In This Article

SIP Investment in UAE- Plans And Benefits

These COVID-stricken years have proved the importance of holding onto personalized savings. When it gets tough, you better hope you’ve got money saved to use it to your advantage.

Saving money doesn’t happen overnight. It takes time and commitment on your part. But, once you develop the habit of saving, you’ll find that little by little, your savings will build up.

This means the smaller sums start adding to one another and transforming into a significant amount over time. In this blog, we will look at the best plans and benefits of SIP investment in UAE.

Quick Summary

In short, explore SIP and different types of SIP investment in UAE, learn about their benefits, and understand why they are a safe and reliable way to invest in mutual funds through SIP.

You can able to find out how SIP investments can be easy on the pocket, help manage market volatility, leverage the power of compounding, aid in financial planning, promote financial discipline, and offer anytime liquidity.

Also get to know about the best SIP investment options in the UAE, including Exchange Traded Funds (ETFs) and the S&P 500.

What Is SIP Investment?

Investing in a better future is something everyone aims to achieve. The easiest way to start doing this is with recurring investments that are done regularly.

The timing doesn’t matter as much as the amount you invest.

And when it comes to investing your hard-earned money safely, there’s no better option than mutual funds.

The term systematic investment plan, also known as SIP, refers to a method of depositing money in various schemes of mutual funds with a predefined frequency and systematic manner.

It’s similar to making recurring deposits in a bank. However, the only distinction here is that your investments will be in mutual funds rather than banks.

So, you have to accept that the risk involved isn’t as low as RD accounts but is still relatively low.

SIP plans are subject to market risk but still have many perks that make them worth trying out.

Often these schemes offer tax benefits as well! SIP allows for a constant, long-term approach to building wealth.

This investment vehicle is designed to help investors reach financial success in the long run.

SIP works within a simple rule— invest your money in a small amount at regular intervals into the SIP fund. Investors can set their preferred frequency of investing.

It can be done on a monthly, yearly, or even on a daily basis. Through SIP, you can attain financial success by taking small steps that lead to big goals!

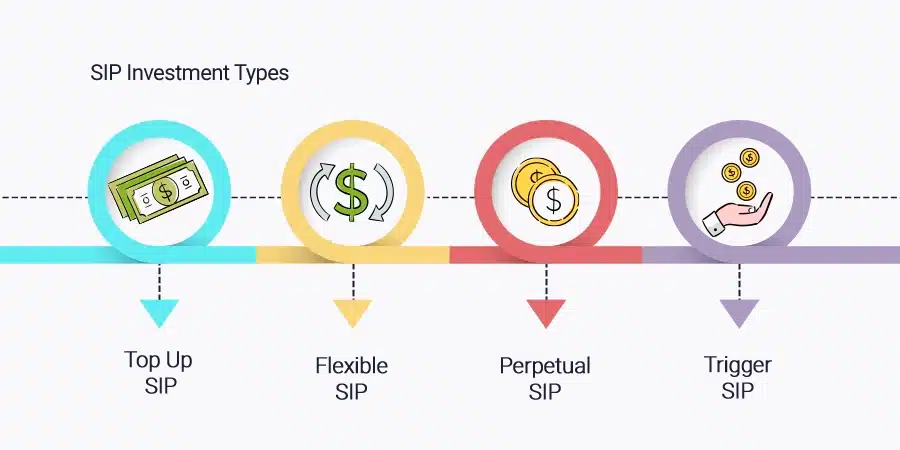

Types Of SIP Investment in UAE

Top-up SIP

This SIP type helps you to grow the amount of money that you invest regularly.

In fact, because your invested amount grows, the longer you leave it untouched, and the more time it has to grow, the more money you’ll have in your retirement fund when the time comes.

And with increasing income levels and raises, you also have more cash to contribute periodically as well!

The best part about this particular SIP option is that it’s flexible enough for all income types.

- Increased Investment Amount

- Growing Investment

- Flexibility for All Income Types

- Missed Opportunity for Higher Returns

- Limited Growth Potential

- Inability to Adapt to Changing Financial Situations

Flexible SIP

They are a great way to grow or reduce your investment based on the specified amount of money you have.

