What is meant by principal protected notes, and how does it benefit investors in the UAE?

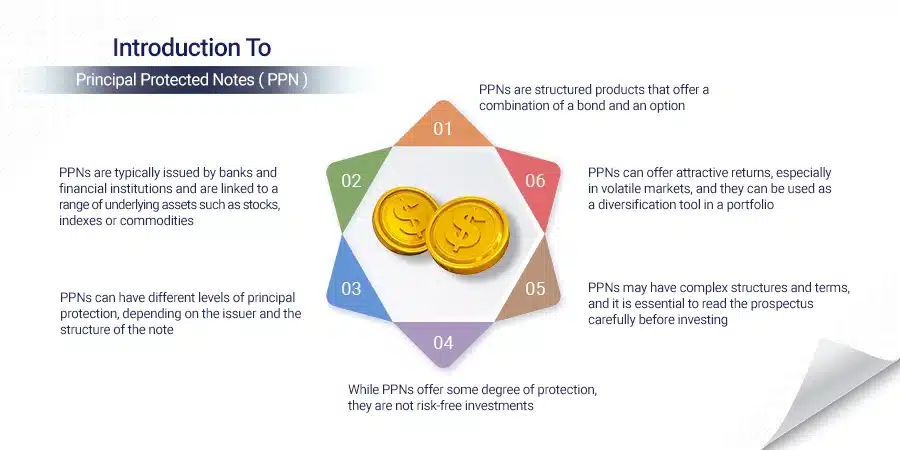

Principal protected notes (PPNs) are financial instruments that combine features of traditional bonds with potential returns from various underlying assets (typically a mutual fund or group of funds, foreign currency, a market index or basket of equities from the equity market, and sometimes hedge funds or even commodities).

These investing vehicles offer a level of security for the investor by ensuring the rate of return on their initial investments while also providing an opportunity to participate in market gains.

In this comprehensive blog post, we will delve into the definition and basic structure of PPNs and discuss their benefits for expatriate CXO-level residents in the UAE.

We will also explore key components such as zero-coupon bonds and the role of investment brokers or dealers in the structure notes.

Furthermore, we will examine risks associated with investing in principal-protected notes like rising rates of interest and inflation risks affecting long-term value.

Tax implications and coupon payments will be covered to help you understand how they may impact your overall investment strategy.

Finally, we’ll touch upon fee structures involved when investing in PPNs and provide guidance on assessing suitability based on personal investment objectives and risk tolerance.

By understanding what notes are at its core, you can make informed decisions about whether this unique investing option aligns with your financial goals within the UAE contex

Understanding what are Principal Protected Notes

A PPN guarantees the investor’s principal back, making it attractive to UAE residents and ex-pats seeking capital preservation and potential for higher returns.

The structure of principal protection combining zero-coupon bonds with other investments

PPNs combine zero-coupon bonds with other investments to provide market exposure while protecting the initial investment amount.

pros

- Capital preservation

- Market exposure

- Diversification

cons

- Limited upside potential

- Complexity

- Market risk

Benefits for investors in terms of capital preservation

- Principal protection: PPNs safeguard your original investments, regardless of how poorly the underlying asset performs.

- Potential for growth: PPNs can provide maximum return if their underlying asset appreciates significantly during their term.

- Diversification: PPNs help diversify risk by providing exposure to various types of assets like equities or commodities.

To fully understand these benefits, it’s essential to evaluate the specific features of each PPN, such as its hard protection or soft protection, which can vary depending on the issuer and product structure.

Key takeaways

The investor in the Middle East seeking capital preservation and potential returns can benefit from Principal Protected Notes (PPNs) combining zero-coupon bonds with other investments.

pros

- Principal Protection

- Downside Risk Mitigation

- Peace of mind

cons

- Full Exposure to Market Risk

- Increased Risk Aversion

- Emotional Stress

Evaluating Issuer Creditworthiness

The Investor must evaluate potential returns and risks before investing in (PPNs) also known as Guaranteed Linked notes).

Assess the issuer’s financial stability by examining their balance sheets, income statements, and cash flow statements.

Look for strong liquidity ratios and low debt levels as indicators of a financially stable company.

Research any news or events related to the issuer that may affect its overall performance.

Credit ratings from reputable agencies like Standard & Poor’s (S&P), Moody’s Investors Service, or Fitch Ratings provide unbiased assessments based on various factors such as financial strength and market conditions.

Higher credit ratings indicate lower default risk, so selecting PPNs with high credit ratings can help minimize your exposure while ensuring a guarantee on your principal.

Understand different types of protection within structure notes:

- Hard protection: Guarantees the return of the principal amount regardless of underlying asset performance.

- Soft protection: Offers partial principal guaranteed, meaning that if the underlying asset performs poorly, you may lose a portion of your invested principal amount.

Evaluating the creditworthiness of the issuer and understanding different types of protection are crucial steps in making informed decisions when investing in PPNs.

Key takeaways

Investors must evaluate issuer creditworthiness and understand principal protection types before investing in Principal Protected Notes.

Interest Rate Risk & Inflation Risk

Don’t let interest rates on risk and inflation risk deflate your investment returns with PPNs.

Impact of rising interest rates on expected returns from PPN

Rising the rates of interest can lead to minimum return from PPNs, as the value of an underlying asset may decrease, making traditional bonds more attractive.

pros

- Potential for high Coupon rates

- Flexibility in adjusting investments

cons

- Decreased returns

- Market Volatility

How inflation can affect the long-term value

Inflation can erode the real return on investments, reducing purchasing power over time, but inflation-linked bonds can help combat this issue.

- Risk management: Diversify your portfolio with different asset classes and investment products.

