Picture this: you’ve successfully climbed the corporate ladder and now find yourself among the high-net-worth individuals in UAE. Congratulations! But, attaining significant wealth entails increased accountability when it comes to properly managing your funds.

High Net Worth (HNW) Strategies are crucial for maintaining and growing your wealth while ensuring a lasting legacy for future generations. To ensure long-term financial planning success, this post will explore various strategies tailored specifically for high-net-worth individuals.

We’ll delve into harvesting tax losses methods that can help reduce the tax burden and manage your capital gains, estate planning essentials to secure your family’s future, asset allocation strategies that align with your risk tolerance levels, maximizing charitable giving benefits through donor-advised funds or private foundations, contributing to tax-advantaged retirement accounts and harvesting tax losses to offset capital gains and other liquid assets.

So finding a trusted financial planning advisor who understands your unique needs. So sit back and prepare to elevate your knowledge of High Net Worth Financial Planning Strategies as we guide you through these essential topics in detail.

Your journey towards even greater financial success begins here!

High Net Worth Wealth Management Strategies

Let’s dive in and explore the world of high-net-worth financial planning. At Quadra Wealth, our professional financial advisors/wealth managers are here to help you maximize your portfolio potential and navigate the complexities of high-net-worth financial planning.

We’ll cover various approaches from financial planning for people who are considered to have a higher net worth and wealth management strategies including harvesting tax losses techniques, estate planning essentials, and asset allocation strategies.

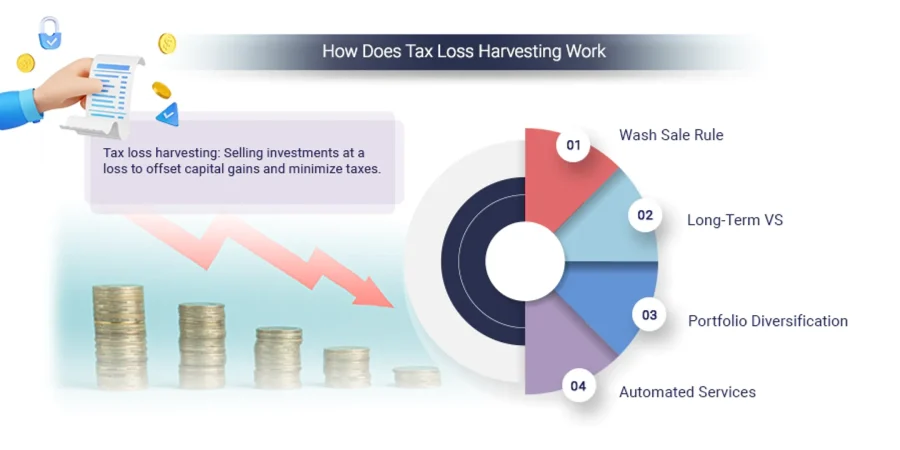

Tax Loss Harvesting Techniques

As your net worth increases, it’s crucial to move beyond basic income and property deductions. An experienced certified financial planner can help you devise a multi-year plan that minimizes tax liability through advanced financial planning techniques like harvesting tax losses – selling underperforming investments to offset gains from successful ones.

- Identifying opportunities: Spotting market trends for strategic sales timing.

- Timing sales strategically: Capitalizing on market fluctuations for maximum benefits.

- Reinvesting proceeds effectively: Reallocating funds into promising investments.

Pros of tax loss harvesting techniques:

- Minimize tax liability

- Portfolio optimization

- Flexibility and control

- Long-term tax planning

Cons of not having Tax Loss Harvesting Techniques:

- Missed tax-saving opportunities

- Inefficient portfolio management

- Limited flexibility in tax planning

- Reduced ability to optimize investment returns

Estate Planning Essentials

Proper estate planning is essential to preserve wealth across generations while minimizing taxes and other expenses. A dedicated professional can guide you through complex processes such as creating trusts or setting up charitable foundations tailored specifically to meet both personal objectives and legal requirements.

- The power of trusts: Learn about their benefits in preserving assets and reducing taxes.

- Gifting strategies during lifetime: Discover how gifting assets now can benefit future generations.

