic financial plans that address everything from investing to tax planning, business plans, charitable giving, estate planning, and beyond based on individual circumstances and goals.

- Wealth managers help minimize tax outflows using advanced strategies.

- The potential returns generated via expert advice often outweigh the initial costs involved.

- Hiring professionals ensures peace of mind knowing one’s finances are being managed effectively and efficiently.

Key takeaways

The debate over whether wealth managing fees are worth it is ongoing, with high-net-worth individuals in the UAE considering robo-advisor as a cheaper alternative to traditional financial advisors or certified financial planners. However, working with experienced wealth managers can provide added value through personalized attention and expert advice on complex issues such as international tax laws and estate planning. Ultimately, while advisory fees may be higher upfront, potential long-term gains make them worthwhile for those seeking specialized guidance.

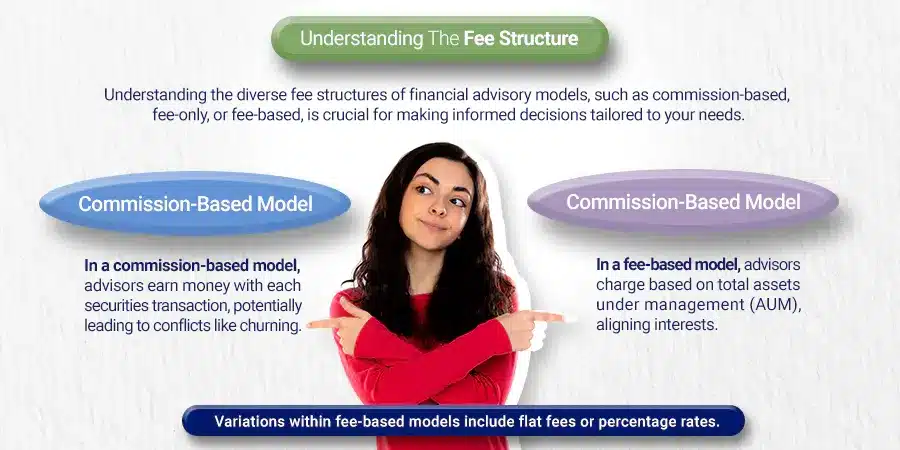

Understanding the Fee Structure

Different financial advisory models have different fee structures. For instance, some operate on a commission-based model while others prefer a fee-only or fee-based structure.

Understanding these various models can help you make an informed financial decision that meets your needs.

Commission-Based Model vs Fee-Based Model

In a commission-based model, advisors earn money each time they buy or sell securities for their clients. This might lead to conflicts of interest, as advisors may be tempted to engage in excessive trading (also known as churning) to generate more commissions.

A fee-based model, on the other hand, charges clients based on the total assets under wealth management (AUM). This aligns the interests of both parties – when your wealth grows, so does your advisor’s income.

However, it’s important to note that even within this model there can be variations; some advisors charge flat fees while others opt for percentage rates.

Transparency in Fixed-Fee Arrangements

Fixed-fee arrangements are another option where you pay a set amount regardless of how much advice is provided or what actions are taken on your behalf.

These types of agreements offer transparency and predictability but may not always provide value if you don’t require extensive services.

Fees Vary

- It’s crucial to understand that fees will differ depending upon whether an advisor operates via commission-free structures or otherwise – something particularly relevant for high-net-worth individuals seeking tailored solutions from Quadra Wealth.

Negotiating Power

- If you feel uncomfortable about what you’re currently paying for advisory services there’s scope either negotiating down existing advisor’s charges or alternatively taking chances with less experienced newcomers offering competitive rates.

The Bottom Line

- Your ultimate goal should be finding someone who provides consistent growth through structured notes without compromising service quality – all at reasonable costs.

Remember, it’s important to do your research and choose an advisor that aligns with your financial goals and values. Don’t hesitate to query and haggle rates to guarantee you’re receiving the top-notch service possible.

Key takeaways

Understanding the fee structure of different financial advice models is crucial when deciding if wealth managing fees are worth it. Commission-based models may lead to conflicts of interest, while fee-based models align interests and can vary in their pricing structures. Transparency in fixed-fee arrangements offers predictability but may not always provide value for those who don't require extensive wealth-managing services. Ultimately, finding an advisor that provides consistent growth through structured notes at reasonable costs should be the goal, and negotiating annual fees or asking questions can help ensure you're getting the best possible service.

Role of Professional Wealth Managers Beyond Investment Advice

Many HNWIs and expatriates in the UAE believe that wealth managers only provide investment management advice. Contrary to popular belief, wealth managers provide more than just investment guidance.

A professional wealth advisor’s role extends beyond offering investment tips or strategies.

Minimizing Tax Outflows with Professional Help

A common problem for HNWIs is complex taxation laws both locally and internationally. Without the right guidance, you could find yourself paying more taxes than needed annually.

A professional tax planner understands these complexities and can help structure your investment to minimize your tax liabilities while ensuring compliance with all relevant regulations.

