Where to invest money in UAE?

Are you unsure of where to invest your money in the UAE? With a diverse range of investment options available, it can be quite overwhelming. This article will guide you through understanding different investments, creating a systematic investment plan, and pointing out key factors to consider while investing in the UAE.

Let’s unlock your path to smart wealth-building!

Key takeaways

● The UAE offers various investment options including stocks, bonds, mutual funds, ETFs, Real Estate Investment Trusts(REITs), and real estate. ● When creating an investment plan in the UAE, assess your financial situation, set clear goals, establish a budget, and have an emergency fund. ● Long-term investing is powerful in the UAE as it allows for wealth growth over time through stock price appreciation and dividends. ● Factors to consider when investing in the UAE include passive investing benefits, diversification importance,

Understanding Investments in the UAE

The UAE is a good place to invest money. It has different ways for people to make more money from their savings. People here can buy parts of companies, which are called stocks. They can lend money to big companies or the government and earn interest.

We call these bonds.

There are also mutual funds in the UAE. These are like baskets full of different types of investments, like stocks and bonds together. The plus side is that if one part does badly, perhaps another part will do well! There’s also real estate for those who want something they can see and touch with their own eyes – a house or an office building maybe.

There is no tax on most kinds of earnings here too; so whatever you earn by investing – it stays with you! That makes the UAE a very attractive place for individuals looking to grow their wealth.

The main advantages of investing in the UAE are the strong legal framework to protect investments. Year after year, the UAE attracts a large amount of foreign direct investment, and according to the UN Conference on the Trade and Development report, in 2021, the UAE was ranked 1st among Arab countries and 15th in the world for its ability to attract foreign direct investment. As the UAE state provides a wide range of asset classes for investors from all over the world, we have prepared an article with details of the 6 most popular investment options in the UAE.

Furthermore, an investment fund offers a broader range of investment opportunities, greater management expertise, and minimum investment fees than individual investors could obtain. Mutual and equity funds are two types of investment funds available to foreign investors and expats in the UAE.

- Tax Advantages

- Strong Legal Framework

- Diverse Investment Options

- Foreign Direct Investment (FDI)

- Stable Economy

- Growing Real Estate Market

- Global Business Hub

- Missed Growth Opportunities

- Lack of Wealth Accumulation

- Inflation Impact

- Limited Retirement Planning

- Dependency on Traditional Income Sources

- Uncertain Future Expenses

- Potential Loss of Wealth Preservation

Creating an Investment Plan in the UAE

Assess your current financial situation, set clear investment goals, decide on an investment budget, and establish an emergency fund before creating your systematic investment plan in the UAE.

Assess Your Current Financial Situation

First, look at your money. Check your assets and debts. Your assets are things you own that have value. They can be a house or car. Debts are what you owe others, like loans or credit card bills.

Next, think about how much money you make each month from work. This is called income. Subtract all the costs like food and rent from this amount to know how much is left for investing in UAE stocks or bonds.

Set Clear Investment Goals

Think about what you want from your money. These are your investment goals. Some people want a new house or car. Others want to pay for school or save for retirement. Put these goals into clear words and numbers.

If you know what you need, it’s easier to plan how to get there with your investments in the UAE. Be sure the goals are things you can see and measure so that you know when they are met.

Decide on Investment Budget

Choosing how much money to put into your investment is key. This amount should not be too small or too large. Look at what you earn and spend each month first. Then, find out how much money you can save without problems in your daily life.

After this, you can see what part of these savings can go into the investments every month.

Establish an Emergency Fund

Having an emergency fund is a must. It is your safety net for hard times. You can use it when you get hit by surprise costs like a car fix or doctor bills. Money in this fund stays separate from your investment budget.

Keeping them apart aids you to make good choices about where to put your cash. Savings accounts, money market accounts, and money market mutual fund accounts are good places to keep these funds safe and easy to reach.

The Power of Long-Term Investing

Long-term investing is strong in the UAE. It lets you grow your money over time. When you invest for many years, your wealth can go up a lot. You can get this power from stocks, bonds, or ETFs.

These are all good ways to make more money.

The stock market has ups and downs. But if you hold on to your stocks for a long time, they might be worth more later on. This is called stock price appreciation. You also earn dividends which add up over the years.

It’s best not to put all your cash into one type of investment though or just pick one company’s stock. Diversified portfolios spread out risk and offer steady growth over the long run instead of quick wins that could turn into losses.

Real estate investments are another way to build wealth as property values often go up in price too but it needs a big sum at first so isn’t right for everyone.