- Incorporating philanthropy: Explore how charitable endeavors can be part of your estate plan.

prosPros of Estate Planning:

- Wealth Protection

- Minimize Taxes

- Smooth Asset Distribution

- Healthcare Decisions

- Charitable Giving

Cons of Not Having Estate Planning:

- Probate Process

- Loss of control

- Family disputes

- Higher taxes

- Inefficient distribution

Assets Allocation Strategies

Diversification is key when managing large portfolios, and our expert financial advisor recommends different asset allocation methods that involve investing in a mix of stocks, bonds, money alternatives, or even real estate holdings depending on individual risk tolerance levels and short-term/long-term goals set by clients themselves. Well, Investing is central to building wealth, and their numerous ways to approach it, depending on your goals and risk tolerance.

- Risk assessment: Understanding your personal risk tolerance level.

- Growth vs income investments: Balancing the right mix for your portfolio.

- Rebalancing frequency: Knowing when to adjust allocations for optimal performance.

If you’re ready to take control of your financial future, contact one of our experienced advisors at Quadra Wealth today.

Pros of Having Asset Allocation Strategies:

- Risk management

- Higher returns

- Customization

- Long-term focus

- Portfolio rebalancing

Cons of Not Having Asset Allocation Strategies:

- Lack of diversification

- Emotional decision-making

- Missed opportunities

- Higher risk exposure

- Lack of consistency

Key takeaways

management firms like Quadra Wealth offer high-net-worth financial planning strategies, including harvesting tax losses techniques to minimize taxes, estate planning essentials for preserving wealth across generations and minimizing taxes, retirement planning and assets allocation strategies involving a mix of investment strategies based on individual risk tolerance levels and goals. By taking control of their financial future with the help of an experienced financial advisor, expatriates and residents in the Middle East can maximize their portfolio potential and navigate the complexities of financial planning.

Tax Loss Harvesting Techniques: A Savvy Approach to Minimizing Tax Liability

As your net worth grows, it’s time to level up your tax strategy game with advanced techniques like harvesting tax losses.

This clever approach involves selling underperforming investments to offset gains from successful ones, reducing overall tax liability.

Reinvesting Proceeds Effectively

Last but not least, make sure you reinvest those proceeds wisely.

- By taking advantage of them as part of a broader diversification strategy by purchasing new assets with different risk profiles or industry exposure.

- Alternatively, consider investing in a substantially identical ETF during the 30-day waiting period to maintain market exposure without violating the wash-sale rule.

In summary, for those with high net worth and seeking a financial plan and manage to their wealth, harvesting tax losses is a great way to reduce taxes and maximize investment accounts.

Working with a knowledgeable planner can be essential to successfully utilizing this sophisticated tax planning technique and keeping your investments in line with your long-term objectives and personal beliefs.

Essentials of Estate Planning

Let’s face it, estate planning is crucial for preserving wealth across generations while minimizing taxes and other expenses.

But don’t worry. We’re here to guide you through complex processes such as creating trusts or setting up charitable foundations tailored specifically to meet both personal objectives and legal requirements.

Trusts and Their Benefits

A trust is a powerful tool that can help protect your assets, provide for loved ones, and even reduce estate taxes in certain situations.

The best part? You have the flexibility to choose from various types of trusts depending on your unique needs – revocable living trusts, irrevocable life insurance trusts (ILIT), or even special needs trusts, just to name a few.

Gifting Strategies During Lifetime

By making gifts during your lifetime, you can reduce the size of your taxable estate while also providing a benefit to those who are important to you.

Strategically gifting money or property within annual limits allows you to share wealth without triggering gift private tax planning consequences – talk about a win-win situation.

Philanthropic Endeavors

If giving back has always been close to your heart, incorporating philanthropy into your estate plan could be right up your alley.

Options like donor-advised funds (DAFs) or private foundations not only support your favorite causes but also offer tax benefits and allow you to leave a lasting legacy.

Are you ready to embark on this financial planning journey of estate planning? We’re here every step of the way, ensuring that your wealth is preserved for generations while making a positive impact in the world.

“Secure your family’s financial future and make a positive impact in the world with high net worth strategies like trusts, gifting, and Philanthropy”.

