In This Article

Best Value Stocks To Buy According To Warren Buffett

In the ever-bustling and dynamic stock market, there exists a figure whose name is a metaphor for financial wisdom and triumph – none other than the illustrious Warren Buffett. Fondly known as the Oracle of Omaha, Buffett is not a mere investor, but a financial philosopher.

He stands tall as a seasoned explorer, finding treasures and weaving tales of financial triumph for decades. Brace yourself as we set sail through the seas of ‘Value Investing’, a strategy that has become synonymous with Buffett’s unparalleled legacy.

Warren Buffett is a well-known figure in the financial world. He currently is the CEO of Berkshire Hathaway, a multinational conglomerate that invests across sectors.

Buffett’s value-driven investment approach has made Berkshire Hathaway a powerhouse in the industry. Also known for his insightful shareholder letters, they are a source of guidance and inspiration in the financial domain.

Immerse Yourself in the Mindset of a Value Investor

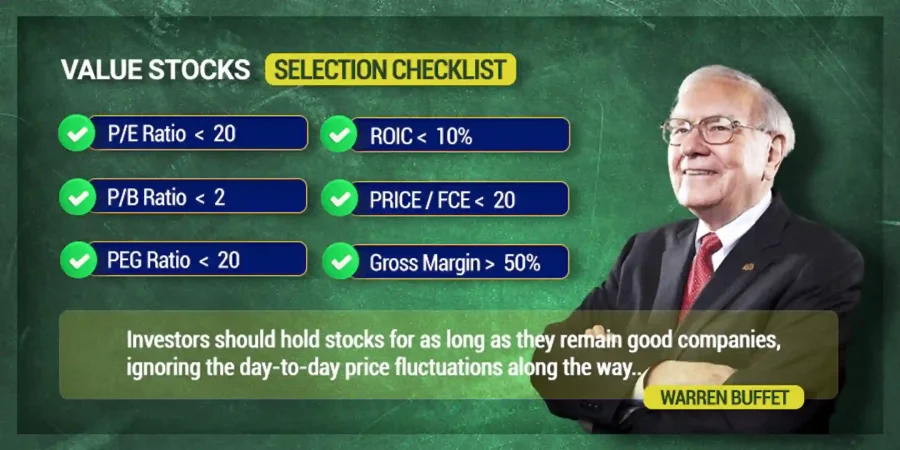

Before delving into specific stocks, let’s grasp the core tenets of value investing that guide Warren Buffett’s decisions. At the heart of his approach is the idea of buying shares in companies, that are fundamentally undervalued stocks by the market.

This involves a thorough analysis of a company’s financial health, competitive position, and growth prospects.

Buffett’s strategy is to seek out businesses with a durable competitive advantage, known as an economic moat, and invest in them with a long-term perspective.

Mundane but Minting

As the Oracle of Omaha has proved, mundane does not equal nonprofitable. He has dug gold mines on the routine pathways with patience as his modus operandi.

His investments often reflect the basic products and services, ranging from consumer goods like razor blades and laundry detergent to soft drinks and automobile insurance. He has shattered the myth that exciting and flashy equate to profitable.

A famous Buffet statement sums up the description of the perfect investment, “I’ll tell you why I like the cigarette business. It costs a penny to make.

Sell it for a dollar. It’s addictive. And there’s fantastic brand loyalty.”

Rake in The Moolah! The Value Stocks to buy are here

Buffett’s stock picks often serve as a lamp post for traders and investors in seas of the stock market. Let’s explore some of his front-runner Warren Buffett stocks to buy for a sustainable and promising investment journey in the year ahead.

