In This Article

Are you worried about your financial future? Pressure regarding your finances may truly influence your quality of life. That’s where support from a wealth management firm comes into play.

The specialists in a wealth management firm are able to help you produce long-term goals, plan for retirement, monitor your resources, and much more.

There are a lot of advantages to working with a wealth management company, let us take a look at a few of these.

Quick Summary

In short, You will learn how a wealth management firm offers you assistance during major life changes, helping you plan for retirement, setting realistic goals, and providing professional advice from this blog so that you can have a secure financial future.

What are the benefits of working with wealth management firms?

1. Access to Multiple Services

A financial adviser can help you track your financial situation and make adjustments when needed. When you utilize Quadra Wealth Management services, you may be sure that people here always have your best interests at heart.

Here are a few of the many services that you may have access to:

- Customized Investment Solutions

- Portfolio Management

- Financial Planning

- Comprehensive Retirement Income Planning

- Children’s Higher Education Fee Planning

With a wealth management firm, you can gain access to many of these solutions from a single source.

It is possible to create a solid relationship with your financial advisor, instead of looking for the expertise of several distinct financial advisors or businesses.

Pros of accessing Multiple Services::

- Saves time and effort

- Wealth management firms offer comprehensive solutions that consider various aspects of your financial situation

- Professionals in wealth management firms have specialized knowledge and experience in different areas, ensuring high-quality advice and solutions

Cons of not having access to multiple services:

- Seek advice and services from multiple sources, which can result in a disconnected and less coordinated financial strategy

- Lack of Expertise

2. Assistance During Major Life Changes

If we can be sure of something, it is that nothing is ever certain. Big changes in your own life can significantly affect your financial situation.

A few of these substantial changes can include having a child, getting married, even buying a home, retiring, or a change in your career.

Any significant change in your own life can come with its fair share of financial stress. Particularly when you find yourself in a circumstance in which you will need to make some big decisions concerning your finances.

That’s where a financial advisor can end up being very beneficial. We’ll supply you with guidance and support during this large change in your own life.

You may rest assured knowing that the future of your own financing is always in the best hands, even during the most stressful or overwhelming circumstances.

Pros of getting assistance During Major Life Changes:

- Expert Guidance

- Stress Reduction

Cons of not getting assistance during major life changes:

- Financial Uncertainty

- Increased Burden

3. Planning for Retirement

Retirement. Retirement implies that (generally ) you no longer need to be employed. The entire world is now your oyster, so to speak.

But because you aren’t functioning, that means the income that you have grown so comfy to see in your bank account is about to go through some serious alterations.

Sure, you may have a retirement which may help cover your bills and day-to-day needs, but will it be enough? It is possible to not ever be too confident of this.

Especially since you may not be in the best place to work anymore. Hence why it is so crucial that you have a solid strategy for retirement.

Quadra Wealth can help you do exactly that. You’re going to be provided with guidance as you make your long-term strategy for retirement. This may consist of everything from liquid assets, properties, investments, and much more.

Pros of planning for retirement:

- Wealth management firms help you develop a well-rounded retirement plan, considering various factors such as investments, assets, and income sources

- Long-Term Security

Cons of not planning for retirement

- Uncertain Future

- Lack of Financial Stability

4. Setting Goals

What better way to get ready for the future, than to establish goals?

Setting goals is a very delicate, yet crucial process. You sincerely ought to think about what you would like, what you need from the future, and the way in which your finances can affect those targets, or how these goals will impact your finances.

A financial adviser can help you create a string of manageable and realistic goals for the future. These can range from one-year targets and five-year objectives to 20-year targets and perhaps even 50-year goals.

It’s about planning with more than enough time ahead of plan, place, and execute what you have to have so as to accomplish your objectives.

Pros of setting Goals:

- Clarity and Direction

- Accountability

Cons of not setting goals:

- Lack of Focus

- Failing to set goals can result in missed opportunities for wealth accumulation, financial growth, and personal fulfillment

5. Feeling Confident

A financial adviser can truly take the weight off your shoulders when it comes to your finances. You can feel confident in the future of your finances, instead of feeling weary regarding the decisions you’ve made on your own.

Quadra Wealth has several years of experience under its belt. We have seen what’s worked, and what has not, and are all experienced in identifying future trends.

And of course, the incredibly strong bond you’ll be able to build with your advisor. We will know your financing, goals, and lifestyle inside and out, making them an enormous asset to your future and present.

Pros of feeling confident::

- You can have confidence in your financial future, knowing that professionals are overseeing and managing your finances

- Having a trusted advisor to rely on can alleviate financial stress and provide a sense of security

Cons of not feeling confident:

- Constantly worry about the state of your finances and whether you’re making the right decisions

- Emotional Burden

6. Advice from the Professionals

The very best way to learn whether you will benefit from our solutions is to inquire. Just contact us now and request a complimentary, no-obligation consultation.

