Struggling to clear your debts and feel like you’re drowning in interest fees? You are not alone, many people find managing multiple debts overwhelming. In this article, we will navigate through an efficient strategy known as the Debt Avalanche Method to help pay off your debt faster by saving on interest charges.

Ready to gain control of your financial future? Let’s dive into how to conquer your debts with confidence!

Key takeaways

● The Debt Avalanche Method helps you pay off debts fast. You focus on the debt with the highest interest rate first.

● List all your debts, note their interest rates and start paying more on the one with high rate, while making minimum payment for others.

● This method can save you lots of money in long - term but needs patience as big loans take time to finish.

● Other ways to clear debt are Debt Snowball Method, Balance Transfer Credit Card and Debt Consolidation. Each has pros and cons. Pick the right way that fits best for your situation.

Understanding the Debt Avalanche Method

This section delves into the concept of the Debt Avalanche method, providing a comprehensive definition and explaining how this debt repayment plan works by prioritizing debts with the highest interest rates, making it a systematic way to pay down high-interest debt while saving money on interest.

Definition and Overview

The Debt Avalanche is a smart way to pay off what you owe. It’s all about focusing on the debts with the highest interest rates first. You still make minimum payments on your other debts, but any extra money goes towards the debt with the highest rate.

This plan lets you save more on interest over time. You follow this method until your highest-rate debt is gone. Then you shift focus to the next high-rate debt and so on until all debts are paid off.

Remember, it starts by setting aside part of your income for paying debts after taking care of living costs.

How the Debt Avalanche Method Works

The Debt Avalanche Method is a neat plan to pay off debts fast. You start by listing all your debts. Then you put them in order from the highest interest rate to the lowest one. Every month, you pay the most money towards the debt with the highest interest rate.

For all other debts, just make the minimum payment monthly. Work hard at paying off that high-interest debt first. Once it’s paid off, start on the next one down on your list using extra funds plus what you were paying as a minimum for that loan earlier.

Keep going until every single debt is paid off!

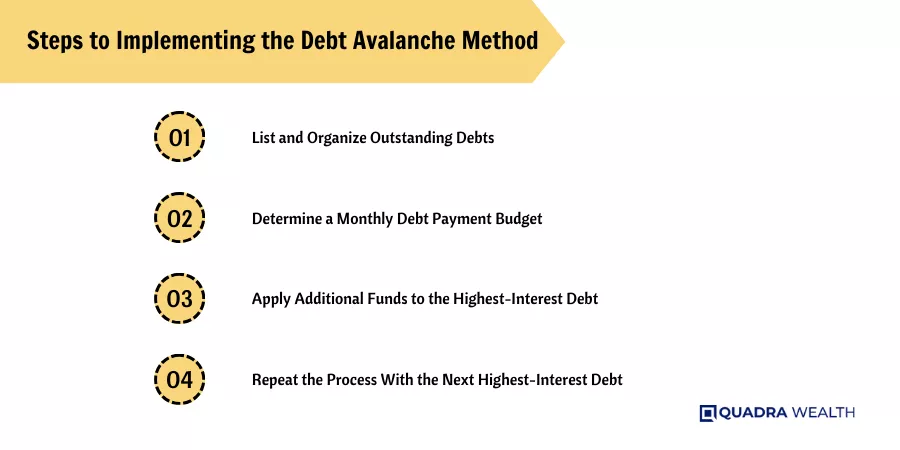

Steps to Implementing the Debt Avalanche Method

This section delves into the different stages of employing the Debt Avalanche Method. It starts with listing all outstanding debts before prioritizing them based on their respective interest rates.

The next crucial step involves allocating payments in order of priority to facilitate efficient debt management and faster repayment. This process requires careful financial assessment and strategic planning to streamline your debt repayment journey effectively.

Listing All Outstanding Debts

Keeping track of all debts is the first step in the debt avalanche method. This process involves:

- Putting down all types of loans like car loans, student loans, and medical bills.

- Adding credit card debt to the list too.

- Making note of how much money you owe for each loan.

- Writing down the minimum payment you need to make every month for each debt.

- Taking note of interest rates for each one.

- Noting down who you owe money to.

Prioritizing Debts Based on Interest Rates

The debt avalanche method starts with debts sorted by interest rates. Here’s how:

- Begin by listing all your debts.

- Write down the interest rate for each debt.

- Sort the list from highest to lowest interest rate.

- The debt with the highest interest rate is your main goal.

- Make minimum payments on all other debts.

- Put any extra money towards the debt with the highest interest rate.

- Keep following this plan until you pay off this debt fully.

Allocating Payments Based on Priority

To use the debt avalanche method, you need to place your debts in order. You focus on the one with the highest interest rate first. Here is how to do it:

- Write down all your debts. Include credit cards, student loans, car loans, and medical bills.

- Note down the interest rate for each debt.

- Look at your list and find the debt with the highest annual percentage rate (APR). This debt is your top priority.

- Make sure you pay the least amount needed on all other debts each month.

- Use any extra money from your income after living expenses to pay this top priority debt.

- When you finish paying off this debt, move to the next one with high APR on your list.

Advantages and Disadvantages of the Debt Avalanche Method

This section will delve into the benefits of the Debt Avalanche method, such as potential savings on interest and time, along with its drawbacks like the possible lack of motivation due to delayed small debt payoff.

- Using the debt avalanche method saves you money and time. You pay less in interest because you focus on debts with the highest rates first. Also, tackling high-interest debt speeds up your overall debt repayment plan.