Understanding Different Investment Opportunities in the UAE

In the United Arab Emirates, there are various investment opportunities available such as stocks, structured notes, bonds, mutual funds, ETFs, REITs, and real estate.

Stocks

Stocks give you part of a company. This way, you get money when the company makes more money. You also make money when others want to buy your stocks for a higher price. In UAE, buying stocks is very common.

It is advised to keep these stocks for a long time rather than sell them quickly. To lessen the risk, it helps to buy stocks in different types of companies and markets. There are robo-advisors like Sarwa that can help pick varied stocks based on your own goals and how much investment risk you can take.

Structured Notes

Structured Notes are a type of investment that gives you the opportunity to earn returns while also protecting your initial investment. These notes have a fixed maturity date and can be linked to different assets like stocks, commodities, or currencies.

They offer both variable or fixed-interest payments depending on the terms of the note. Investing in Structured Notes requires understanding the risks involved and potential returns.

It’s important to carefully analyze these investments before making any decisions.

Bonds

Bonds are a type of investment that can provide you with fixed-interest payments and the potential to grow in value. They are considered to be a relatively safer investment compared to stocks or real estate.

In the UAE, there are various options for investing in bonds, which can be purchased through banks and financial institutions. Investing in bonds can give you a stable passive income source while also having the potential for growth over time. there are three types of bonds available one is Corporate bonds which are Company issuances, Treasury (national) bonds which is Federal government issuances, and Municipal bonds by Local government, state, city, and local community issuances.

It’s important to consider your risk tolerance and financial goals when deciding whether to invest in bonds or other types of investments available in the Dubai financial market.

Mutual Funds

Mutual funds in the UAE are investment options that pool money from different investors to invest in a variety of securities like stocks and bonds. There are two types of mutual funds: passively-managed and actively-managed.

Passively-managed funds aim to match the market’s performance, while actively-managed funds strive to outperform it. However, actively-managed funds often have higher fees and come with higher risk without necessarily providing higher returns.

It’s important for investors in the UAE to know that they have access to both local and international mutual funds when considering their investment choices.

ETFs

ETFs, or Exchange-Traded Funds, are a popular investment option in the UAE. These funds offer diversification by investing in a wide range of assets like stock exchanges and bonds. They are cheaper, more liquid, and more transparent compared to traditional mutual funds.

One way to invest in ETFs is through robo-advisors like Sarwa, which can help create diversified portfolios using low-cost ETFs. Diversification is important because it helps reduce risk by spreading out investments across different asset classes.

ETFs are considered passive investments that aim to match the performance of the market rather than trying to beat it. So if you’re looking for a simple and cost-effective way to invest in a variety of assets, consider adding ETFs to your investment strategy.

REITs

REITs, or Real Estate Investment Trusts, are a popular investment option in the UAE. They allow investors to gain exposure to the real estate market without actually owning properties.

One of the advantages of investing in REITs is that they can provide regular dividends and potential price appreciation, which can offer a stable source of income. By including REITs in your investment portfolio, you can diversify your holdings and reduce risk.

Robo-advisors like Sarwa can assist you in creating diversified portfolios based on your investment objectives and risk tolerance. So if you’re looking for a way to invest in real estate without the hassle of property ownership, consider exploring REITs as an option.

Real Estate

Real estate is a popular investment opportunity in the UAE. Many people choose to invest their money in properties because it can provide both rental income and the potential for property value appreciation over time.

Metropolitan Capital Real Estate LLC is a company that can help investors find, select, and transact investment assets in the UAE real estate market. They offer assistance throughout the entire process, from identifying good investment opportunities to completing the necessary paperwork.

With their expertise and experience, investing in real estate can be a smart choice for those looking to grow their wealth in the UAE.

Factors to Consider When Investing in the UAE

Consider factors such as passive investing benefits, diversification importance, portfolio structure understanding, and fee considerations when making investment decisions in the UAE.

The Benefits of Passive Investing

Passive investing has several benefits that make it attractive to investors. One major advantage is that passive funds aim to match the performance of the market, rather than trying to beat it.

This means that investors can benefit from the overall growth of the market without having to constantly monitor and adjust their investments. Another benefit is that passively-managed funds typically have lower management fees and taxes compared to actively-managed mutual funds.

This allows investors to keep more of their returns in their pocket instead of paying excessive fees. Additionally, passive investments like ETFs offer diversification by owning a share of one ETF, which spreads out risk across different assets.

The Importance of Diversification

Diversification is extremely important when investing in the UAE. By spreading your investments across different assets, such as stocks, bonds, real estate, and mutual funds, you can reduce the risk of losing all your money if one investment performs poorly.

