In This Article

Financial Planning for Young Professionals: An easy guide

Financial planning for young professionals is a journey that starts with a single step.

In today’s fast-paced world, it’s more important than ever for young professionals to take control of their financial future. By implementing the right strategies, you can maximize your returns and build a strong foundation for long-term wealth accumulation.

This blog post will provide valuable insights and good financial planning tips for young professionals, covering essential topics such as maximizing investment returns, creating a comprehensive financial plan, managing risk effectively, diversifying your portfolio to minimize potential losses, and monitoring performance regularly to ensure continued success on your path towards financial freedom.

Embarking on this journey now will pay dividends down the line – don’t miss out on these crucial steps to have a secure financial future.

How to Maximize Your Investment Returns as Young Professionals?

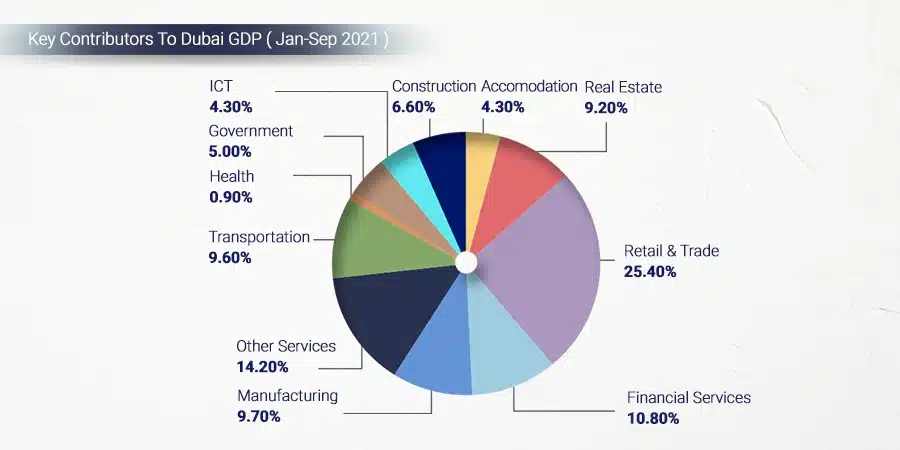

As young professionals in the UAE, it is vital to construct an effective financial strategy for attaining optimum investment yields. One way to achieve this is by understanding structured notes.

Structured notes are financial instruments that can help boost your portfolio growth and provide consistent returns.

These mortgage securities are issued by financial institutions and combine various assets like bonds and derivatives. The performance of these underlying assets determines the return on investment (ROI).

Why Choose Structured Notes?

There are several reasons why structured notes can be a good investment option:

- Customization: You can tailor them to suit your risk tolerance and desired ROI.

- Diversification: They offer exposure to different asset classes within one product.

- Protection: Some structured notes come with principal protection features, reducing potential losses if markets decline.

Tips for Investing in Structured Notes

- Educate yourself: Understand how they work, their risks, the fees involved, and potential benefits before investing.

- Select reputable issuers: Stick with well-established banks or financial institutions when purchasing structured notes.

- Diversify: Don’t put all your eggs in one basket; spread investments across multiple structured notes and other asset classes.

- Maintain realistic expectations: While high ROIs are possible, remember that structured notes are not a guaranteed path to wealth.

By following these tips, you can gain financial literacy make informed decisions, and maximize your investment returns with structured notes.

Looking for expert guidance? Contact Quadra Wealth for a personalized investment plan for the young and guidance on investing in structured notes. But don’t stop there.

To achieve a well-rounded portfolio, consider expanding your investments beyond structured notes to include stocks, bonds, ETFs, and mutual funds.

This way, you’ll be well-equipped for long-term growth and financial independence as an expatriate or resident in the UAE.

Pros of Choosing Structured Notes:

- Customization: Tailor investments.

- Risk Management: Mitigate losses.

- Income Generation: Regular income.

- Diversification: Broaden portfolio.

Cons of Not Choosing Structured Notes:

- Limited Customization: Fewer options.

- Increased Risk: Higher risk.

- Reduced Income Opportunities: Miss income potential.

- Limited Diversification: Restricted access.

- Market volatility can impact long-term wealth accumulation.

- Overreliance on a single investment approach may backfire.

