Deciding on your asset allocation for retirement can be a challenging task, even for the most seasoned investor. It’s important to remember that successful retirement planning involves a balance between capital preservation and growth.

This blog post aims to guide you through understanding how to structure your portfolio, diversify your assets, manage assets during inflation or recession, and other elements pertinent to ensuring a smooth-sailing retirement plan.

So let’s build that secure financial future together!

Key takeaways

● Asset allocation is how you spread your money in retirement. Mix stocks, bonds, mutual funds, and cash for growth and safety.

● Your age and comfort with risk help decide where to put your retirement savings.

● Target-date funds can handle asset moves for you as you age. This lowers risk at retirement time.

● Diversify your portfolio by putting money in different places. Balance between risky stocks and safe bonds or cash investments.

● Inflation or a slump can hurt your portfolio. Be smart with cash use, bond tactics, and diversifying assets to stay secure.

● Adjusting over time is key. Check on how well assets do often so the plan keeps working right.

● Market swings affect when to take out savings. Take more when markets are high but less when they drop to save money longer.

● Keep your emergency fund entirely in cash. As is the nature of emergencies, you may need access to this money with just a moment's notice.

The Importance of Asset Allocation in Retirement

Asset allocation in retirement is key. It helps balance the growth and protection of your money. You need a mix of stocks, bonds, and cash investments to make a steady income. This way you won’t lose all your savings if one type fails.

Stocks can help keep your savings safe in early retirement years. Balancing with bonds or cash makes sure you stay smart when the stock market shifts up or down too much. As time goes on, change your focus more to making regular income and keeping what you have saved safe from loss.

How to Structure Your Retirement Portfolio

To structure your retirement portfolio, start by setting aside a year’s worth of cash for immediate expenses. Next, create a short-term reserve using conservative investments such as short-term bonds or certificates of deposit.

Finally, invest the remaining portion in a balanced mix of stocks and bonds to ensure future growth. Remember that your asset allocation should align with your risk tolerance and retirement goals.

Set aside one year of cash

It’s smart to have cash handy in your first year of retirement. Think about how much money you will need for the whole year. Include everything from food to bills and fun stuff too.

You may want to keep this cash in a savings account or money market fund to make sure it stays safe.

Setting aside one full year of living expenses gives you peace of mind. It helps protect your downside during tough times like a downturn or personal crisis. This way, you don’t have to touch your other assets right away if things get rough.

Create a short-term reserve

Having money set aside in a short-term reserve is smart. This is like your safety net. It should be an amount equal to two to four years of living costs. You can keep this cash in a bank account that pays you interest or in a money market fund.

This way, the money keeps growing and it’s still easy for you to get when needed. Also, having this reserve helps lower the risk that comes with other investments like stocks or bonds.

So even if markets go down, you’re safe because you have enough cash on hand already.

Invest the rest of your portfolio

Put your leftover money into a mix of stocks and bonds. This helps you make more money over time. If the market goes down, you still have cash to live on and do not need to sell your stocks at a low price.

You also help keep up with inflation when you invest in this way. It is good to own more stocks than bonds early in retirement to protect against running out of money later on.

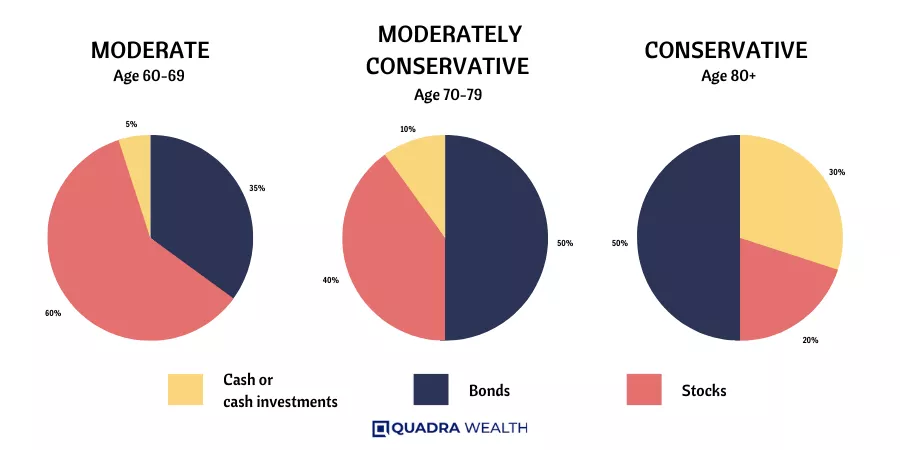

Adjusting Asset Allocation According to Age and Risk Tolerance

This section delves into the intricacies of adjusting your retirement portfolio taking into account both your retirement age and risk tolerance, underlining that investment decisions should not be based on stock market conditions alone.

Dive in to discover how to smartly balance your asset allocation for a smoother financial sail through retirement.

Considering your innate risk tolerance, not just your age

In the world of retirement planning, age is not the only player. Our ‘risk tolerance’ also has a big part. This is how much risk we can handle when things don’t go as planned with our money.

