Introduction

As an investor, it is always a better idea to invest in structured products as you can customize your investing options based on the objectives or goals you have in mind.

Structured notes are products that combine debt with equity. Here, you have a bond or a promissory note that is customized in the name of the investor. And, the bond has underlying assets attached to the same. The assets comprise equities, a basket of stocks, and currencies, to name a few.

And, the leveraged note is a type of structured product that is even better because the portfolio helps you amplify your returns on your initial investment. This way, you garner your wealth-realization objectives more precisely than ever.

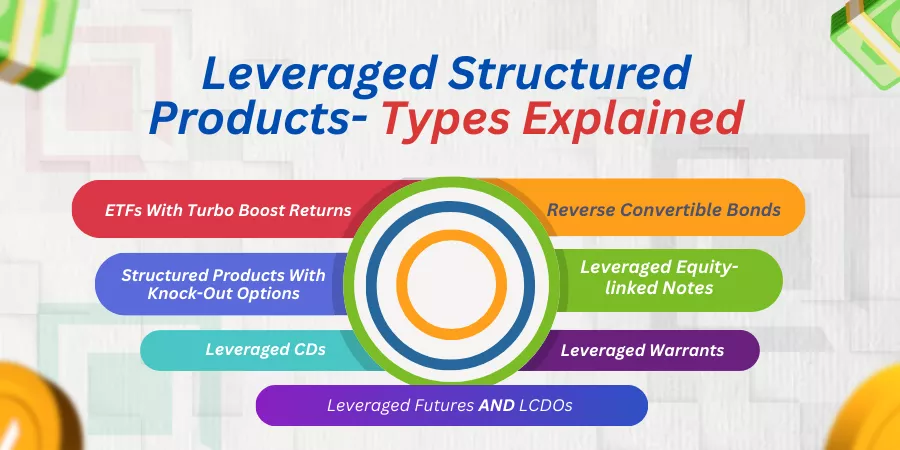

On this note, let us learn about 8 different types of leveraged structured products that you can have hands-on with:

Leveraged Structured products- Types Explained

ETFs With Turbo Boost Returns

ETFs stand for exchange-traded funds. These are a structured pool of derivatives that come with 2X or 3X times the regular returns you may expect from the regular version of underlying assets. Ultra S&P 500 can be a classic example of this wherein you choose a higher trading commodity to amplify your returns. You must also look for credit risks and market fluctuations pertaining to the same.

Reverse Convertible Bonds or RCBs

Reverse Convertible bonds can be a win-win situation for the product-issuing firms and for the investors who are involved. This is mainly because the RCBs allow investors to get an upside exposure to the performance of the underlying assets that the notes are linked to.

Above all, these are short-term debt instruments that allow maximized returns on investor’s capital.

Finally, even if the performing assets fall short of barrier limits as have been set, the investor’s principal amount gets converted into underlying stocks of the said assets. And, the investors can sell them like direct investments in the secondary market to recover their capital sum.

Structured Products With Knock-Out Options

Structured products with knockout options can be considered turbo investments that can amplify your rate of earnings. You buy them at lower premiums over the regular products that come without the knock-out mechanism added to them. The in-built knock-out mechanism the notes have, put a cap on potential losses, the investment would otherwise make in case of direct investments of the same. Hence, knock-out products can be considered leveraged structured products.

Leveraged Equity-linked Notes

Leveraged equity-linked notes are several notches higher than regular equity-linked notes. Here, the investor can add turbo X returns to the underlying stocks or equity assets to which the notes are linked. Here, the investors can get increased exposure to notes that are linked to equity assets and capitalize turbo returns on the performance of the underlying assets. This is meant for dynamic investors who know how to deal with the equity market.

Leveraged CDs

Certificates on Deposits or CDs can be structured or leveraged to suit the investor in terms of wealth-earning or achieving his income-generation objectives. These are bonds that can be linked to equities, indices, or currencies. You can customize these structured deposits to provide you with fixed-income coupons or payouts from the gains of the underlying assets these leveraged notes are linked. However, CDs have fixed maturity dates and the principal redemption happens by the time the investment portfolio matures.

Leveraged Warrants

Warrants provide investors with rights but not obligations to buy them at call prices (buying prices) and sell them at put prices (Seller prices) and these are structured bonds that are linked to a whole fleet of underlying assets like commodities, futures, indices, stocks, and currencies to name a few. Turbo boost warrants can amplify pricing movements on underlying performance. With the enhanced performance of underlying assets, the warrants can fetch investors attractive coupon payments and provide downside protection against capital erosion.

Leveraged Futures

Leveraged futures come to you with call options for buying and put options for selling. These are embedded options that are put into financial derivatives. These options leverage amplifying returns on your underlying asset portfolios. Investors can structure these products for enhanced returns as the derivatives are linked to equities, commodities, and currencies that are high-paying in the market. You can choose the term of the assets and also choose when coupon payouts or dividend earnings have to be made. Therefore, leveraged futures also fall under the category of turbo-structured products for you to choose from.

Leveraged Collateralized Debt Obligations or LCDOs

Collateralized Debt Obligations or CDOs are investment products that combine various debt instruments to leverage enhanced returns on your investment portfolio. You can receive fixed coupons or variable payouts from the underlying assets these LCDOs are linked to.

These are leverage products the issuer gives away to amplify product returns. However, the volatility of market conditions concerning the performance of asset classes leads to the risk of losses too for the investors.

What Are The Pointers To Remember Concerning Leveraged Structured Notes?

These are the pointers one must keep in mind while buying leveraged structured products. Helping you through with a run-down into the same:

Amplified Gains Vs Losses

When you add a leveraging component to financial instruments you must understand that your investment portfolio will either amplify profits or losses. This is because leveraged elements like spreads or collaterals can land you into making phenomenal profits. At the same time, when the performance of underlying assets is very bad then the investors have to suffer losses too by a greater extent.