Key takeaways

Secure your family’s financial future and make a positive impact in the world with high net worth strategies like trusts, gifting, and Philanthropy

Asset Allocation Strategies: Diversifying Your High Net Worth Portfolio

It is essential to spread out investments across a range of assets in order to effectively manage a large portfolio. Every certified financial advisor and wealth manager will present you with high-net-worth investment planning strategies based on the information you bring them.

Our expert advisors at Quadra Wealth recommend various asset allocation strategies tailored to your individual risk tolerance and financial planning goals including retirement planning.

Here are some key areas/ points you should consider:

Assessing Risk Tolerance Levels

The first step is understanding your risk tolerance level. Are you comfortable with aggressive investing or do you prefer more conservative options? This will help determine the right balance for your portfolio.

Balancing Growth vs high-Income Investments

Growth investment focuses on capital appreciation while high-income investment generates steady cash flow. A well-rounded high net worth portfolio includes both types of assets, striking an optimal balance between potential returns and stability.

Portfolio Rebalancing Frequency

Rebalancing your portfolio and the individual’s assets periodically ensures that it remains aligned with your investment return objectives and risk profile. Discuss the ideal frequency with your advisor – whether quarterly, semi-annually, or annually – based on market conditions and personal preferences.

Incorporating the aforesaid tenets into one’s assets division plan can have a noteworthy effect on the growth of an affluent investor portfolio over time. Remember, diversification is crucial to managing risk and maximizing returns.

Key takeaways

Diversify your high net worth portfolio with asset allocation strategies tailored to your risk tolerance and financial goals

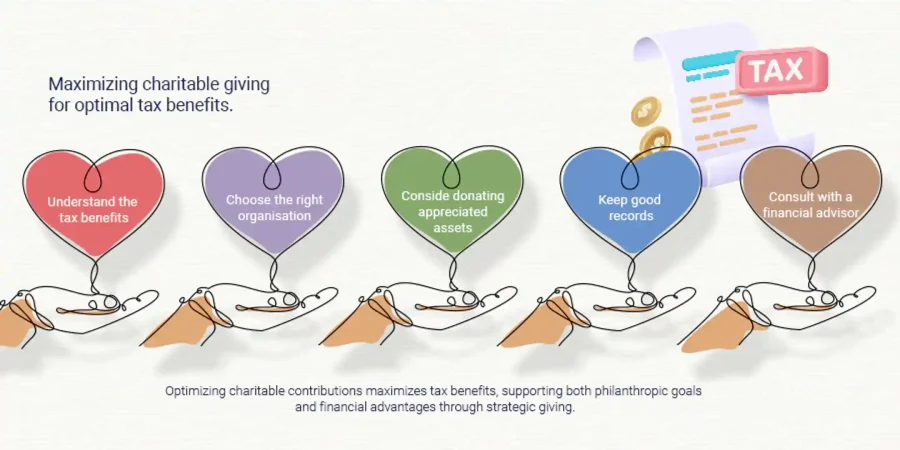

Maximizing Charitable Giving Benefits

Let’s jump into the realm of philanthropy.

Our purpose here is to help you maximize tax savings while meeting your personal charitable objectives. To achieve this, we’ll explore different giving vehicles like donor-advised funds (DAFs) and private foundations.

Donor-Advised Funds vs Private Foundations

Option 1: Donor-advised funds are an easy way to start your philanthropic journey – they’re cost-effective and offer flexibility in grant-making decisions. Learn more about DAFs here.

Option 2: On the other hand, private foundations provide greater control over investment and distributions but come with higher administrative costs and regulatory requirements.

Tax Implications of Different Giving Vehicles

- Tax Deduction Limits:

money donations: up to 60% of adjusted gross income (AGI)

Stock or real estate: up to 30% AGI for DAFs; up to 20% AGI for private foundations

Estate Tax Savings: Both DAFs and private foundations can help reduce estate taxes by removing donated assets from your taxable estate.

Aligning Philanthropy with Personal Values

Finally, let’s make sure your giving aligns with what matters most to you. Whether it’s supporting education, healthcare, or environmental causes – work closely with your financial planning advisor to create a personalized philanthropic plan that reflects your values and passions.

So there you have it. By choosing the right giving vehicle and understanding tax services bill implications, you’ll be well-equipped to maximize both personal satisfaction and financial benefits through charitable endeavors.

