In This Article

What Is Global Wealth Management: A Guide For Expatriates

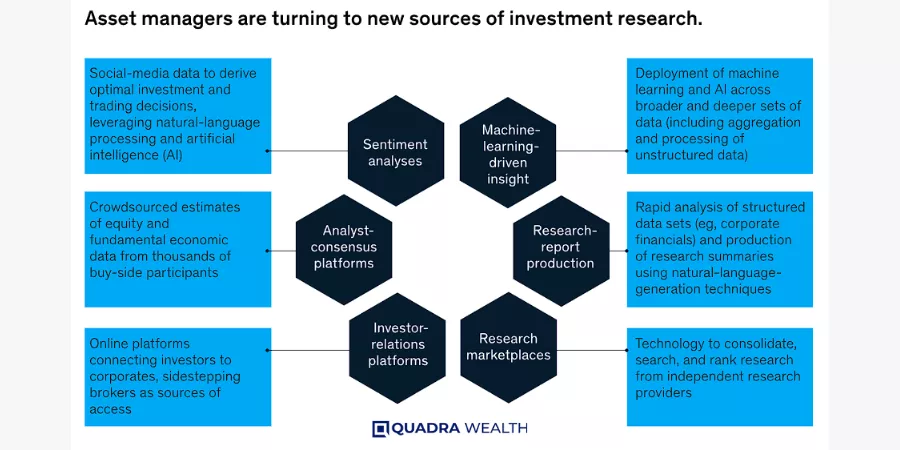

A major shift has been seen in this industry due to advances in tech, changes in client preferences, and the emergence of novel approaches. This blog post dives deep into the complexities of global asset management, looking at how AI is transforming advisors and digital collaboration tools, as well as surveying worldwide satisfaction levels.

We explore how artificial intelligence (AI) is revolutionizing advisor activities and digital collaboration tools in asset management firms. Additionally, we will shed light on understanding clients’ satisfaction levels through insights from worldwide surveys.

The emergence of low-cost DIY investing accounts solution presents both threats and opportunities to an established financial advisor. We discuss these impacts while also highlighting future business models in the global asset management industry.

Finally, amidst accelerating regulatory changes and increased competition, What are global money-managing companies doing to rethink their strategies? Stay tuned as we examine forces driving change within asset and wealth managers along with imperatives for survival success within this dynamic environment.

Learn How To Increase Your Passive Income By 20%, 30%, or more….and Secure A Reliable, Predictable Income Stream In Less Than 5 Years!

The Evolution of Global Wealth Management

Global asset management is a dynamic and rapidly evolving field. It has undergone significant transformations due to technological advancements, financial innovation, and changing client demands. The future of asset management lies in embracing these changes and adapting strategies accordingly.

Technological Transformation in Asset Management

Technological advances have revolutionized the asset-managing industry, enabling advisors to optimize portfolios and deliver personalized assistance. Innovative digital solutions have enabled financial advisors to optimize their portfolio management, resulting in more efficient and effective outcomes than ever before. Advanced digital solutions are enabling advisors to deliver a more customized experience, tailored to individual customer requirements.

- Efficiency

- Access/convenience

- Portfolio management

- Risk management

- Personalized services

- Security

- Lack of human touch

- Implementation challenges

- Algorithmic biases

- Resistance to change

Changing Client Demands

The pandemic has brought about a shift in investor preferences. According to PwC’s Asset & Wealth Management Revolution report, over 40% of clients now prefer virtual advisor interactions over traditional face-to-face meetings. This trend underscores the importance for asset managers to adapt their assistance delivery models towards digital platforms that can cater to this new norm.

There’s also been an increasing demand for sustainable investments among clients globally – another factor driving change within this sector. As per Global Banking & Finance Review, environmental social governance (ESG) investment is gaining traction with investors looking for ways they can contribute positively towards society to help clients achieve their goals.

All these factors combined are shaping up what we know today as global asset management – an industry that’s continually evolving through disruption yet holds immense potential for growth and prosperity if navigated correctly.