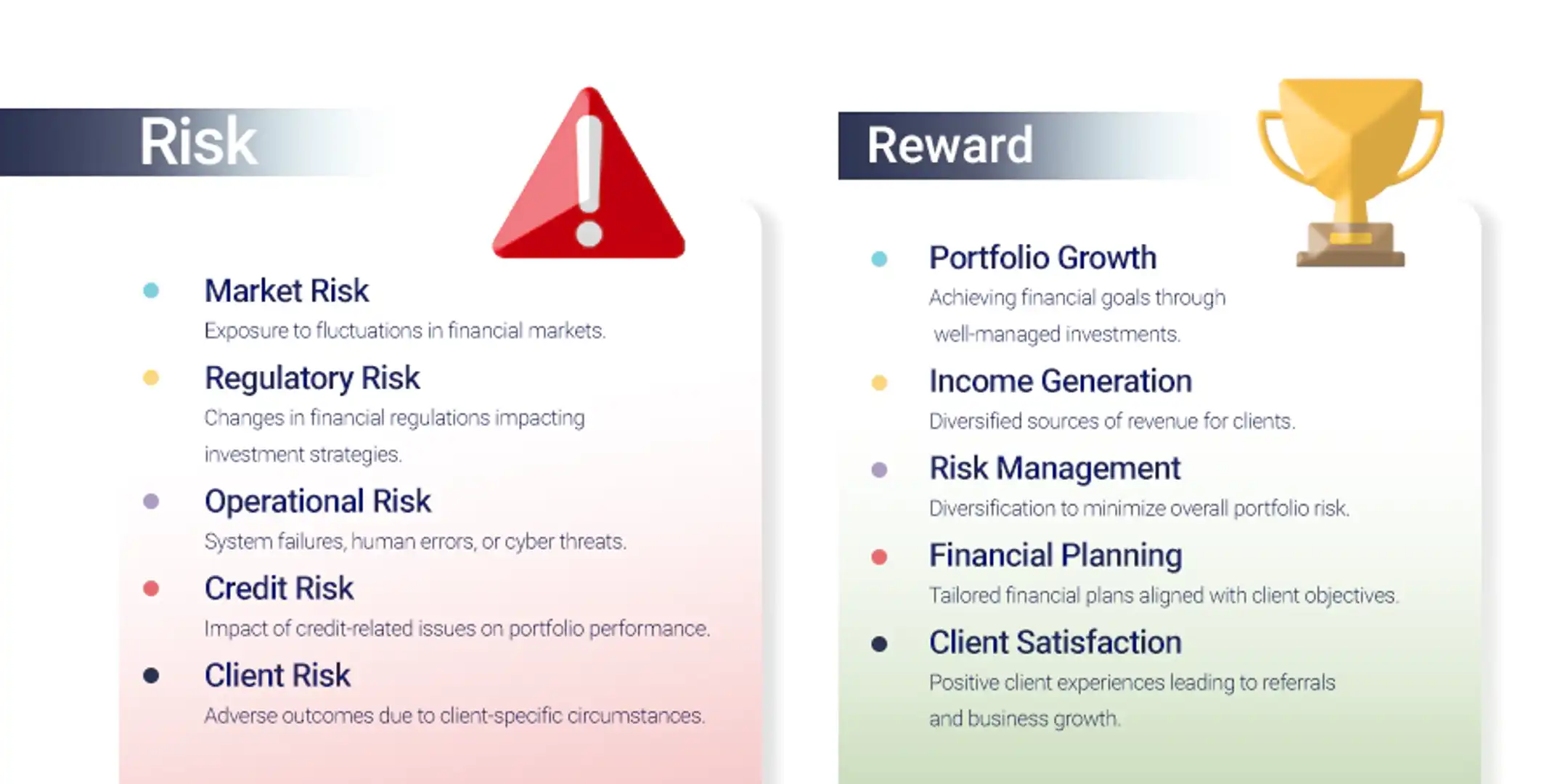

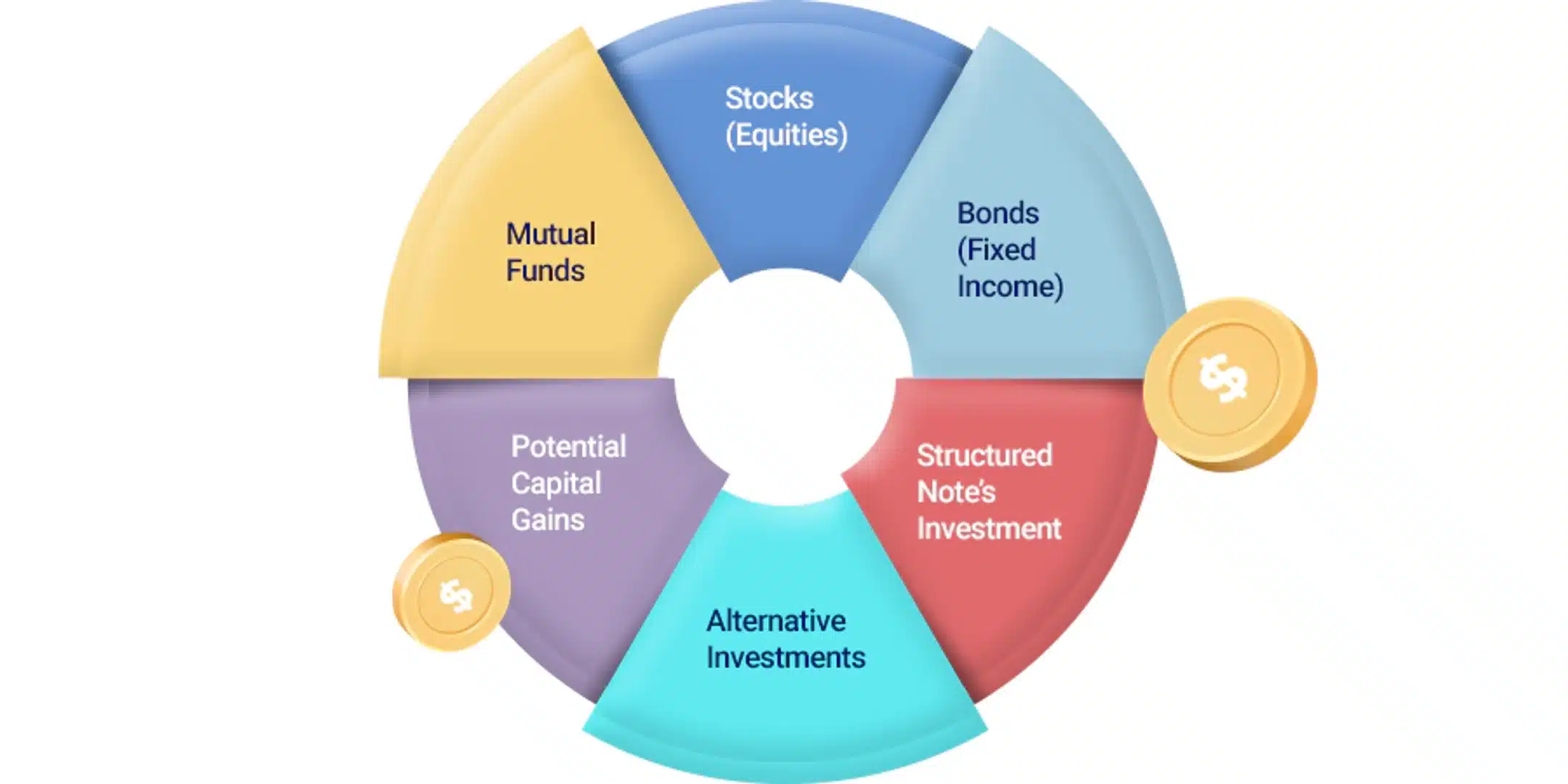

Discover ways to save investment fees along with also the customized investment solutions that are readily available to you! Ranging from structured notes to bonds to fixed income to mutual funds.

Pros of getting advice from Professionals:

- Wealth management firms offer access to experienced professionals who possess in-depth knowledge of financial markets, trends, and strategies

- Customized Solutions tailored to your specific financial goals and circumstances

Cons not getting advice from professionals:

- Suboptimal outcomes and missed opportunities for growth

- Susceptible to biases and emotional decision-making

Conclusion

In conclusion, working with a wealth management firm can provide you with a range of benefits, from access to multiple services to assist during major life changes, planning for retirement, setting realistic goals, and receiving professional advice from experienced professionals.

By partnering with a wealth management firm like Quadra Wealth Management, you can feel confident about your financial future and have peace of mind knowing that your finances are in good hands. So why not take the first step and schedule a complimentary consultation today?

Frequently Asked Questions

What is a wealth management firm?

A wealth management firm is a financial institution that provides a range of services to help wealthy individuals manage their finances, plan for the future, and achieve their long-term financial goals.

What services can I expect from a wealth management firm?

An investment management firm can offer a range of services, including customized investment solutions, portfolio management, financial planning, retirement income planning, and children’s higher education fee planning.

How can a wealth management firm help me during major life changes?

Major life changes, such as having a child, getting married, buying a home, retiring, or changing careers, can significantly affect your financial situation. Asset management companies can provide guidance and support during these changes, helping you make informed decisions about your finances.

How can a wealth management firm help me plan for retirement?

Planning for retirement can be a complex process, and a wealth management firm can help you create a long-term strategy that takes into account your liquid assets, properties, investments, and other factors. This can help ensure that you have enough income to cover your expenses and enjoy your retirement.

How can a wealth management firm help me feel more confident about my finances?

Working with a wealth management firm can take the weight off your shoulders when it comes to your finances. By partnering with experienced professionals, they understand your financial situation, and your needs and offer realistic and achievable financial plans.

How can I schedule a consultation call with Quadra Wealth?

To schedule a consultation with Quadra Wealth Management, simply contact us and request a complimentary get-no-obligation consultation.