Diversification helps to balance out potential losses and gains, allowing you to potentially earn more consistent returns over time. It’s like not putting all your eggs in one basket – by diversifying your investments, you increase your chances of generating long-term wealth while minimizing risks.

Robo-advisors like Sarwa can assist investors in creating diversified portfolios tailored to their specific goals and risk tolerance levels.

Understanding Portfolio Structure

Portfolio structure refers to how your investments are allocated across different types of assets. It’s important to have a diversified portfolio that includes a mix of stocks, bonds, and other investment vehicles.

This helps spread out the risk and increase the potential for returns. Common mistakes include focusing on individual stocks instead of diversifying your investments. By spreading out your money across different types of assets, you can reduce the impact if one particular investment performs poorly.

Remember, having a well-structured portfolio is key to long-term success in investing.

Fee Considerations

Investors in the UAE should carefully consider fees when making investment decisions. Passively-managed funds, such as index funds, tend to have lower fees and taxes compared to actively-managed mutual funds.

These lower fees can help increase overall returns over the long-term investment. Additionally, investors may benefit from using robo-advisors like Sarwa, which can assist in creating diversified portfolios while keeping costs low.

It’s important to understand the fees associated with different investment options and choose those that align with your financial goals. By paying attention to fee considerations, investors can make informed choices that maximize their potential returns.

Investments for Different Financial Goals

Short-term investments provide liquidity and quick returns, while medium-term investments offer stability and growth. Long-term investments aim for significant wealth accumulation over time.

Discover the best investment option for each goal in the United Arab Emirates. Read more to make informed decisions about to obtain financial freedom.

Short-Term Investments

Short-term investments in the UAE are a way to achieve different financial goals. When it comes to investing for short-term financial goals, it’s important to have a plan and understand your current financial situation.

This includes creating a budget and setting clear investment objectives. It’s also recommended to establish an emergency fund before making any investments. Short-term investments in the UAE can include options like savings accounts, money market accounts, or money market mutual fund accounts.

These types of investments provide liquidity and can be accessed quickly when needed. By focusing on short-term goals and having a well-thought-out investment plan, individuals can make smart decisions that align with their financial objectives in the UAE.

Medium-Term Investments

Medium-term investments in the UAE offer several options for individuals looking to grow their wealth over a moderate period. One popular option is stock exchange trading, where investors can buy and sell shares of publicly traded companies.

Another option is investing in real estate, taking advantage of the stable property market and opportunities for growth. Private pension schemes are also available, allowing individuals to save for their retirement over a medium-term period.

Additionally, funds and deposit accounts provide further investment choices for those interested in earning returns on their money. The UAE’s positive investment climate and efforts to strengthen the business investments sector make it an attractive destination for medium-term investments.

Fact 1: The UAE offers a range of medium-term investment options such as stock exchange trading, real estate purchase, private pension schemes, funds, and deposit accounts.

Fact 2: The UAE has a positive investment climate that supports medium-term investments with efforts to strengthen the business sector.

Long-Term Investments

Long-term investing is the best investment strategy in the UAE. It’s about thinking ahead and making your money work for you over time. By focusing on long-term goals, such as retirement or buying a home, you can potentially earn higher returns.

Diversification is key here too – spreading your investments across different assets like stocks, real estate, and funds can reduce risk. Robo-advisors like Sarwa can help investors create portfolios tailored to their goals and risk tolerance.

So instead of chasing quick profits, consider the power of long-term investments for a more secure financial future in the UAE.

