Are you struggling to explore new avenues for a good return on your investments? Fixed income structured notes could be that hidden gem. While these unique financial instruments allow potential for larger gains and downside protection, they can also feel complex and intimidating.

This blog post will simplify the concept of fixed income structured notes, shattering misconceptions, explaining how they work, who should invest in them, and ultimately guiding you through their world filled with diverse opportunities.

Ready to boost your portfolio strength? Let’s dive in!

Key takeaways

● Fixed income structured notes are linked to assets. They let you earn more and lose less.

● These notes can be changed to fit your needs. You can earn money even when asset value drops.

● There is a chance the bank will not pay up, so these notes come with some risk.

● To invest, know what you may lose, pick the right note for you, avoid high fees and keep watch on the asset's worth.

Understanding Fixed Income Structured Notes

Fixed income structured notes are a type of investment. They use debt and offer a return based on something else like assets or indexes. This is called the underlying asset. It can be many things, from shares in big firms to an index that tracks whole markets.

But these notes have something more than this link to other assets. They also have built-in parts that handle risk and reward in different ways. For example, some are linked with call options on stocks that may rise sharply but could also fall hard too.

These fixed income structured notes can limit your losses if things go wrong and cap your winnings if times get better by using bonds or call options in their build-up formulae- along with the component connected to another asset’s performance! That’s why these tools would provide useful protection when we experience high market volatility but at the same time allow us profit despite low interest rates!

They give both downside protection and chances for gains which seldom see together anywhere else considering its distinctive structure: it partners stable partnerships with risky ones under specific conditions!

Advantages of Fixed Income Structured Notes

Fixed income structured notes offer higher returns through their multi-asset class approach. They provide downside protection, shielding investors from potential market downturns. These financial instruments allow for customization to align with an investor’s specific goals and risk/reward tolerance.

Lastly, they enable complex investment strategies, making it possible to balance risk and achieve diverse portfolio goals.

Higher Returns

Fixed income structured notes offer a way to earn more money. They can give higher returns than other ways of investing. How? They link the amount you get to assets like equities or real estate.

If these assets do well, your return goes up.

But there is another side too. These notes also limit how much you might lose if things go wrong. Thus, they let you win bigger and lose smaller at the same time. So, fixed income structured notes may help make your investments grow faster.

Downside Protection

Fixed income structured notes have downside protection. This means they keep you safe when the value of what you invest in goes down. You can still earn money even if the asset value drops.

This helps balance risk and reward when investing.

Customization

Customization is a big plus of structured notes. You can change them to fit your needs. They offer different payouts like protection from loss and ability to earn money or grow with rising stock values.

Not only that, they let you get in on different assets such as stocks, how an index performs, things people buy and sell every day, or other items. This makes it easy to spread out your investments.

The best part? These notes give solid returns more often than direct investments since they keep making money even when the asset’s value drops. It also saves time as multiple types of investment are bundled into one note so you don’t have to build each one separately.

Enables Complex Investment Strategies

Fixed income structured notes allow tough bets on set results. This makes room for hard-to-find payoff types. They mix steady bonds and risky call options. In short, they slash losses and hold high win chances.

But a word of warning! Structured notes might be hard to get if you don’t know much about financial bits and pieces. So being aware helps with wise investing moves!

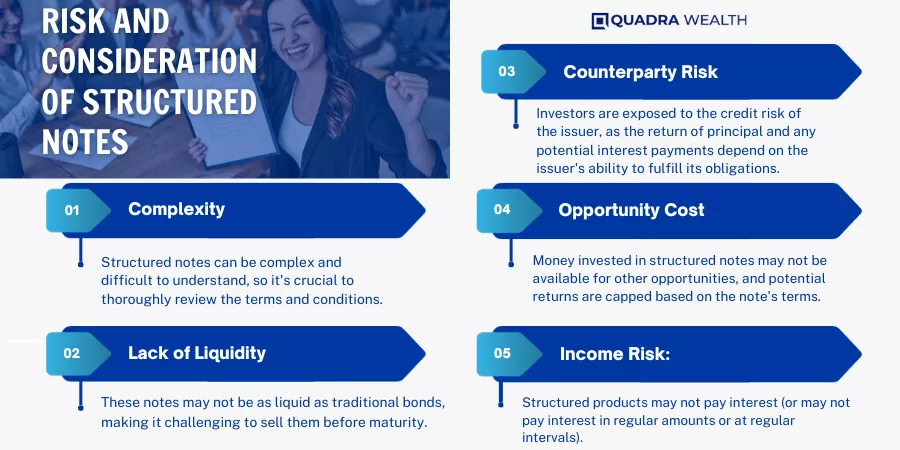

Disadvantages of Fixed Income Structured Notes

While fixed income structured notes can offer high returns and downside protection, investors must also consider the potential credit risk, possibility of missed payments due to issuer insolvency, and potentially high fees associated with these financial products.

Credit Risks

Credit risks are part of fixed income structured notes. This means that there is a chance the bank giving out the note may not pay up. If the bank can’t meet its promises, you could lose your money.