This service alone often justifies the fees charged by professional advisors.

- Expertise and knowledge

- Tax planning

- Compliance and accuracy

- Maximizing deductions and credits

- Lack of expertise

- Time-consuming

- Increased risk of errors

- Missed opportunities

Tailored Financial Plans Based on Individual Circumstances

Wealth managing professionals offer personalized financial plans tailored to individual circumstances. Estate planning involves distributing financial assets after death, an area where expert guidance is essential for avoiding potential legal complications or disputes among heirs.

An experienced advisor will assess your risk tolerance level before suggesting suitable investment options, thus protecting against unnecessary losses due to overly risky ventures.

Whether retirement is decades away or just around the corner, having comprehensive financial planning ensures sufficient funds for maintaining a lifestyle post-retirement without depleting savings prematurely.

In essence, hiring a professional wealth manager isn’t merely about getting stock picks.

It’s about gaining access to holistic asset management services designed specifically for preserving and growing personal fortunes effectively despite market uncertainties or regulatory changes across jurisdictions worldwide.

This advantage is well worth considering given the potential benefits derived compared to the costs involved.

Key takeaways

“Avoiding taxes and investment tips, professional wealth advisors offer tailored financial plans for HNWIs in the Middle East to preserve and grow their fortunes.

- Personalized approach

- Goal-oriented

- Risk management

- Flexibility and adaptability

- Lack of direction

- Missed opportunities

- Inefficient use of resources

- Increased financial stress

Industry Standards for Advisory Services' Costs

When it comes to asset management, knowing the industry standards for advisory service costs is key. On average, you can expect to pay around 1.02% of your Assets Under Management (AUM).

This percentage usually includes comprehensive asset management services and annual updates to full financial plans. It’s a worthwhile expense for many high net worth individuals seeking bespoke solutions for retirement savings planning, trust creation, and wills & estate planning aimed at minimizing taxes effectively.

Average Rate of Advisory Service Cost

The typical cost for a professional wealth advisor in the UAE and globally tends to hover around 1.02% of your total assets under their management per year.

However, this rate may fluctuate based on the complexity of your financial condition and the level of personalized attention required; for example, a more intricate portfolio necessitating substantial research and continuous monitoring could incur higher fees than those with simpler portfolios.

For instance, if you have a more complex portfolio requiring extensive research and constant monitoring, fees may increase accordingly.

Conversely, those with simpler portfolios might find themselves paying less than this average rate. Here is an insightful article explaining how these fees are calculated.

Comprehensive Asset Management Services Included

The fee charged by the private wealth advisor isn’t just about investment guidance. It also covers a broad range of other services designed to help clients grow their net worth over time while mitigating risks associated with market fluctuations.

- Tax Planning: Advisors often assist in devising strategies that minimize tax liabilities. This is particularly beneficial for expatriates residing in countries like UAE where tax laws can be quite intricate. Check out this piece for further details.

- Estate Planning: Wealth managers provide guidance on creating effective wills and trusts aimed at preserving family legacies while reducing inheritance tax implications wherever possible. Discover additional information about estate planning services by clicking here.

Key takeaways

The article discusses the industry standards for wealth managing fees, which usually hover around 1.02% of the total client's assets under management per year and cover comprehensive liquid assets management services such as tax and estate planning. The cost can vary depending on factors like portfolio complexity and personalized attention required, but it is often worth it for high-net-worth individuals seeking bespoke solutions for their financial needs.

Passive vs Active Investment Strategy Considerations

Choosing between passive and active investment strategies can significantly impact whether advisory charges are justified.

The decision largely depends on your financial goals, risk tolerance, and market understanding.

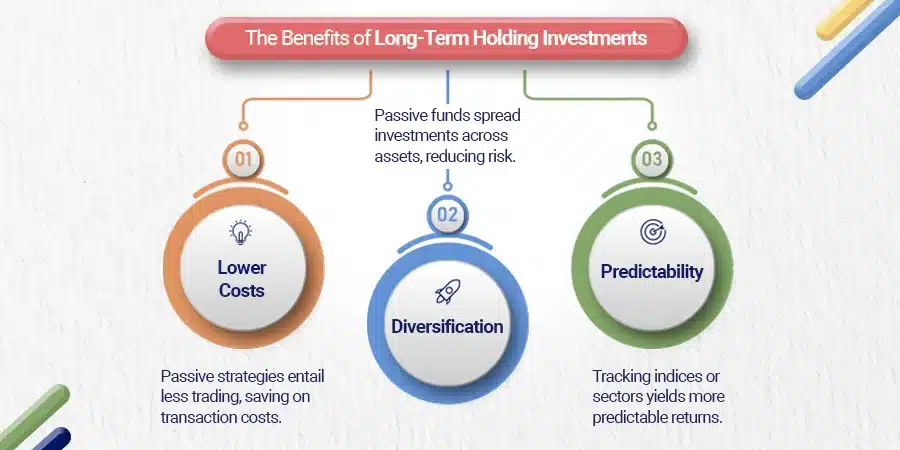

The Benefits of Long-Term Holding Investments

A passive approach to investing involves long-term holding investments aimed to maximize returns through minimized buying and selling actions.

