Should I talk to a Financial Advisor When Buying a House?

In This Article Should I talk to a Financial Advisor When Buying a House? Or

A good investment portfolio is key to your financial well-being. It helps you cut down the effort and time you spend on researching stocks.

It brings together the best of your skills, knowledge, experience, and even luck. However, building a strong investment portfolio isn’t easy.

This blog will explore all things ‘investment portfolio’. Right from what goes into building one to how you can build one that earns you sizeable profits.

In short, it provides a brief overview of investment portfolios, including the types of asset classes, different investment strategies, and steps to building your portfolio portfolio.

It emphasizes the importance of diversification, asset allocation, and understanding risk tolerance.

You can gain insights on how to construct a well-balanced portfolio and make informed investment decisions to work towards your financial goals.

An investment portfolio is a collection of different stocks, bonds, mutual funds, and other assets.

These can be used by a financial institution or investor to invest in the market and make more money.

A well-balanced investment portfolio has a combination of assets that may be used to reduce risk and increase profits.

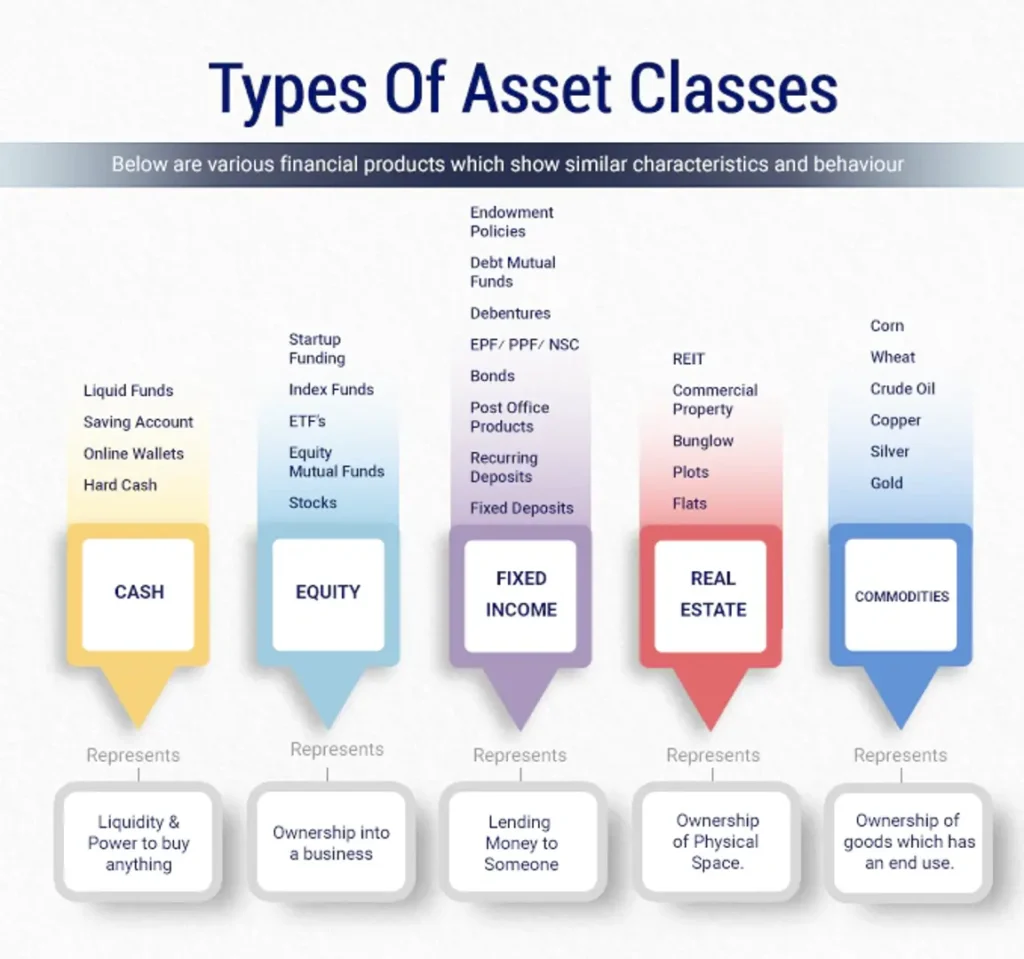

Asset classes are the different types of assets that you can invest in. Portfolio investments are all about asset allocation.

Investors need a range of assets, from stocks to bonds, to make their money work for them.

A healthy mix of different types of assets in your portfolio is crucial.