1) Apple Inc. (AAPL):

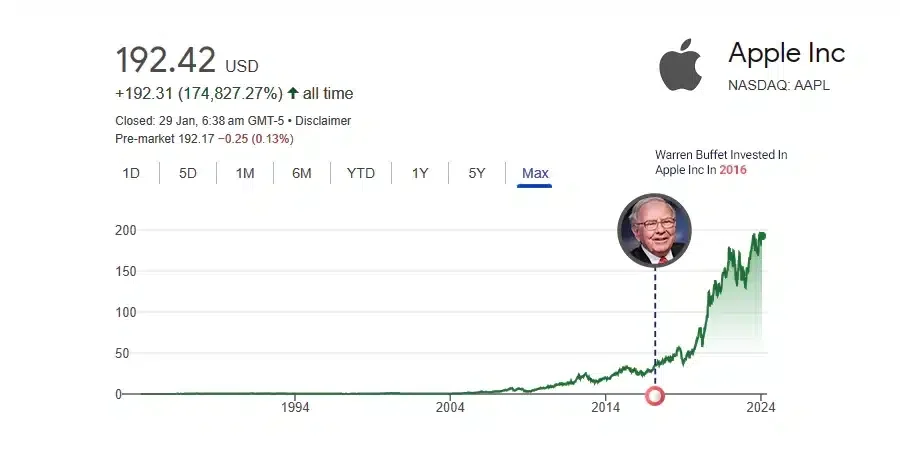

Buffet, the legendary investor, has always been known for his aversion towards technology stocks, but Apple has managed to win him over.

With its strong ecosystem, supreme brand value, consistent innovation, and commitment to shareholder value, Apple has become a stalwart pick and Buffet’s largest stock holding.

Apple, currently is the world’s most valuable public company, with a market capitalisation above a trillion. Apple under the able leadership of its CEO Tim Cook, has expanded its product portfolio and diversified its revenue streams.

Its iPhone remains the company’s biggest revenue contributor. Its other products and services, such as the iPad, Mac, wearables, and services, are growing steadily.

Berkshire Hathaway initially invested in Apple back in 2016, and since then, the company’s stock has performed exceptionally well. Today, AAPL represents over 41% of the company’s total portfolio, making it the largest equity position.

Apple’s continued success has time and again proven its ability to innovate breakthrough technologies and products and thereby deliver value to its customers and shareholders alike.

Also Read: Want to invest in Green Companies? Read on!

2) Bank of America (BAC):

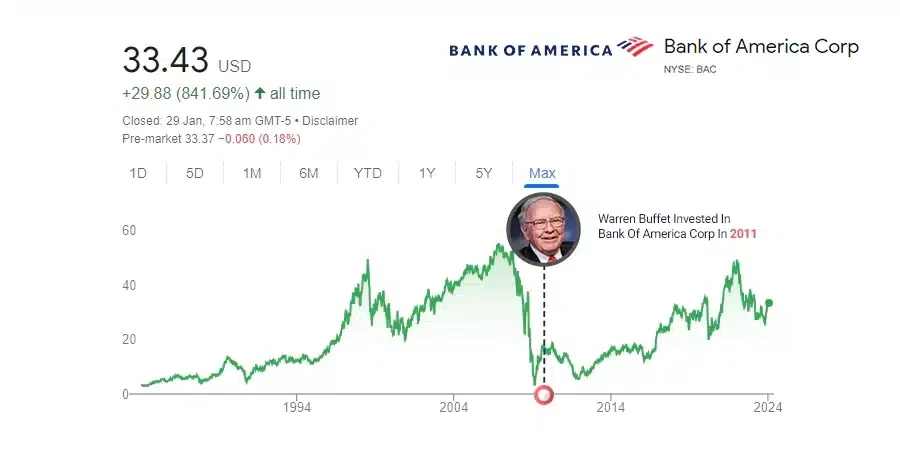

Bank of America, a prominent financial institution in the USA is known for its focused consumer business. It has a reach to business customers globally and offers a diverse range of financial products and services.

Its credit card and its value-added services are raked in as the best in class. The bank’s commitment to shareholder value resonates perfectly with Buffett’s value investing principles. Warren Buffett initiated investment in Bank of America in 2011 when the bank faced challenges amidst the eurozone debt crisis.

