What is Debt to Income ratio? Struggling to understand how your level of debt might impact your financial prospects? Known as a Debt to Income Ratio (DTI), this figure is critically evaluated by lenders when you want to borrow money.

This guide will provide an easy-to-grasp explanation of what a DTI is, its importance, and methods for calculation and reduction.

Prepare to gain the insight needed to improve your financial health!

Key takeaways

●Debt-to-Income Ratio (DTI) shows how much you earn and how much you owe. Lenders use it to see if they should give you a loan.

●Many things make up your DTI. This includes monthly debt and income before taxes.

●A good debt-to-income ratios are usually below 43%. Some lenders prefer it even lower, like under 35%.

●You can find out your own DTI. First, add up all the money that needs to be paid each month. Then divide this by what you earn before tax.

●To lower your DTI, pay off small debts first or find ways to earn more money. Using a co-signer might also help when getting a loan.

Understanding What Is Debt to Income Ratio

In this section, we delve into the concept of Debt-to-Income Ratio (DTI), exploring its definition and understanding the different factors that comprise it.

We will elucidate what DTI is and discuss components like monthly debt payments and gross monthly income, elucidating how they contribute to your overall ratio.

What is a Debt-to-Income Ratio?

A Debt-to-Income Ratio (DTI) is a tool used by lenders. They look at how much money you earn each month and how much you spend on debt payments.

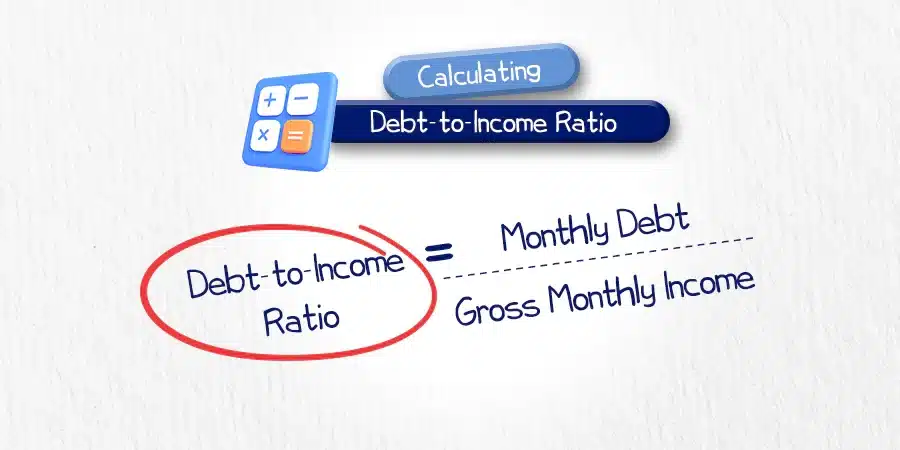

To calculate your DTI ratio, they divide your total monthly debt payments by your gross monthly income.

This ratio helps lenders see if you can handle paying back more money or not.

Different loans and lenders all have their own rules about what DTI is too high for them to give out a loan.

Factors that make up a DTI ratio

Several things form a DTI ratio. They are:

- Your monthly debts: These can be money you owe for your house, car, or student loans. Credit card bills might also count.

- Your gross monthly income: This is all the money you make before taxes and other charges get taken out of your pay.

- Lenders: Banks and loan companies decide how big or small a DTI ratio should be for each type of loan they offer.

- The Consumer Financial Protection Bureau (CFPB): This group makes sure banks and lenders treat you fairly.

Importance of Debt-to-Income Ratio

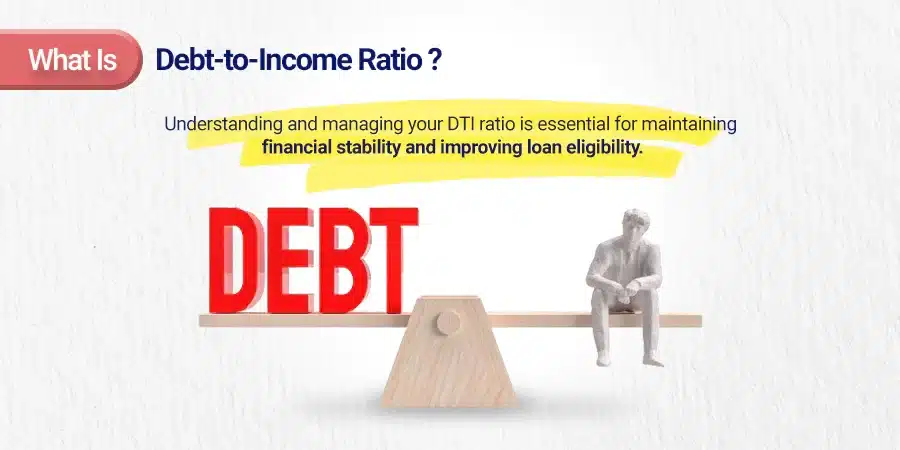

Understanding the significance of your DTI ratio is crucial as lenders often use it to assess your ability to repay borrowed money.

A good debt-to-income ratio would enhance your potential for loan approval and help secure favorable interest rates, while a higher DTI ratio could signify financial stress and possibly limit access to credit facilities.

Therefore, effectively managing this ratio is vital in attaining sound financial health and achieving long-term fiscal goals such as homeownership or efficient debt management.