- This means getting out of debt quicker! So, if saving money on interest matters to you, this method could be a great choice.

- The debt avalanche method has a downside. It can slow down your joy of paying off debt early. Let's say your highest interest rate debt is also the biggest one. You will need more time to pay it off.

- This can make you feel as if you are not making progress at all. Also, some people find it hard to stay on this plan because they do not see fast results. Sticking to your debt repayment plan needs motivation which might be less in this case compared to other methods like the debt snowball method where small wins come faster.

Debt Avalanche vs. Other Debt Repayment Strategies

In this section, we’ll weigh the debt avalanche method against other popular debt repayment strategies such as the debt snowball method, balance transfer credit cards and debt consolidation, helping you choose a plan best suited to your financial situation.

Debt Snowball Method

Y

The Debt Snowball Method is another popular debt repayment strategy, which focuses on paying off the debts with the smallest balances first, regardless of the interest rates. This method provides a psychological boost by eliminating small debts quickly, which can help to maintain motivation. However, it may not save as much money in interest as the Debt Avalanche Method.

Steps | Description |

1. List your debts | Start by listing all your debts from smallest to largest balance, irrespective of the interest rate. |

2. Make minimum payments on all debts | Continue making the minimum payments on all your debts to avoid late fees and negative impacts on your credit score. |

3. Pay extra towards the smallest debt | Any extra money you have should be put towards paying off your smallest debt. This accelerates the payoff process and eliminates one debt from your list. |

4. Roll over the payments | Once the smallest debt is paid off, take the amount you were paying on that debt and put it towards the next smallest debt. This creates a ‘snowball effect’ where the amount you are putting towards your debts increases as you pay each one off. |

5. Repeat until all debts are paid | Continue this process until all your debts are paid off. The key is to maintain momentum and keep the ‘snowball’ rolling. |

Despite the advantages of seeing quicker results, the Debt Snowball Method does not save as much in total interest charges as the Debt Avalanche Method. Financial planners often recommend building a six-month emergency fund before starting any accelerated debt payoff plan, including the Debt Snowball Method. This strategy can help to cover unexpected expenses without adding further to your debt.

Balance Transfer Credit Card

A balance transfer credit card is another strategy used for managing and repaying debt.

- Potentially offers a lower interest rate

- Possibility of a 0% introductory APR

- Allows for consolidation of debts

- Can simplify payment by combining multiple debts into one

- Balance transfer fees could be costly

- Normal APR will apply after the introductory period

- Requires good to excellent credit score

- Risks increasing debt if not careful with new card

The balance transfer credit card enables you to transfer debt from other accounts, often at a lower interest rate. Some cards offer a 0% introductory annual percentage rate (APR), but it’s important to remember that a normal APR will apply after the introductory period. It allows for the consolidation of multiple debts into a single payment, simplifying your finances. However, balance transfer fees can be costly and you typically need a good to excellent credit score to qualify. Furthermore, there’s an inherent risk of increasing your debt if you are not careful in managing the new card.

Debt Consolidation

Debt consolidation is another strategy used to manage and repay outstanding debts. This method typically involves taking out a new, large loan to pay off multiple smaller debts, essentially consolidating numerous payments into a single one.

Aspects | Description |

Methodology | Debt consolidation involves taking out a new loan to pay off multiple debts, ideally with a lower interest rate. |

Benefits | Debt consolidation simplifies debt repayment by merging multiple payments into a single one. It also often results in a lower interest rate, which can save money over time. |

Drawbacks | While debt consolidation simplifies repayment, it does not eliminate debt. If not managed properly, it can also lead to further debt accumulation. In addition, the lower interest rates are sometimes introductory and may increase over time. |

Best suited for | Debt consolidation is best suited for individuals with multiple high-interest debts, such as credit cards and personal loans, who are able to secure a lower interest consolidation loan. |

Conclusion

Use the debt avalanche method to pay back money faster. Pay your debts with the highest interest rates first. This will help you save more money over time. It’s a good plan if you stick to it and are patient.

FAQs

The Debt Avalanche Method is a systematic way of paying down debt. You start by paying off your largest debt balance with high interest, using the available monthly income.

You don’t always need a financial advisor, but they can give you good debt advice and help control credit card balances. The best ones offer strategic consulting based on your personal finance status.

Unlike methods that focus on smallest debt balance first, here you pay off debts with high-interest rates first which saves money in the long run.

Yes! There are many top-rated debt reduction software programs that support this strategy and even add rewards like cash back to encourage user’s progress.

Many people may feel relief slowly as it targets big amounts first unlike other methods where smaller debts are paid off quickly giving a sense of fast progress or ‘quick wins.’

In order to pay-off large debts effectively without leading towards financial crisis; regular budgeting becomes key for effective management of available monthly income and avoiding unnecessary spending.

Should I talk to a Financial Advisor When Buying a House?

In This Article Should I talk to a Financial Advisor When Buying a House? Or

Master Robert Kiyosaki 10 Keys to Financial Freedom

In This Article Robert Kiyosaki 10 keys to financial freedom Have you ever felt the

Can SIPs Make You Rich? Mutual Fund SIP Grow Your Wealth

In This Article Can SIP make you rich? Systematic Investment Plans can help in wealth

Exclusive Investments of Elon Musk: Disruption, Vision, and Risk

In This Article A visionary entrepreneur who has been a consistent disruptor in the way