Bank of America has become a substantial component of Berkshire Hathaway’s portfolio, representing more than 10% of its holdings.

3) The Coca-Cola Company (KO):

Coca-Cola, representing stability and steadfast brand strength is a forever favorite of Warren Buffett’s portfolio. As a major player in the U.S. consumer staples sector, Coca-Cola offers a range of products, from its iconic cola to snacks and sports drinks.

Operating in a fiercely competitive market of soft drinks, Coca-Cola has consistently delivered solid returns and dividends over the years. Berkshire Hathaway initiated its investment in Coca-Cola in 1988, marking its oldest equity position.

Buffett has been committed to holding these shares, and Coca-Cola currently constitutes approximately 7% of Berkshire Hathaway’s portfolio. As a classic example of a company with a wide economic moat, Coca-Cola continues to be a cornerstone of Buffett’s holdings.

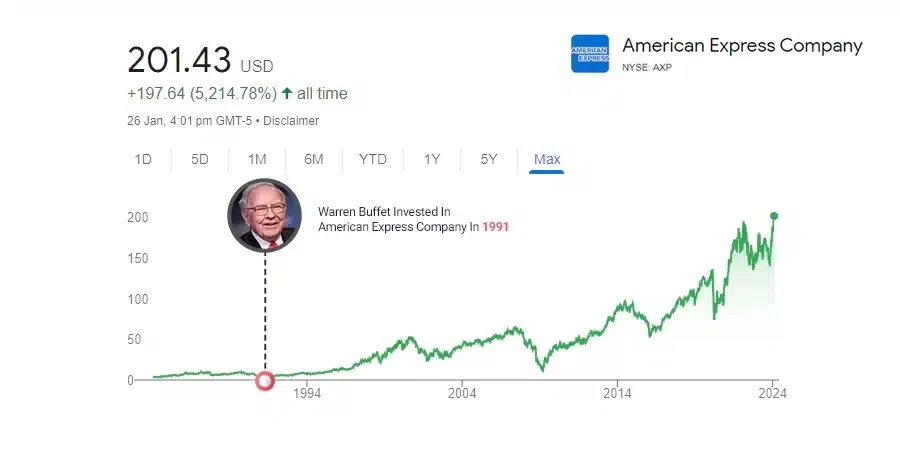

4) American Express (AXP):

American Express has long stood in Buffett’s portfolio, which is a testament to the institution’s at-par excellent qualities. With a focus on financial services and a riveting brand presence, American Express remains a star pick in Buffett’s portfolio.

American Express, renowned for its best-in-class credit cards, also offers travel-related banking services, banking products, merchant services, and payment gateways, to name a few.

American Express’s has sustainably diversified its revenue streams and maintained a competitive edge. Buffett initiated his investment in American Express in 1991, initially acquiring preferred stock before converting it to common stock in 1994.

Presently, AXP constitutes over 8% of Berkshire Hathaway’s portfolio.

Also Read: Want to Multiply Your Wealth Steadily?

5) Johnson & Johnson (JNJ):

Johnson & Johnson is a major player in the healthcare sector and a favorite of Warren Buffett. The company has a stringent commitment to research and development and successfully puts a diversified portfolio in its niche. This has made it a reliable investment in all economic conditions.

With a portfolio spanning pharmaceuticals, medical devices, and consumer products, Johnson & Johnson represents stability in a sometimes unpredictable market.

The company’s continued focus on research and development and a strong balance sheet, positions it as an all-weather-friendly value investing. Buffett’s investment in Johnson & Johnson reflects his belief in the company’s ability to deliver consistent returns over the long term.

Johnson & Johnson has a proven track record of being insulated from all market conditions and adapting to changing market conditions, thereby making it a valuable addition to investor’s portfolios.

6) Verizon Communications Inc. (VZ):

Verizon is a prominent market player in the domain of telecommunication services, like wireless communication, high-speed internet, and television.