- Lack of awareness about financial planning options.

Key takeaways

Maximizing investment returns is crucial for young adults in the UAE, and structured notes can be a great option to achieve this. These financial instruments offer customization, diversification, and protection features but require education on their risks and fees before start investing. So it's also important to diversify your portfolio with other financial instruments like stocks, bonds, ETFs, and mutual funds for long-term growth as an expatriate or resident in the UAE.

Create a Financial Planning: A Tailored Approach to Your Wealth Goals

Before we explore the secrets of successful investment planning for young, it’s crucial to understand the importance of creating a plan tailored to your individual needs and goals.

The more detailed you get with your goal setting, the easier it will be to create a realistic investment planning strategy to make it happen.

Here’s a simple 5-step process to get you started:

Step 1: Identify your financial objectives – what are you aiming for? Is it retirement, buying property, or funding higher education?

Step 2: Assess your current financial situation. Take stock of your assets, liabilities, steady income sources, and expenses.

Step 3: Collaborate with an experienced financial planner. Their expertise can give you guidance through complex financial decisions and investment strategies.

Step 4: Create an actionable plan that outlines steps towards achieving each goal. This includes setting timelines and milestones along the way.

Step 5: Maintain discipline by regularly reviewing progress against targets while adjusting the financial planning as needed based on changing circumstances or market conditions.

Adhere to these instructions and you’ll be on the path of constructing tailored financial plans that fit your unique needs.

“Craft a personalized financial plan that works for YOU. Identify long-term financial goals, assess your situation, collaborate with your advisor, create an actionable plan, and maintain discipline.

Manage Risk: Navigating the Investment World with Confidence

Navigating the investment world with confidence requires effective risk management to ensure long-term success. Financial planning is incomplete without understanding and managing risk.

No worries. I’ve got you covered with these actionable tips:

Tip 1: Understand that risk is inevitable but manageable. Embrace it and learn how to navigate through it wisely.

Tip 2: Get familiar with different types of risks such as market risk, credit risk, and liquidity risk – knowledge is power.

Tip 3: Avoid putting all your eggs in one basket by diversifying your investments across various asset classes. This way, if one investment goes south, others can help cushion the blow. The financial planner recommends diversification as a key strategy for managing risk.

Above all, remember that managing risk is about striking the right balance between potential rewards and possible pitfalls. You’ve got this.

Arm yourself with these hints and you’ll be prepared to face any investment risks that arise.

Now let’s move on to diversifying your portfolio – another essential aspect of successful investing. “Take charge of your financial future with these actionable tips for managing investment risks and diversifying your portfolio.

Diversify Your Portfolio: A Smart Investor's Guidance and Advice to Long-Term Growth

To ensure safe and prosperous financial security, diversifying your portfolio is essential. This means spreading your investments across various asset classes to minimize risk and maximize returns.

Let me break down the process for you:

Step 1: Understand different asset classes, such as stocks, bonds, real estate, commodities, and cash equivalents.

Step 2: Assess your risk tolerance. Are you a conservative or aggressive investor? This will help determine the right mix of assets for you.

Step 3: Allocate your investments accordingly. A portfolio that is properly diversified should encompass a blend of higher-risk stocks and lower-hazard bonds.

A Few Tips on Diversifying Your Portfolio Effectively

Incorporate international exposure by investing in global markets through mutual funds or exchange-traded funds (ETFs).

Add alternative investments like private equity or real estate investment trusts (REITs) to further diversify your holdings.

Avoid over-diversification; owning too many similar assets can dilute potential gains without reducing risk significantly.

Diversify within each asset class – investing in multiple sectors/industries rather than focusing on just one.

Remember, diversification is not a one-time task. Revisit your portfolio periodically to rebalance and make necessary adjustments based on market conditions and personal financial goals.

Looking for more guidance? Check out this comprehensive guide on how to diversify your investments effectively.

In conclusion, diversifying your investment portfolio is essential for long-term growth and risk management. It’s time to put these tips into action and watch your wealth grow.

Diversify your investment portfolio for long-term growth and stability. Follow these smart tips to minimize risk and maximize returns.

Monitor Performance: Keeping an Eye on Your Investments

Let’s talk about monitoring your investment performance. Why is it important? Well, keeping track of how your investments are doing helps you stay focused on your financial goals and make necessary adjustments along the way.