Why Your DTI is Important

Your DTI matters a lot to lenders. This number shows if you can pay your debts on time every month.

Banks and other loan companies use your DTI to know how much risk they take by lending you money.

If your DTI is low, it’s easier for you to get a loan or a credit card. A maximum DTI might make this hard for you. The U.S.

government agency, CFPB, says that keeping your DTI under control is good for your financial health too.

What Counts As A Good DTI Ratio?

A good DTI ratio is in the eyes of lenders. They usually like it to be below 43%. If you have a very low DTI ratio than that, you are in a better place.

Some even prefer it if your DTI falls under 35%. The front-end ratio should not be more than 28% for best results. Keeping the back-end ratio below 36% also helps.

Following these rules makes lenders happy and puts you on their good side. Typically, borrowers with low debt-to-income ratios are likely to manage their monthly debt payments effectively.

As a result, banks and financial credit providers want to see low DTI ratios before issuing loans to a potential borrower.

How to Calculate Debt-to-Income Ratio

Understanding how to calculate your Debt-to-Income ratio is essential in financial planning.

The debt-to-income (DTI) ratio is a personal finance measure that compares an individual’s monthly debt payment to their monthly gross income.

Your gross income is your pay before taxes and other deductions are taken out.

The debt-to-income ratio indicates the percentage of your gross monthly income that goes to paying your monthly debt payments.

First, aggregate all your minimum monthly payments due on recurring debts.

This might include a mortgage or rent payment, car loans, student debt, and regular credit card charges.

Then you divide this total sum by your gross monthly income -the amount you earn before any deductions like taxes and insurance contributions are made- giving a raw number often expressed as a decimal value.

For easier interpretation, multiply the result by 100 to get a percentage representation of your DTI ratio; this shows the percentage of income that goes into settling your recurrent debts each month.

Adding Up Your Minimum Monthly Payments

First, you need to gather all your monthly bills. These might be for credit cards, car loans, and other debts.

Write down the smallest amount you must pay each month to keep up with these debts. This is called adding up your minimum monthly payments.

Dividing Your Monthly Payments By Your Gross Monthly Income

To find your debt-to-income ratio, you need to divide your monthly debt payments by your gross monthly income. Gross monthly income is the money you earn each month before taxes get taken out.

Your monthly debt payments include all the money you owe each month. This can be credit card bills, car loans, or any other debts. Once you have these numbers, do a simple division.

Divide the total of your debts by your total income for that same month.

Converting The Result To A Percentage

After you divide your monthly debt payments by your gross monthly income, the next step is to make it a percent. You can do this quickly.

Just move the decimal point two places to the right. Now you see your DTI as a percentage. This is helpful because lenders look at DTI in this way.

It helps them see if giving you a loan is risky or not.

How to Lower Your Debt-to-Income Ratio

Alleviating your debt-to-income ratio can be an essential step in securing better loan terms and enhancing financial stability, which can encompass methods such as settling your minor debts first, finding ways to elevate your income or even considering the help of a co-signer to get a loan.

Paying Off Your Smallest Debts

One good way to lower your DTI ratio is to pay off your smallest debts.

Start with the tiniest debt you have, maybe a small credit card bill or an unpaid loan. Pay it off fully as fast as you can.

This action will reduce your monthly debt payments and lower your DTI ratio over time. It also helps improve your credit score, making it easier for lenders to trust you in the future.

So, tackle these small debts first before moving to bigger ones like auto loans and a qualified mortgage.

Raising Your Income

You can lower your DTI ratio by increasing your income. This might mean looking for a better-paying job or starting a part-time gig.

Some people also boost their income with a side hustle like selling crafts, tutoring, pet sitting, or freelance work.

An increase in money earned will decrease the DTI ratio and make you more appealing to lenders.

Keep in mind that more cash coming in helps lower debt levels and boosts cash reserves too!

Using a Co-Signer

A co-signer can help you get a loan. They are like your helper. The bank looks at their money too.

If they make good money and don’t owe a lot, this is good for you. It could mean lower costs for the loan.

But remember, if you don’t pay, the co-signer will need to.

Conclusion

The debt-to-income ratio is key when you want to borrow money. It tells lenders if you can pay back a loan. To get the best personal loans, keep low debt-to-income ratios.

A high ratio could mean more debt and less money for needs and wants.

Frequently Asked Questions

Your debt-to-income (DTI) ratio compares your monthly debt payments to your monthly gross income. When you apply for things like the best mortgage, auto, or other types of loan, banks and other lenders use the ratio to help determine how much of your income is going toward your current debt obligations—and how much more you can afford to take on.

Financial companies look at this ratio during the loan approval process to check if you can manage extra debt like a mortgage loan or personal loan.

When figuring out your Debt to Income (DTI) ratio, the financial assessment takes into account costs like housing expenses (monthly payment), property taxes, homeowners insurance, and recurring monthly debt – all against your total monthly gross income. Lenders may consider your debt-to-income ratio in tandem with credit reports and credit scores when weighing credit applications.

Yes! Most lenders favor a lower DTI for home purchase or refinance. High DTIs may lead to higher rates for mortgages and other loans or even denial from some lenders.

Mortgage payments, credit card payments, car loans, and student loans along with any personal or business loan repayments show up under your total recurring debt calculation.

Yes! You might work on paying down current debts such as auto loans and credit cards to lower revolving debts which then lowers your overall DTI; improving chances for future credit utilization ratio.