This strategy typically results in lower investor expenses as it requires less frequent trading and therefore incurs fewer transaction costs. Moreover, a passive strategy often aligns with the market’s performance over time, providing consistent growth to an investment portfolio.

- Lower Costs: Since this approach involves less trading activity compared to an active strategy, you save on transaction costs which can add up over time.

- Diversification: Passive funds usually invest in a broad range of assets offering diversification benefits that help reduce risk.

- Predictability: With its focus on tracking specific indices or sectors, the return pattern is more predictable than those offered by actively managed funds.

Risks Associated With Short-Term Market Fluctuations

In contrast, an active investment strategy takes advantage of short-term market fluctuations but carries higher risks” and consequently higher service charges too.

It aims for above-average returns but demands greater involvement from wealth managers who need to continuously monitor markets and make timely decisions based on their analysis.

While potentially lucrative if successful, this method may result in increased management fees due to the additional work involved.

- Frequent Trading: An active approach requires regular buying and selling of securities leading to high transaction costs which could eat into your profits if not properly managed.

- Volatile Returns: Returns from actively managed portfolios tend to be more volatile because they depend heavily on the fund manager’s ability to predict future price movements accurately – something no one can guarantee.

If you’re unsure about which route is best for you ” passive or active” it might be worth considering professional advice. A good financial planner will take into account your individual circumstances before recommending a suitable course of action.

Remember though that while expert advice can indeed prove beneficial; it comes at a costa€” a factor worth contemplating when deciding whether wealth managing fees are justifiable for your situation.

Key takeaways

Passive and active investment strategies have different benefits and risks associated with them. Passive investing involves long-term holding investments, resulting in lower expenses, diversification, and predictability. On the other hand, active investing aims for above-average returns through short-term market fluctuations but carries higher risks due to frequent trading and volatile returns. It is important to consider professional advice before deciding which strategy is best suited for your individual circumstances while also taking into account the cost of wealth managing fees.

Negotiating Your Advisor's Charges

As a high-net-worth individual or ex-pat in the UAE, you may be wondering if the fees you’re paying for wealth management services are worth it.

The answer depends on your financial goals and comfort level with managing your own investments. Negotiating for lower fees is possible, so don’t feel like you’re stuck with what’s initially offered.

Negotiation Strategies for Lowering Advisor Fees

First, understand what services you’re getting for your money. Does your advisor provide comprehensive asset management and financial planning?

Or just investment guidance? Once you understand the services provided, research other advisors to determine if their fee structures and commission rates are more advantageous.

Newcomers often offer competitive rates and commission-free structures, leaving more money in your portfolio.

- Shop around: Compare fee structures across different advisors to give yourself leverage when negotiating.

- Demonstrate loyalty: Use your long-term client status as a bargaining chip.

- Bulk discounts: Consolidate your assets under one advisor for discounted rates.

Consider taking a chance on a less experienced advisor who may offer reduced initial rates while building their clientele base.

Just make sure they operate through commission-free models to leave more funds available in your account.

Don’t accept inflated advisory service charges without questioning them first.

You can reduce existing expenses and explore newer options for better value. Those seemingly hefty wealth managing fees can be truly worthwhile after all.

Conclusion

Additional information not covered in the outline can help investors make informed decisions.

Is it worth paying wealth management fees?

It depends on your financial goals and needs, but professional advisors can offer personal finance, tax optimization, and asset management services that may justify their fees.

Passive vs active investment strategies and negotiating for lower fees are important considerations for investors.

While wealth managing fees may seem high, they can provide value beyond just investment advice.

Understanding fee structures and industry standards is crucial before choosing a professional wealth manager or asset management firm.

Investors must weigh the potential benefits against the costs to determine if the professional wealth manager is worth it.

Check out credible sources to back up these claims.

Frequently Asked Questions

The value of wealth management fees depends on the complexity of your financial condition and the level of service you require. For those with significant assets, diverse portfolios, or complex tax situations, professional advice can provide substantial benefits that outweigh the costs. Investopedia provides more insights.

It depends on the services provided and the return on investment. If the advisor can help you earn more than the fee charged, then it may be worth it. However, it’s important to compare fees and services from different advisors before making a decision to achieve your financial goals and attain financial security.

There is no one-size-fits-all answer to this question. Fees can vary depending on the advisor, the services provided, and the size of the portfolio. However, a typical fee range is between 0.5% to 2% of assets under management.

It depends on your financial situation and goals. If you have a complex financial situation or need help with investing in asset management, tax planning, or retirement planning, a financial advisor can provide valuable financial advice. However, if you have a simple financial situation, you may be able to manage your finances on your own without paying for professional advice.