This is because that translates to achieving long-term capital growth with appropriate risk management.

Long-term asset growth represents capital accumulation by reinvesting the returns generated by the assets.

It is achieved by purchasing assets at low prices, which generates cash flow, and then reinvesting it at higher prices.

It results in sizeable gains over time until one has accumulated enough assets to sell at a high price.

By including the following in your portfolio, you will be able to achieve this goal.

Stocks

Stocks are a significant component of the majority of investment portfolios and a common method of investing in a company.

This means that you own portions or shares of a company as a stockholder. This grants you partial ownership over any company stocks you have.

The portfolio allocated to stocks may include stocks bought through dividend-paying companies, which are often large firms like Coca-Cola, which regularly pay out the total amount of dividends they earn to shareholders.

Increasing your potential future income through stock investment is determined by three main factors:

1. How popular they are;

2. Supply and demand— if demand is greater than supply then the price will increase, but if supply exceeds demand then prices fall; and

3. Performance or profit trends.

Bonds

Bonds are loans that enable investors to lend money to the government, agencies, or businesses. The payment structure is different from most other investments.

Simply put, bondholders do not get to own a part of the company they are lending their money to. On maturity, they get to keep only their principal amount and the interest earned over the course of time.

However, bonds carry less risk as compared to individual stocks but offer lower potential returns due to this factor.

Alternative investment options

Alternative investments are investments that are classified as being outside the mainstream.

This can include investments in the property market, and in commodities like gold and oil. These often come with a certain level of risk.

However, they can also produce incredibly high returns in the long term.

People often assume that all investment portfolios are the same and all investors have the same type of portfolio. While there are some similarities, there are also a lot of differences.

These include the types of portfolios owing to the purpose of the investment and the investment strategy.

Income portfolio

A diversified income portfolio is more focused on earning regular monthly payments rather than focusing on capital gains.

Searching for low-risk alternatives can alleviate the pressure investors sometimes feel to find the ‘next big thing’ when trying to secure profits from their investments.

One of these passive income options is by investing in bonds. They are a fixed-income investment tool that nearly all wealthy individuals hold for their long-term yields.

Growth Portfolio

A growth portfolio contains assets that have the potential to grow several times their current value over time.

Growth portfolios often contain high-risk options such as stocks of small businesses or undervalued assets; these are generally ideal for younger individuals or even businesses.

The reason is that they are still working hard to amass enough wealth down the road to support themselves later.

Value portfolio

Value portfolios are a great way to invest in stocks that you think will appreciate in value over time.

Many people think that these portfolios can only be applied to the stock market. However, they can also be used when investing in other things such as real estate and even in businesses.

For this type of investment portfolio, finding a bargain by valuation is a great way to determine where the most profitable business opportunities are during difficult economic times.

Investors will often look for businesses that have the ability to sustain growth and profits but whose current market value significantly falls below what analysis considers their appropriate market value to be.

Essentially, this kind of investing focuses on ways in which we can exploit companies that are currently trading far below what they’re worth which could mean huge profit margins as well as good business opportunities.

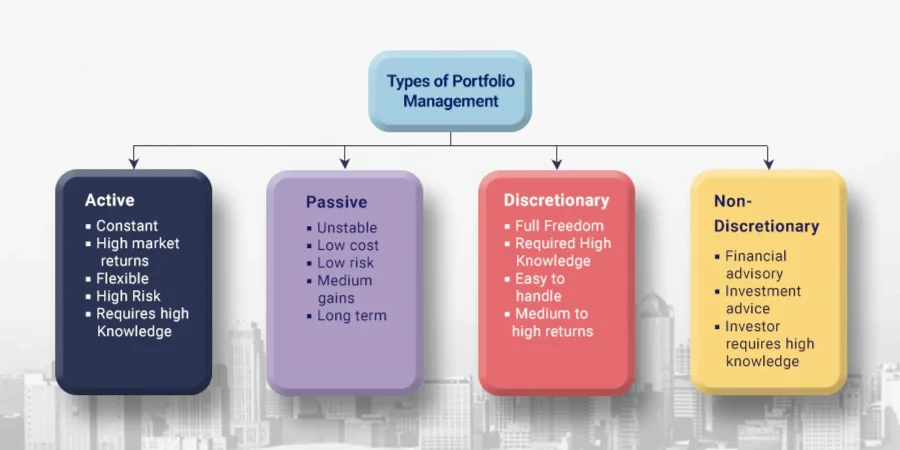

Active Investment Vs Passive Investment

There are two main investment strategies— active and passive— that investors use to manage their portfolios based on a variety of factors such as risk tolerance, time available for monitoring of investment securities, aggressive or relaxed attitude toward changes in portfolio security holdings over short periods of time versus long term outlooks, amount of capital desired to spend during an active trading period, etc.