The company has a widespread market presence and is a major market player with a large chunk of market share. It boasts an unwavering commitment to delivering seamless connectivity solutions. Verizon’s exceptional market standing and track record of consistently delivering reliable dividend payments make it an appealing choice for long-term stocks for investors, particularly given the essential nature of its services.

The company’s time-tuned telecommunication offerings and focus on customer satisfaction further strengthen its reputation as a dependable and trustworthy service provider. It is no surprise that Verizon has been identified as a Warren Buffett pick, given its strong market position, reliable dividends, and essential services.

7) Chevron Corp:

Chevron is a major player in the energy sector, involved in every aspect of the oil and gas industry. It holds a significant position in the US market, offering comprehensive energy solutions by operating across every stage of the petroleum production process.

Interestingly, Berkshire Hathaway recently added Chevron to its holdings, with Chevron constituting approximately 8.3% of its holdings.

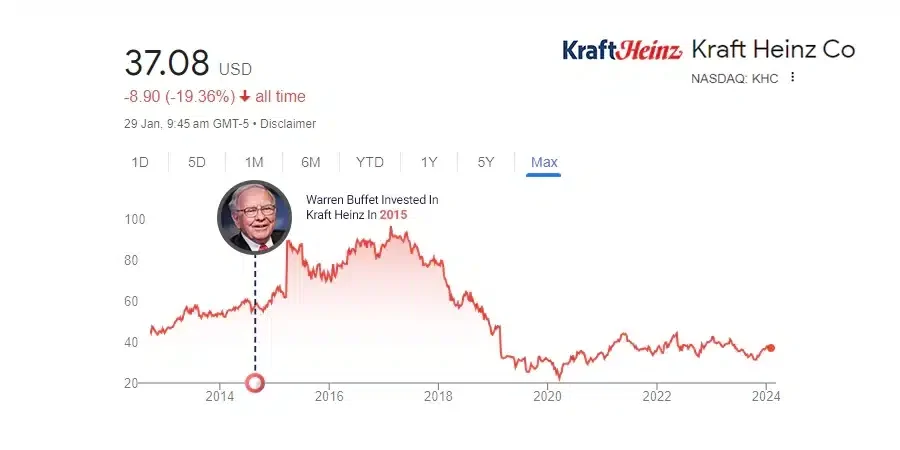

8) Kraft Heinz Co. (KHC):

Kraft Heinz is a food industry giant that resulted from a collaboration between Berkshire Hathaway and 3G Capital, representing Warren Buffett’s entry into the food industry. Today, KHC produces a diverse range of products, including iconic ketchup and cheese products, as well as a variety of drinks, snacks, and processed foods.

Although Buffett has not had much success with KHC, the company still constitutes approximately 3.8% of Berkshire Hathaway’s holdings, underscoring its long-term potential as a food industry leader.

9) Occidental Petroleum Corporation (OXY)

Did you know that Occidental Petroleum is a US-based energy company that deals with the exploration and production of crude oil and natural gas? It primarily focuses on the domestic market, with 80% of its production expected to come from the US in 2022.

Interestingly, Warren Buffet’s Berkshire Hathaway has a significant stake in the company, with Buffett first buying the preferred best stocks in OXY back in 2019.

Some speculate that Buffett may be eyeing a full acquisition of the firm, given that Occidental currently makes up nearly 4% of Berkshire Hathaway’s holdings.