If you suddenly find yourself with more cash than usual, you can use that money to bolster your investment portfolio turnover.

Likewise, if you lose some earnings due to revenue shortfalls or other reasons, you can cut down on the next few payments or skip them altogether.

- Adaptability

- Utilizing Extra Cash

- Managing Revenue Shortfalls

- Missed Investment Opportunities

- Limited Control Over Investment Amounts

- Inability to Cope with Financial Setbacks

Perpetual SIP

SIPs can work towards progressive financial goals effectively, but many investors opt for the ease of exit.

The formal structure is SIP investments are applicable for a period of one year, three years, or five years.

SIP investment is also referred to as a perpetual plan if you have not mentioned the end date of your contribution or have left an open-ended mandate at the time of signing up.

This type of investment allows you to access your funds whenever needed. However, it would be prudent to not overuse this option and set an end date.

- Access to Funds When Needed

- Investment Continuity

- Flexibility for Future Plans

- Lack of Access to Funds

- Uncertainty of Investment Period

- Potential Overuse

Trigger SIP

This feature is ideal for those investors who want a bit more control over their assets. It is also good for those who may be more familiar with financial markets and indices.

Trigger SIPs are also used for speculation, which does not necessarily make them favored by financial advisors, who would rather work closely with clients to ensure that an investment strategy is sustainable in the long run instead of risky investments that don’t guarantee income generation.

- Greater Control Over Investments

- Potential for Speculation

- High Risks

- Lack of Professional Guidance

- Potential for Emotional Decision-Making

Is SIP A Safe Way To Invest?

SIP is a very reliable way of investing in mutual funds without necessarily having to “time the market”.

This makes it a strategy that requires a lot less expertise or knowledge when compared to other investment options.

Although one should always keep up with what’s going on in the market, as soon as you’ve decided to invest your money via SIP, there’s no need to worry about short-term fluctuations on any given day which may either drive prices up or down at the hour.

This is because by spreading out an investment over time and paying deposits regularly, the value one will end up paying will be an average of high and low values depending on how things unfold.

If you consider the long-term perspective as an investor, you can avoid paying overpriced fees for buying a mutual fund every month.

Benefits Of SIP Investment In UAE

SIPs are a great way to invest in mutual funds. They are very easy to set up and are a great way to grow your money over time.

They also come with a lot of benefits that you might not see till you invest in them. Let’s look at a few of them

Easy on the pocket

Factors like working a full-time job and other financial obligations can make it difficult to set money aside for investments.

That’s why the SIP investment in UAE are advantageous when you’re a working professional who might not have the ability to put money toward a stock investment outright at one time.

When you invest through this method, you make an installment toward your share over time.

It is a better method than contributing all at once, in a lump sum.

- Regular Investing

- Small Initial Investment

- Cost Averaging

- Lump Sum Investments

- Timing Challenges

Manages the market’s unpredictable nature

A good SIP investment in UAE can help you even out the market’s highs and lows. That said, it is unwise to time the market because of its inherent volatility.

Instead, you must understand that timing the market cannot work in your favor. So, all you have to do is focus on investing and growing your wealth slowly and steadily.

You can do this by choosing the best mutual fund with a strong track record that aligns with your investment style.

- Rupee-Cost Averaging

- Reduces Emotional Decision-Making

- Timing Risks

- Emotional Bias

Uses the power of compounding

SIPs help you instill a good habit of regular investing. This investment can be compounded over time.

This allows your funds to gain better returns when compared to investing unusually which is normally done as lump sums.

This is especially helpful considering the market’s usual ups and downs.

- Long-Term Wealth Creation

- Potential for Higher Returns

- Missed Opportunity for Long-Term Growth

- Lower Returns

Great tool for financial planning

All investors have their own goals for the wealth they want to create. Their goals could be short-term, medium-term, or long-term.

The path to achieving your financial goals lies in proper planning and setting aside funds for a saving scheme.

A lot of investors invest in the equity market to support their short-term objectives.