The strategy one chooses is to match their financial profile or necessities they want to fulfill with the investment environment they want to build which will result in their account net worth, i.e., how much it will be worth at the end.

Active investment

Active investing means merely owning assets that do not satisfy you. Instead, it forces you to consider ways to grow your wealth.

Active investment management always entails analyzing the market and acting on a portfolio of assets that may be affected by short-term factors.

Within this approach is the constant examination of financials in the hope and expectation for a positive outcome plus, traders will plan out when and how best to execute those trades based on their strategy or knowledge.

Having an active investment management team lends itself well to improving performance metrics because there are individuals who look at trends or changes before they happen, then strategize about what should be done with specific investments in light of findings.

A common misconception about active investing versus passive investing is that active investing involves more risk than passive investing.

However, this does not have to be the case.

Keep a small percentage of the total portfolio in actively managed securities and a larger portion placed into passive ones.

Certainly! Here are the pros and cons of having and not having active investment and passive investment strategies:

Passive investment

If you’re a passive investor, you must keep things simple.

This is because being a passive investor means sticking to a tried-and-true strategy of investing for the long term and buying/holding your investments for most of the duration with no second-guessing.

While many people tend to shy away from this kind of insistence towards simplicity, it can be very rewarding in the long run as such an investment style attracts high returns on minimum work once you’ve laid the foundations for your portfolio.

The best part about being a passive investor is that it does not require much thought if one sticks to using index funds that are traded infrequently and have less volatility in their returns as compared to actively managed funds which require more effort but tend to be riskier since they’re often managed actively by swimming around in the stock market’s waters consistently.

A strong portfolio helps us to diversify our money. It helps us to create a balance and build a healthy financial future.

According to Forbes, here are some of the steps that you can take to build an investment portfolio.

Determining the objective of the investment portfolio

As you’re deciding where to pool your funds, it’s important to understand that there are several ways in which a portfolio might be used.

As a potential investor, you need to know what the portfolio is being built for, so you can direct your resources more specifically toward something that meets the needs of the person requesting investments.

Assess risk tolerance

The word ‘risk’ is often associated with the potential for danger or injury.

When it comes to investments, a financial risk means a degree of uncertainty or a possibility of losing money.

Most experts agree that in finance there is almost always an inverse relationship between risk and reward.

The higher the percentage of your investment capital you’re willing to put at stake, the greater your chance to see sizeable gains.

Of course, you also might stand to lose money if one or a few of your picks tank badly.

Before you dive into the world of investing, you’ll want to assess your risk tolerance or capacity.

It refers to how much of an investment gamble you’re willing to take.

You’ll also need to think about your financial needs and liquidity so that you can diversify into different categories of capital such as government securities, stocks/ equities, etc.

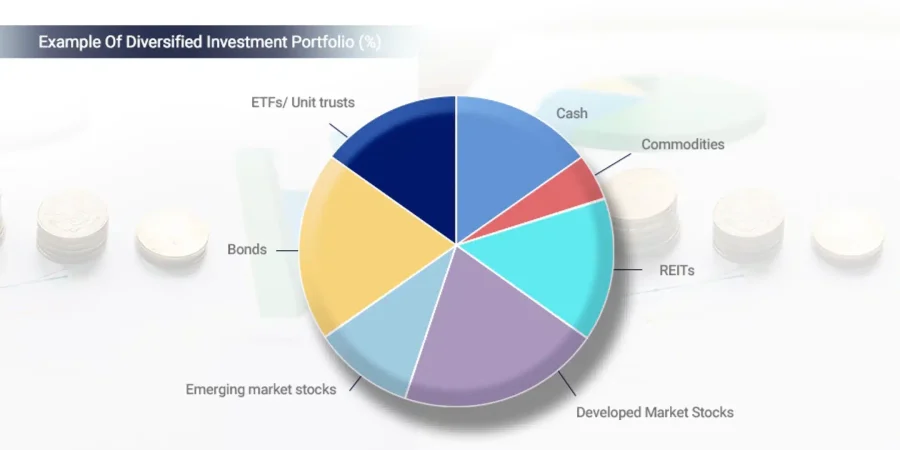

Diversify your portfolio

Your long-term holding strategy should focus on building a diversified portfolio that gives you favorable returns while also protecting your capital from unforeseen market happenings.