“Embrace the evolution of global asset management with technology, sustainability, and changing client demands. Navigate disruption for growth and prosperity”.

Role of Artificial Intelligence (AI) in Asset Management

As the asset managing industry advances to meet client needs and desires, AI is becoming a major factor in its transformation. As the industry evolves to meet changing client demands and preferences, AI has emerged as a game-changer.

Enhancing Advisor Activities with AI

In today’s digital age, over 40% of clients prefer virtual advisor interactions. This trend has necessitated the need for asset managers to adapt their strategies and leverage innovative technologies like AI-powered tools. These tools enhance advisor activities by providing personalized insights based on individual client data.

AI can rapidly and precisely scrutinize a large quantity of data to detect trends or regularities that could be overlooked by human advisors. It can also automate routine tasks such as portfolio rebalancing or tax loss harvesting, freeing up advisors’ time so they can focus more on strategic planning and building stronger relationships with their clients.

- Data analysis

- Time-saving automation

- Risk assessment/prediction

- Improved client service

- Enhanced compliance

- Trust/accountability

- Limited human judgment

- Technical challenges

- Ethical considerations

- Human touch/empathy

Leveraging Digital Collaboration Tools

Beyond enhancing traditional advisory roles, AI enables asset managers and financial planners to offer new services through digital collaboration tools. For example, robo-advisors use algorithms to provide automated investment advice tailored specifically for each user’s financial goals and risk tolerance levels.

Robo-advisors are becoming increasingly popular among younger investors who value convenience and low fees above all else. They’re especially appealing because they allow users to access their portfolios anytime from anywhere via mobile apps or web platforms – something that wasn’t possible before the advent of technology-driven solutions within the sector.

In addition to improving customer experience, using these advanced technologies helps firms stay competitive in a landscape where new entrants are constantly disrupting traditional biz models by offering low-cost DIY investment solutions. This makes a strong case for why the future of global asset management lies in the hands of those willing to embrace change and innovate continuously.

- Improved communication

- Remote Collaboration

- Enhanced transparency

- Efficient document management

- Enhancing client engagement

- Technology dependency

- Learning curve

- Security concerns

- Loss of personal touch

- Accessibility challenges

Key takeaways

The role of artificial intelligence (AI) in asset management is becoming increasingly important, as it can enhance advisor activities by providing personalized insights and automating routine tasks. Asset managers who leverage digital collaboration tools like robo-advisors can offer new assistance to clients while staying competitive in a landscape where low-cost DIY investment solutions are disrupting traditional biz models. Embracing change and innovation will be crucial for the future success of global asset management firms.

Understanding Clients' Satisfaction Levels

In the rapidly evolving world of asset management, understanding client satisfaction levels is paramount. A recent global survey involving more than 2,600 wealthy clients across key markets worldwide revealed some fascinating insights.

Insights from Worldwide Survey on Client Satisfaction

The survey showed that while traditional investment products continue to hold sway, there’s a growing interest in new asset classes among clients. This shift presents both challenges and opportunities for asset managers and firms alike. It’s crucial for these entities to stay abreast with changing investor preferences to deliver sustainable growth.

- Clients are increasingly looking at alternative investments like ESG (Environmental, Social, Governance) funds as part of their portfolio mix.

- Wealthy individuals are showing an inclination towards impact investing – where they seek not just financial returns but also social or environmental impacts from their investment.

- Digital assets such as non-fungible tokens (NFTs) have caught the fancy of younger investors who are comfortable with technology-driven investments.

Opportunities Amidst Complexity

This complexity in client demands can be seen as an opportunity by forward-thinking asset-managing firms. By offering innovative solutions tailored to individual needs and risk profiles, they can improve customer experience significantly. For instance:

- A diversified portfolio incorporating traditional assets along with newer asset classes could cater well to those seeking variety in their investment.

- AI-powered robo-advisors can help manage such portfolios efficiently while keeping costs low for clients.

- Digital platforms providing real-time updates about market trends and personalized investment advice can enhance engagement levels among tech-savvy customers.