We are all different in this way. Some of us may feel okay taking on more risk for the chance to get more money back later on. Others may want less risk, even if it means they might make less money.

It’s key to think about your own comfort with risk before deciding where to put your retirement savings. You might have a pension that gives you steady cash each month. In this case, you could keep more of your funds in stocks which usually come with higher risks and rewards over time.

Not letting stock market conditions dictate your allocation strategy

Don’t let ups and downs in the stock market change your plan. Stick to your asset allocation strategy. Market swings are normal. Even when markets go down, don’t rush to sell your stocks.

This can hurt you more in the long run.

Stay calm during market storms. Keep an eye on your overall goal instead of daily changes in the stock market. Your retirement is a long-term goal, not a short-term one. Ignore small shifts and focus on steady progress over time.

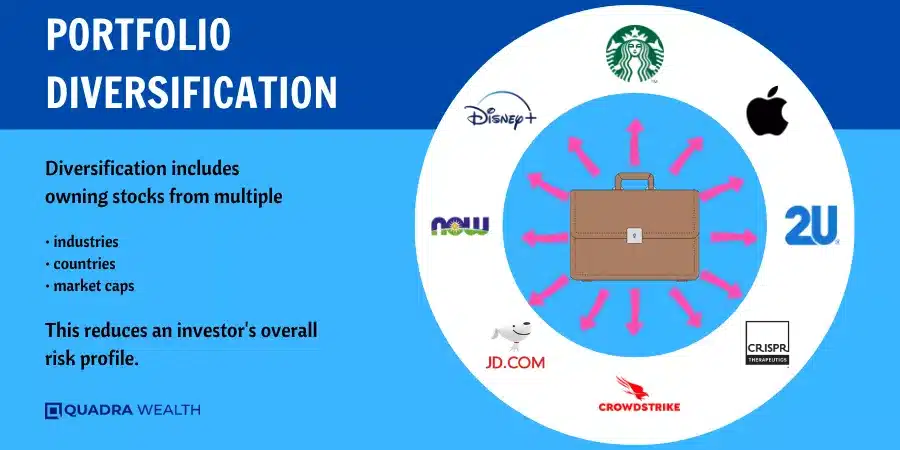

The Role of Diversification in Retirement Asset Allocation

Discover how diversification can protect your retirement assets, balance risks, and ensure a steady retirement income flow. Dive deep into understanding the importance of maintaining a variety of stocks, bonds, and cash investments to form a robust safety net for your golden years.

Stay tuned to explore more on this crucial investment strategy!

Diversifying holdings within each asset class

In a retirement portfolio, spreading money across several types of assets is wise. This practice is called diversification. Diversifying your holdings within each asset class can help lessen the risk of loss if one investment dips in value.

For example, don’t only invest in stocks from one type of business or sector. Instead, buy shares from various companies and markets to ensure the safety of your retirement funds. Likewise, diversify bond investments by buying bonds with different maturity dates and coupon rates yields, which are also known as bond ladders.

The same rule of thumb applies to other assets like real estate and cash exercises too! Thereby you protect your downside even when there’s a downturn. Remember to focus on both preservation and growth throughout this process.

Stocks, Bonds, and Cash: Balancing the Three

Balancing investments in stocks, bonds, and cash is an essential part of retirement asset allocation. The three offer different degrees of risk and return, and having a mix of them can help provide a steady income while preserving capital.

Asset Class | Consideration |

Stocks | Stocks offer the potential for high returns but also come with high risk. They can provide regular income through dividends, and maintaining a larger allocation in the early years of retirement can guard against the risk of outliving savings. |

Bonds | Bonds are less risky than stocks and offer stable returns. Keeping two to four years’ worth of living expenses in short-term bonds provides access to cash during market downturns without selling stocks. Building a bond ladder with staggered coupon and maturity dates can provide a steady flow of income over time. |

Cash | Having a year’s worth of spending cash on hand is recommended to supplement annual income. Cash investments are low-risk but also provide low returns. They serve as a safety net and can be used for unexpected expenses or during market downturns. |

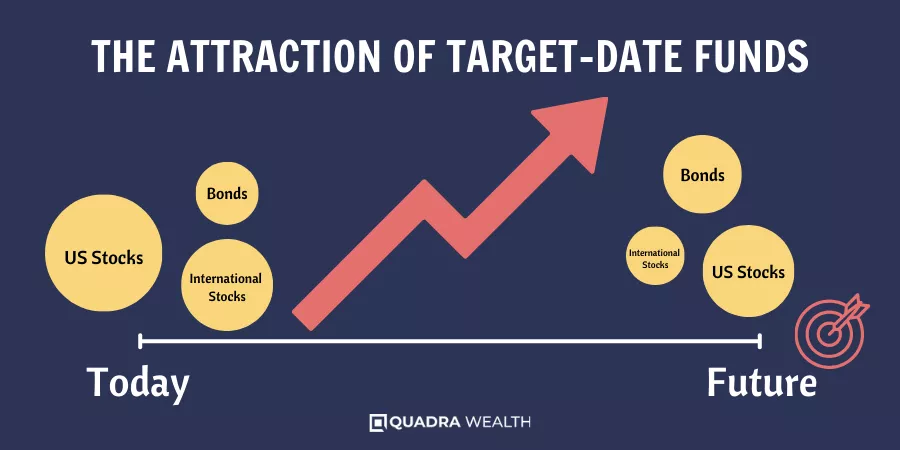

The Attraction of Target-Date Funds

Explore the allure of target-date funds, an investment option that automates the best asset allocation based on your anticipated retirement date, and learn how it simplifies your retirement planning.