Key takeaways

Maximize your charitable giving benefits and align them with your personal values through donor-advised funds or private foundations. Learn more now

Finding a Trusted Wealth Planning Financial Advisor: Your Ultimate Guide

Embarking on your wealth journey to find the right financial advisor can feel overwhelming. But fear not. We’ve got your back with this foolproof 3-step process for finding an expert who has your best interests at heart. Let’s dive in:

Evaluating Potential financial planner’s Qualifications

Step 1: Do your homework and research their experience, credentials, and communication style. Check for designations such as “high-value”, “high-net-worth people/individual” or “wealthy investors”.

Pros of Evaluating Potential Financial Advisor Qualifications:

- Expertise assurance

- Trust and confidence

- Personalized advice

- Objective guidance

Cons of Not Evaluating Potential Financial Advisor Qualifications::

- Limited knowledge

- Risk of poor advice

- Potential financial loss

- Lack of accountability

Establishing Clear Expectations Upfront

Step 2: Create a list of questions to ask during initial consultations – inquire about managed services provided, fees charged, and how many meetings you should expect each year.

Pros of Establishing Clear Expectations Upfront:

- Clarity and alignment

- Mutual understanding

- Realistic goals

- Efficient collaboration

Cons of Not Establishing Clear Expectations Upfront:

- Miscommunication

- Conflicting expectations

- Wasted time and effort

- Disappointment or frustration

Maintaining Open Communication & Monitoring Progress

Step 3: Keep the lines of communication open and monitor your progress and wealth report regularly. Regularly monitoring progress can help guarantee that your wealth planning is on track and you are heading in the right direction toward achieving your goals.

Pros of Maintaining Open Communication & Monitoring Progress:

- Transparency and trust

- Course correction

- Proactive decision-making

- Improved outcomes

Cons of Not Maintaining Open Communication & Monitoring Progress:

- Lack of information

- Mismanaged expectations

- Missed opportunities

- Detrimental surprises

Finding a trusted financial advisor may seem daunting, but with these actionable steps in hand, you’ll be well-equipped to make an informed decision that sets you up for long-term wealth creation and success.

Key takeaways

Take control of your financial future with these 3 steps to finding a trusted high net worth advisor. Start building wealth today

Frequently Asked Questions

What are the strategies to increase net worth?

To increase your wealth, and need to focus on increasing assets and reducing liabilities. Strategies include saving more, investing wisely through asset allocation, minimizing taxes with tax-loss harvesting techniques, optimizing estate planning, maximizing charitable giving benefits, creating retirement planning, and working with a trusted financial advisor.

Targeting high-net-worth individuals (HNWIs) requires understanding their unique needs and preferences. Offer tailored financial solutions such as personalized wealth management services or exclusive investment wealth management opportunities. Network in affluent circles by attending industry events or joining relevant organizations. Utilize digital marketing channels like LinkedIn to reach professionals at the CXO level.

How do I protect my net worth?

Protect your wealth by diversifying investments across various asset classes to minimize risk exposure. Implement effective estate planning strategies including trust planning for wealth protection purposes. Maintain adequate insurance coverage for potential risks like liability lawsuits or property damage. Consult a qualified financial advisor or the wealth managers for guidance on safeguarding your wealth.

The term “high-net-worth 2023” refers to an individual’s anticipated net worth status in the year 2023-23 based on current growth rates and trends in personal wealth markets globally (source). The threshold defining a person as having ‘high net worth’ may vary depending on regional standards but typically includes those with investable assets exceeding $1 million USD

Conclusion

The high net-worth individual in the UAE and expatriates at the CXO level can benefit from implementing harvesting tax losses techniques, estate planning essentials, asset allocation and asset protection strategies, retirement plans, and maximizing charitable giving benefits.

By identifying opportunities in the market, timing sales strategically, establishing trusts and gifting the financial plan during a lifetime, assessing risk tolerance levels for balancing growth vs high income investments, and utilizing donor-advised funds or private foundations for philanthropic endeavors; wealthy individuals can maximize their wealth potential.

To ensure success with these financial planning strategies, it is important to find trusted financial planners by evaluating qualifications upfront while establishing clear expectations. Monitoring progress and maintaining open communication is key to achieving your desired results.

If you’re looking to implement High Net Worth and wealth management strategies into your portfolio and increase your wealth, contact Quadra Wealth today!