- Hedging strategies: Use options or futures contracts to protect against adverse movements in the rate of interest or inflation.

- Regular monitoring: Keep a close eye on market trends and economic indicators to make informed decisions about PPN investments.

The investor must understand the impact of interest rates on risk and inflation risk to make informed decisions about notes.

Key takeaways

Protecting your investments return from interest rates and inflation risks with PPNs. Diversify, hedge, and monitor for informed decisions.

Understanding Fees and Choosing the Right Brokers for Principal Protected Note

Don’t let fees eat away at your potential profits when investing in PPNs – do your analysis and understand the fee structure, and compare offerings to find reasonable fees that align with your investment goals.

- Sales charges: Upfront fees are charged by brokers when purchasing PPNs.

- Management fees: Ongoing fees covering expenses related to managing an underlying asset.

- Rider fees: Additional costs for features like soft or hard protection.

- Surrender charges Charges for selling PPNs before the maturity date.

Find reliable brokers who understand your financial goals by checking their credentials, reading reviews, and asking about their experience with PPNs.

Key takeaways

Maximize your investment potential with PPNs. Understand fees & choose reliable brokers for consistent growth.

Tax Implications & Coupon Payments

PPN may not be ideal for tax benefits or regular income, unlike conventional bonds.

Comparing PPNs with the Other type of Fixed-Income Security in Terms of Taxation

Interest earned on Treasury bonds is exempt from state and local taxes, while municipal bond interest is generally free from federal taxes, but PPNs are subject to principal gains tax.

pros

- Potential Tax efficiency

- Tailored tax planning

- Alignment with Tax goals

cons

- Tax Liabilities

- Complexity

The Absence of Timely Coupon Payments and Its Impact on Investors

PPNs lack consistent coupon payments, and returns are linked to underlying assets, which can make it difficult for the investor to rely on steady cash flow to meet their financial needs.

- No guaranteed income: The lack of predictable coupon payments can make it difficult for the investor to rely on steady cash flow to meet their financial needs.

- Potential missed opportunities: Without regular income generated by coupons, the investor might miss out on reinvestment opportunities that arise during periods when market conditions are favorable.

- Risk-reward trade-off: While PPNs offer protection to your principal, the absence of timely coupon payments means that the investor must be willing to accept a degree of uncertainty in exchange for potential returns linked to underlying asset performance.

The Investor ought to assess cautiously all components of PPNs so as to make judicious decisions regarding if this type of investment conforms with their goals and willingness for risk.

Key takeaways

Investors should weigh the risk-reward trade-off of PPNs, as they lack consistent coupon payments and may not offer tax benefits.

Assessing Suitability & Risk Tolerance

Is PPN right for you? Consider your risk tolerance and financial goals before investing in these complex structure products.

Factors to consider:

- Risk appetite: Assess your willingness to take on risk as PPNs protect your principal. While offering potential returns from the underlying assets.

- Inflation concerns: Consider how inflation might affect your long-term purchasing power, especially if you’re looking at longer-dated PPNs.

- Cash flow needs: Keep in mind that PPNs do not pay timely coupon payments like conventional bonds if you rely on regular income from investments.

- Tax implications: Understand the tax treatment of gains made through these instruments compared with other fixed-income securities available in the market.

Benefits vs. Drawbacks:

While initial preservation may seem attractive, remember that there are trade-offs such as limited upside potential due to caps or participation rates linked with underlying asset performance.

Additionally, factors like issuer creditworthiness and the interest rates fluctuating can impact expected returns from these investments.

It’s crucial to consult a reliable broker who understands your financial goals and can help assess whether this type of investment aligns well with them.

Soft vs. Hard Protection:

When considering PPNs, it’s essential to understand the principal protection offered and how it differs between soft protection (partial guarantee of your principal investment) and hard protection (guarantees the full amount invested).

Make an informed decision about including these instruments in your investment portfolio by evaluating factors such as risk appetite, inflation concerns, cash flow needs, tax implications, and potential returns against associated risks.

Key takeaways

Assess your risk tolerance before investing in principal protected notes. Consider factors like inflation, cash flow needs, and tax implications for informed decisions.

FAQ

What is a Principal Protected structured Notes?

A Principal Protected Structured Note (PPSN) is a fixed-income investment that combines zero-coupon bonds with derivatives to provide principal protection and potential returns linked to the performance of the underlying asset, such as stocks or indices. PPSNs offer investors partial exposure to market gains while ensuring their initial investment remains intact.

Principal protection refers to an investment feature that products which guarantee a full return of their principal amount at maturity regardless of market fluctuations or negative performance of the underlying assets. This characteristic provides a level of security for risk-averse investors seeking potential growth without risking their original investment.

While PPNs guarantee the full or partial return of your initial investment, they still carry some risks like credit risk from issuer default, liquidity risk due to limited secondary markets, inflation risk affecting long-term value, and opportunity cost if other investments outperform them. Additionally, rising interest rates can negatively impact PPN values before the maturity date.

A 100% PPN ensures the complete preservation of the investor’s principal upon maturity regardless of any negative movements in the underlying asset(s). However, it may offer a minimum return compared to partially-protected notes since more funds are allocated toward securing full principal protection rather than higher-yielding components like derivatives.

Conclusion

What exactly is a PPN? It’s a fancy investment product that lets you earn returns while keeping your initial investment safe from harm.

PPNs are a mix of bonds and derivatives that give investors exposure to different underlying assets, but they come with risks like interest rate fluctuations and inflation.

Before you jump into PPN investments, get guidance from your financial advisor and make sure you assess your financial goals and risk tolerance as an individual investor in UAE.