The use of data analytics tools can provide deep insights into customer behavior patterns enabling better service delivery.

Stay Ahead of the Game

By adopting this strategy, wealth managing firms can stay ahead of the game and maintain high satisfaction levels amongst their clientele even amidst increasing competition within the industry.

Key takeaways

Wealth management firms must understand client satisfaction levels in order to stay ahead of the game and provide sustainable growth. A recent survey revealed that clients are increasingly interested in alternative investments like ESG funds, impact investments, and digital assets such as NFTs. By offering innovative solutions tailored to individual needs and risk profiles, wealth managers can improve customer experience significantly while keeping costs low for clients through AI-powered robo-advisors.

Threats from New Entrants Offering Low-Cost DIY Investment Solutions

The global asset management landscape is witnessing a significant disruption due to the advent of fintech revolutionaries offering low-cost Do-It-Yourself (DIY) investment solutions. These new entrants are taking advantage of tech and data analysis to provide user-friendly platforms, allowing people to manage their own investments at a much lower cost than usual.

Impact of Fintech Revolutionaries on Competitive Landscape

Fintech startups are reshaping the competitive landscape by leveraging cutting-edge technologies like AI and blockchain to offer innovative investment products. They are not only challenging traditional business models but also compelling established players in the industry to rethink their strategy. A report highlights how these disruptors are making waves in financial services with their agile operating models and customer-centric approach.

- Increased competition

- Technological advancements

- Expansion of the client base

- Enhanced customer experience

- Collaboration opportunities

- Regulatory challenges

- Disintermediation risks

- Trust and credibility concerns

- Scalability and sustainability

- Technological risks

Strengthening Customer Relationships through Data-driven Insights

In response, successful wealth managers are investing heavily in digital operating models and using data-driven insights for decision-making processes. By leveraging big data analytics, wealth managers can gain valuable insights into client profiles to provide tailored advice that meets their individual needs.

This strategic shift towards digitization has multiple benefits: it helps reduce operational costs while strengthening customer relationships by delivering enhanced value propositions that meet evolving investor expectations. For instance, firms like Quadra Wealth, which provides structured notes as an alternative investment option for expatriates residing in UAE and other Middle East countries, use advanced algorithms along with human expertise to ensure consistent growth for clients’ portfolios despite market volatility.

The rise of robo-advisors is another example where automation combined with sophisticated algorithms offers cost-effective portfolio management services without compromising on quality or performance outcomes. According to a recent study published by Deloitte, robo-advisory assets under management (AUM) globally will reach $16 trillion by 2025 – showcasing its growing acceptance among investors across all age groups.

- Personalized experiences

- Anticipating client needs

- Improved client satisfaction

- Efficient client segmentation

- Long-term relationship building

- Privacy concerns

- Data accuracy and quality

- Ethical considerations

- Data interpretation challenges

- Overreliance on data

Key takeaways

The global asset management industry is being disrupted by fintech startups offering low-cost DIY investment solutions. These disruptors are leveraging cutting-edge technologies like AI and blockchain to offer innovative investment products, challenging traditional business models and compelling established players in the industry to rethink their strategy. Wealth managers are responding by investing heavily in digital operating models, using data-driven insights for decision-making processes, and delivering enhanced value propositions that meet evolving investor expectations through personalized advice tailored specifically to each individual's needs.

Future Business Models in Global Asset Management

The world of global wealth management is undergoing a significant shift. The market, once diverse and highly fragmented, seems poised to converge into three distinct business models: high-volume mass-market franchises, affluent franchises, and wealthy franchises. This convergence signifies the industry’s response to the changing landscape brought about by technological advancements and evolving customer demands.

The Convergence into Three Distinct Business Models

In the face of rapid digital transformation, future-ready firms are expected to adapt their strategy accordingly. High-volume mass-market franchises focus on serving a large number of clients with relatively smaller portfolios. Affluent franchises cater to individuals who have substantial assets but do not fall into the ultra-high-net-worth category. Finally, wealthy franchises serve an exclusive clientele consisting mainly of ultra-high-net-worth individuals (UHNWIs).