These types of notes also bear more default risk than basic debt or mixed assets do. They are seen as an unsecured loan to banks, which adds more credit threat. Keep in mind call risk too; some banks can buy back such notes before time at less value than face worth.

Possibility of Missed Payments

Fixed income structured notes have a risk. You might not get your money when you should. This is because they can miss payments or even be in default. These notes often tie to the credit risk of the company that issues them.

So, high volatility and falling markets can cause problems. The issuer may find it hard to make payments on time or in full if there are tough economic factors.

High Fees

Structured notes cost a lot. These high fees can hurt your gains. The average fee in 2020 was about 2.9%. Often, these costs make structured notes less worthy than other choices for investors wanting cheap options.

If the returns don’t cover the costs, it’s a problem. Other ways to grow money might be better picks when high fees chip away at possible wins from structured notes.

Types of Fixed Income Structured Notes

Fixed income structured notes take many forms. Here are some of them:

- Principle Protected Notes: The investor’s first cash put in is safe with these notes. But the return links to an underlying asset or index.

- Income Notes: These notes offer steady payments to the owner. They work well for people who want regular money.

- Growth Notes: These types of notes have their returns tied to how well an asset or index does over time.

- Leveraged Notes: With these ones, an investor gets more than the regular return from an asset or index.

- Reverse Convertibles: In this case, the investor might end up with the risky asset instead of his cash if bad things happen.

How Do Fixed Income Structured Notes Work??

Fixed income structured notes are a mix of bonds and other tools. They include call options on stocks, which can be risky. These notes rely on an underlying asset or group of assets.

The return that you get from these notes depends on how this underlying thing does.

These kinds of investments can offer many possible payoffs. This makes them special in the world of investing. But they can also be hard to understand at times because they use things like derivatives and complex bets in their structure.

You need to have the right kind of knowledge for this as it is easy to lose track if not followed properly.

Who Should Consider Investing in Fixed Income Structured Notes?

People with a lot of cash to use may want to think about these notes. They are good if you’re okay with a bit more risk for a higher return on your money. Some folks like that they can set limits for gains and losses.

It’s also helpful to know how different markets move. This helps pick the right note act just the right time.

Some people make unique bets with their money using fixed income structured notes. For example, some people bet on how wild things get in the stock market or on very certain results happening (think bull put spreads).

You need strong skills though; these notes have complex parts named derivatives. If you don’t understand these, it will be hard to tell what might happen next!

Common Misconceptions about Fixed Income Structured Notes

Many people have wrong ideas about fixed income structured notes. Let me clear up some of these common misconceptions.

- Some think that structured notes are simple. This is not true. They mix debt and complex structures linked to the ups and downs of an asset or a group of assets.

- People often believe that all structured notes give high returns. But, the return on a structured note ties to an asset’s performance, which may not always be high.

- Too many investors think they face no risk with these notes. This is wrong because credit risks, interest rate risks, and other market factors can affect them.

- Many people get tricked into thinking there are no fees tied to such investment schemes. However, these products may come with high fees that eat into your profits.

- Some investors believe that structuring protects them from losses completely.

- A common myth is one can easily sell off these financial tools at any time for full value and benefit from price flexibility, but truthfully liquidity is often limited in reality.

- Also, a lot of folks incorrectly assume these investments only work for top-level expert investors or large-scale institutions due to their complexity.

- Lastly, it’s wrongly assumed by few that structured notes only assist in making big bets on unusual results like stock market turbulence or targeted spreads; however they’re commonly used for a wider variety of payoffs as well.

How to Invest in Fixed Income Structured Notes

Here is your guide to invest in fixed income structured notes:

- First, get a grip on your finances. Understand what you can afford to lose if things go south.

- Then, research and learn about the different kinds of structured notes.

- Talk to a financial advisor. Get their opinion on investing in these kinds of notes.

- Set your investment goals. This will help you decide which kind of note suits you best.

- Look at the risks involved. Every investment has some risk.

- Pay attention to the terms and conditions of the note.

- Avoid high fee notes. High fees can eat into your profits.

- Always spread out your investments. Don’t put all your eggs in one basket!

- Review the performance of the underlying asset or index linked to the note’s return.

- The last step is buying the note through a broker or other financial firm.

FAQs

Fixed income structured notes are an asset class in a multi-asset class fund, using collateralized loan obligations and short-term notes.

Adding this type of alternative investment to your yieldstreet portfolio could help. They’re often used for custom payouts and private market investing with exposure to supply chain financing.

Sure! This way of investing lets you get into bonds, equities, blue-chip stocks or even restricted securities without trouble—and faster too!

Yes, things don’t always go smoothly with investments—private placements included—and you might lose money because of bad market conditions or modeling errors.

Stretching valities may put your key funds at risk indeed—it’s not a good thing for investors seeking steady bond returns from their portfolios.

It is good sense to reach out for financial advice—from say an advisor before doing any complex calculations on future performances; also remember the Securities and Exchange Commission rules.