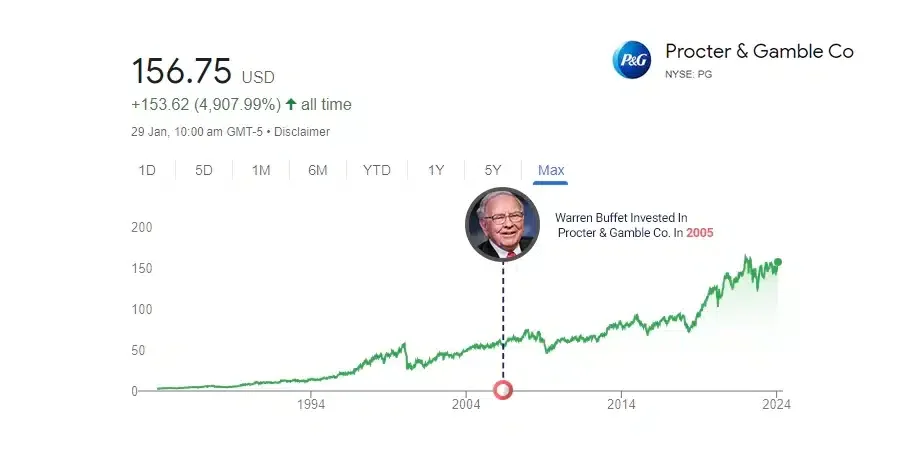

10) Procter & Gamble Co. (PG):

Buffett’s affinity for consumer goods is reflected in Procter & Gamble. With a portfolio encompassing everyday products, Procter & Gamble aligns with Buffett’s preference for companies offering essential goods and services.

It has a noteworthy global presence in the consumer goods sector and has a diverse portfolio of household staples. From iconic products in the realms of beauty and grooming to healthcare and homecare, P&G’s presence is felt in millions of households worldwide.

11) Wells Fargo & Co. (WFC):

Wells Fargo remains a major player in Buffett’s portfolio despite recent challenges the company faced. The bank’s efforts to resolve past issues and its established presence in the financial sector contribute to its appeal. Weathering the Storms in the Financial Sector:

Buffett’s affinity for the financial sector is evident in his substantial investment in Wells Fargo (NYSE: WFC). Despite facing challenges and controversies, Wells Fargo remains a key player in Buffett’s value stock arsenal.

The bank’s extensive branch network, diversified financial services, and commitment to resolving past issues position it as a potential gem for many investors seeking market value with a margin of safety.

As Buffett often emphasizes, a company’s ability to recover from setbacks is a crucial aspect of value investing.

12) HP Inc.:

Founded in 1939 as the Hewlett-Packard Company, HP is a pioneer of the global tech industry. Today the company’s three business divisions are personal systems, printing, and corporate investments.

There was a time when every engineer swore by their Hewlett-Packard calculator, whereas now the personal systems segment is dedicated to laptops and home computers. The firm remains a major player in printers and 3D imaging solutions, while its corporate investments arm provides incubation and investment in startup projects.

Buffett famously avoided the tech industry until the middle of the last decade, when Berkshire began buying up shares of Apple. HPQ is a newer tech investment for Buffet, who started establishing a stake in the company in early 2022.

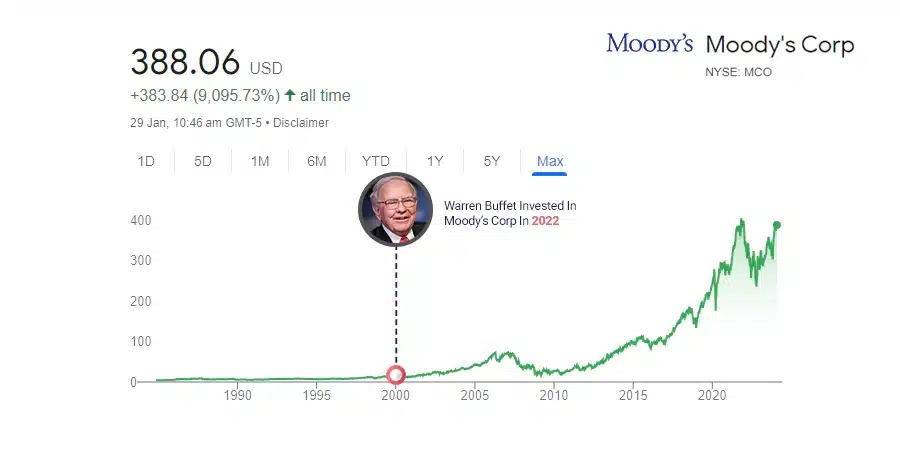

13) Moody's Corporation (MCO):

The company’s role in providing essential financial information and its competitive position in the credit rating industry make it a strategic addition to Buffett’s portfolio. Moody’s is a financial services company that publishes bond and credit ratings on companies and governments. Its ratings evaluate the financial stability and outlook of public and private companies.