Your investment portfolio should reflect this and include a diverse set of investment types and companies.

This will help shield you from the ups and downs of the market and will minimize the amount of money you lose over time.

By owning a diversified portfolio, no single investment in your portfolio will have a large impact on the overall risk and returns.

Asset allocation

Balance is key to achieving optimal diversification in your portfolio.

When you’re combining different funds together to form a portfolio, a crucial part of your overall strategy is determining what percentage you want to invest in each type of investment.

This is an important decision and can affect whether or not the value of your portfolio will increase by more than simply holding an index.

Critically reviewing factors like risk profile and return expectations, as well as how long you are going to hold your investment will help you determine what’s best for your situation.

That’s why we recommend utilizing a variety of investments in your portfolio, to distribute risk across your investment options like a stock fund and bonds.

However, if you’re holding an aggressive portfolio of investments, then we’d also suggest considering having a high investment percentage for equities and a smaller percentage of a bond investment.

Rebalance your portfolio

It can be really helpful to review your investments from time to time to make sure everything is on track whether you’re working with a financial advisor or not.

When reviewing your portfolio you may notice that the combination of portfolio of stocks and bonds in the allocation isn’t actually right for where you are right now.

You can fix this situation by hiring a financial advisor!

If you hire a financial planner, they will take care of asset allocation and rebalancing for you as needed and make sure all your assets are where they should be so you can enjoy favorable returns.

Conclusion

When building an investment portfolio, there are several factors to consider- the strategies can you use to build your portfolio; the types of investments available; the risks and rewards of each type; how you can build your portfolio in a way that will meet your needs, and more.

Key concepts for managing an investment portfolio include understanding your risk tolerance, diversifying your assets, and learning to rebalance your asset allocation.

For individuals seeking to invest, it’s important to do your research and work with a trusted and unbiased financial advisor.

Our expert advisors can help you understand the different types of investments available and how to build a robust investment portfolio that is right for you.

Simply book a call with our financial advisor today by clicking on this link.

Frequently Asked Questions

Determining the objective of an investment portfolio is crucial as it provides clarity and direction for making informed investment decisions. It helps align the portfolio with broader financial goals and ensures that investments serve a specific purpose in the overall financial plan.

Assessing risk tolerance is important as it helps tailor the portfolio to an individual’s comfort level. It ensures a balance between risk and reward and promotes emotional stability during market fluctuations, preventing impulsive decision-making and potential losses.

Diversifying a portfolio helps reduce the concentration risk associated with holding a few assets, thus mitigating the impact of individual investment losses. It also provides the potential for enhanced returns by tapping into different investment opportunities and benefiting from various market cycles.

Asset allocation refers to the distribution of investments across different asset classes. It is important as it allows for the optimal balance between risk and return based on investment goals and risk tolerance. Effective asset allocation customizes the portfolio to an individual’s needs, maximizing potential returns while managing risk.

Portfolio rebalancing helps maintain the intended asset allocation by periodically adjusting holdings. It ensures that the portfolio remains aligned with investment objectives and reduces the risk of becoming too heavily weighted in any one asset class. Rebalancing also encourages a disciplined investment approach by buying low and selling high.

Not rebalancing a portfolio can lead to a drift from the target asset allocation, resulting in unintended risk exposure and potentially impacting long-term investment objectives. It also means missing out on opportunities to buy undervalued assets or reduce exposure to overvalued assets.

In This Article Should I talk to a Financial Advisor When Buying a House? Or

In This Article Robert Kiyosaki 10 keys to financial freedom Have you ever felt the

In This Article Can SIP make you rich? Systematic Investment Plans can help in wealth

In This Article A visionary entrepreneur who has been a consistent disruptor in the way

Quadra Wealth is an independent offshore financial planning and wealth management advisory firm based out of Dubai, UAE. We specialize in wealth management services, not limited to retirement planning, children’s higher education plans and wealth accumulation plans.

Quadra Wealth is an independent offshore financial planning and wealth management advisory firm based out of Dubai, UAE. We specialize in wealth management services, not limited to retirement planning, children’s higher education plans and wealth accumulation plans.

The Secret Fusion

Grow Your Assets

Faith Meet Opportunities

Tailored Wealth Management

Who We are & What We Stand For

Learn strategies for consistent growth and capital preservation techniques