To invest your money correctly, we recommend opting for SIP to invest for those who want to take advantage of their investments whether it be for short or long-term purposes.

The earlier you start investing, the more returns you will see in your future!

- Goal-Oriented Investing

- Dollar-Cost Averaging

- Lack of Structure

- Potential for Missed Goals

Aids in financial discipline

A SIP can be the best investment for individuals in the UAE to start saving money. With SIPs, new and seasoned investors can develop a habit of saving money.

They can do this without constantly having to watch or time the market is high to the market is low.

- Regular Investing Habit

- Avoids Timing Errors

- Inconsistent Investing

- Emotional Decision-Making

Anytime liquidity

Compared to other types of investments, SIP units are very liquid. They can be sold at any time. In this way, they can function as an “emergency fund”.

This means that they can act as a last resort or an alternative to additional loans. The ability to liquidate your investment easily though may cost you as you will receive fewer returns.

- Flexibility and accessibility

- Emergency fund option

- Convenient cash flow management

- Risk mitigation

- Limited access to funds

- Missed investment opportunities

- Inflexibility in financial planning

- Potential loss of returns

Setting aside a percentage of your paycheck can be a great way to save up for what you need.

With systematic investments, you’re able to set aside the same SIP amount of money each month for some time.

So, the gains you get from this investment are more than worth it.

If you have an unstable income where you might sometimes have more money than other times, this is not the most ideal form of investment.

When you have multiple possible income streams— both, long-term and short-term investments may make sense.

However, some financial experts might advise you to invest in SIP when you have less stable income streams.

This is because it can help instill financial discipline if you spend too much every now and then!

For an even better understanding, it is wise to discuss the pros and cons of SIP investment in UAE with a financial advisor.

They will be able to assist you with the right plan that aligns with your financial goals.

Also read: 10 Reasons Why You Should Hire A Financial Advisor

Best SIP Investment In UAE 2023

Exchange Traded Funds or ETFs

ETFs work on the philosophy of passive investing in which the fund manager does not highly involve himself in the decision of choosing stocks.

They are linked to indexes such as S&P 500 and Sensex.

When you invest in equity exchange-traded funds, you may either want to use a lump sum amount or set up a systematic investment plan (SIP).

SIP investment in UAE is convenient, safe, and ideal for long-term goals.

- Diversification

- Cost Efficiency

- Liquidity

- Transparency

- Limited Diversification

- Higher Costs

- Lack of Flexibility

- Lack of Transparency

S&P 500

The S&P 500 is widely regarded as a benchmark of the stock market in the United States.

The S&P is composed of five hundred companies from different sectors to reflect the market conditions at any given moment.

As an index, it reflects the market rather than individual companies and its movements are usually representative of how actively traded stocks fare on Wall Street.

Since investors cannot invest directly in an index as they do with individual stocks, an alternate tool has been created to offer exposure to their performance – this is what we refer to as index funds.

These are considered ideal investments for those who are looking for a low-risk or minimum investment with decent returns.

It is important to evaluate the performance of a fund against the risk because it helps to evaluate if the fund’s risk parameter is in line with your risk appetite.

- Broad Market Exposure.

- Track Record

- Stability

- Passive Investing

- Missed U.S. Market Exposure

- Individual Stock Selection Risk

- Active Management Challenges

- Potential for Underperformance

SIP Investment Calculator

The SIP investment calculator is a time-saving tool. It not only allows you to calculate the returns on your investment but also helps you to manage your finances.

The SIP calculator online is quite helpful for investors who may want to increase their future investments and thus earnings.

The genius of an SIP investment calculator is that it provides potential investors the ability to calculate their investment returns without having yet actually begun investing.

This allows them to forecast more smoothly in terms of what sort of returns they might anticipate, taking under consideration any investment incentives or bonuses that may be included with their plans as well.

Top 3 SIP Investment Mistakes To Avoid

With the recent surge in the popularity of SIPs, one has to understand the key components involved in investing in them.

As these require monthly or quarterly installments, it is important to understand the investment risks and returns associated with such a property.