So, here’s a step-by-step guidance to effectively monitor your investment portfolio:

Set up a performance measurement system. This can be as simple as using a spreadsheet or opting for specialized software.

- Establish benchmarks. Compare your portfolio’s performance against relevant indices like the S&P 500 or MSCI World Index to gauge its success relative to the market.

- Review regularly. Check-in on your investments at least quarterly – more frequently if you’re actively trading – and assess their progress towards meeting your financial objectives.

- Analyze individual assets within your portfolio. Determine which ones are performing well and contributing positively to overall growth while identifying underperformers that may need attention or replacement.

- Evaluate risk-adjusted returns by calculating metrics such as the Sharpe Ratio or Sortino Ratio. These help measure how much return you’re getting for each unit of risk taken in comparison with other investments.

- Consider seeking professional guidance from a certified financial planner or financial advisor if you’re unsure about your portfolio’s performance and need guidance on making adjustments.

Remember, monitoring your investment is an ongoing process that helps ensure you stay on track to achieve your financial goals such as building a fund during emergencies, eliminating debt or mortgage, or savings for retirement.

Regularly evaluating your investments can provide the insight needed to make informed decisions and adjust your strategy as desired. Ready to take control of your finances?

Get started with Quadra Wealth today.

“Maximize your investment growth potential with these 5 easy steps to monitor performance and achieve financial independence.

Conclusion

Young professionals can find financial planning daunting, However, it’s important to remember that financial planning is crucial for long-term success and security.

Yet these five steps will help you to take care of your financial health and achieve your desired outcome. First, maximize your investment returns by understanding the different options available to you.

Second, create a financial plan that aligns with your goals and objectives. Third, manage risk through diversification and insurance policies.

Fourth, diversify your portfolio to reduce risk and increase potential returns. Finally, monitor performance regularly to make informed decisions.

Pro tip: build an emergency fund. Aim to save three to six months’ worth of living expenses in a separate savings account that is easily accessible in case of an emergency.

By taking control of your finances early on in life and implementing a solid financial plan tailored to your needs as a young adult living in UAE or an expatriate at the CXO level, there is no limit to what you can achieve financially! Don’t wait any longer; start today!

If you need help creating personalized financial plans that meet all of your unique needs as a young professional or an ex-pat at the CXO level in UAE, please visit Quadra Wealth.

At Quadra Wealth, our professional financial advisors are dedicated to helping you realize your financial objectives through a tailored financial plan and guidance.

Frequently Asked Questions

The 50-30-20 rule is a simple budgeting guide for allocating your after-tax income: 50% towards necessities, such as housing and utilities; 30% towards discretionary spending, like dining out and entertainment; and 20% towards a savings account, or debt repayment. This approach helps young professionals prioritize their expenses while building financial stability.

Financial planning for young adults is crucial because it sets the foundation for future financial success. It enables them to manage and save money effectively, build an emergency fund, invest in long-term goals (such as buying a home), reduce their debt burden, retirement planning (start saving early on), and build good credit history – all of which contribute to overall financial well-being.

Hiring a financial planner in your twenties can be beneficial if you need guidance with complex finances or have specific goals that require expert guidance. However, many basic personal finance principles can be self-taught through online resources or books. Consider seeking professional help when needed right financial planning strategy to invest and support your short- and long-term goals. but focus on developing sound money management habits first.

Gen Z primarily gets their finance-related advice from online sources, such as blogs, podcasts, and social media platforms like TikTok or Instagram. They also rely on financial apps and tools to manage their money. Additionally, Gen Z may seek guidance from family members or friends who have experience in their own finance.

Should I talk to a Financial Advisor When Buying a House?

In This Article Are you planning on purchasing your first home? Or thinking of splurging

Master Robert Kiyosaki: 10 Keys to Financial Freedom

In This Article Have you ever felt the earn, spend and save trilogy too mundane?

Can SIPs Make You Rich? Mutual Fund SIP Grow Your Wealth

In This Article Can SIPs make you rich? Systematic Investment Plans can help in wealth

Exclusive Investments of Elon Musk: Disruption, Vision, and Risk

In This Article A visionary entrepreneur who has been a consistent disruptor in the way