Dive deeper to discover if this hands-off approach is right for you.

How they manage asset allocation for you

Target-date funds do a lot to help your money. They keep an eye on your age and how far you are from retirement. Then, they pick a mix of stocks and bonds for you. As you get older, these funds slowly move some cash from stocks to bonds.

This change is careful so that by the time you reach retirement, your portfolio has less risk in it. The goal here is to balance growth with safety.

Managing Your Retirement Asset Allocation During Inflation and Possible Recession

During periods of inflation or potential recession, it’s essential to be proactive in managing your retirement portfolio which may involve making the best use of cash, strategizing with bonds, and diversifying your assets.

Making the best use of cash

You need cash in retirement. It helps pay for daily needs. A good plan is to have one year’s worth of cash at the start of each year. This money can be added to other income like pensions or Social Security.

It is also smart to keep more money close by. Aim for two to four years’ worth of living costs in fast-access spots, like short-term bonds or bank accounts. This gives you extra cash if there’s a market slump and you don’t want to sell your stocks low.

Bond strategies

Bonds help with money in hard times. A bond ladder is a good plan. It brings steady money over time. During inflation or recession, use this tactic to manage your retirement assets.

Different bonds can be part of the plan too. Bonds that are less risky are good for people who need money soon or don’t like risk much.

Diversifying your portfolio

Putting your money in different places helps balance risk. This is called diversifying your portfolio. You can invest in stocks, bonds, and cash investments. Each one has its own purpose.

Stocks can grow money for the future. Bonds give a steady income flow when built with different maturity dates in a bond ladder method. Cash investments offer quick funds without selling stocks during market downturns or times of need.

This way, you do not put all eggs in one basket, making it safer for your retirement nest egg to grow.

Additional Tips for Building or Sustaining Your Retirement Portfolio Allocation

Put your retirement portfolio on a path of sustained growth with careful periodic adjustments, smart withdrawal strategies based on market conditions, and prudent investments in reliable financial tools and resources.

Stay tuned to learn more about nurturing your nest egg effectively for retirement bliss.

Adjusting over time

Change is a part of life. This holds true for your retirement portfolio too. As you age, your needs and goals will change. So should your asset allocation plan. It’s not enough to create a solid plan at the start of your retirement journey and then forget about it.

Adjusting over time means looking at how well your assets are doing regularly. If one part of following your plan doesn’t work anymore, you need to switch things up a bit. For instance, if you have risky stocks that aren’t performing well, maybe it’s better to shift some money into safer bonds or real estate.

Also, adjusting over time can help keep an eye on changes in income flow demands. A person with a pension may go bold with their investments while someone relying only on savings and Social Security benefits could be more cautious about risks.

Withdrawing more during positive markets, less during down markets

Market changes can affect your retirement savings. In good times, when markets soar, you could take out more from your savings. But in tough times, when values drop, you should take out less.

This smart move can help make sure your money lasts longer. It helps keep your retirement safe and secure.

Investing in quality tools & resources

Good tools and resources are a big help. They make your retirement plan better. Some people use personal finance apps or hire a financial advisor to guide them. These tools and resources can give useful tips and advice for your plan.

Without these, you might miss out on earning more from your savings. So, put some money towards getting quality tools and resources for your retirement plan. It will pay off in the long run!

Conclusion

Having the right asset mix in your retirement years is key. It helps you make money last long and stay steady. You need to hold onto what you have while making room for growth. Make choices that fit your age, risk level, and hopes for the future.

FAQs

Asset allocation in retirement is how you spread your savings plan across different investments like stocks, bonds, and rental properties for income generation.

Balance Income and Growth by having a mix of investments like dividend-paying stocks for potential growth and annuities or interest-bearing bank accounts for guaranteed income streams.

Yes, owning rental properties can offer a regular source of funds apart from your other retirement plans such as Roth IRA or Traditional IRA.

You could think about investing in high-quality, short-term bonds, corporate bonds, or government bonds which are often part of fixed-income investments within Schwab Intelligent Portfolios.

It’s always good to keep an eye on various risks like loss of principal due to market valuations, credit risk, and liquidity risk when making financial planning decisions but also consider the longevity risk without some exposure to stocks in your investment portfolio

Yes! The Schwab Center has several beneficial resources including Schwab Wealth Advisory services plus helpful calculators such as the ‘Schwab IRA Calculators’ specific for individual plans; these will help you make informed choices towards achieving financial stability during your golden years.