Together with S&P Global and Fitch Ratings, the three top agencies control 95% of the market for bond ratings. MCO is one of Berkshire Hathaway’s oldest holdings.

Buffett first received a stake in the company when it was spun out of Dun & Bradstreet, which he owned but subsequently sold off. Today Moody’s accounts for 2.2% of Berkshire Hathaway’s portfolio.

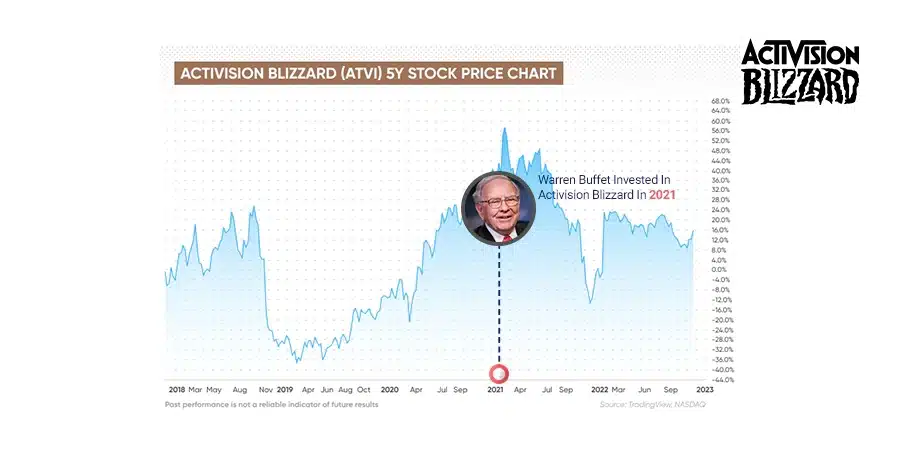

14) Activision Blizzard:

This company is a powerhouse in the interactive entertainment industry, known for developing and publishing some of the world’s most popular video game franchises. From iconic titles like Call of Duty and World of Warcraft to Overwatch and Candy Crush, Activision Blizzard has a diverse portfolio with a massive global reach.

Activision Blizzard, Inc. is an American video game holding company based in Santa Monica, California. It was founded in July 2008 through the merger of Activision, Inc. and Vivendi Games.

In January 2022, Microsoft announced a deal to acquire ATVI for more than $68 billion, although the deal has been tied up in antitrust regulatory purgatory since then.

Buffett bought his shares of ATVI in late 2021. Today, the stake is 1.2% of Berkshire Hathaway’s portfolio.

Parting Thoughts

The world of Warren Buffett’s value investing philosophy hows a roadmap to financial wisdom and all-weather investing success. His emphasis on the intrinsic value of the company and the best long-term perspective serves as great hand-holding for investors sailing through market fluctuations. The Oracle of Omaha’s timeless principles remind us that in the fleeting trends, the foundation of long-term investing lies in a patient and disciplined approach.

As we draw inspiration from Buffett’s journey, may we apply these invaluable lessons to our own investment endeavors, building a path of prosperity.

Should I talk to a Financial Advisor When Buying a House?

In This Article Should I talk to a Financial Advisor When Buying a House? Or

Master Robert Kiyosaki 10 Keys to Financial Freedom

In This Article Robert Kiyosaki 10 keys to financial freedom Have you ever felt the

Can SIPs Make You Rich? Mutual Fund SIP Grow Your Wealth

In This Article Can SIP make you rich? Systematic Investment Plans can help in wealth

Exclusive Investments of Elon Musk: Disruption, Vision, and Risk

In This Article A visionary entrepreneur who has been a consistent disruptor in the way