Risks Involved

As an investor, you must understand that leveraged structured products can magnify the profits and losses of your given portfolio. Therefore, you must understand or know about the significant risks that are involved when dealing with these products. Therefore, you must consider the risk tolerance you can take inside your financial belt before you start engaging with these products.

Formulate A Questionnaire Before Choosing A Leveraged Investment Plan

These are the questions that you ask financial managers or independent wealth generation specialists as a novice or amateur investor:

- Is this a structured product that offers me financial security over my capital investment?

- Will products make ample gains in volatile market scenarios?

- How do I get the asset’s look back on its previous trends?

- Who issues structured products?

- Are my notes insured by the FDIC or tied to an index?

- Is the performance of an underlying asset subject to changing market conditions?

- What happens to my investment portfolio in case of a knock-out?

- If the underlying asset reaches barrier limits, will the issuer default on their obligations including assets and retail investments?

- How can underlying assets rather create diversified portfolios?

- What would happen if my product pays value at maturity while an option expires worthless?

- Why do notes suffer a lack of liquidity?

- How do call or put options work on assets and derivatives belonging to the securities exchange?

- How can financial innovation catapult risk-return objectives with customized exposure to assets like stocks?

- How do I vouch for the credit quality of options traders, broker-dealers, or other U.S.-based financial conglomerates?

- Can you elaborate on the JP Morgan Chase or counterparty risk factors?

- What kind of products may offer customized returns on investment?

- What kind of latest innovation products provide principal protection? Understanding Your Investment Objectives

As leveraged notes bring potential profits and gains on a maximized scale, you must clearly outline what your investment objectives are before plunging into buying a fleet of these products. You must read the initial offer documents thoroughly to find if you would be able to achieve your wealth or income objectives with the portfolio that stands chosen. Researching how various products work in the market can also help you become a more informed investor as compared to signing on the dotted lines without knowing what is what.

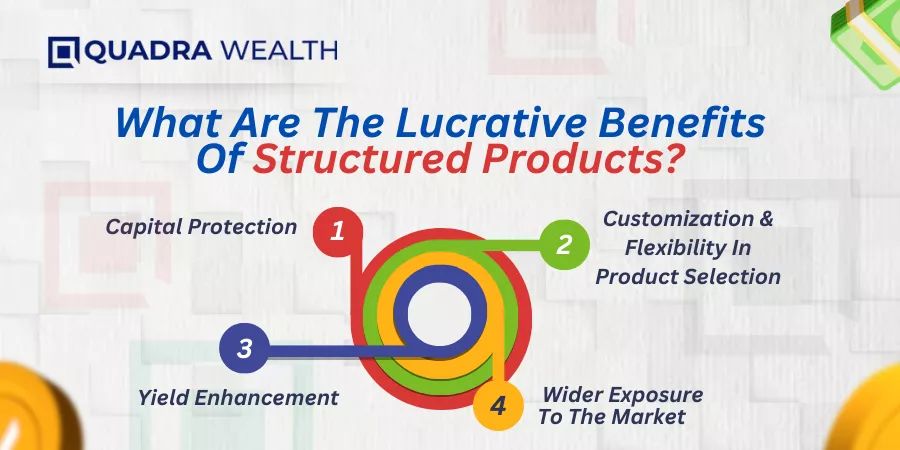

What Are The Lucrative Benefits Of Structured Products?

In this segment, let us unveil some of the lucrative benefits you get while investing in structured products on the whole. Helping you with a run-down into the same:

Capital Protection

The structured products are hybrid instruments comprising debt as well as equity. The product issuing firms work hand-in-hand with the investors to structure financial portfolios according to their independent financial goals or objectives. Plus, the notes are also embedded with spreads, buffers, and barrier limits to mitigate the profits and gains for investors. Therefore, investors get a substantial amount of soft-core or hard-core protection against their capital or principal investments.

Yield Enhancement

Using structured notes, you can customize your financial products the way you want. You can opt for fixed-coupon payouts or look for growth notes that link returns to the performance of underlying assets the notes are linked. At the same time, you can add leveraging or turbo elements to them to enhance the yield of your investment portfolio. Therefore, you can customize these products to suit your short-term, medium-term, or long-term financial goals and objectives.

Customization And Flexibility In Product Selection

Structured products offer predetermined interest rates that can enhance potential returns on stocks or bonds you have linked with. You can choose the type of investment that can seamlessly meet your financial crisis. You can choose products that offer optimal gains in bullish or bearish scenarios too. This is because structured products are pre-packaged investments that provide upside participation or downside buffers on the investor’s capital.

Wider Exposure To The Market

Investors get a wider exposure to the primary and secondary market with structured investments. While these are notes comprising debt and equity, you have the bonds providing capital protection to investors while returns or potential gains are linked to the performance of underlying assets these notes are linked to. Therefore, you get wider exposure to markets as compared to the exposure you get with traditional bonds or fixed-income securities.

Moreover, structured products use knock-outs, spreads, buffers, or leveraging options to enhance potential gains an investor would make in the case of traditional bonds or fixed-income securities. Through the creation of structured products, the issuers of structured products have multiple underlying assets like the s&p 500 and that is why

The Bottom Line

You can get cues from the financial industry regulatory authority to have a fair view and knowledge of how leveraged upside participation or downside buffering mechanisms work. These are protected notes that offer non-traditional payoffs via leveraged debt and equity instruments. The amplified returns can leave you with diversified retail portfolios after all.

Although the leveraged products are accessible to retail investors, these are not fully principal-protected notes and can be suited for investors who have a reasonable level of risk tolerance on hard-to-reach asset classes too. .