In this section, let’s try to understand the mistakes in SIP investments you should avoid.

Having unrealistic expectations

A common mistake that most investors make is setting unrealistic or unattainable goals for their SIP. Investors often want to retire before they should, for example.

They should consider establishing a realistic goal based on their income and investment goals and find ways to achieve them.

The key is to have an achievable result. This way you don’t become discouraged by setbacks or any other related events that would stand in your way.

- Achievable Goals

- Long-term Perspective

- Reduced disappointment

- Unattainable Goals

- Impulsive Decision-making

- Emotional Stress

Investing in equity SIPs for shorter durations

Investors who wish to stay invested for a long time should consider purchasing equities.

Investments that involve a short-term horizon might be better served by investment vehicles such as liquid funds, or shorter-duration instruments of lower-risk participation to ensure the stability of returns.

- Flexibility

- Liquidity

- Capital Appreciation Potential

- Missed Growth Opportunities

- Lower Risk Mitigation

- Limited Capital Appreciation

Backing out during market volatility

Sticking to a long-term equity fund strategy works best when investing a set amount and staying invested over time in the market.

However, sometimes even the most dedicated investors can’t stick to their investment plan in the face of market fluctuations.

They may withdraw funds from the market when they feel there might be a downturn that will negatively affect their investment.

It’s understandable since it’s human nature to not want to lose all of your invested money. However, it helps to keep in mind that markets fluctuate.

There are always opportunities for growth once the downward movement has stabilized.

- Potential Buying Opportunities

- Long-term Performance

- Avoiding Emotional Decisions

- Potential Losses

- Missed Opportunities

- Timing the Market

Closing Thoughts

Setting up a SIP investment in UAE is a smart way to make regular investments. It saves you the stress of deciding when to invest.

It also ensures that your mutual fund investments are relatively safe.

Having a financial advisor handhold you in setting up an asset allocation based on your goals and investing horizon can help you reach financial freedom sooner.

They can also take care of things such as tax rebalancing for passive income investors.

Consult our financial advice experts to know more about SIP investment in UAE and other reliable ways to reach your financial goals.

FAQs

SIP investment in UAE refers to a method of depositing money in various and the best mutual fund schemes with a predefined frequency and systematic manner. It allows for a constant, long-term approach to building wealth.

The types of SIP investment in UAE includes Top-up SIP, Flexible SIP, Perpetual SIP, and Trigger SIP. Each type offers its own advantages and flexibility.

SIP is considered a reliable way to invest in mutual funds without having to time the market. It reduces the need for expertise or knowledge compared to other investment options and allows for investment averaging.

SIP investment plans in UAE offer several benefits, such as being easy on the pocket, managing market volatility, utilizing the power of compounding, acting as a great tool for financial planning, aiding in financial discipline, and providing anytime liquidity.

Exchange Traded Funds (ETFs) and the S&P 500 are among the best SIP investment options in the UAE. ETFs offer the convenience of passive investing, while the S&P 500 provides exposure to the benchmark of the US stock market.

A SIP investment calculator is a time-saving tool that helps investors calculate the potential returns on their investments and manage their finances effectively.

Some common popular investment mistakes to avoid when comes to SIP would include having unrealistic expectations, investing in equity SIPs for shorter durations, and backing out during market volatility. It’s important to set realistic goals and stay invested in the long term.

Consulting a financial advisor can be beneficial in setting up asset allocations based on your goals and investment horizon. They can provide guidance and assist with tax rebalancing for passive income investors.

Should I talk to a Financial Advisor When Buying a House?

In This Article Are you planning on purchasing your first home? Or thinking of splurging

Master Robert Kiyosaki: 10 Keys to Financial Freedom

In This Article Have you ever felt the earn, spend and save trilogy too mundane?

Can SIPs Make You Rich? Mutual Fund SIP Grow Your Wealth

In This Article Can SIPs make you rich? Systematic Investment Plans can help in wealth

Exclusive Investments of Elon Musk: Disruption, Vision, and Risk

In This Article A visionary entrepreneur who has been a consistent disruptor in the way