This strategic realignment allows these businesses to better address specific client needs while leveraging technology for operational efficiency according to BCG’s 2023 Global Wealth Report.

Eight Connected Capabilities for Future-Ready Firms

To thrive in this new environment, wealth management firms need eight connected capabilities:

- Digital-first mindset,

- Data-driven decision-making,

- Personalized client experiences,

- Flexible operating model,

- Sustainable investment options,

- Tailored product offerings,

- Cybersecurity measures and regulatory compliance practices,

- A strong leadership team can steer the organization toward its goals.

All these broad range components shape tomorrow’s world where they must evolve into technology businesses hiring excellent people with leadership skills. PwC’s Global Asset Management Survey 2023 supports this view, stating that digitization is no longer optional; it has become a necessity for survival in today’s competitive marketplace.

“The world of global asset management is evolving into three distinct business models. To thrive, firms must adapt to digital-first mindsets and personalized client experiences.

Unprecedented Growth Rate in Global Wealth

The world’s wealth management firm is experiencing an unparalleled surge in growth, despite the numerous challenges it faces. The resilience of this sector is a testament to its robustness and adaptability.

Explore challenges and Continued Growth within the Sector

In spite of various hurdles such as regulatory changes, increased competition, and disruptive value chains brought about by new entrants into the market, global wealth grew at an unprecedented rate in 2023. This shows that asset managers are successfully navigating these complexities while continuing to provide value to high-net-worth clients.

These services include helping individuals save for old age through multi-asset solutions. By ensuring scale and creating sustainable sources of future growth, they have been able to weather storms and continue on a trajectory of success within this dynamic environment.

In spite of various hurdles such as regulatory changes, increased competition, and disruptive value chains brought about by new entrants into the market, global wealth grew at an unprecedented rate in 2023. This shows that asset managers are successfully navigating these complexities while continuing to provide value to high-net-worth clients.

These services include helping individuals save for old age through multi-asset solutions. By ensuring scale and creating sustainable sources of future growth, they have been able to weather storms and continue on a trajectory of success within this dynamic environment.

Fastest Ever Recorded Annual Growth Rate

Astonishingly enough, according to findings from the Global Wealth Report 2023, last year marked the fastest-ever recorded annual growth rate in global wealth. The broadening of investment possibilities for mass-market customers has been a result of this tremendous growth, allowing them to benefit from it as well.

This extraordinary pace was primarily driven by rebounding equity markets and soaring house prices worldwide. The vast majority of this newfound wealth has been concentrated in the upper echelons, with the top decile holding more than eight times what is owned by the bottom half combined.

“The global wealth management industry is booming. Despite challenges, asset managers are successfully navigating complexities to provide valuable services for clients. The result? Unprecedented growth in 2023.

Astonishingly enough, according to findings from the Global Wealth Report 2023, last year marked the fastest-ever recorded annual growth rate in global wealth. The broadening of investment possibilities for mass-market customers has been a result of this tremendous growth, allowing them to benefit from it as well.

This extraordinary pace was primarily driven by rebounding equity markets and soaring house prices worldwide. The vast majority of this newfound wealth has been concentrated in the upper echelons, with the top decile holding more than eight times what is owned by the bottom half combined.

“The global wealth management industry is booming. Despite challenges, asset managers are successfully navigating complexities to provide valuable services for clients. The result? Unprecedented growth in 2023.

Rethinking Strategies Amid Accelerating Regulatory Changes & Increased Competition

In the rapidly evolving landscape of global asset management, asset, and wealth managers find themselves at a crossroads. The accelerating regulatory changes, increased competition, and disruptive value chains require a significant shift in their strategy.

Forces Driving Change in Strategy of Asset and Wealth Managers

The emergence of new entrants into the market is one force driving this change. These newcomers often bring innovative approaches and access to international investment that challenge traditional methods. For instance, fintech firms offer low-cost DIY investment solutions that appeal to an increasingly tech-savvy clientele.