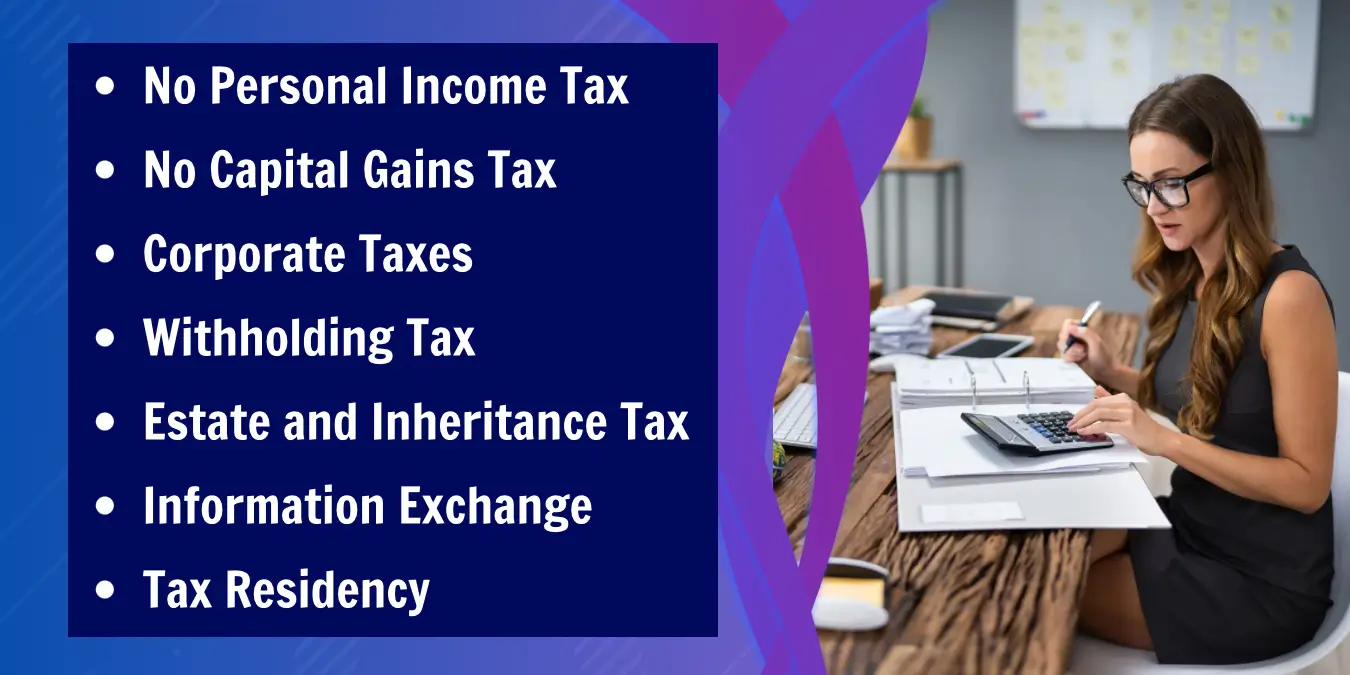

Tax Considerations on Investments in the UAE

Investing in the UAE has tax advantages for expats and non-residents. One of the biggest benefits is that there is no personal income tax or capital gains tax on the sale of real estate or securities.

This means that you can keep more of your investment returns without worrying about taxes eating into your profits. Additionally, there is also no inheritance tax in the UAE, which means that you won’t have to worry about passing on your investments to your loved ones.

It’s important to note, however, that while there are no direct taxes on investments in the UAE, other fees and charges may apply depending on the specific investment products you choose.

For example, if you invest in mutual funds or ETFs, there may be management fees associated with those funds.

Overall, investing in the UAE offers attractive tax benefits for expats and non-residents. It’s always a good idea to consult with a fund manager or tax professional who specializes in international investments to ensure that you fully understand any potential tax implications before making investment decisions.

Seeking Investment Advice in the UAE

When it comes to seeking investment advice in the UAE, there are a few options available. You can choose to work with a traditional financial advisor who can provide personalized guidance and recommendations based on your goals and risk tolerance.

However, it’s important to note that these services can be expensive.

Another option is to consider online robo-advisors, which use algorithms to create and manage diversified investment portfolios for you. These platforms often have lower fees compared to traditional advisors and offer convenience through their user-friendly interfaces.

Additionally, you may find value in attending seminars or workshops conducted by reputable financial institutions or experts in the field. These events can provide valuable insights into various investment strategies and opportunities in the UAE.

Remember, before seeking any investment advice, it’s crucial to do your own research and understand your personal financial situation. By educating yourself about different investment solutions and considering professional advice, you’ll be better equipped to make informed decisions about investing your money wisely.

Conclusion

In conclusion, the UAE offers a variety of investment opportunities for both Emiratis and expats. By creating an investment plan, embracing long-term investing, and considering factors like risk tolerance and goals, individuals can make informed decisions about where to invest their money in the UAE.

From stocks and bonds to real estate and mutual funds, there are options available for different financial goals. It is important to do thorough research and seek professional advice when investing in the UAE to maximize potential returns.

FAQs

Some good options to consider for investing money in UAE include real estate, stocks, mutual funds, and starting a business.

Yes, investing money in UAE can be safe if you choose reputable investments and do thorough research before making any decisions.

Investment opportunities exist across various sectors such as real estate, tourism, finance, healthcare, and technology. It’s important to assess your risk tolerance and conduct proper market analysis before investing.

The amount of money needed to start investing in the UAE varies depending on the type of investment and individual circumstances. It’s advisable to consult with financial advisors or experts who can provide personalized guidance based on your financial goals and resources.