Moreover, regulatory changes around the world compel wealth managers to adapt their practices accordingly. For example, stricter data protection laws like GDPR in Europe or CCPA in California require firms to overhaul their data handling processes – from collection through storage and usage.

The wealth managers start by developing a plan that will maintain and increase a client’s wealth based on their financial situation, goals, and risk tolerance.

Importantly, each part of a client’s financial picture, whether it is tax planning or wills and estates, is coordinated together to protect the wealth of the client. This may coincide with financial projections and retirement planning.

After the original plan is developed, the manager meets regularly with clients to support and update goals, review, and rebalance the financial portfolio. At the same time, they may investigate whether additional services are needed, with the ultimate goal being to remain in the client’s service throughout their lifetime.

Imperatives for Survival and Success within a Dynamic Environment

To survive and thrive within this dynamic environment marked by ever-evolving industry norms, trends, and technologies, asset and wealth managers need foresight and agility to proactively shape the future direction of the industry.

- Diversification: With volatility being an inherent part of financial markets today more than ever before, it’s crucial to diversify across different asset classes to mitigate risk exposure while maximizing potential returns on the investment made on clients’ behalf.

- Sustainability: There’s a growing demand among investors for sustainable investment options that align with personal values and environmental, social, and governance (ESG) considerations, making the case for these sources of future growth imperative for survival and success within the sector. Morgan Stanley has a great resource on sustainable investment.

- Digital Transformation: Embracing digital transformation is essential to remain competitive in an era where technology plays a pivotal role in everything from client acquisition to portfolio management and customer service. Deloitte has a great article on digital transformation in wealth management.

Talent Acquisition: Hiring excellent people with leadership skills is key to ensuring the successful implementation of strategic initiatives aimed at adapting to the changing landscape of global wealth management.

Key takeaways

Global wealth manager must rethink their strategy in response to regulatory changes, increased competition, and disruptive value chains. New entrants into the market bring innovative approaches that challenge traditional methods while stricter data protection laws require firms to overhaul their data handling processes. To survive and succeed within this dynamic environment, asset and wealth managers need foresight, agility, and diversification across different asset classes to mitigate risk exposure while maximizing potential returns on the investment made on clients' behalf. Additionally, embracing digital transformation is essential for remaining competitive in an era where technology plays a pivotal role in everything from client acquisition to portfolio management and customer service. Finally hiring excellent people with leadership skills is key to ensuring successful implementation of strategic initiatives aimed at adapting to the changing landscape of global wealth management.

FAQs

Global wealth refers to the total value of the asset owned by individuals, companies, and governments around the world.

Wealth management is a financial service that helps individuals and families manage their money to achieve their long-term financial goals.

Wealth management is important because it helps individuals and families make informed decisions about their finances to achieve long-term economic securities. Offers, a holistic approach to meet the complex needs of a client, a broad range of services—such as investment advice, estate planning, accounting, retirement, and tax services—maybe it plays a crucial role in ensuring sustainable growth to build a better life. Learn more.

Conclusion

Global wealth management has evolved due to technology and changing client demands, with AI enhancing advisor activities and digital collaboration tools. Worldwide surveys help understand client satisfaction levels, but new entrants offering low-cost DIY investment solutions threaten the competitive landscape. Future business models converge into three categories with eight connected capabilities for future-ready firms. Unprecedented growth rates present challenges and continued growth while rethinking the strategy amid regulatory changes and competition is imperative for survival success.

Discover Different Types of Insurance Scams and Ways to Prevent Them

Introduction As insurance subscribers, you must understand different types of insurance scams. One service provider’s

Insurance is a Liability or an Asset- Let Us Find Out

Introduction Insurance is a type of calamity-protecting product as against a regular form of investment.

Short-Term vs. Long-Term Insurance: Key Differences Explained

Introduction Choosing an insurance plan can be a way of securing your life, health, or

Key Differences Between Investment Management and Wealth Management

It may seem insignificant to differentiate between investment management and wealth management when it comes